HBD has seen more changes and adoption in the last period. A 20% APR on HBD in the savings, a USDC-HBD pool on Polycub was created that now has more than 400k liquidity.

Meanwhile the DHF budget kept increasing and so does the funding for the @hbdatabilizer. For those who don’t know the @hbdstabilizer account is trying to maintain the peg of the HBD to the dollar. It receives HBD from the DAO/DHF and trade it on the internal market and then sent funds back to the @hive.fund.

Let’s take a look how is the @hbdstabilizer doing!

Since the last Hardfork and the ability to convert HBD to HIVE, the @hbdstabilizer works in both directions and it is buying or selling HBD on the internal market depending on the HBD peg at the moment. The bot is runed and operated by @smooth.

We have two scenarios/modes of the stabilizer operation.

- Selling HBD

- Buying HBD

HBD is paired on the internal market with HIVE so the trading is in the two native Hive currencies.

Selling HBD

If the price of HBD is above the dollar then the stabilizer is selling HBD to bring it back to $1.

When the stabilizer is selling HBD, it receives HBD from the DHF (DHF payments are in HBD only), sells it on the internal market for HIVE and sends back the HIVE to the DHF, where it is being instantly converted to HBD so it can be used from the DHF.

These instant conversions from HIVE to HBD in the DHF are a bit tricky since there is no virtual or any operation showing them, hence the exact price of conversions. @howo has already stated that he will be developing an operation that will show these conversions in the future.

Buying HBD

When HBD is below the peg then the stabilizer is buying HBD to bring the HBD value to $1. Since it receives HBD from the DHF, fist it is converting that HBD to HIVE, and then uses HIVE on the internal market to buy HBD. Buying HBD means selling HIVE.

From the description above we can conclude that the @hbdstabulizer is receiving funds in HBD only but it is returning funds in HBD and HIVE. When it sells HBD it is returning funds to the DHF in form of HIVE, and when it is buying HBD it is returning funds in form of HBD. To be able to compare the received vs returned funds we will need to convert the HIVE sent to the DHF in HBD.

The @hbdstabilizser started operating at the end of February 2021, and we will be looking at the data since then.

HBD Sold VS Bought

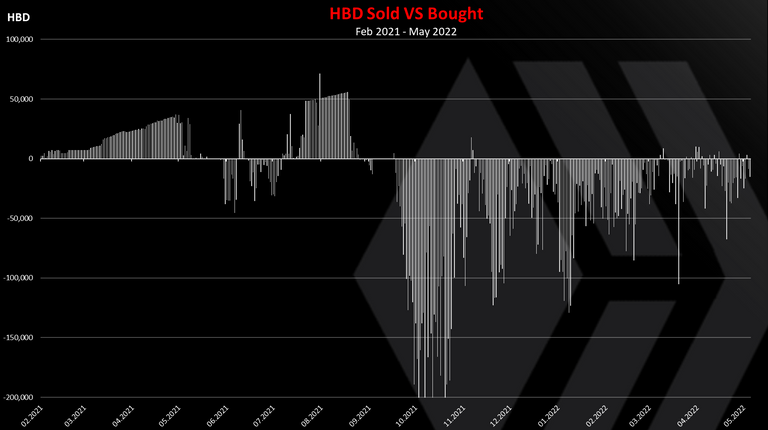

Now let’s take a look at the market activities and how much selling and buying the stabilizers has been doing.

Note that when the stabilizer is selling HBD it means HBD is above the peg, and when it is buying HBD is below the peg.

We can see that until August 2021 the numbers for the HBD sold mostly kept going up and reached 50k per day. The stabilizer had a small budget in that period and the market conditions allowed HBD to break the peg on the upside.

Because of this a lot of conversions from HIVE to HBD happened in September 2021, resulting in HBD expansion. Then in October the HBD price returned back to 1$ as the speculators stopped buying HBD, and then a lot of buying was made from the stabilizer.

Since October 2021, the stabilizer is buying more HBD then selling (supporting the price of HBD), although the amounts keep going down.

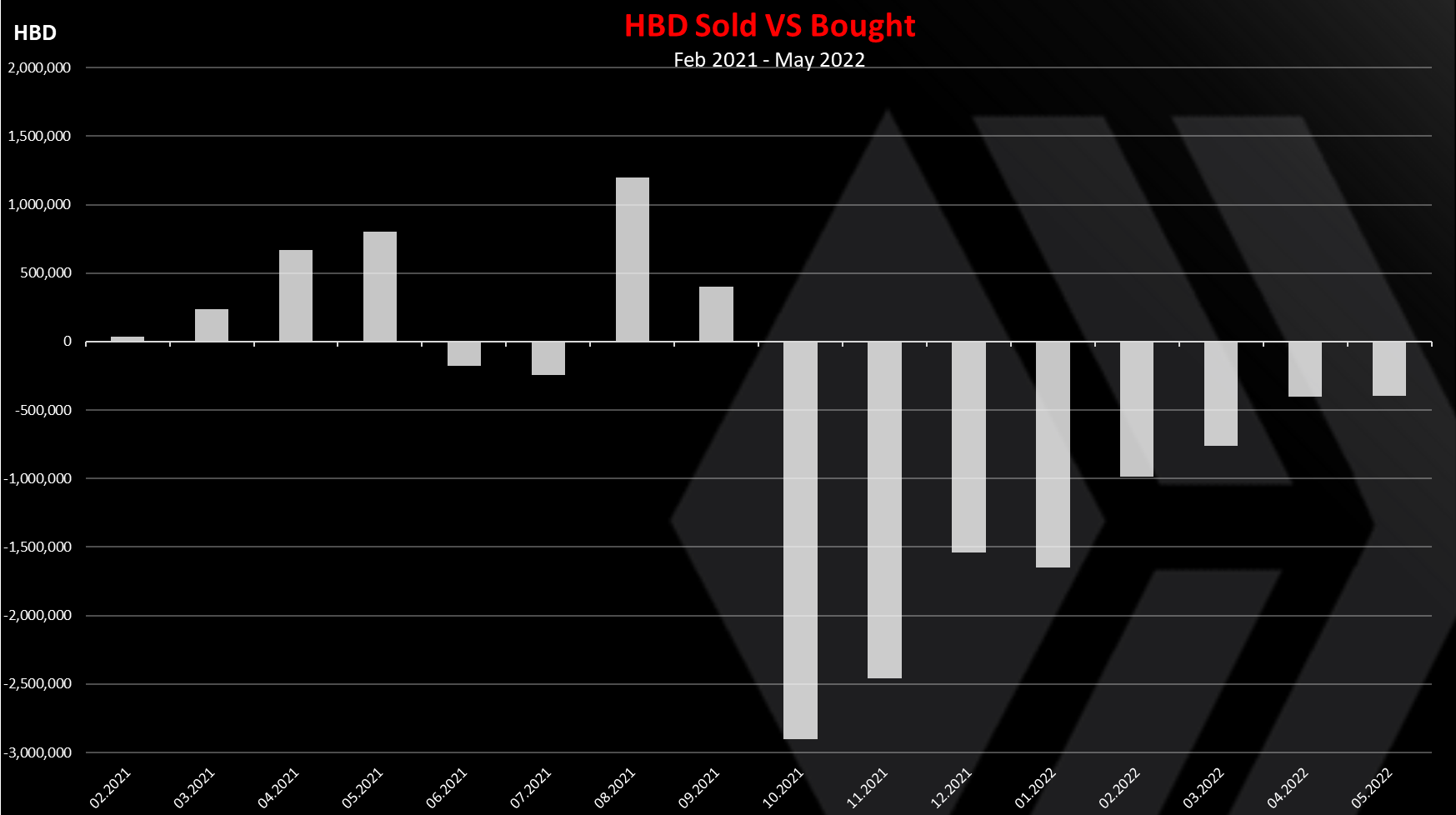

Here is the monthly chart.

We can see the trend from above here as well. Selling HBD at first in 2021, and a constant buying HBD since October 2021, giving HBD a support. In the last months there are around 400k HBD more bought then sold per month by the stabilizer. Back in October 2021 there was almost 3M net HBD bought by the stabilizer.

A total of 3.8M HBD was sold and 12M HBD was bought in a year and three months operation of the @hbdstabilizer. Note that a lot of these amount are circulated.

Funds Received

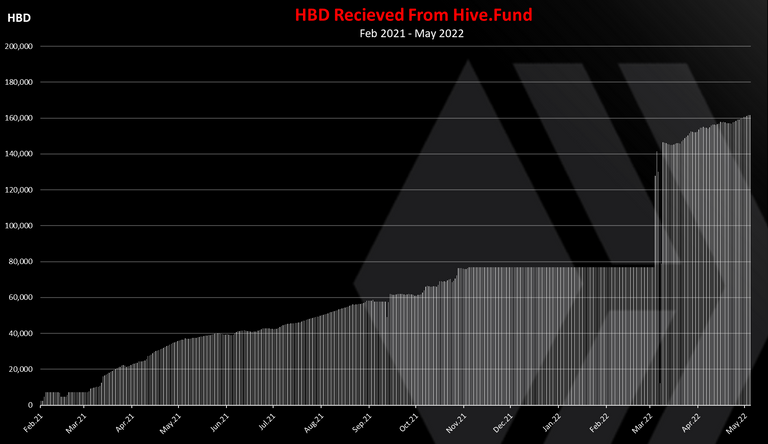

As already mentioned the DHF is paying funds only in HDB. Here is the chart for the HBD transferred to the stabilizers.

As mentioned, the @hbdstabilizer started receiving funds for the first time on February 20, 2021. At first it was only 2.3k per day. The thing is the DHF had a small amount of HBD back in February 2021 and could not transfer more funds. As the time progressed the funds in the DHF grew from 1M to more than 16M HBD now and the daily payouts increased.

The stabilizer now receives more than 160k HBD daily and growing. It is not using all these funds and a big sums is just sent back. Depending on the market condition it will use the funds as needed and provide liquidity in the direction that is needed at the moment.

Funds Sent To The Hive.Fund

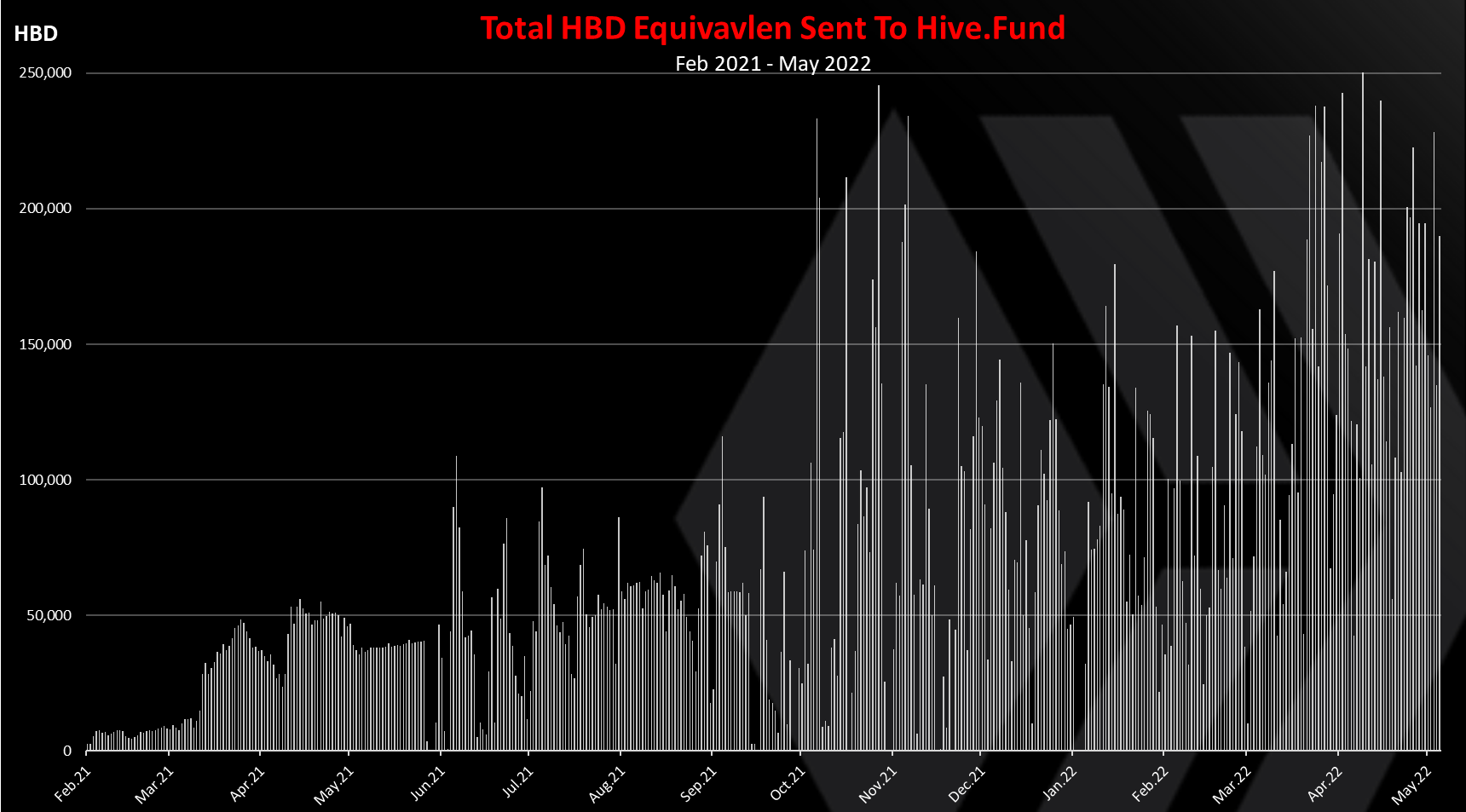

We have seen the funding of the @hbdstabilizer now let’s take a look at the funds that it has sent back to the fund.

Note that funds sent to the @hive.fund are in form of HIVE and HBD. I have converted the HIVE rewards to HBD, for easy representation and comparison. The numbers are approximate because of the conversions.

As mentioned the @hbdstabilizer sells HBD for HIVE on the internal market and then sent the HIVE to the @hive.fund where it is instantly converted to back to HBD. It is also buying HBD with HIVE when the price of HBD is bellow one dollar and sends that back the HBD as well.

On occasions there was more then 200k HBD sent to the DHF on a daily basis.

HBD Received VS Sent

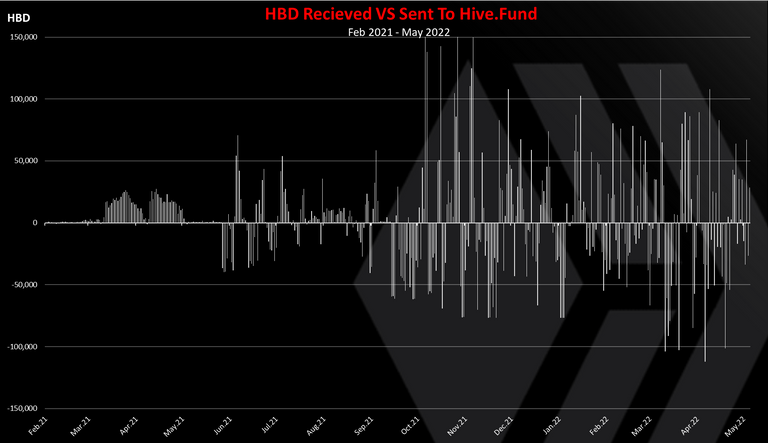

If we plot the amount of HBD received VS sent to the @hive.fund from the @hbdstabilizers we get this.

A positive bar means that the stabilizer has sent more funds to the DHF then received, a net profit, while a negative bar means that the stabilizer has received more funds then sent back, or a net loss.

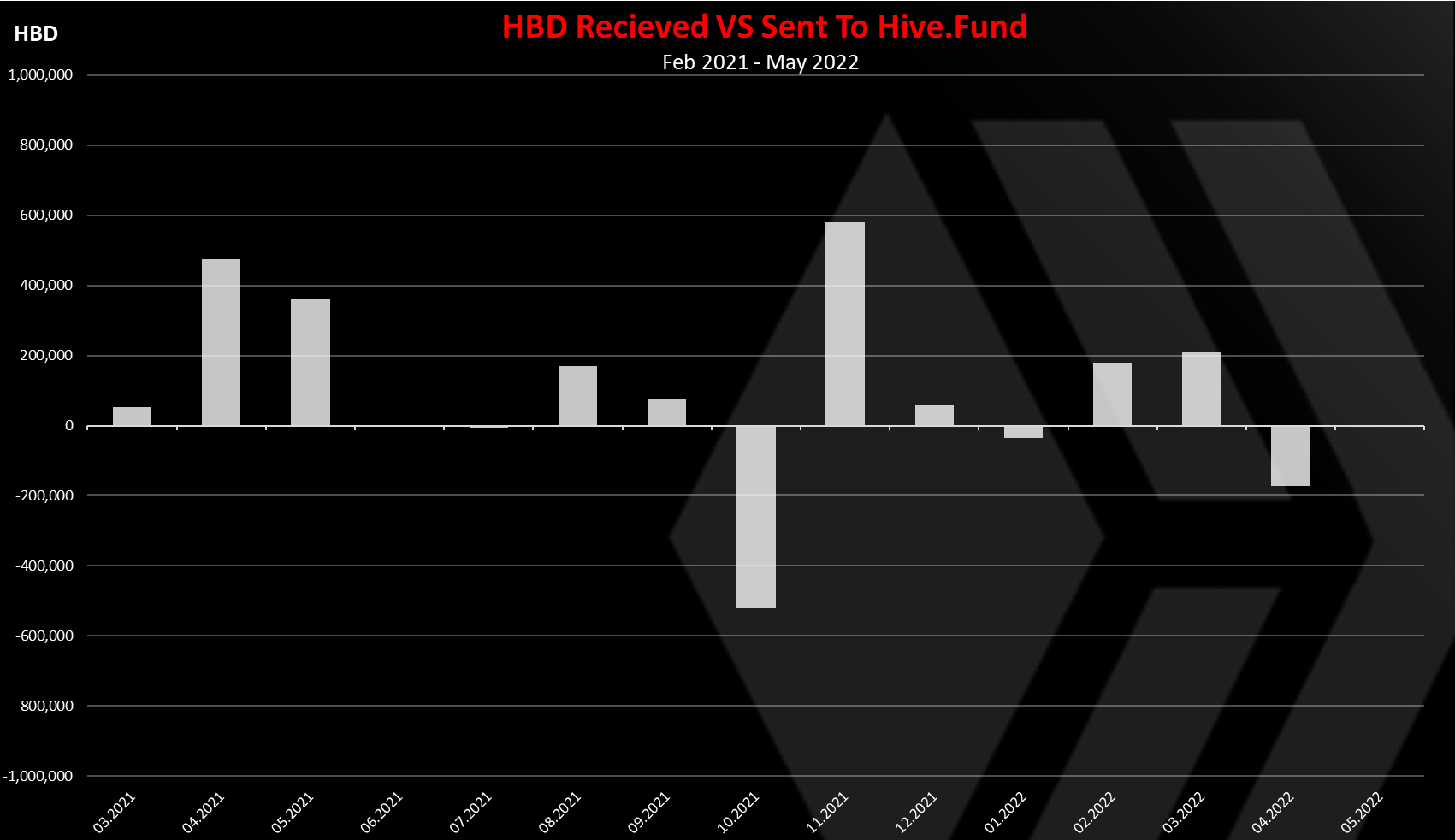

The monthly chart looks like this.

We can see that in most of the months of operations the stabilizer is in profit or neutral, with the exception of October 2021 and April 2022.

The hbdstabilizer profitability is a combination of the buying and selling it is making on the internal market and the conversions from HBD to HIVE.

As mentioned above the @hbdstabilizer is constantly making HBD to HIVE conversions in order to have HIVE and buy HBD if needed. The thing is these conversions take 3.5 days and have a market risk in them, and sometimes they can be market positive, while other times negative. Because the stabilizer is making a relative big amounts in conversions, those can add up.

November 2021 is a record month for the profit of the @hbdstabilizer. The HIVE price reached ATH high in that month and most likely this profit is coming from conversions.

In April 2022, the HIVE price went down, together with the overall crypto market, and we can see that the stabilizer is in negative, although in this month the 20% APR was introduced and there was demand for HBD and the stabilizer was selling HBD at a premium.

Overall, in the period of operation the stabilizer received a total of 29.7M HBD from the DHF and returned a 31.1M HBD, resulting in 1.4M profit.

A cumulative profit for the @hbdstabilizer of 1.4M HBD.

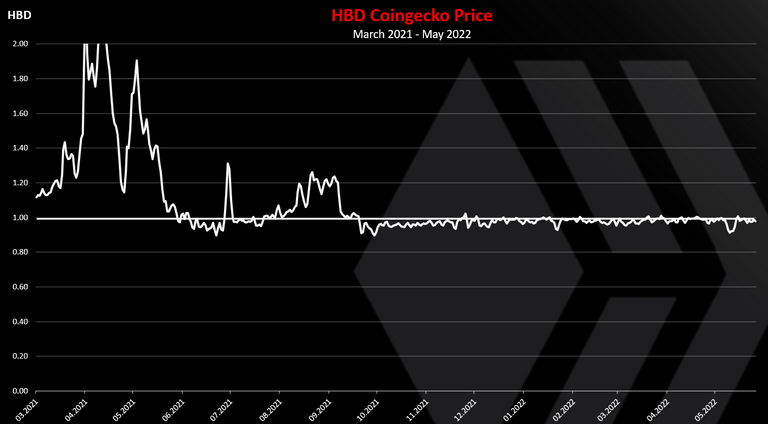

HBD Price

At the end the chart for the HBD price in the period.

Note that this price is mostly from Upbit, while the internal market and the pHBD on Polycub are not included. These pools have the dominant trading volume for HBD in the last months.

We can see that HBD was quite unstable in the first half of 2021 reaching price more then 2 USD. At that time the HIVE to HBD conversions were not possible, and the DHF funds were small. Since June 2021 the HBD has been more stable, with a spike up at the end of August to $1.2, but the conversions were live then and the DHF had more funds, so the peg was brought back quite fast.

Since September HBD is trading mostly in the range of 0.95 to $1. On the internal market and on Polycub the peg is holding better.

The net effect from the @hbdstabilizer still remains positive This profitability comes from the trading on the internal market but also from the HBD to HIVE conversions.

There was a lot more volatile in terms of positive and negative balance for the stabilizer in 2021, while 2022 has less oscillations.

The final goal is for the HBD to have a stable price, and that has been achieved with relative success in the last period.

The HBD concept is solid. It has a lot of elements now for it to work. It has an incentivized internal market where DHF funds are used through the @hbdstabilizer to maintain the peg. Any external markets and exchanges can use the internal market and arbitrage the price of HBD. The two-way conversions are also doing their job. HBD has a 20% interest now for the savings account, that is a competitive APR.

All the best

@dalz

Posted Using LeoFinance Beta