The TerraUST fiasco has left a mark on the stablecoins industry. The crypto market cap felt further after the UST fiasco in May 2022. Before the implosion of the project the combine market cap of LUNA and UST was more then 40B.

In the traditional industry when a project from this size goes down its usually a cause for government intervention.

A lot of stablecoins saw decrease in their market cap after this and some small ones collapsed as well. When it comes to the top two USDT and USDC, Tether USDT has seen decrease while USDC has been growing. But in the last month this has been reversed and Tether started growing again!

With this said let’s see how the market cap of the top stablecoins looks in the last month.

Apart from the fiat backed stablecoins (USDT, USDC, BUSD….) that are keeping USD in banks (or equivalent) there are tokens like DAI, UST, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Binance USD [BUSD]

- Dai [DAI]

- FRAX [FRAX]

- Terra-UST

There is a few more out there like TrueUSD [TUSD], Huobi USD [HUSD], etc, but we will focus on the above as the biggest ones in market cap.

The period that we will be looking at is from Jan – Aug 2022.

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly its founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank.

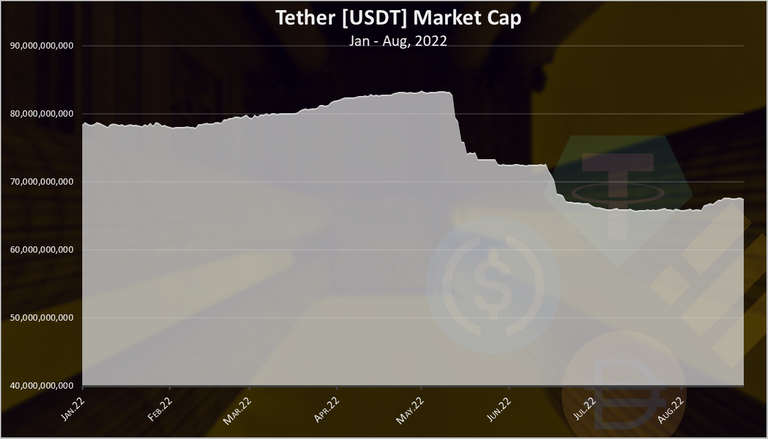

Here is the market cap for Tether in the last period.

In the first months of 2022, up to May, Tether was growing slowly, going from 78B in January to 83B at its peak at the beginning of May.

Then UST happened and we can see the major drop in the Tether market cap. Just in a week Tether dropped for a full 10B in market cap. This was a real stress test for the token. A lot of users wanted out and were cashing billions. Tether provided all the exit liquidity users wanted in a very short period of time. Billions in the first days, and around 15 billion in less than a month. If this was to happen on any traditional bank, bankruptcy is almost certain.

There are a lot of audits and transparency reports for stablecoins, but the above is the ultimate test in real time from the market. Having in mind Tether was able to provide the needed exit liquidity proves that it is able to operate under the stressful conditions in the crypto market.

USD Coin [USDC]

USDC is a common project between Circle and Coinbase.

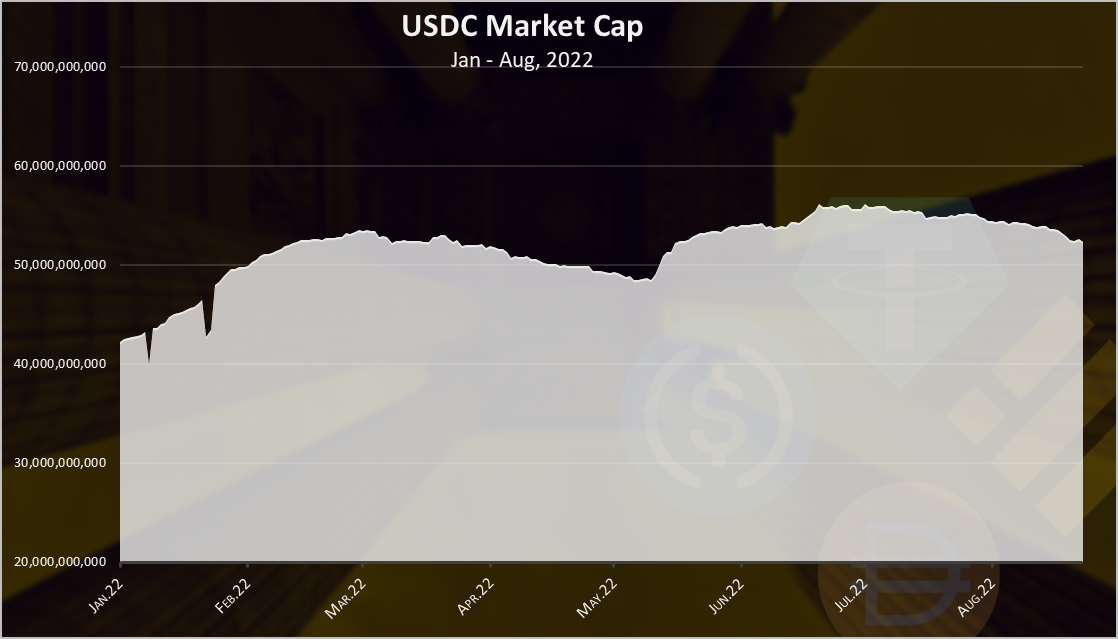

Here is the chart.

We can see the growth in the beginning of 2022 adding more than 10B in three months, but then in March the market cap of USDC started declining.

We can see a sharp increase in May 2022. At this time UST collapsed and a lot of capital entered USDC looking at it as a safe place to park their stablecoins. In the last month, the USDC market cap started do slowly decline again.

USDC stands at 52B now, down a bit from its peak of 56B.

Binance USD [BUSD]

The Binance exchange stablecoin. It’s mostly used on Binance and BSC as well as a trading pair against other cryptos.

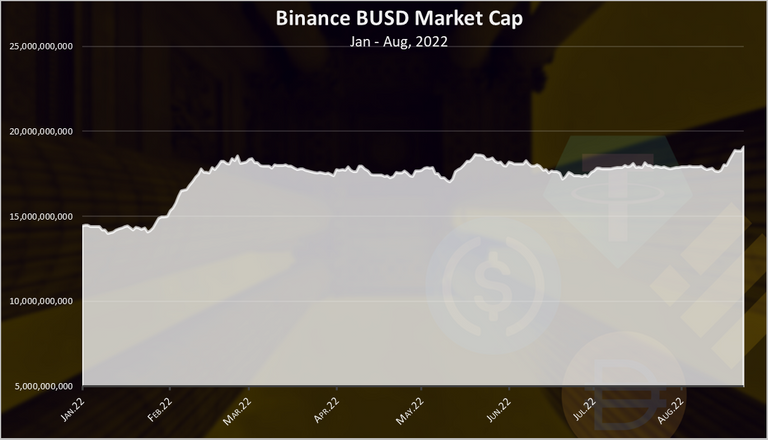

BUSD has been quite stable in 2022. An increase at the beginning of the year, then a small increase again in May 2022.

Interesting we have seen a recent increase in the market cap of BUSD. Almost 20B now.

Dai [DAI]

DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

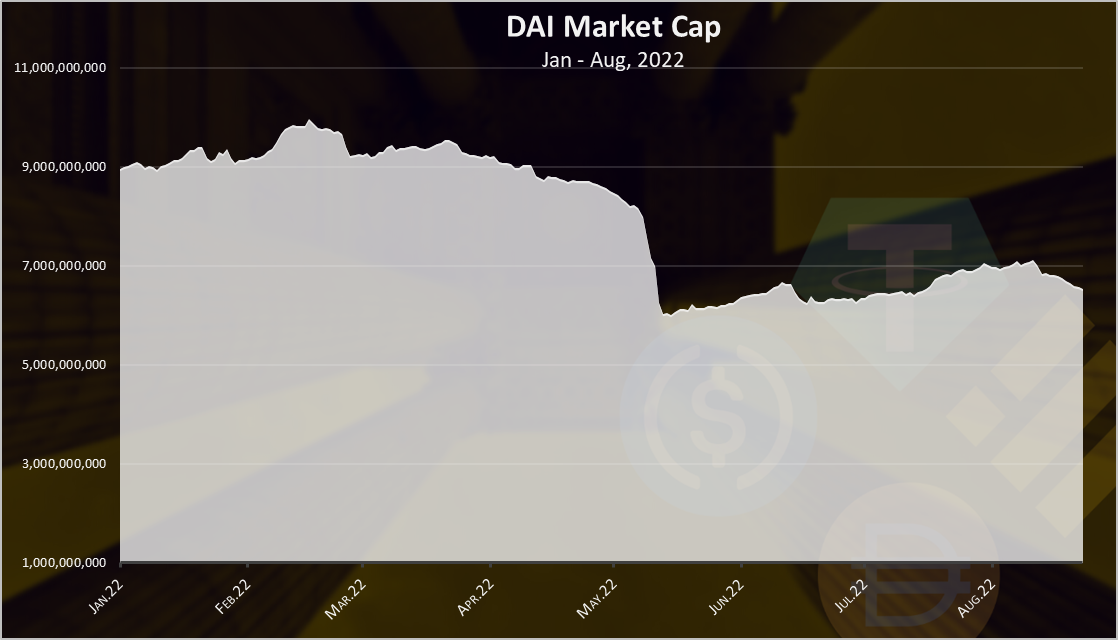

DAI as the number one crypto backed stablecoin has reduced its market cap in 2022. DAI works as overcollateralized stablecoin, where users put in 150% or more of other crypto assets to mint 1DAI. Since its backed by crypto asset, and the price of those has dropped it is logical for the overall market cap of DAI to drop as well.

We can see that during the UST fiasco in May 2022, the DAI market cap reduced as well, from , from 8B to 6B. The DAI market cap at the moment is 6.5B, while in the peak it reached almost 10B.

TerraUSD (UST)

The UST implosion is probably going in the history of the crypto books. UST is backed by LUNA, through instant conversions. But there is no limit how much of it can be printed, neither absolute nor relative to the market cap of the underlying asset LUNA.

Because of this there was an attempt, to put additional reserves in form of Bitcoin, but obviously this was not enough.

Here is the chart.

Starting from May 8th , the UST market cap started to decline in a free fall. At the peak the UST market cap was 18.2B. It went under 1B in less than a week time!

From the chart above we can see that there was more then 10B capital that wanted to exit UST. The few billions BTC that the team had obviously was not enough to provide the instant liquidity that the market needed. For a parallel we can notice the USDT market cap, that has 10B in reduction, that made the price of USDT to deppeg a bit, but USDT jumped in and provided all the liquidity that the market needed and restore the peg.

USDT VS USDC

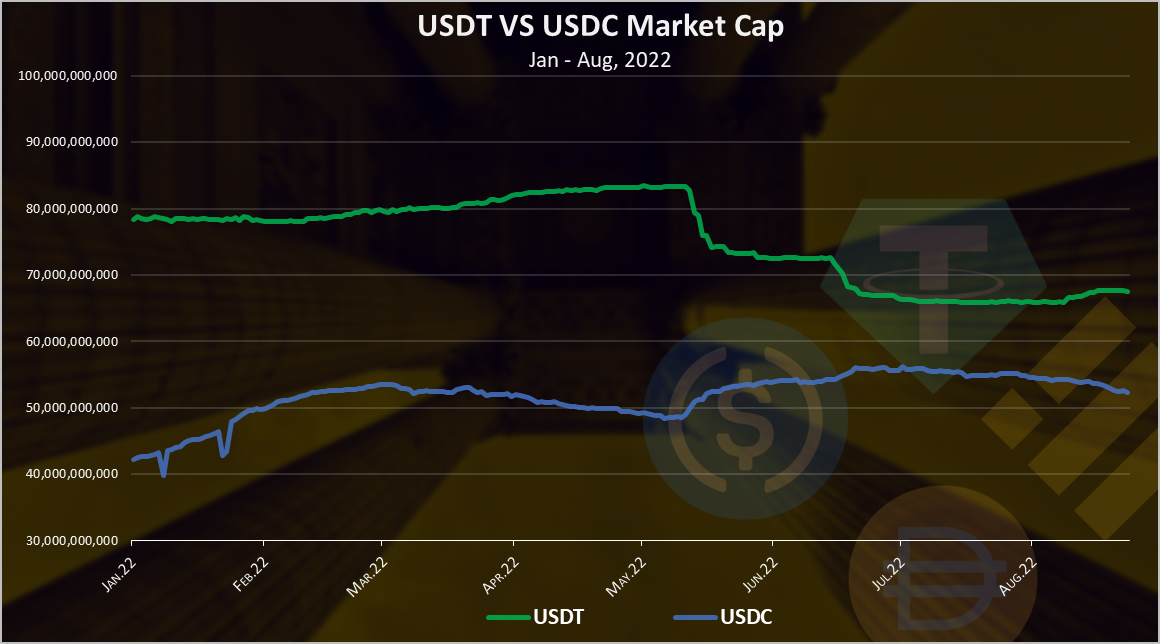

If we compare the top two stablecoins in the year we get this.

This two are almost inversely corelated 😊.

We can see the drop in the market cap of USDT in May 2022, and the increase in the market cap of USDC. But in the last month USDT has started growing again, while USDC has dropped.

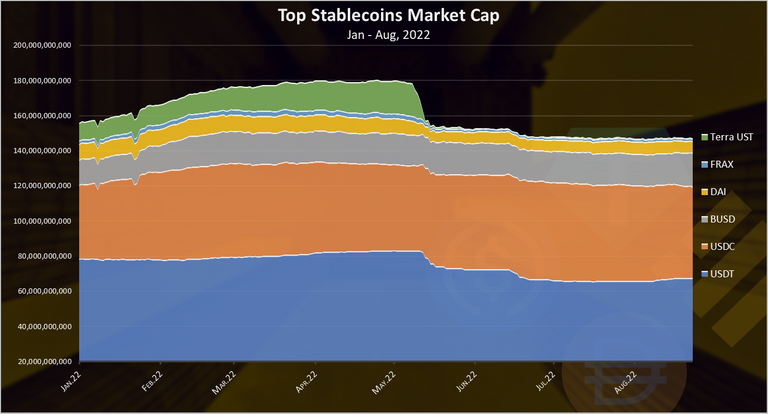

Cumulative Stablecoins Market Cap

Here is the chart for the total stablecoins market cap.

At the peak the market cap for the stablecoins was more than 180B. When TerraUST collapsed it lost almost 30B in a matter of week.

In the last months, the market cap of the stablecoins has been steady around the 150B mark. It hasn’t changed at all, although we can see some movements between the different stablecoins.

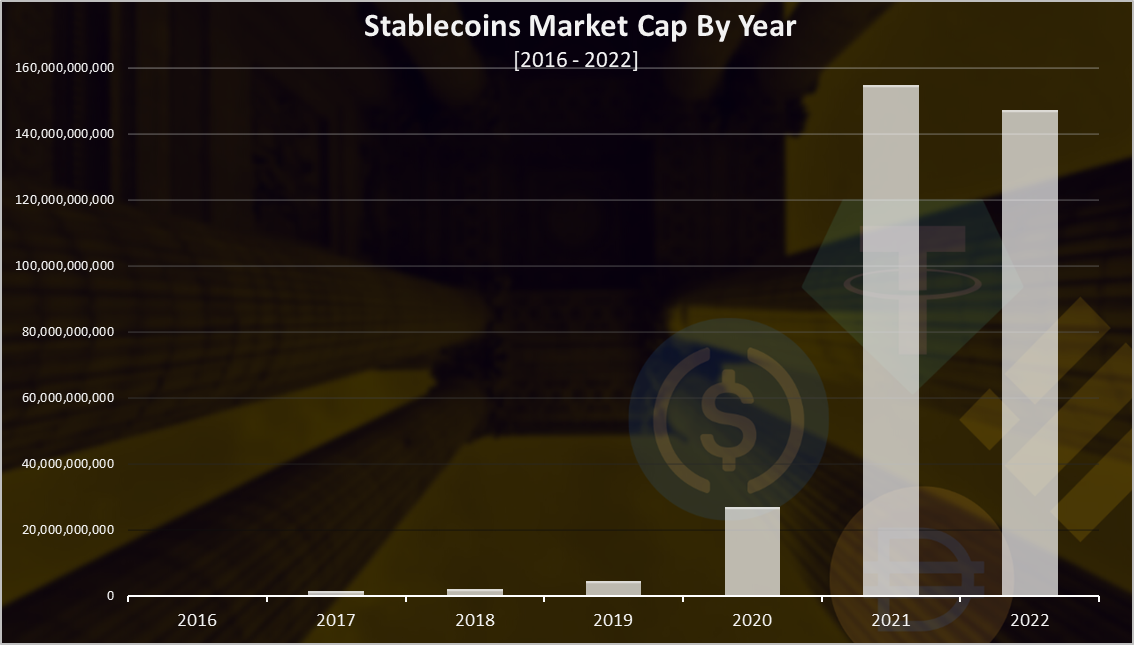

For context on a longer timeframe, on a yearly basis the market cap for stablecoins look like this.

After an explosive growth in 2021, the stablecoins market cap has started dropping in 2022. Will see how will the year end, but obviously the trend is down, alhough much not that much.

For example, the stablecoins market cap has reduced from 180B to 150B, or less than 20% drop. The top cryptos, BTC and ETH have both seen a drop more than 50%.

Top Stablecoins Rank

Here is the chart for the latest market cap of the top stablecoins.

Tether is still on the top, but USDC is closing in now. A 67B to 52B in market cap. BUSD is now on the third place, followed by DAI. FRAX is no.5.

Overall the stablecoins market cap seems to stabilize in the last month around the 150B mark. After a period of lowering its market cap USDT has now started growing again, while USDC has dropped a bit. These two act as opposites through all the 2022.

While we have seen a drop of the total market cap of the stablecoins for around 17%, this is still a much smaller drop compared to the drop in market cap for the top cryptos as BTC and ETH, that have more than 50% drop in both of the cases.

All the best

@dalz

Posted Using LeoFinance Beta