Uniswap has been the one protocol that is probably the most to blame for all the DeFi movement that happened in the last bull market. The ease of use, simple and user friendly UI, while at the same time providing economic incentives has make it grown and compete with the no.1 CEXs.

Let’s take a look how it is doing under the current market conditions after the FTX implosion.

The crypto market is once again brough to its knees from the FTX meltdown. More than 10 billion in users’ funds are now in question, will they ever receive anything back from it. A company that had valuation more than 30B is now worth zero.

This has put a lot of scrutiny under the centralized exchanges and some of them started to show their balance sheets as proof of reserves (PoR). Meanwhile in the defi world everything is on chain all the time and all the data can be verified at all time. DeFi has gained some more points this week.

With this said lets take a look at the good old Uniswap.

Here we will be looking at:

- Total value locked

- Trading Volume

- Uniswap V2 VS V3 in trading volume

- Number of users

- Top Pairs

- Price

The period that we will be looking at is 2022.

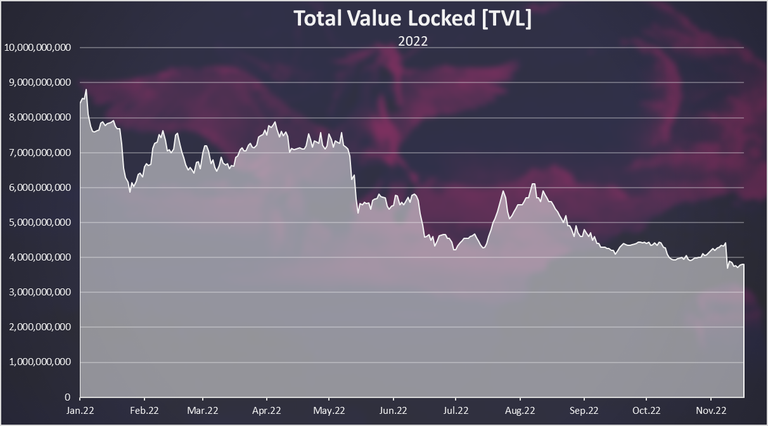

Total Value Locked

Here is the chart for the TVL on Uniswap starting from September 2020.

At the beginning of the year there were almost 9 billion in TVL on Uniswap. This has kept going down throughout all the year and now we are at record lows with around 3.8B in total value locked. The biggest drop from 7B to 4.5B happened in May after the LUNA/UST collapse. Then there was a slight period of growth in the summer of 2022 and a drop again reaching the all time low now.

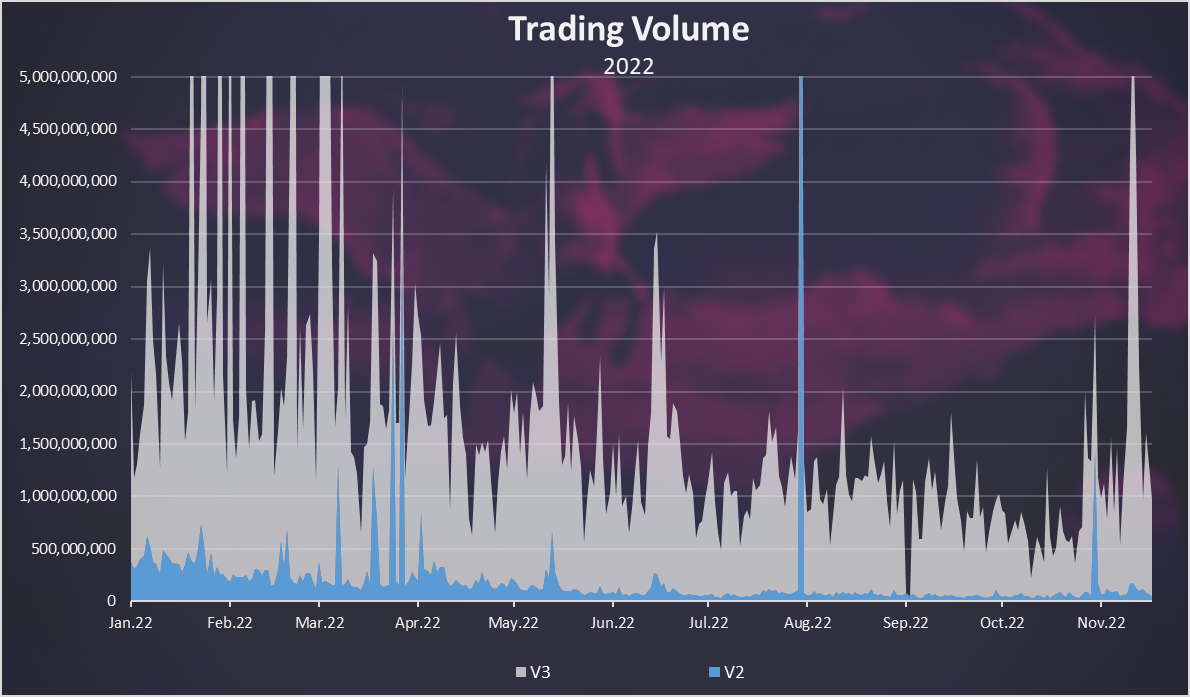

Trading Volume

Trading volume is extremely important. That is where the fees come from and the APR for liquidity providers. No trading volume means no fees and no capital in the protocol.

The chart for the trading volume looks like this.

We can see that most of the volume is now from Uniswap V3. The V2 version has dropped behind. V3 was launched back in May 2021, and we can see that in less than a year it has become dominant.

Also, we can see the spike in the volume in the last week because of the volatility in the market. On November 11 there was more than 5B in trading volume. Prior to this the trading volume has bee somewhere around 1B per day.

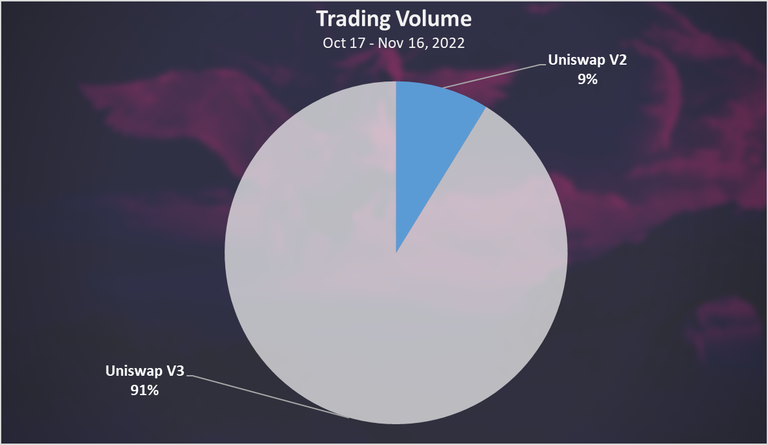

The trading volume share for V3 vs V2 for March 2022 looks like this

An overwhelming 91% to 9% in favor of V3.

DEX VS CEX Volume

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

An example for the last 24 hours:

Uniswap ranks on the 3th spot. On November 11, Uniswap was no.2 in terms of volume. Prior to this Uniswap was out of the top 5. Now we can see that it has entered the top 5 and it is around second and third spot.

Obviously DEXs are now serious competitors to CEXs. There is two more DEXs that are in the top exchanges, Curve and Pancake.

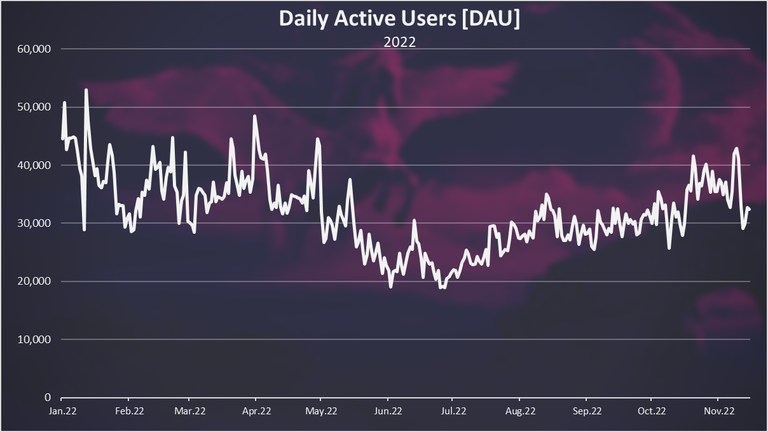

Active Users

How many users Uniswap has? Here is the chart.

In terms of active users we can see a reverse trend after the summer. The year started with 50k DAUs, and till June it has dropped to 20k DAUs. Since then the numbers have been on an uptrend and in recent days it has reached 40k again.

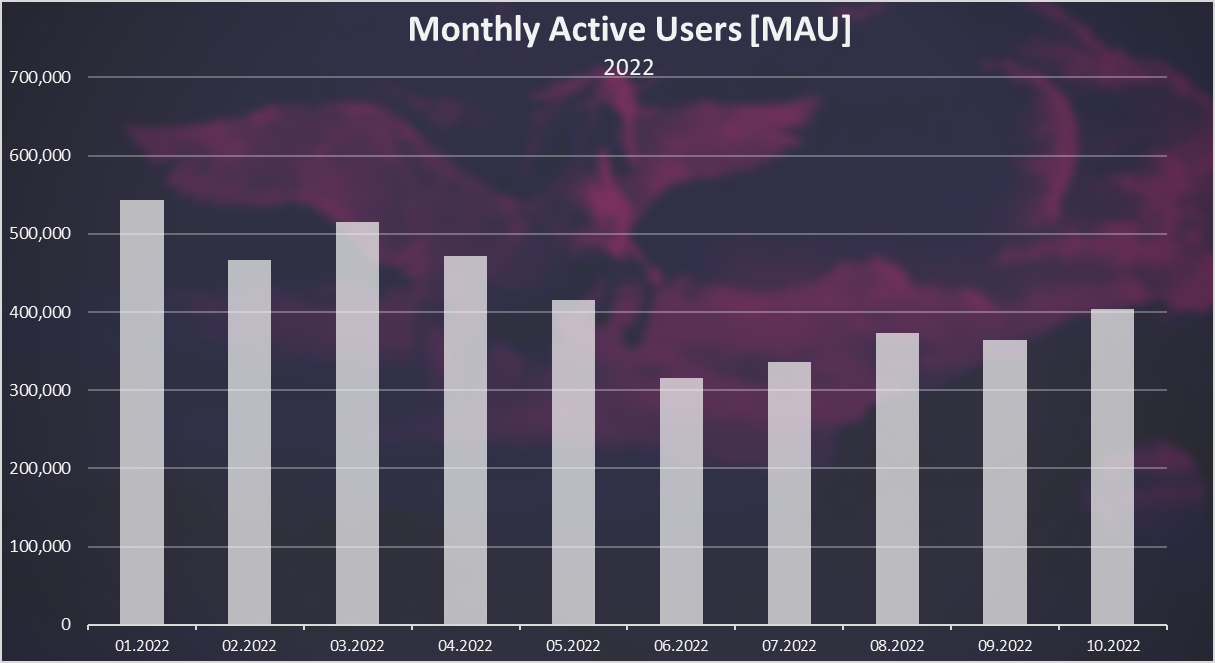

On a monthly basis the chart looks like this.

A similar pattern here with a low reached in June with 300k and a grow since then reaching 400k users in October 2022.

Top Trading Pairs on Uniswap

Here is the chart for the top trading pairs ranked by liquidity.

Stablecoins are now the number one pairs on Uniswap. Out of the top 10, five are stablecoins pairs.

The DAI-USDC is number one with almost 900M in liquidity combined from all the pools. Next is the ETH_USDC pair, followed by ETH-WBTC.

We can see that the bear market has made a lot of users to swap to stablecoins and those are the largest positions now. In the past the ETH pairs were leading.

Price

The all time chart for the UNI price looks like this.

The year started with Uniswap at 18$ and the token price has been in major decline since then. We are now at 6$ price, and the token has been around this level for a while now. Back in 2021 the ATH for the UNI token was at 40$.

Uniswap I now competing with the top exchanges in the world like Binance and Coinbase. It is a major player in the defi space with 4 billion in TVL at the moment. The trading volume on the protocol is also healthy with an average around 1 billion per day, while it has reached even 5B on Nov 11 when there was volatility in the market, placing it as the number to exchange in the world, just behind Binance.

The number of DAUs has been around 40k in the last period while the MAUs are 400k. Stablecoins are now dominant with 0.9B in liquidity for the USDC-DAI pool.

All the best

@dalz

Posted Using LeoFinance Beta