While 2022 has been a challenging year for the cryptocurrency industry, HBD has been in a bright spot, especially for users within the Hive ecosystem. This is because, in the past year, witnesses have increased the interest rate for HBD in savings and, since April 2022, it has been set at a very attractive 20% APR.

One question that arises is whether this is sustainable. To answer this, we will be examining the theoretical inflation resulting from the HBD interest.

To start, it's important to understand where the HBD interest comes from.

It is an additional inflation on top of the regular inflation. Because HBD is a derivative of HIVE, this means we are increasing the base inflation rate for HIVE. However, the Hive inflation and supply have always been complex, with many details, particularly with HIVE to HBD conversions and vice versa. The conversion dynamics can result in an end result that is very different from what was initially envisioned. It is not a straightforward process where the new minted coins simply get added to the current HIVE base.

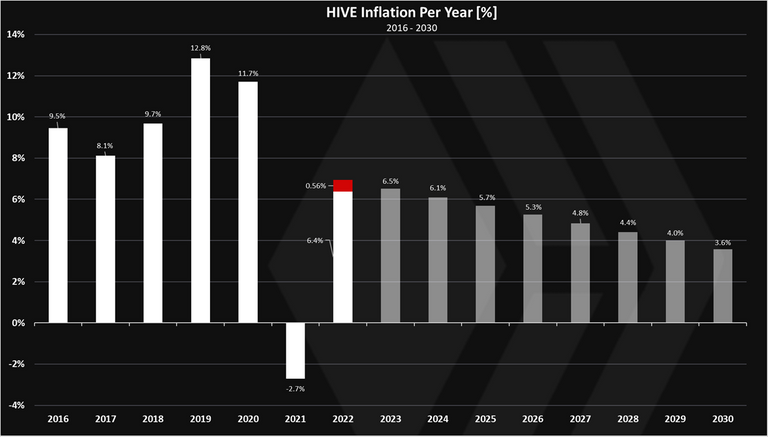

Currently, the regular inflation rate is around 7%. However, for example, Hive inflation for 2021 was deflationary at -2.7% due to conversions. The realized inflation for 2022 is surprisingly the same as the projected rate of 7%. This is surprising because, since the beginning of the chain in 2016, all realized inflation rates have been different from the projected ones.

How Much HBD Is Created From HBD Interest?

HBD is created from HBD in savings. To get the data, we need two things:

- HBD in savings

- interest rate

HBD Savings

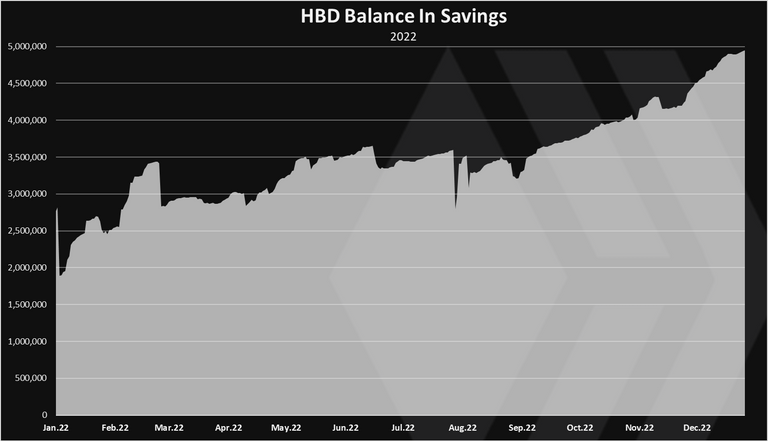

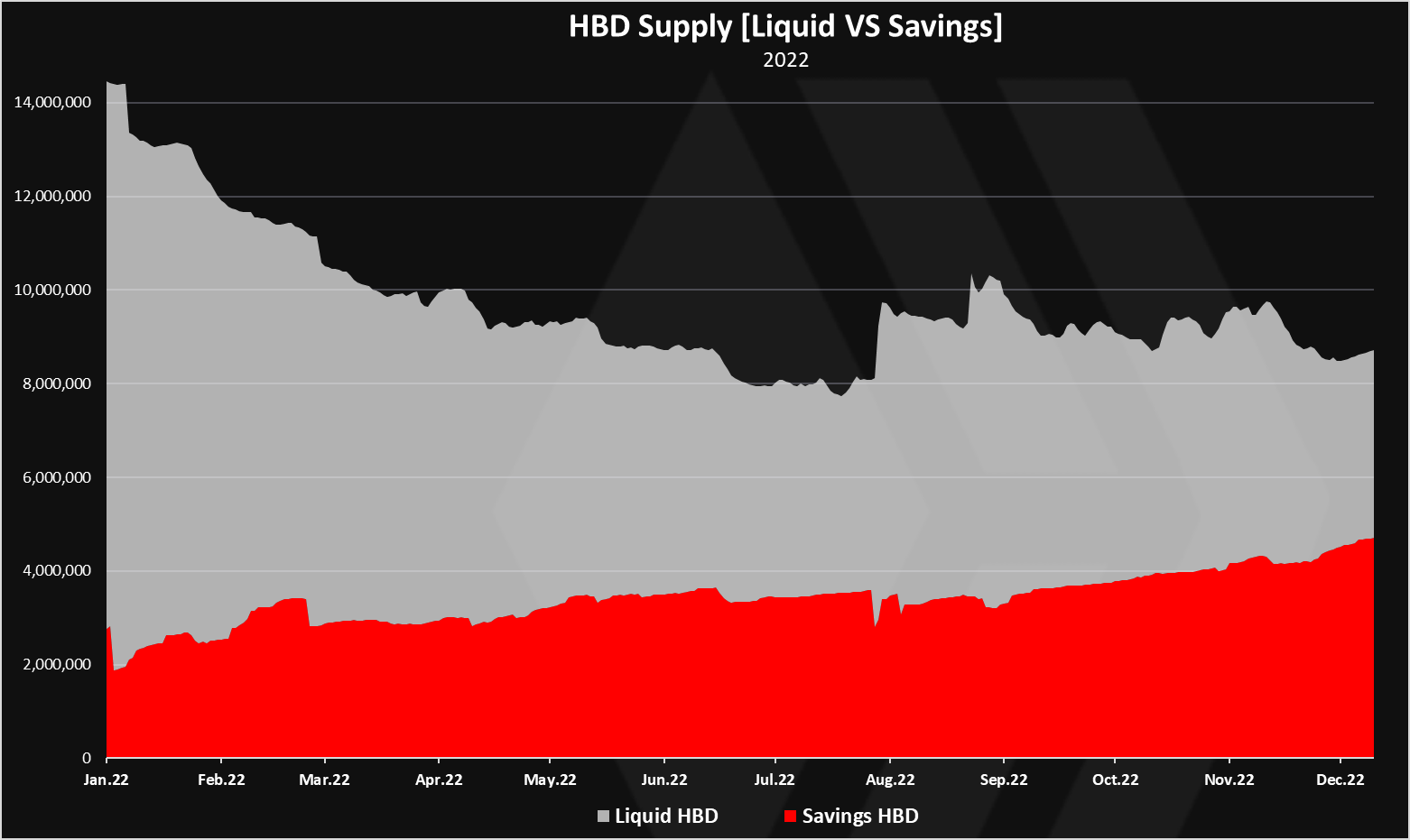

First the chart for the HBD balance in savings in 2022.

The HBD in savings has been consistently growing in 2022. At the beginning of the year, there was around 2 million HBD in savings, and now we are at 5 million! We can see that, in the past few months, the amount of HBD in savings has increased even more. This is mostly due to the increase in the debt limit from 10% to 30% with the last hardfork in October, and other market conditions.

The above is the principal for the HBD interest.

What About the HBD Interest Rate?

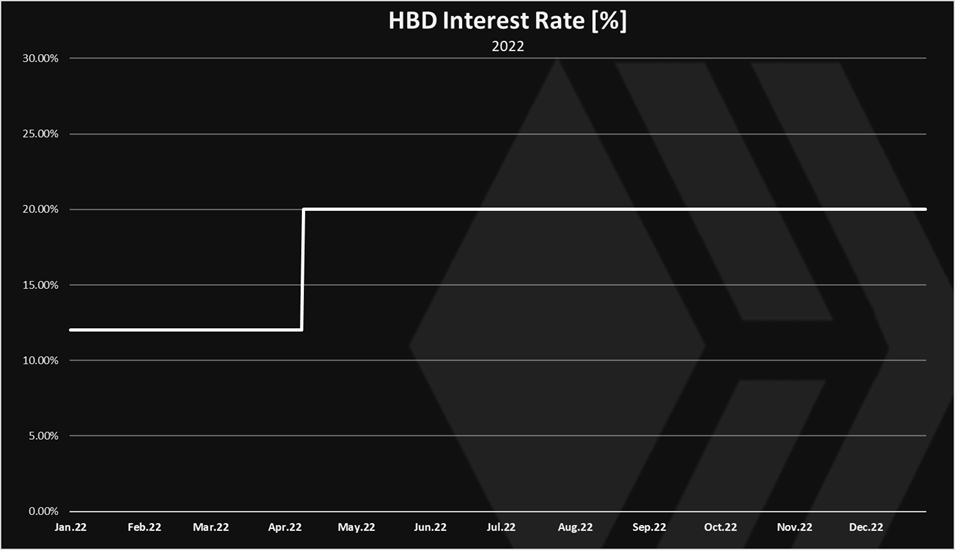

Here is the chart.

There were a few more changes in the interest rate back in 2021, but we have seen a one- time increase in 2022, from 12% to 20% in April 2022, and it has stayed there since then.

Now that we have the principal and the interest rate, we can calculate the interest in HBD.

Daily HBD Interest

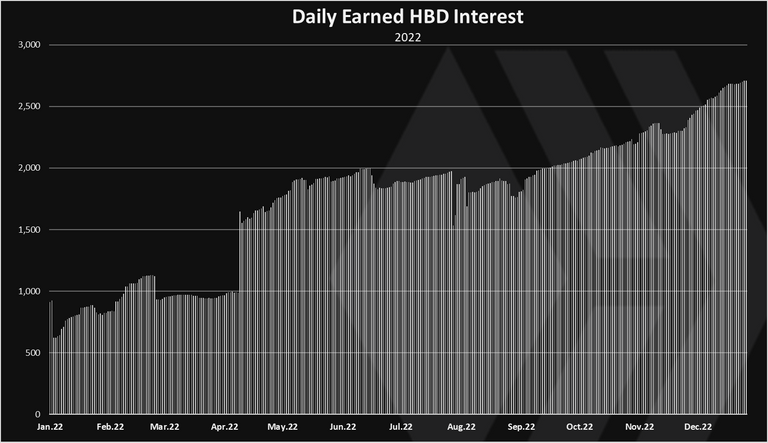

Here is the chart.

Not surprisingly, as the principal and interest have grown in 2022, so has the paid HBD interest.

At the beginning of the year, there was around 700 HBD paid daily. This increased to 1,000, and then sharply increased to 1,500 in April, when the interest rate was set to 20%. Following this, the principal grew, resulting in more HBD deposits in savings, and the daily interest reached 2,000 and stayed there for months until September. In the past few months, we have seen continuous growth in payouts, mostly due to the growth in the amount of HBD in savings.

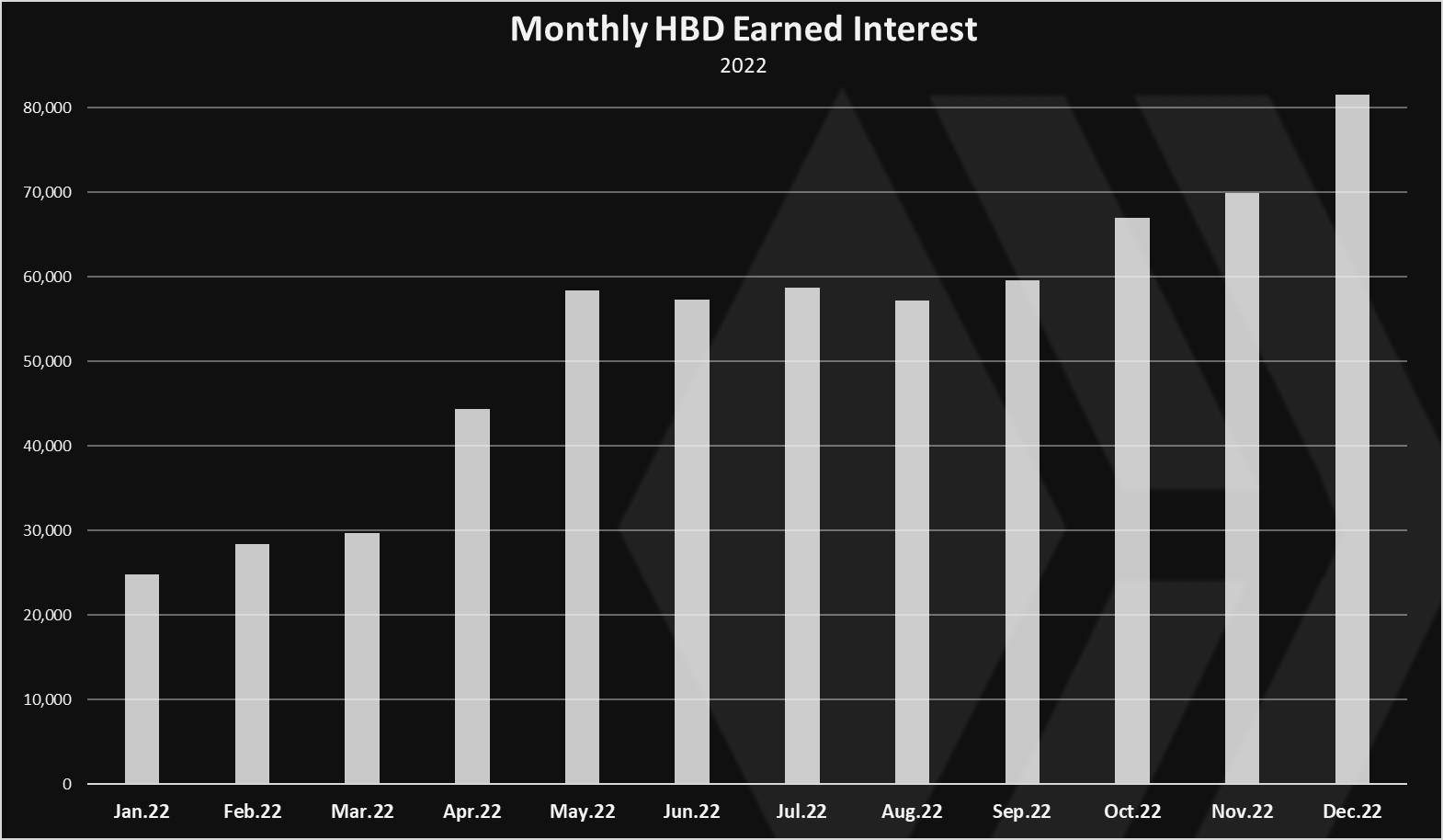

The monthly chart looks like this.

The amount of HBD interest now stands at 80k HBD per month.

Cumulative for 2022 there is 640k HBD paid as interest.

Inflation From HBD In 2022

Ok so we got the absolute amount of HBD paid daily, monthly and overall. But what this means when we compared it with the overall HIVE supply and inflation.

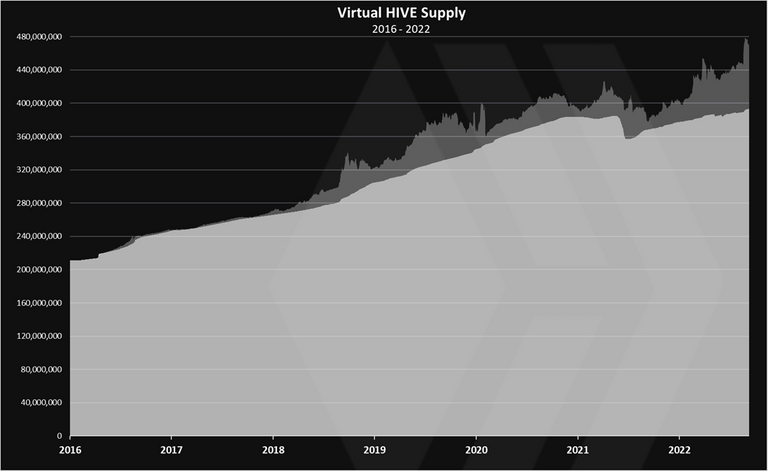

At the beginning of the year there was 370M HIVE in circulation and now we are at 395M HIVE. An overall of 25M HIVE was added in 2022 from all type of inflation sources, that is exactly at 7% inflation, as the projected one. Having an inflation as the projected one, might be considered as a win for HIVE in a year where the crypto markets are down.

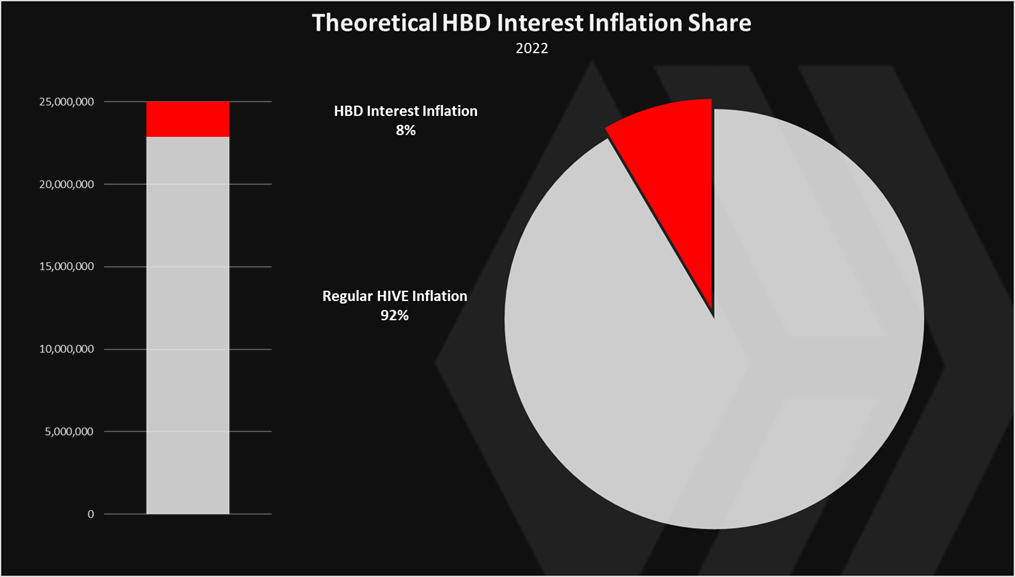

What is the share of the HBD in this overall HIVE inflation?

We have seen that an overall 640k HBD is paid as interest in 2022. To convert this in HIVE we need the HIVE price. The proper method here would be to take the HBD interest generated on each day and convert it to HIVE with the price for that day. Meaning a sort of average. But let’s go with the worst-case scenario that is the lowest price for HIVE that is now.

When we convert the 640k HBD in HIVE at a price of 0.3, we get a 2.1M HIVE. Meaning from the 25M HIVE created in 2022, a 2.1M is coming from HBD interest. This of course is a theoretical number, because not all the HBD interest will be converted to HIVE and at the 0.3$ price.

The chart pie for the HBD inflation share looks like this.

An additional 8% on top of the current inflation. This is a share of the inflation.

When we take a look at inflation rate for HIVE on a yearly basis we get this.

Up to 2022 the numbers are realized, and after that, they are projected.

We can see that the realized inflation for 2022 from the HBD interest is 0.54%

This again is a scenario where the HIVE price is at 0.3$ and all the HBD is converted to HIVE. In reality this will be a mix and we cannot properly allocate what share of the HBD interest was actually converted or not. Most of it will probably remain as HBD.

If we set the price of HIVE double than that is today then the inflation form the HBD interest will be at 0.27%, and if we set the price of HIVE lower at 0.15%, then the inflation from HBD interest will be at 1%.

Projected inflation from HBD interest

2022 had a mixed interest rate for HBD at 12% and then 20%. We have also seen a growth in the HBD in savings. How will this continue forward?

For the current interest rate at 20% and HBD in savings at 5M, this will generate a 1M HBD interest in a year. Now comes the tricky part, at what HIVE price we should convert the HBD in HIVE. If we set it to the current one of 0.3$ it will be 3M HIVE per year, or around 0.75% additional inflation. For a lower price this will be higher say double 1.5%, and for a higher price, the opposite, say 0.37% for 0.6$ HIVE.

For a more volatile scenario If the amount of HBD in savings goes 10X to 50M HBD and the HIVE price remains the same as now we will have an additional inflation of 10M HBD, that is equivalent to 30M HIVE or 8% additional inflation. But this is almost impossible to happen as this much of new HBD entering circulation in a short period of time will for sure increase the price of HIVE.

HBD Supply

Except for the HIVE price, the other major thing that impacts the amount of HBD interest is the HBD in savings. We have seen an increase in the HBD in savings from 2M to 5M in 2022. Thing is 2022 started with a lot of HBD floating freely around. At the beginning of the year there was 14M HBD in circulation out of which only 2M were in savings. Now we have 9M HBD in circulation, the HBD supply has contracted, and out of those 5M are in savings.

It is increasingly difficult to add more HBD in the savings without the need to push HIVE. There might be a slow increase in the amount of HBD in savings, but drastic changes cannot happen.

This is simply because of the fact that the HBD supply is constrained and small. There is no pre-mine or any type of source from where a significant amount of HBD can come on the market without the need to get HIVE first. The most liquid market for HBD now is the internal market, where the stabilizer provides HBD from the DHF, but it usually does that at a premium, locking HIVE in the process. Of course, the conversion option is the ultimate liquidity for HBD, but that one directly removes HIVE from circulation.

The main conclusion from the above is that even with the sharp drop in the HIVE price that happened in 2022, the inflation from the HBD interest remains small at 2M HIVE equivalent or 0.54%. This is not an actual number but a theoretical. The actual HIVE inflation for 2022 ended as the projected one at 7%, meaning things have balanced out between payouts and demand for HBD in 2022, resulting in close to zero additional inflation.

Going forward in 2023, all things remaining the same, this number might be around the 1% (plus/minus 0.5%). Again, only a theoretical number, HBD demand can offset this. We are entering in 2023 with much lower freely available HBD supply then it was at the start of 2022. Most of it is in savings. Because of this HBD might be more sensitive for demand, as there is no freely circulating HBD. HBD demand offsets the interest, as it pushes HIVE.

In the mid-term, five year, the interest from HBD is not putting any pressure on HIVE and is totally manageable. The exact output will depend on markets dynamics, that we can not predict. The risk might increase in the long term if the price of HIVE remains stagnant and depressed for a prolong period of time. The interest might start to put some pressure than. If there is any increase in the HIVE price, the HBD interest can go a long way.

Predicting how things will go is extremely hard, and there is a big possibility for mistake. The crypto market can be very volatile and unpredictable. At the end there is always the HBD haircut rule that is the ultimate protection for HIVE from HBD.

All the best

@dalz

Posted Using LeoFinance Beta