UST keeps making headlines with its 20% APY on Anchor. The algorithmic stablecoin gas gowned so fast, a lot of people are starting to shows concerns about it. At the moment of writing this the marketcap for UST is at 16.7 billion, ranking 14 of all coins, just behind the Binance BUSD.

Let’s take a look at the growth of UST through some data.

For those who don’t know, UST is an algorithmic stablecoin from the Terra ecosystem. It works in a way that each 1 UST can be converted to the network native coin LUNA and back. On HIVE this is called conversions, while on Terra is burning/minting mechanism. Just recently there was an announcement that UST will be additionally backed by Bitcoin that the Terra foundation is planning to buy, and in case of emergency use that instead of LUNA, preventing death spiral.

The period that we will be looking at is Jan 2021 to Apr 2022.

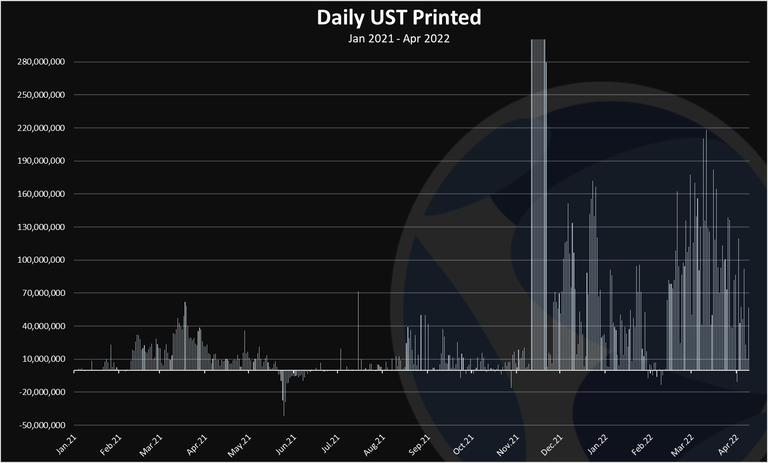

Daily UST Printed

Here is the chart for the UST printed per day.

As we can see there was a massive amounts of UST minted per day back in November 2021. At times there was 400M UST added daily. A few billions added in a week time. I think these massive amounts came from some Terra officials holdings or DAOs.

In 2022 UST has on average 70M printed daily!

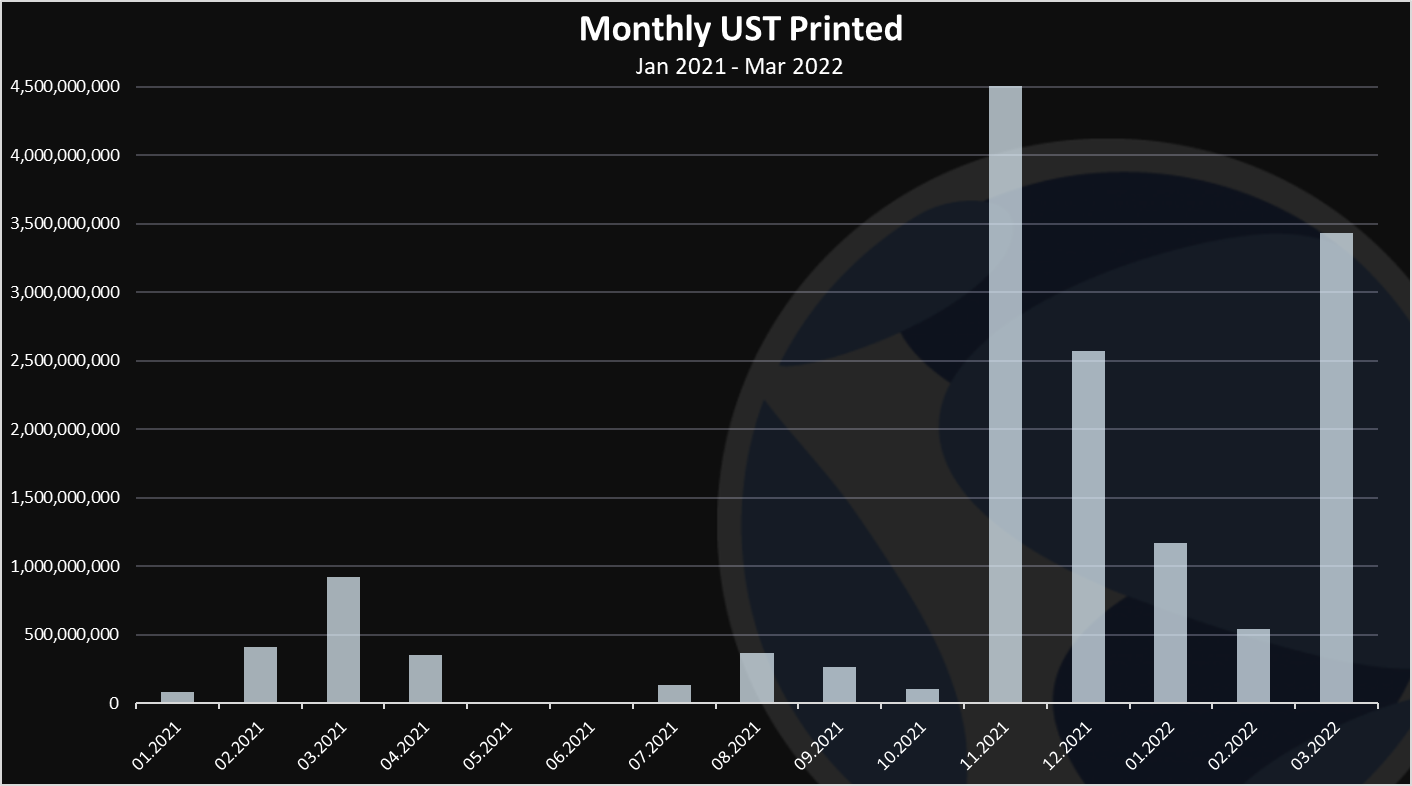

Monthly UST Printed

Here is the monthly chart.

Here again we can see the massive printing back in November 2021, when an additional 4.5B were printed in one month. March 2022 has also a lot of UST printed with almost 3.5B printed.

These numbers are nothing short but amazing.

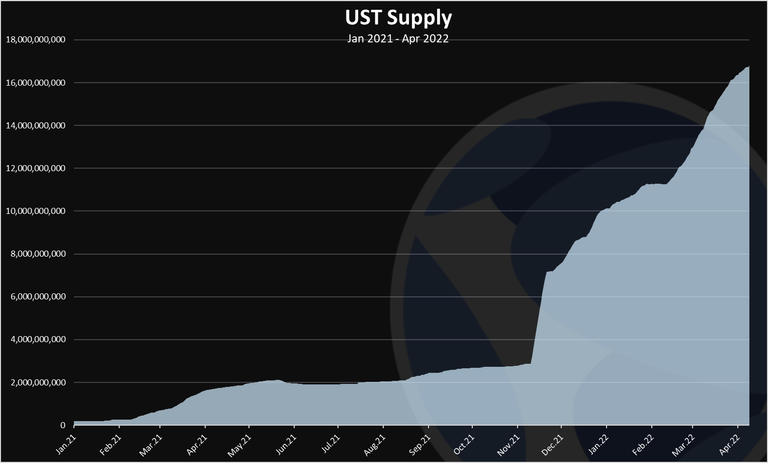

UST Supply

The chart for the UST supply looks like this.

Up only 😊.

UST now has more then 16B in supply making it no.4 on the stablecoins ranks, and from the trend it will most likely flip BUSD soon to become no.3 stablecoin, just behind USDT and USDC.

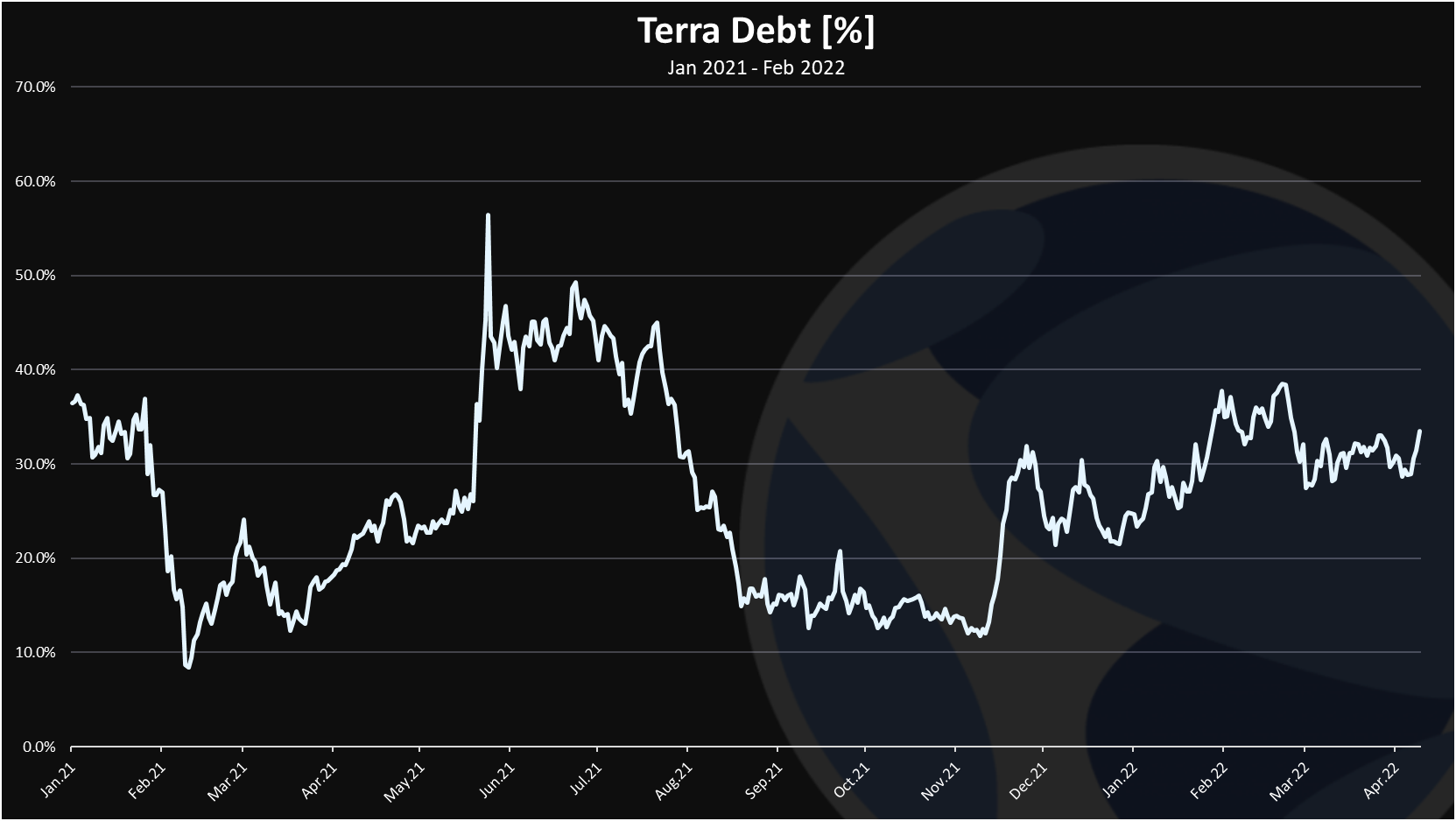

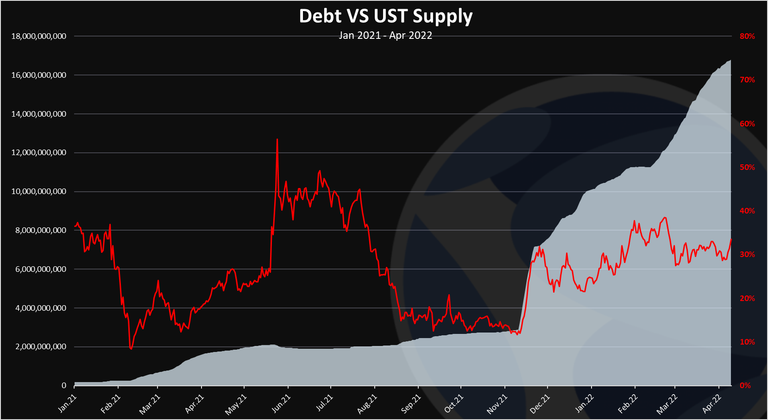

Terra Debt

This wording is not official among the Terra ecosystem but I’m making a parallel from Hive since its very similar. The debt is the ratio of the UST supply to the LUNA + UST marketcap.

Here is the chart.

We can see that the Terra debt has ranged from 10% up to 55% in the past. The sharp increase in May 2021 is due to a sharp correction of the crypto market and the LUNA price. Whenever the LUNA price drops the debt increases and the opposite.

In the last period the debt has been between 30% to 40%.

When we plot the UST supply against the debt, we get this.

There hasn’t been a strong correlation between the UST supply and the debt, except for November 2021, when large amounts of UST were printed at once and this caused the debt to increase as well. Since then, the debt levels has been quite stable, even with the continuous increase in the UST supply. The debt level is more corelated to the price of LUNA, so as long as LUNA holds in price so will the debt, even with the increase in the UST supply.

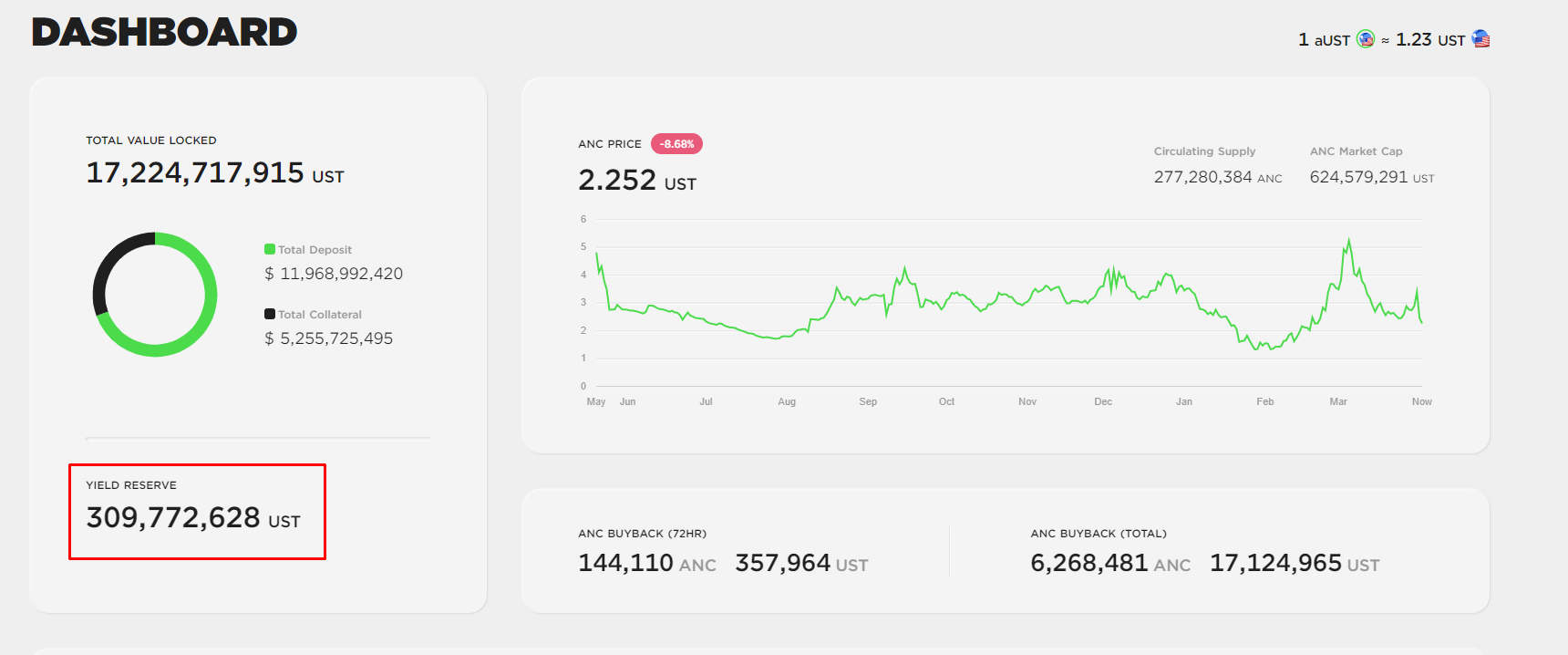

Anchor Yield Reserves

Another important metric for the UST stability, except for the LUNA price, will be the yield reserves on Anchor. The Anchor protocol at the moment holds around 12B in UST or around 72% of all the UST supply. It is obviously a very important protocol for UST.

https://app.anchorprotocol.com/

If you go on the app, on the bottom left, there is an info for the yield reserves in UST. This is how much the protocol has in reserves to pay for the 20% yield on UST. The way the anchor works, it is collecting yield from other staked assets like bLUNA and bETH, and transfer those to the yield reserves. If the collected yield from those staking rewards are higher then the 20% it leaves the excess yield in the reserves, and if it is smaller then 20%, then it takes from the reserves to provide a fixed 20% APY to UST deposits. There is more mechanics to Anchor but this is the most important one.

The thing is in the last months the staking rewards are always in short (around 7%), and the yield reserves keep going down. They have been filled back in February with more then 400M from the LFG(Luna Foundation Guard), with an expectation in time the protocol to be self sustainable. At the moment the UST yield is subsidized.

All the best

@dalz

Posted Using LeoFinance Beta