How is the Bitcoin network doing in 2022?

The overall market has been in a downtrend throughout the whole year. Lets see how has this impacted the key network metrics.

We will be looking at:

- Total number of wallets

- Active wallets

- Hash rate

- Number of transactions

- Fees

The data presented here is mostly gathered from the blockchains charts.

Number of Wallets

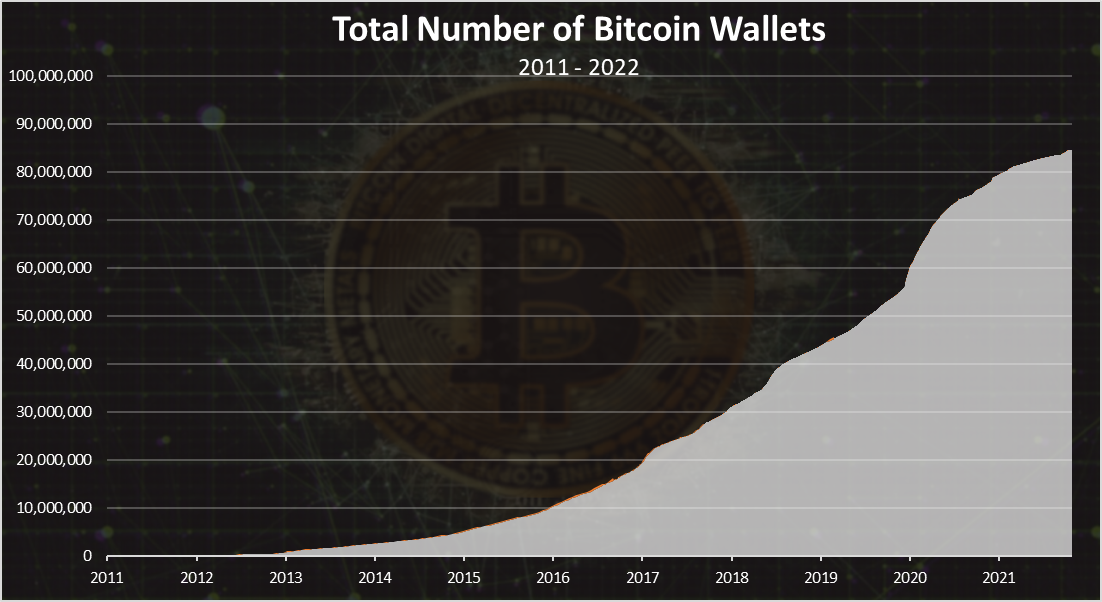

Here is the chart for the total number of Bitcoin wallets created.

Bitcoin stands at 84.6M wallets now. We can notice an increase in the last year or two but let’s take a look at the last year for better clarity.

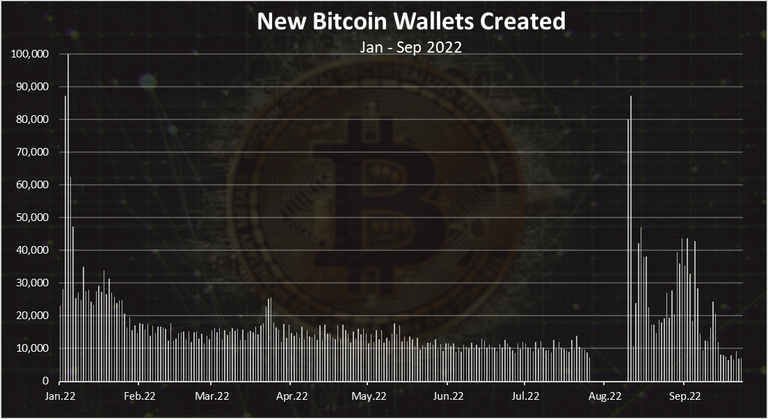

Around 10k wallets created per day. There has been a drop in the numbers of wallet created compared to the previous years. At the beginning of the year, we can also see a higher numbers than later on. But overall, the number of new daily wallets has been quite stable around the 10k mark.

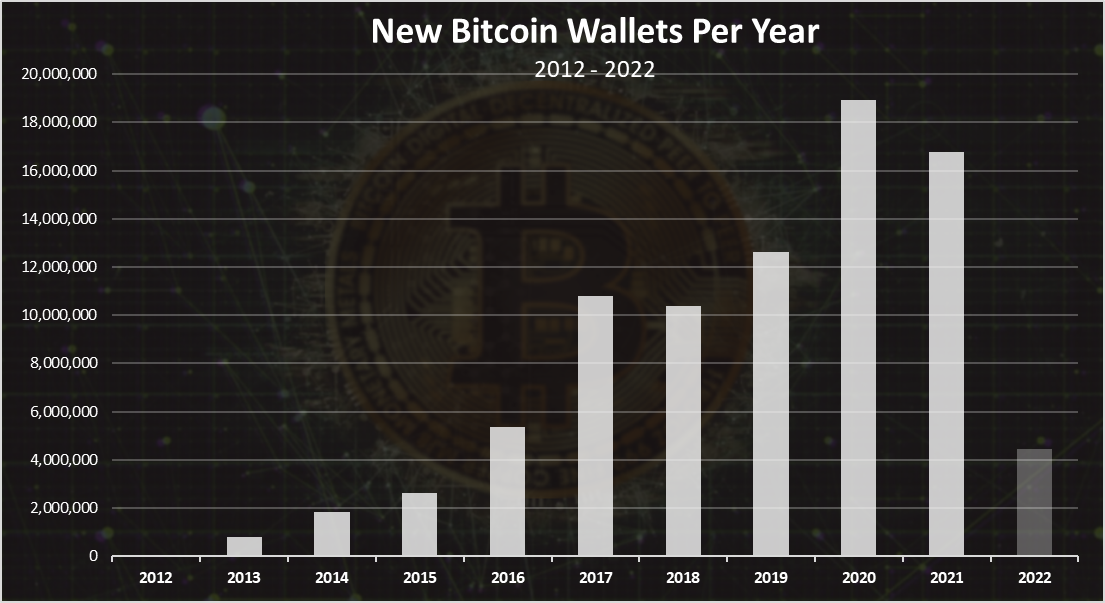

The yearly chart for new bitcoin wallets

The chart for the number of new Bitcoin wallets per year looks like this.

We can see that the ATH for new wallets is in 2020 with around 19M Bitcoin wallets created in that year. In 2021 there is almost 17M bitcoin wallets created, even though BTC has seen a massive run-in price especially in the first half of 2021. Most likely because new users are using custodial wallets.

2022 is not over yet, but the numbers of new wallets are quite small. At the moment just above 4M. I find this surprisingly low, and it seems like a trend that started back in 2021, when the number of new wallets just didn’t corelated with the price increase. As mentioned, it might be because of new users using custodian wallets. Another speculative thing I can think about is that previously someone was creating a bunch of new wallets just to pump the numbers. There have been cases like this for other projects, and with the decentralized nature of Bitcoin, everyone can do it.

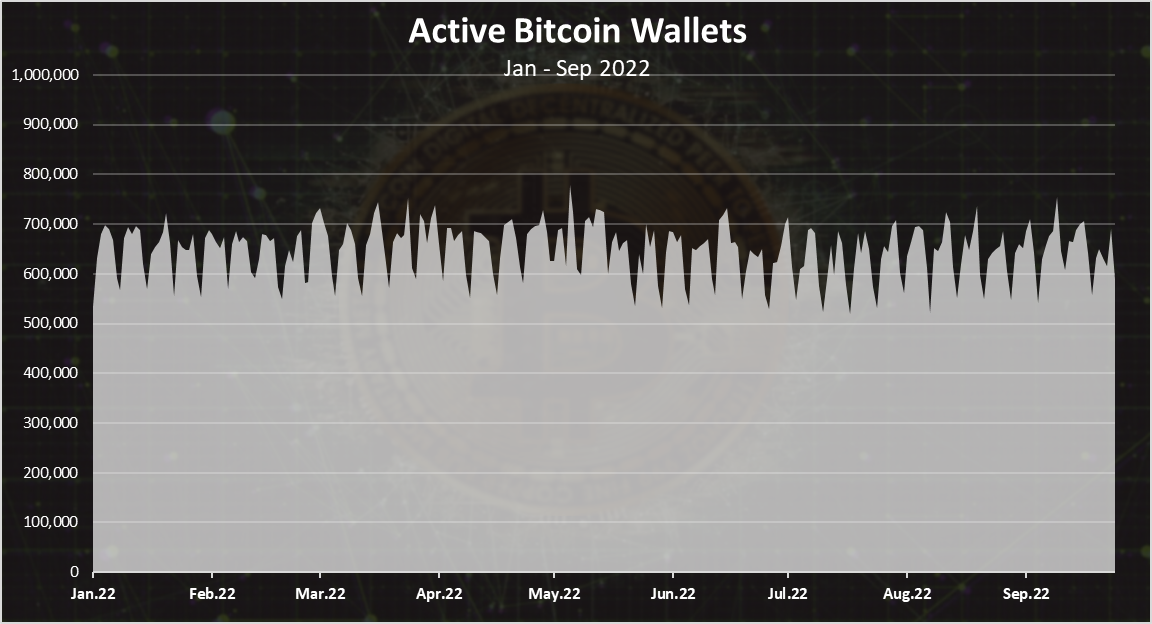

Active wallets

How many of the are being used?

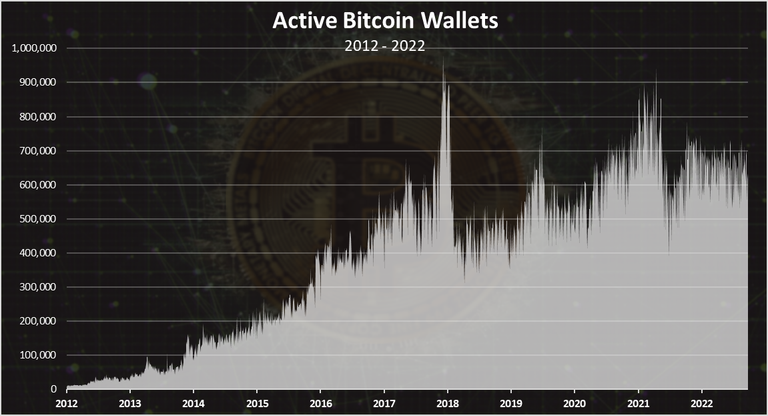

Here is the chart.

The record high numbers for active Bitcoin wallets per day was reached in December 2017 with almost 1M active Bitcoin wallets. A sharp drop in 2018 to the 400k daily active wallets, and a steady growth since then.

If we zoom in for the last year we get this.

A very steady number with around 700k active wallets. The drop in the price didn’t impacted this chart at all. What’s interesting there is some up and down pattern throughout all the year.

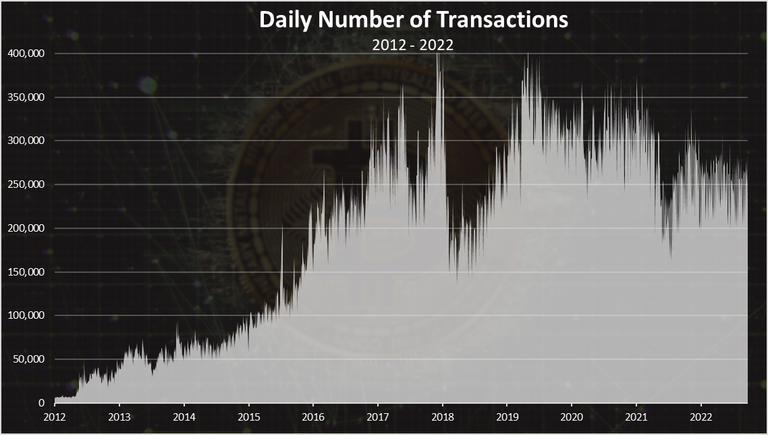

Transactions

The activity on the network is mostly represented by the number of daily transactions.

A steady number of transactions in the last year with around 250k transactions per day. The ATH for network transactions is just above 400k per day.

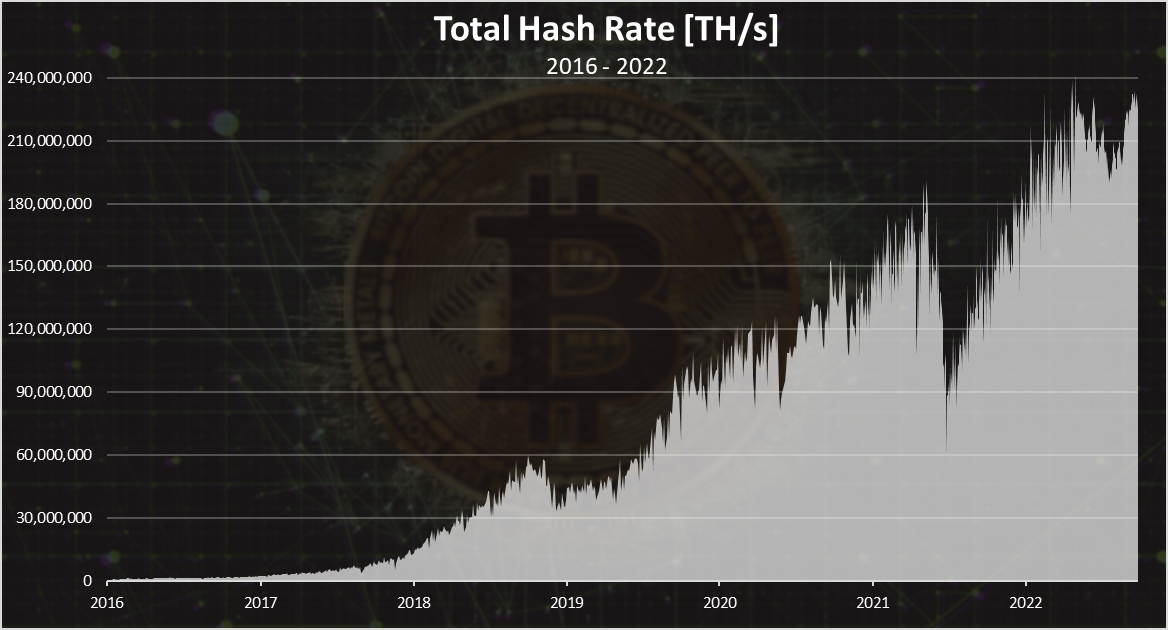

Hash Rate

The ultimate Bitcoin value is the network stability and security. The network security in a proof of work chains is measured in hash rate, or how difficult is to mine. The bigger the completion, the higher the hash rate.

The hash rate has been going mostly up, until June 2021, when we can see a sharp drop. This is because of the ban on Chinese miners. An increase again since then.

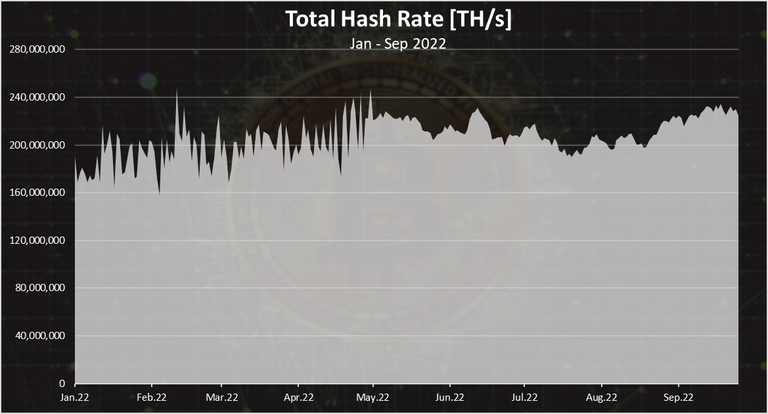

If we zoom in 2022 we get this.

A steady growth here.

At the beginning of the year the hash rate was at 170M TH/s and now it stands at 230M TH/s. More than 30% increase in less than a year. Miners are obviously bullish on Bitcoin.

What’s even more amazing is that 2022 has been a year in which the energy prices reached high levels all around the globe, and still BTC miners are not capitulating, but on contrary are growing.

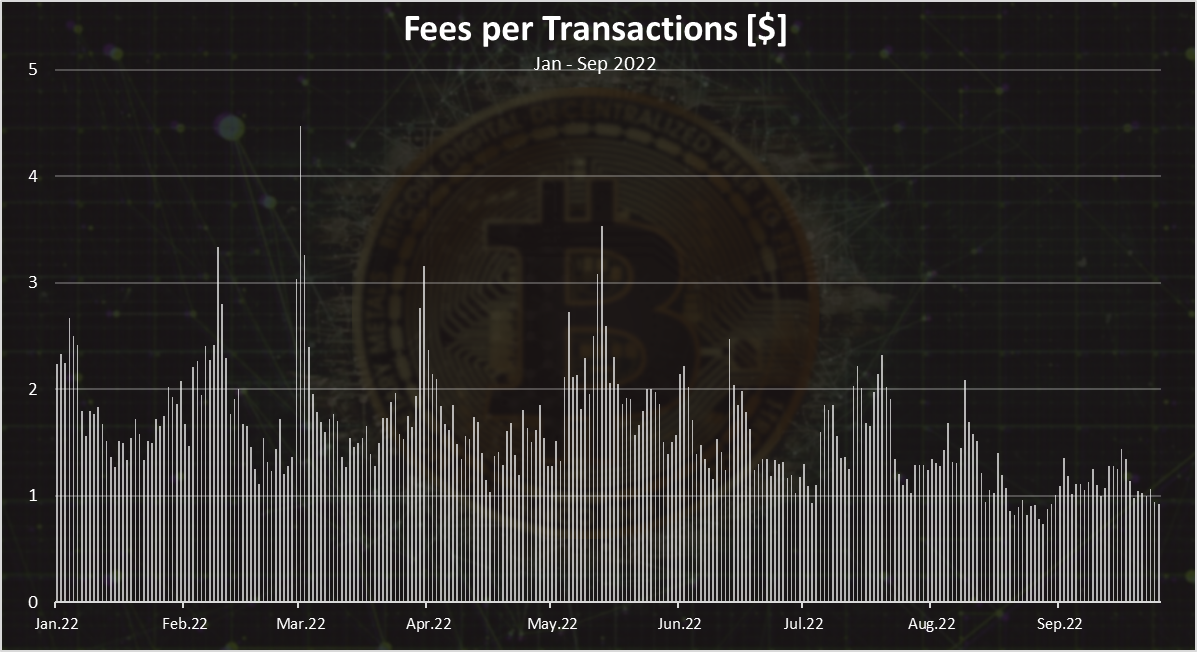

Fees

A bit unpopular topic the fees.

The bitcoin fees are quite low these days, with around a $1 per transactions. They have been going down throughout the year, but were relatively low to start with, $2 at the beginning of the year.

Back in 2021, at one point the fees reached $30 per transaction.

While unpopular Bitcoin fees are essential for the future security of the network. When the inflation rewards go down, the majority of the incentives for miners should come from fees. I have recently wrote a post on Bitcoin Inflation and Long-term Network Sustainability.

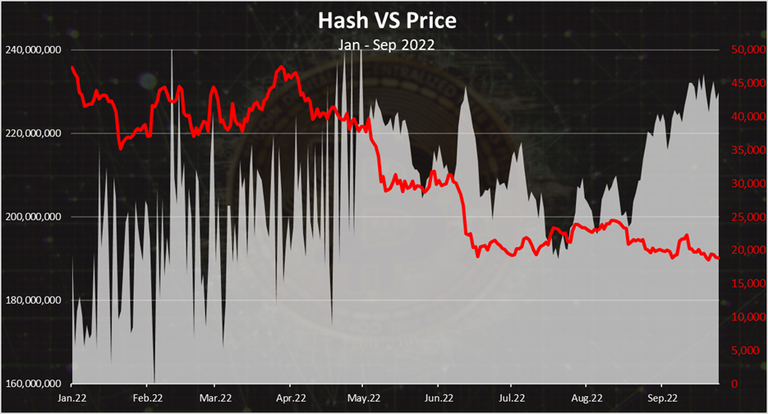

If there is one thing to takeaway from this numbers, that would be the Hash rate. While the price keeps going down the Hash rate keeps going up in an overall market of high energy prices!

When we plot the price against the hash rate we get this.

Two metrics going in opposite directions 😊.

No matter the price, the bitcoin hash rate keeps growing, indicating more miners jumping into the game. Makes you wonder what would have happened if the Bitcoin prices was going up.

The other metrics, like wallets and transactions are quite steady and are not showing much correlation with the price, indicating that new users are either custodial or its mostly institutions.

All the best

@dalz

Posted Using LeoFinance Beta