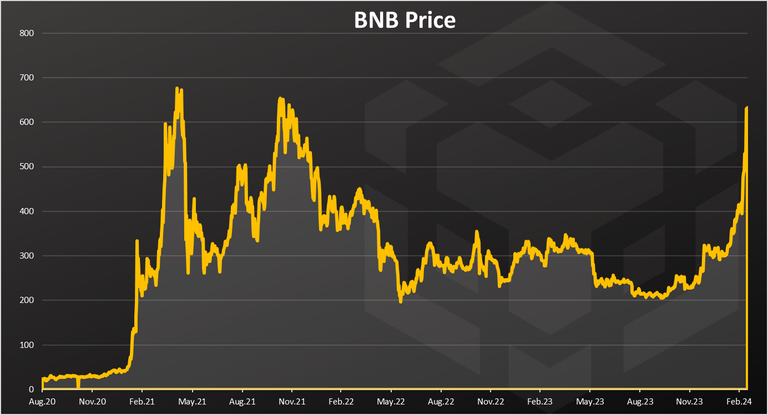

After a tough period for the BNB token during the bear market, it seems that it has started to recover in the last period. Just a reminder that there was a lot of FUD about BNB during the bear market, stories continue to show up and there seems to be no end to it. Court cases were also involved against the CEO CZ that ended with his resignation and huge fine paid in the billions. But things seems to have been resolved for Binance now with a clear path forward. In the last month the BNB tokens has doubled in price.

BSC has gained traction in the previous bull market, especially from the users who were priced out from Ethereum due to the high fees.

Let’s see how this chain is doing under the bear market conditions.

We will be looking at:

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

- Market Cap

Most of the data is collected from https://bscscan.com/.

Number Of Addresses

One of the key metrics for crypto projects is the number of wallets.

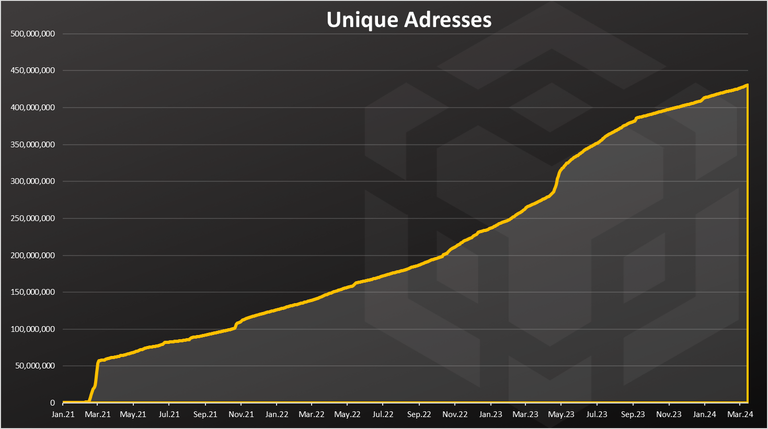

First the overall number of wallets.

The number of wallets on BSC just keeps going up, no matter what.

The chain started growing back in February 2021, and since then it kept adding new wallets. What’s interesting is that there is a bump in new wallets created in May 2023 during the bear market. Since then the numbers have steadily increased.

The BSC chain now has almost 430M wallets making it the number one chain in the world by the number wallets. For comparison Ethereum is now around 260M wallets.

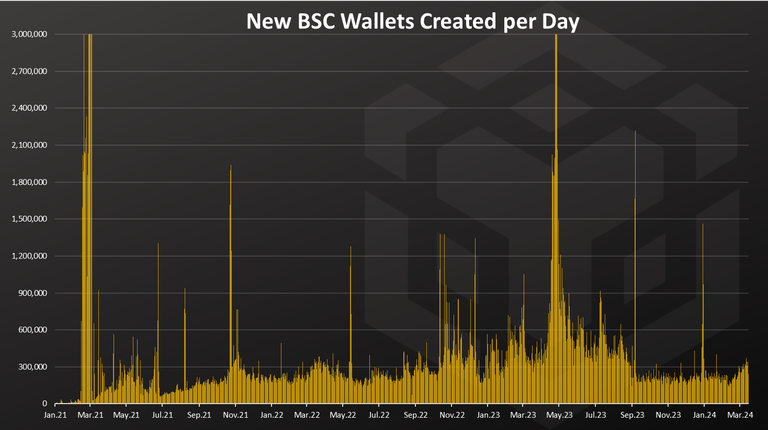

On a daily basis the numbers of new accounts created looks like this:

There has been a big spike at the begging back in 2021, and a steady numbers of new wallets since then. It seems that the new daily wallets kept growing towards 2023 and then spiked in May 2023. Since then there has been a small drop in the new daily wallets created and for a long period of time the numbers were around 200k. In the last weeks this number has increased and there is now more than 300k new daily wallets created on the BSC chain.

Note that the creation of these wallets is free, so in some cases it can be seen as spam actions.

Active Addresses

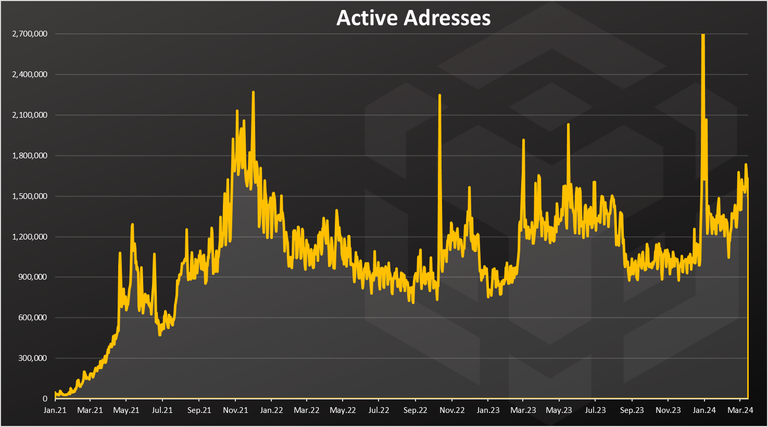

What’s more interesting in times like this is how many wallets are transacting. How many of those addresses are actually active?

When we look at the numbers of transactions we have a better understanding of the situation. There was a masiive growth back in 2021, the a drop towards 2022, and a sideways action since then up to recently. In the last weeks we have an growth in the number of transactions reaching 1.8M daily active wallets.

Interestingly there is one big spike in January 2024, reaching more than 2M transactions in a day. Previously the ATH was in January 2022 with 2M active wallets. At the lows there was around 900k DAUs.

Going for the 2M DAUs mark once again. This is still a good number, and it is one of the highest in the industry as well, compared to Ethereum for example when this number is around 500k these days. Solana seems to be around 1M now.

Daily Transactions

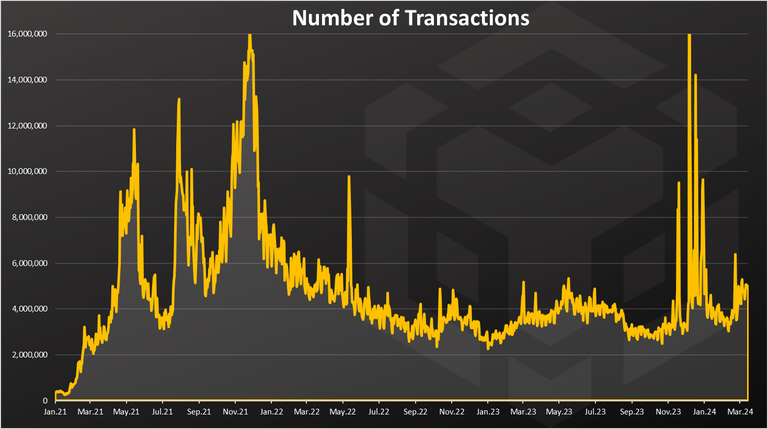

The activity on the networks is mostly represented by the number of daily transactions. Here is the chart.

We can notice the spike in the number of transactions in January 2024. This corelate to the spike in the number of active wallets as well. Not sure what exactly happened in January 2024 that caused this. It was a short lived spike with the number of daily transactions reaching 16M, similar to the previous ATH from January 2022.

During the bear market of 2023 the number of transactions was in the range of 3M to 4M per day, and in the last weeks there seems to be a more organic growth pushing these numbers to 5M per day and above.

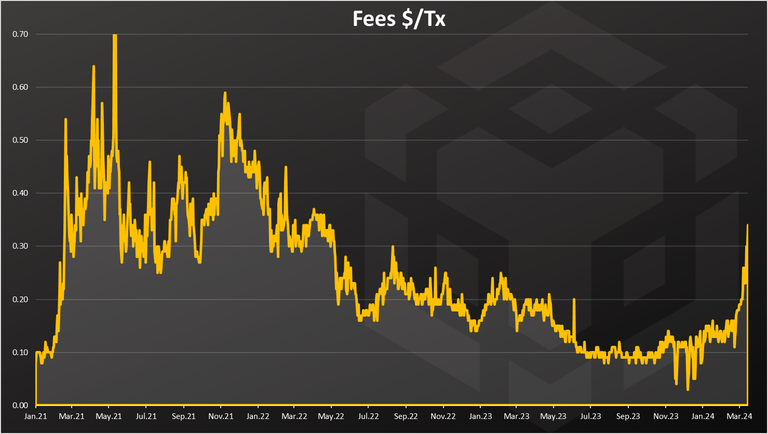

Fees

Fees are quite the unpopular topic and one of the main reasons for the new EVM chains, as users are trying to find a way to escape ETH high fees.

The fees are in dollar terms, average for the day.

After the massive growth in 2021 the fees have dropped during the bear, from 0.6$ to 0,1$. But in the last weeks they have increased again to 0.3$ and above. Meanwhile Ethereum had an upgrade that provides low fees to its L2 chains, just in the few cents range, and Solana is less than a cent. The main competitor to these fees is now Ethereum.

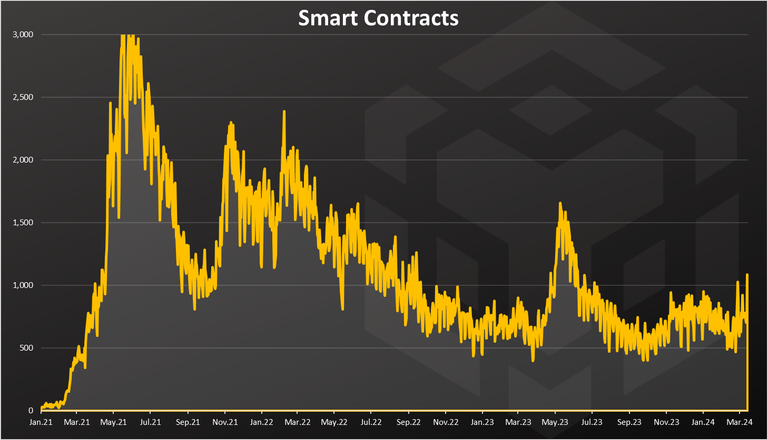

Contracts

BSC is a smart contract platform so here is the chart for verified contracts per day.

A massive growth in the first half of 2021, and downtrend in 2022. In 2023 we can see a spike back in May up to 1500 SC per day, but a drop since then to around 700 per day where it is now.

BNB Price

What about the market cap?

This is the ultimate metric for the chains. Here is the market cap for BNB.

The BNB price is close to its previous ATH levels. The BNB token is now trading around the 600 USD mark, while previously its ATH was just above that. It’s a remarkable recovery and a very strong one. If BNB brakes its ATH levels soon it will be the second token from the top coins that will reach a new ATH, just after Bitcoin. Ethereum for example is still far from its previous ATH close to 5k, while Solana is also closer to its ATH.

All the best

@dalz