As we are getting ready for the next bullrun, at least I am trying to keep up to date with the economy in general. If the economy is strong presumably that will result in a very nice bullrun. At least that is the general idea. But now we have big players in the economy that appear to disagree on whether we will have a recession or not. Let's try and see if we can get a better understanding of the current situation.

Blackrock say no way we will get a resession

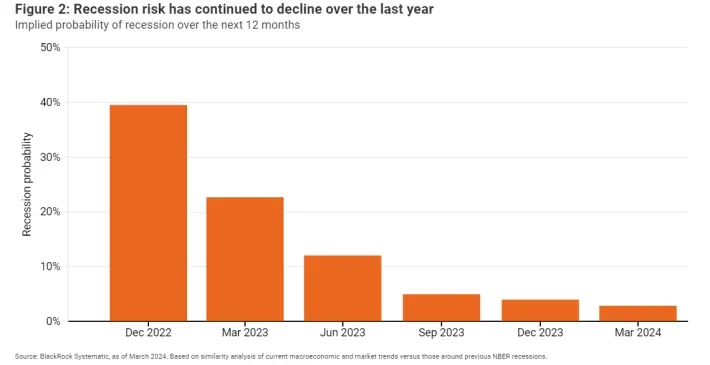

According to a recent report from Blackrock they say there is only a 3% chance that we will get a recession in the next 12 months. This is a very stark contrast to their predictions back in 2022. Then they predicted there was an almost 40% chance for a recession in the next year. What has changed?

We can see that according to Blackrock´s predictions, we have seen a steady decrease in the probability of a recession occurring in the coming year. If you have been following the news over the past year or two you will most likely have come across the first reason for Blackrocks change, Teck or more specifically AI stocks. They have literally been booming, and not only them, but AI adjacent stocks as well like NVIDIA have also seen tremendous growth recently. The second reason they point out is the labor participation in the job market as well as immigration which is boosting the job market in the US. And the third reason is the current momentum the economy has very well could last the coming year.

These three factors are the main ones that Blackrock is citing for their assessment of a 3% chance of a recession. But they also mention some risks, higher inflation than expected, higher long interest rates, and the current geopolitical situation. However, Walmart appears to not agree with Blackrock about the current situation as they are issuing a warning about the current state of the economy. Let us take a look at what they are saying.

Walmart issues warning

Bloomberg published a piece about Walmart and how their sales increased 3.8% thanks to wealthier consumers spending more at Walmart. What that usually means is that more and more people are struggling financially as they are now shopping at bulk stores like Walmart. While the normal customers, the pore segment, most likely is spending even less. That is the usual spending pattern you tend to see in these types of situations. While unemployment is very low in the US, the people who are unemployed are long-term unemployed. That is the key difference. Recently unemployed people tend to spend money like normal, as they have the outlook that they will get a new source of income soon. But as it shifts to a longer unemployment these persons spending tightens.

Places like Walmart are usually seen as a good indicator of how the economy is doing thanks to these exact metrics we are currently seeing. When the economy is bad the "richer" customers come to shop. When it is good it is just the "poor" people who shop.

Let's look at what China is doing

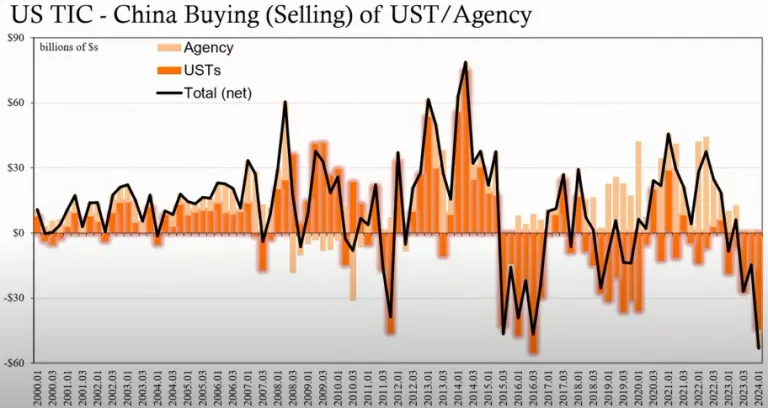

There are other signs or data we can look at as well that paint a pretty bleak picture. This is the fact that China currently is selling record amounts of US Treasuries. This will in turn have a negative effect on the US economy. There are those who think that China intentionally is doing this to hurt the US economy while preparing for a Dollar economy with their BRISC partners something that has been talked about for a long time.

If we take a look at the data it sure is painting a very dark picture. But the data also shows us something else. That is China buys and sells US Treasuries all the time. And if anything it is more or less in sync with their economy. When it's booming they are buying, when they are hurting they are selling. And currently, China's economy is hurting, a lot. Chance the record number of sales.

These economic problems China currently is facing are most likely not something that is facing only them. As the majority of the Western world has been struggling with a raging inflation that just won't die. That makes it more likely that this indeed is an indicator of a global economic situation. Rather than China trying to get one over on the US.

Conclusion

It does seem that the current economy is struggling a fair bit. And it is not looking like it will get better any time soon. But the AI hype might very well be able to carry the economy, at least for the rich. The AI hype might very well outweigh the bad stuff, putting the whole equation on a positive. But that doesn't mean that many will be struggling financially.

What this means for the eventual bullrun, well there are many who say Bitcoin will keep doing what it is doing no matter what the rest of the world is doing. So that may be some comfort. For me, It is looking like everything is up in the air. And personally, it will most likely be a tougher time ahead. Unless those bulls start running. =)

I hope that you found this post useful, even if it was not able to reach any definitive conclusions. But just like with your financial decisions, I guess you have to make your own conclusions as well. ;)

If you would like to support me and the content I make, please consider following me, reading my other posts, or why not do both instead.

https://medium.com/@bo.daniel.jensen

See you on the interwebs!

Picture provided by: fair use

Resources

- https://www.blackrock.com/us/individual/insights/systematic-equity-market-outlook

- https://www.bloomberg.com/news/articles/2024-05-16/walmart-wmt-earnings-rise-as-wealthier-customers-shop-at-retailer

- https://www.bloomberg.com/news/articles/2024-05-16/china-sells-record-sum-of-us-debt-amid-signs-of-diversification