Okay so it's obviously been a really huge week for the entire LeoVerse. What was just a dream for so many years - Project Blank - is now a reality. Many of us are experiencing the new LeoFinance x Project Blank UI for the first time.

From my experience, let me tell you... It's a work of art.

This is what Hive has needed for so many years. A true engagement and social media platform.

Hive is ironically not all that social. It's far better than the entire crypto industry but there are plenty of pitfalls to it as well.

How Does This Help CUB?

I know what you're wondering... how does any of this help CUB?

Well in my opinion this helps CUB in a lot of ways. Namely, the bigger the LeoVerse becomes the bigger CUB becomes.

I believe the team when they say that LEO is the center of the entire project and CUB is the center of the entire DeFi side of the project.

It's like having two departments in the same corporation. I believe that CUB has been shown some massive attention that was sorely needed after all of this time.

We needed the Multi-Token Bridge and honestly, HIVE needed the bridge too.

Unprecedented volumes are happening for bHBD and bHIVE... This has caused some growing pains in terms of liquidity but I also believe these are being worked on and improved in a lot of ways. We're seeing real-time improvements and a constant stream of new capital entering despite all of the pressures for the opposite.

Follow along as I report daily on @cubdaily 🙏🏽

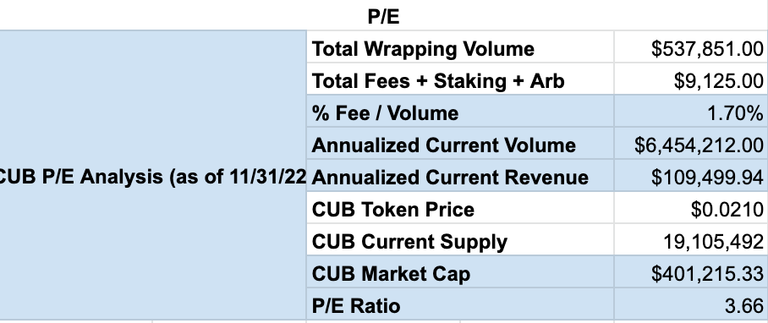

P/E Analysis of CUB

Here's a new section I'm trying out. I decided to run a P/E analysis of CUB using data from each Monthly Burn Report posted by @leofinance. Check out the second analysis I ran and leave a comment below with your thoughts.

Keep in mind that a low P/E ratio is good. It means that the revenue that CUB is generating each month is increasing faster than the CUB price is increasing (more revenues earned per share of CUB).

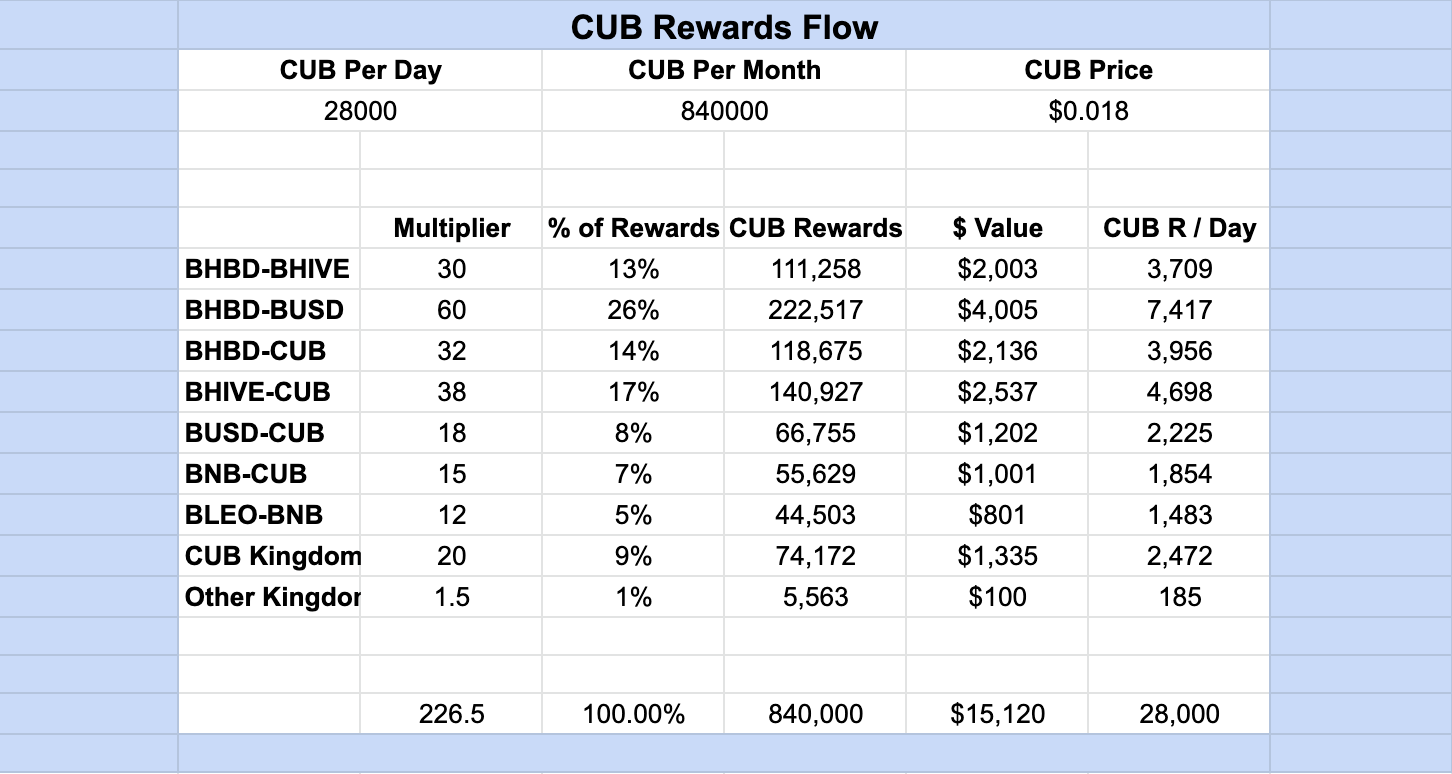

CUB Rewards Flow

*NEW

Here's another new section of my daily reports. This chart will be updated monthly. It accounts for the flow of CUB rewards.

"Over time, I'll start collecting data on how much each Liquidity Pool actually earns for the CUB Protocol (through wrapping revenue, arbitrage, etc.). Obviously, that's a lot of data to capture! This tells us something very important though: is the DAO effectively using its monthly funds (inflation) in paying LPs to build liquidity that ultimately generates revenue. Let's keep an eye on it and see how this progresses, maybe the team can even take this data and use it to migrate multipliers to more effectively build liquidity in the pools that are generating the most revenue."

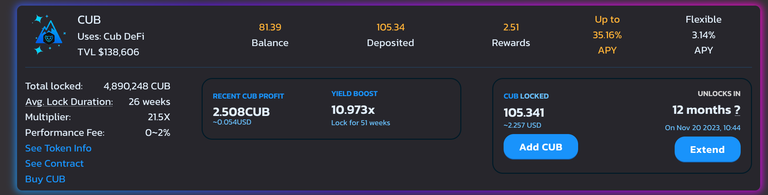

Locked CUB

A new section! The new CUB Kingdom is now live and we can track the amount of CUB locked and how long it is locked for.

- CUB Locked: 5,596,410

- Avg. Lock Duration: 33 Weeks

CUB Token

- Price: $0.02

- Total CUB Supply: 20,781,214

- Total CUB Burned: 2,202,377

- Total Market Cap: $408,563

- Total Value Locked: $1,355,497.24

Multi-Token Bridge Stats

- bHBD-bHIVE: $162k

- bHBD-BUSD: $277k

- bHBD-CUB: $130k

- bHIVE-CUB: $191k

- Total: $760k

CUB Burns

.png)

Further Reading:

- Latest Reports From this Account: @cubdaily

- Latest CUB Burn Report From the LeoTeam: https://leofinance.io/@leofinance/cub-monthly-report-or-november-2022-50-of-cub-inflation-bought-and-burned-tvl-continues-to-grow-and-arb-bot-2-0

About CubDaily

I'll be using this account to report on the CUB stats each and every morning. Together we'll track the growth of CUB under the completely revamped ecosystem that LeoTeam has built called the Multi-Token Bridge.

Posted Using LeoFinance Beta