The Lido protocol has been dominating staking on Ethereum. For those unfamiliar with it, It is a smart contract defi protocol that provides users to stake ETH no matter the amount they have and earn interest on their Ethereum. To run a Ethereum validators users need a hardware and a minimum 32 ETH staked. The LIDO protocol is facilitating the staking of Ethereum allowing everyone to get some interest on their tokens.

What is more interesting is when you stake Ethereum, you get staked tokens back in the form of stETH, then you can then use on other places, like collateral for loans, or even sell them. The initial ETH remains staked and keeps earning interest. This what is know as liquid staking, as your funds are staked but not locked up. Have in mind that the stETH is a totally different asset than the native ETH that is staked. Because of this, the price of stETH, although in theory pegged 1 to 1 with ETH, can deppeg and be priced lower. This has happened in the past, especially in times of distress in the markets.

More to read on MakerDAO in there whitepaper on the link.

Here we will be looking at:

- Total value locked TVL in USD and ETH

- Daily Ethereum staked/unstaked

- Share of Lido staked Ethereum

- Lido APR on staked ETH

- Staked ETH stETH to ETH Price

- Defi protocols rank by TVL

- Number of users DAUs

- Price

The period that we will be looking at is 2021 - 2023.

The data here is compiled from different sources like DefiLama and Dune Analytics.

Total Value Locked [TVL]

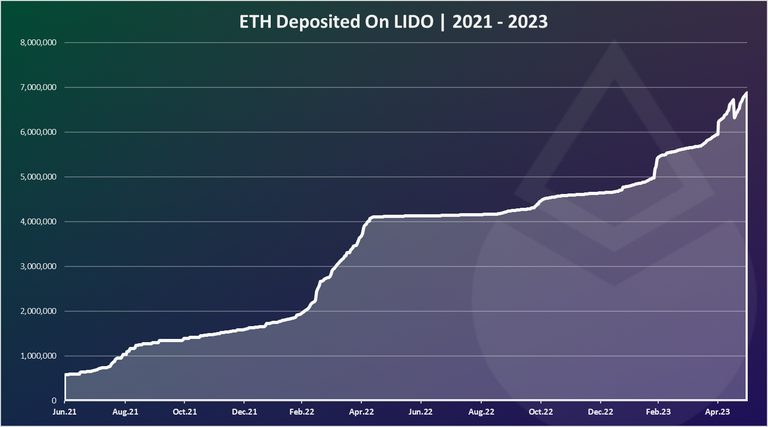

Here is the amount of ETH staked on Lido.

As we can see the amount of Ethereum staked on Lido has been constantly going up in the last two years. The protocol was first launched back in 2021, and since then it has kept on growing and now has almost 7M Ethereum staked.

We can see that the growth was especially visible in the first months of 2022, but then the crypto market dropped and the deposits in Lido slowed down. In 2023 we can see an increase in the deposits again.

Note that prior to May 2023, there was no option to unstake Ethereum. This option was provided with the latest update, and we can see a small drops in the staked ETH.

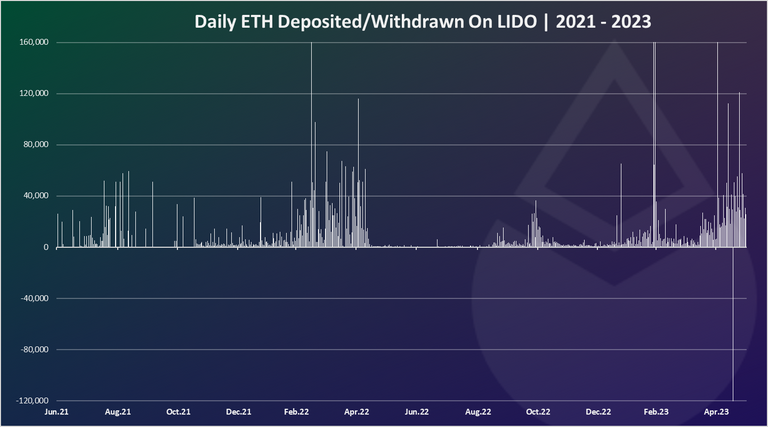

On a daily basis the chart for staking ETH looks like this:

Here again we can notice the uptrend in the first months of 2022, then a quite months after May 2022, and uptrend again in 2023.

We can also see the one negative line in May 2023 when 400k was net unstaked in a day. This is because of the Kraken unstaking under the pressure of the regulators to stop their staking services.

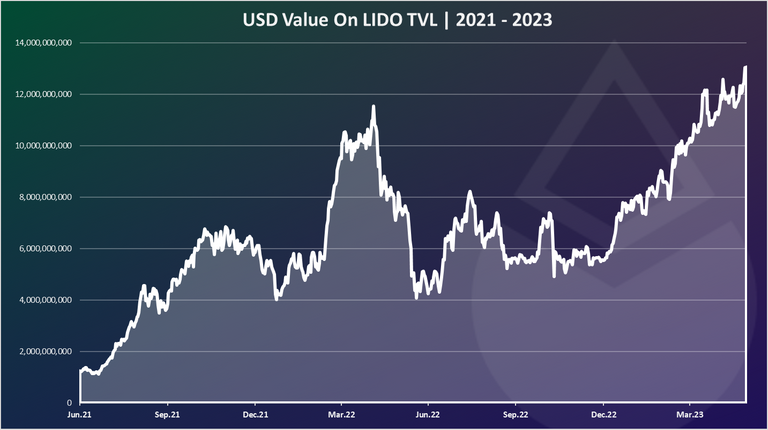

In dollar terms the chart for TVL on Lido looks like this:

This chart is more dynamic then the ETH chart. This is because of the price of Ethereum that has been changing in the period.

As we can see there was a local peak back in May 2022 with almost 12B in USD staked, then a drop and growth since December 2022 to 13B in TVL on Lido. This is quite the number.

Share of Lido staked Ethereum

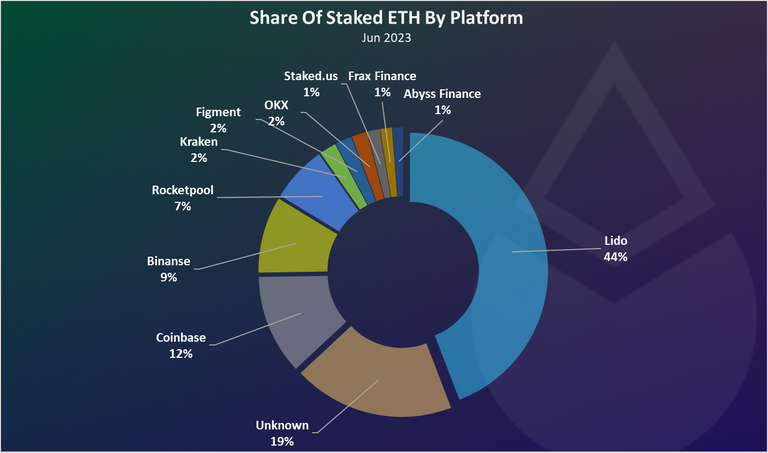

Ethereum can be staked on multiple platforms, not just Lido, and can be done directly by eligible participants. Here is the chart for the staked ETH by platform.

As we can see Lido is dominating with 44% share from all the staked ETH. On the second spot are unknown pools, maybe individuals or small exchanges.

Coinbase is on the third spot with 12%, with its staking ETH service. What is interesting about this, is that Coinbase does it in a indirect manner for its users, staking it in their wallet, unlike Kraken that was staking ETH in their wallets, not users wallets. This allows Coinbase to avoid sanctions from regulators.

Binance is next on the chart, and then one more defi protocol Rocket pool.

As we can see, staking Ethereum has been consolidating in a few big pools, that has cause a reason for concern for some, as a potential threat for the decentralization of the chain.

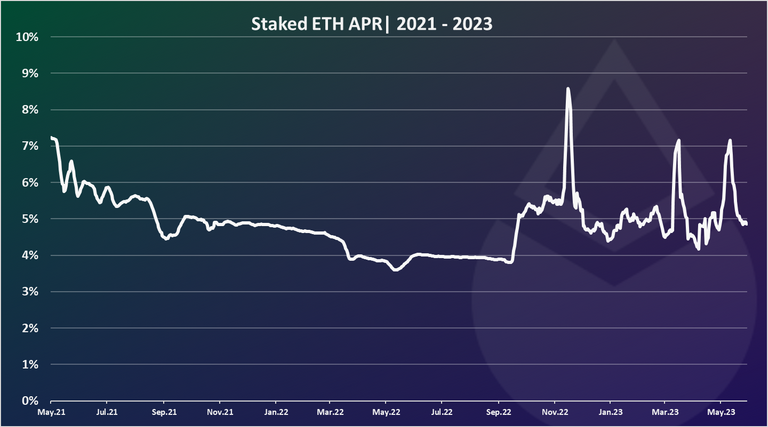

Lido APR on Staked ETH

One of the most important thing for Lido is what is the APR users receive on their staked ETH? Ethereum validators receive rewards from the regular inflation but also a share of the transaction fees. Because of this the APR on staked ETH is not fixed.

Here is the chart.

As we can see at times the APR on stETH has been as high as 8%, and as low as 4%. In the last period the APR for staked ETH on Lido is in the range of 5% to 7%.

Staked ETH stETH to ETH Price

Here is the chart.

In theory this price should be always 1, as every stETH is backed by the same amount of Ethereum. But at times the market wants intant liquidity and there can be a deppeg in the stETH price. This was especially a case in the past, when there was no unstaking option and users were locked.

Now the unstaking option is live and the peg should hold much better. As we can see there was some deppeging back in May 2022, when the crypto market crashed. At the time the ratio of stETH to ETH was at 0.95. Will be interesting to see will the peg holds going forward because as we mentioned the unstaking is now live.

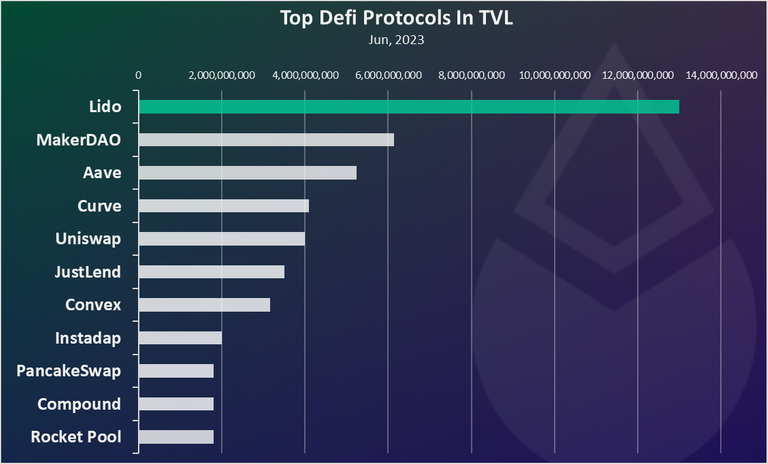

Top Defi Protocols Ranked By TVL

How is the Lido protocol doing when compared to the other ones? The total value locked is usually one of the metrics these protocols use.

Here is the chart.

Lido has now emerged as the number one protocol in TVL. Its simple but powerful function to provide liquid staking for Ethereum, where users can receive APR on ETH, with no constrains on the amounts that they but, and at the same time being able to have the stETH tokens as a liquid funds has contributed to a massive growth.

Staking Ethereum is now obviously a big business and Lido is taking a major part in it.

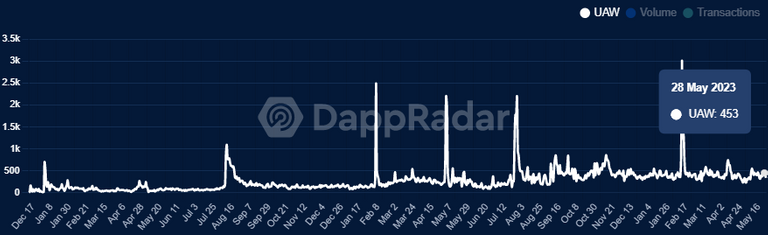

Active Users

How many users the Lido protocol has?

This was a bit of a tricky metric to find as there is a lack of data out there. At the end I settled for the data provided by DappRadar.

This is a chart from Dappradar that provide data for weekly users.

From the data here we can see that the number of users is quite small ranging from 300 to 400 weekly users with occasional spikes to a few thousands. This suggest that even with the big TVL, the Lido protocol is still used by the big whale accounts, and not as much by the retail.

Price

The Lido protocol has its governance token. Here is the chart.

Some ups and downs here.

We can see that ther peak was reached back in 2021 with ATH of $6 per token. Then a drop in the price going in 2022, with some occasions spikes in between. The lowest the token has been in July 2022 with a price around 50 cents.

At the moment LIDO is around $2.

All the best

@dalz