Another month under the Hive belt with deflationary tokenomics. This one has been quite significant as well.

Let’s take a look at the HIVE tokenomics for February 2023.

The projected inflation for 2023 is around 6.5% on a yearly basis, or 0.55% on a monthly basis. As for the title said Hive ended the month deflationary with more than 1% in the negative.

Hive has a double currency system, HIVE and HBD, with conversions between them that add or remove HIVE from circulation on top of the regular inflation. Furthermore, the decentralized hive fund DHF, that serves as a DAO converts the HIVE that is in the DHF. The @hbdstabilizer has also grown and it is playing an important role in the overall tokenomics, making conversions and trading on the internal market.

Because of this additional mechanics the HIVE inflation and supply can be drastically different in real time then the regular/projected one.

To be able to follow the HIVE supply we need to take a look at all the different ways HIVE is created, author, curation, witness rewards, conversions etc, then net that out with the HIVE burned from conversions, accounts fees, null transfers etc. To get the virtual supply we need to do the same for the HBD supply as well.

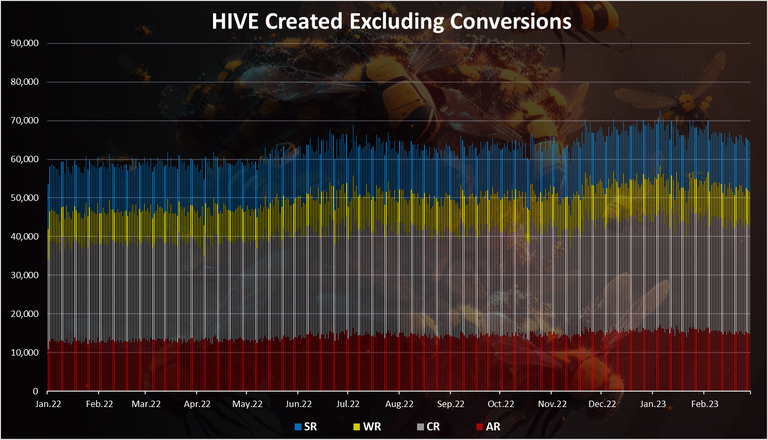

HIVE Created

Here is the chart.

The chart above includes:

- Author rewards

- Curation rewards

- Witness rewards

- Staking rewards

These are the regular ways new Hive enters circulation, and all of them are through vested HIVE, aka powered up. You can notice the slight fluctuations in the daily amounts that is connected with the virtual hive supply, or the base for the inflation. When the price of HIVE is low, the virtual hive supply increases, and when it is up, the virtual hive supply decreases.

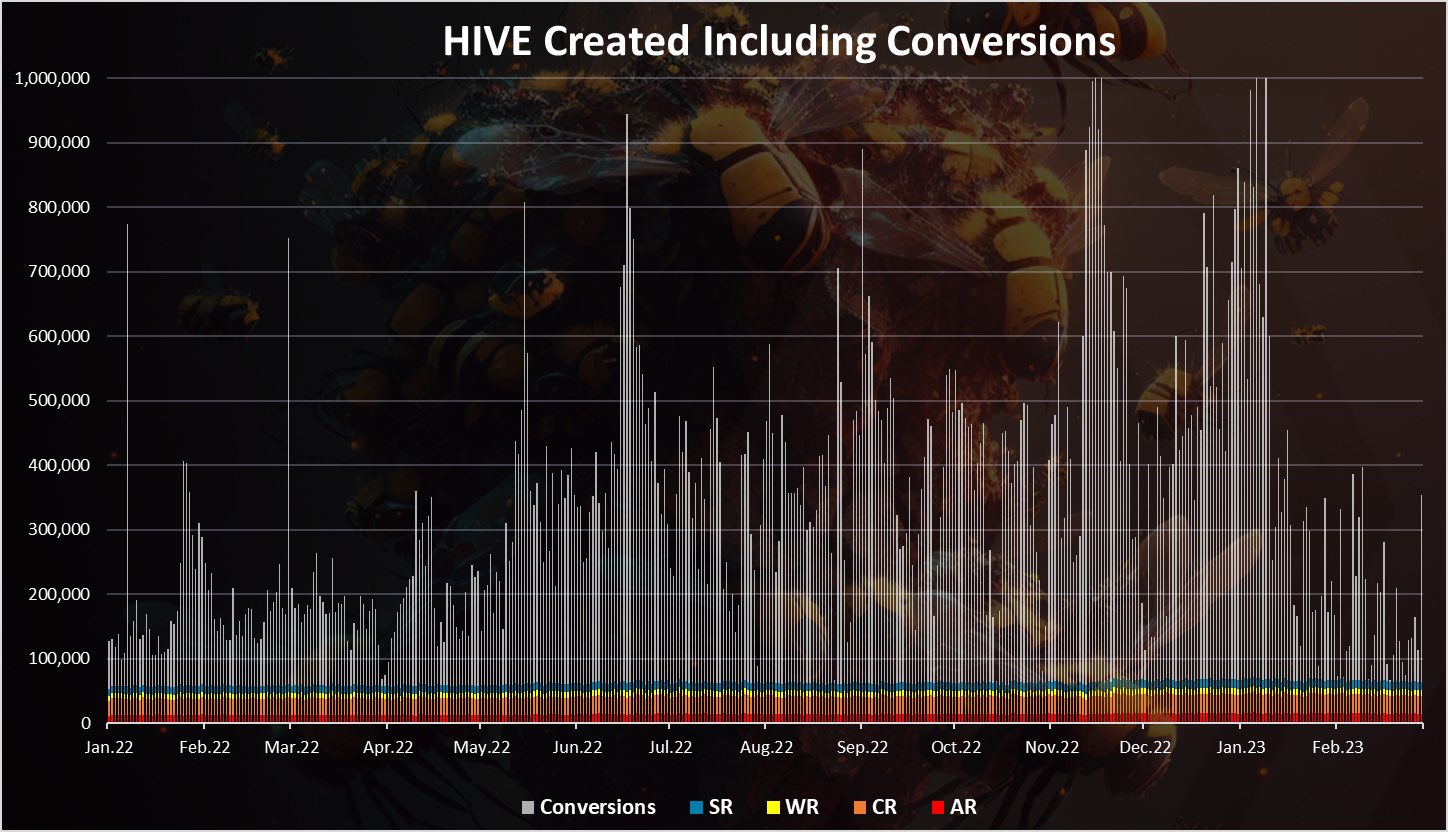

Thing is the conversions are playing a major role in the ecosystem. Here is the chart again, including conversions.

We can notice that the HBD to HIVE conversions are the dominant in the chart. This works in both ways and a big part of them is converted back to HIVE, especially through the work of the stabilizer.

The regular inflation is around 65k HIVE per day. In February there was on average around 100k HIVE per day from HBD conversions, although as noted most of them are converted back to HBD. The HBD to HIVE have been lower than usual.

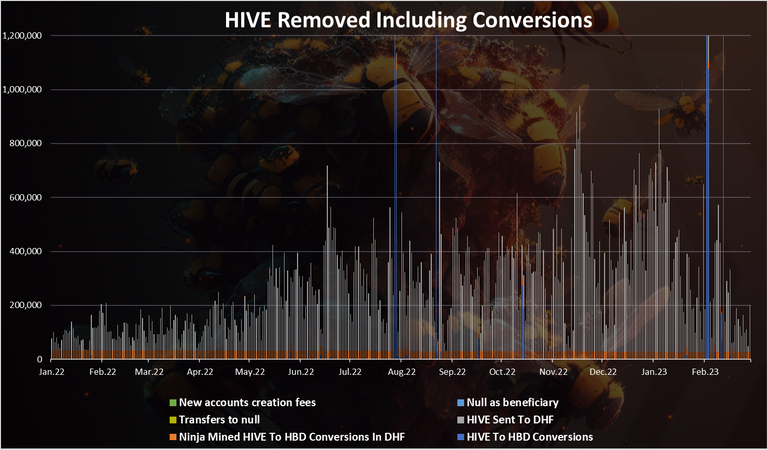

HIVE Removed From Circulation

Here is the chart.

The above takes into consideration six different ways of HIVE removed

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

- Transfers to null

- Null as post beneficiary

- New accounts creation fee

- HIVE to HBD conversions

The HIVE transfers to the DHF are now dominant. These are transfers made by the stabilizer. We can see a few spikes in the HIVE to HBD conversions back in August 2022 and one smaller one in September. These were due to the increase in the HBD price.

There is another one that happened just at the end of this month.

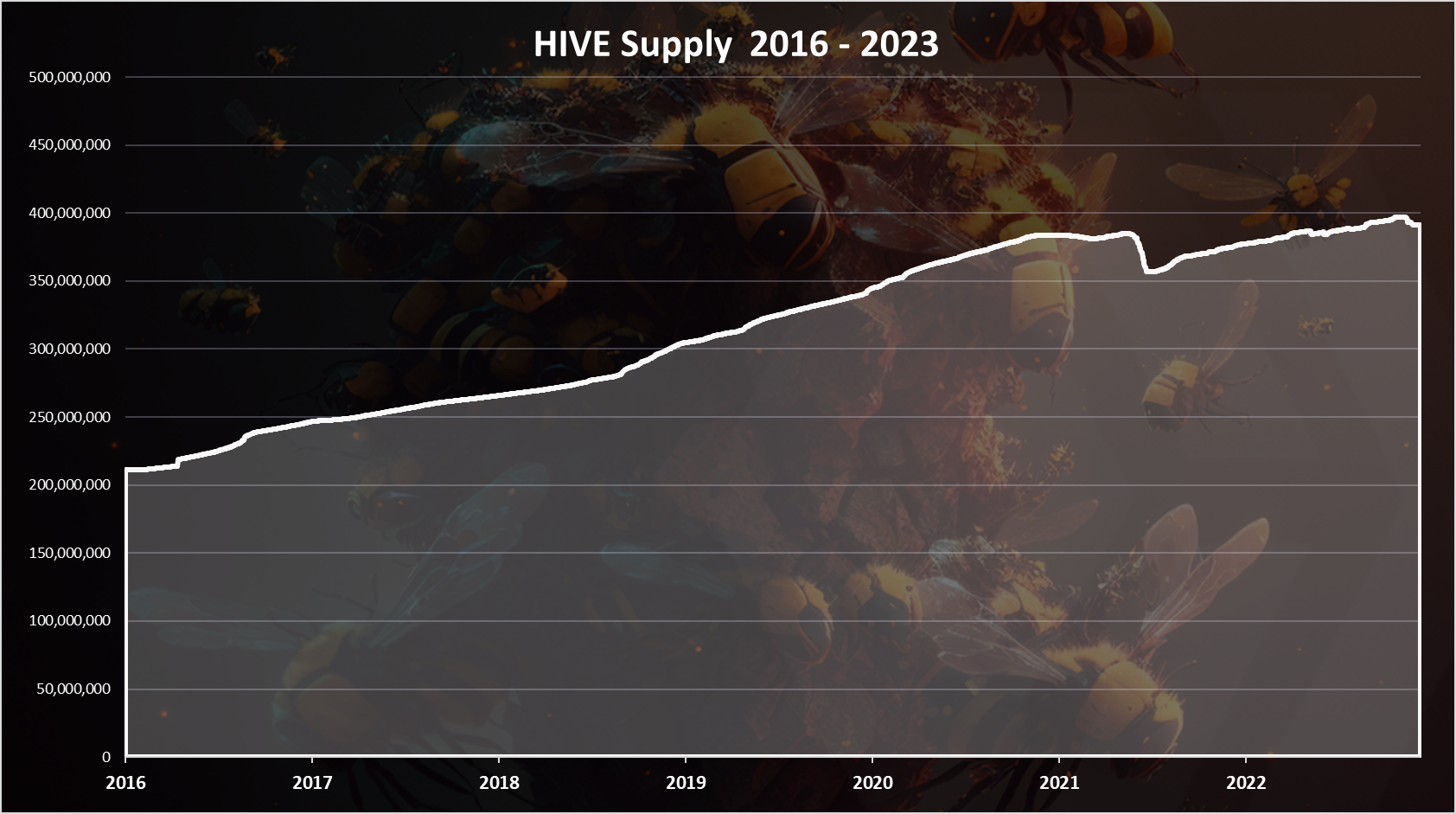

Historical HIVE Supply

When all the above is added and removed, we get this chart for the all-time HIVE supply.

Up until August 2021, the supply was almost steadily increasing with a small fluctuation. Then a drop in the supply in August and September 2021.

We can see some small drops in the supply in August 2022, and now again a bit more significant in February 2023.

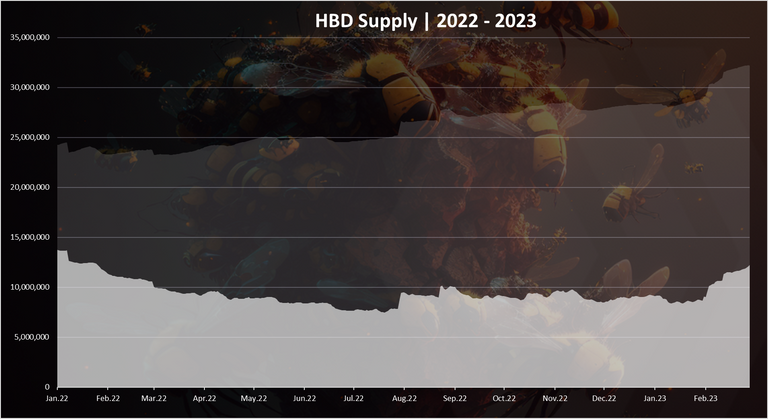

HBD Supply

Here is the chart for the HBD supply.

This is a chart starting from 2022.

The light color is HBD in the DHF. The HBD in the DHF is not freely circulating HBD and only enters circulation when payouts to the DHF workers are made.

HBD is being created and removed in a various way, but the conversions play the major role here in both directions. Other ways HBD is created is DHF proposal payouts, author rewards and interest.

We can see that after a downtrend in 2022, we now have seen some uptrend in the HBD supply in 2023, that is the main reason for the HIVE deflationary forces.

In February the HBD supply has increased from 10M to 12M HBD.

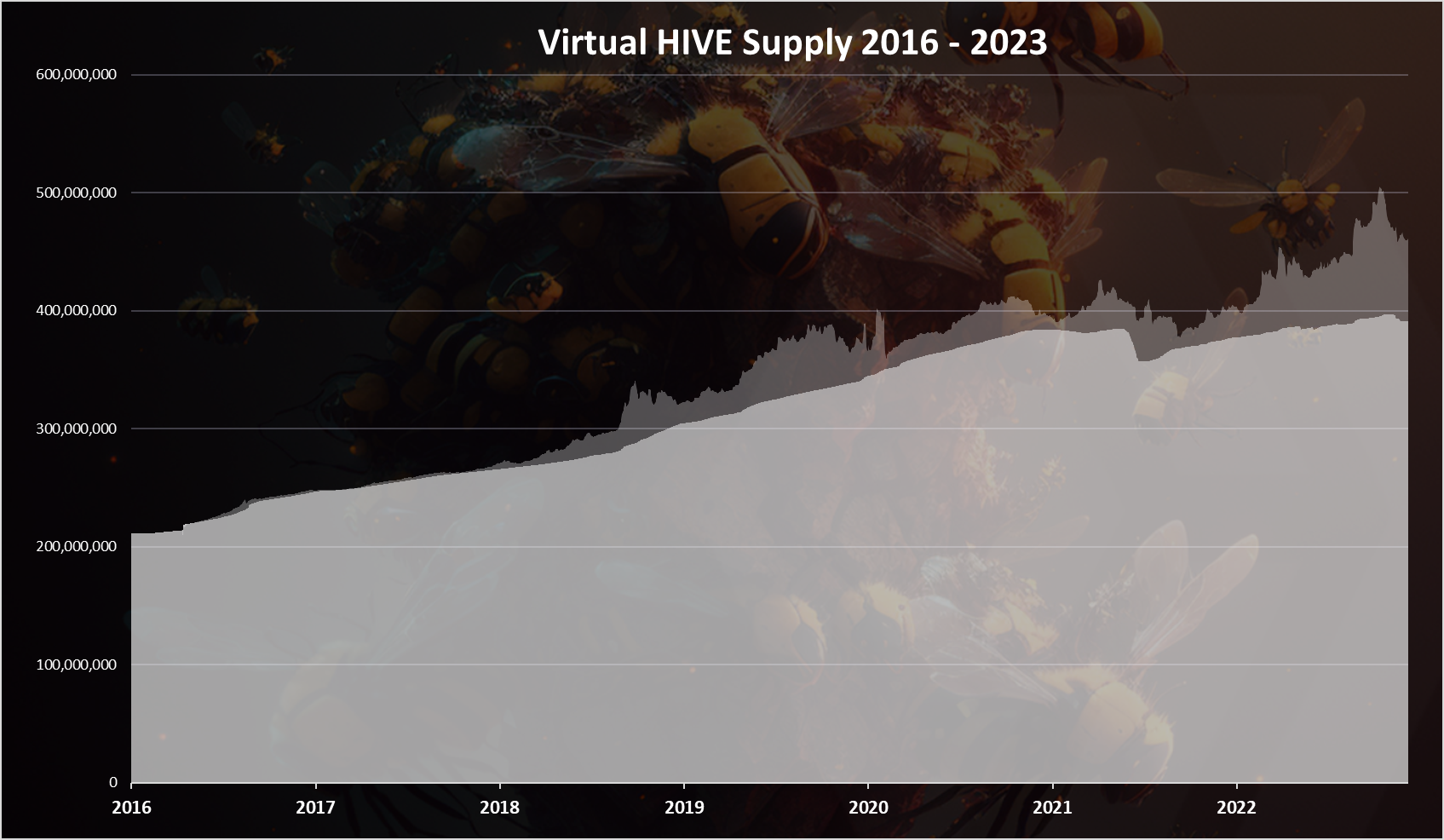

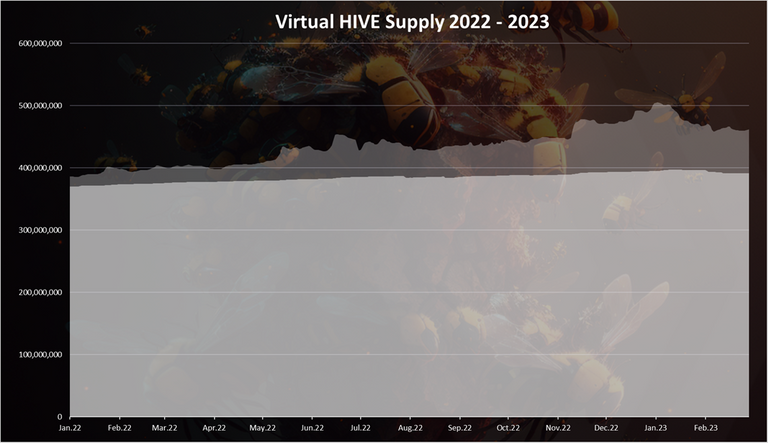

Virtual HIVE Supply

When we add the HIVE equivalent supply from the HBD to the HIVE supply we get the chart bellow.

When we zoom in 2022 - 2023 we get this:

The light color is HIVE that in theory can be converted from HBD at the current market prices for HIVE.

We can see that the virtual supply fluctuates a lot, mostly because it is tied to the price of HIVE. As the price of HIVE drops, the virtual supply increases and the opposite.

In 2022 the virtual supply has increased because of the drop in the HIVE price. We can see the reversal trend in 2023 with both the virtual HIVE supply and the circulating HIVE supply going down.

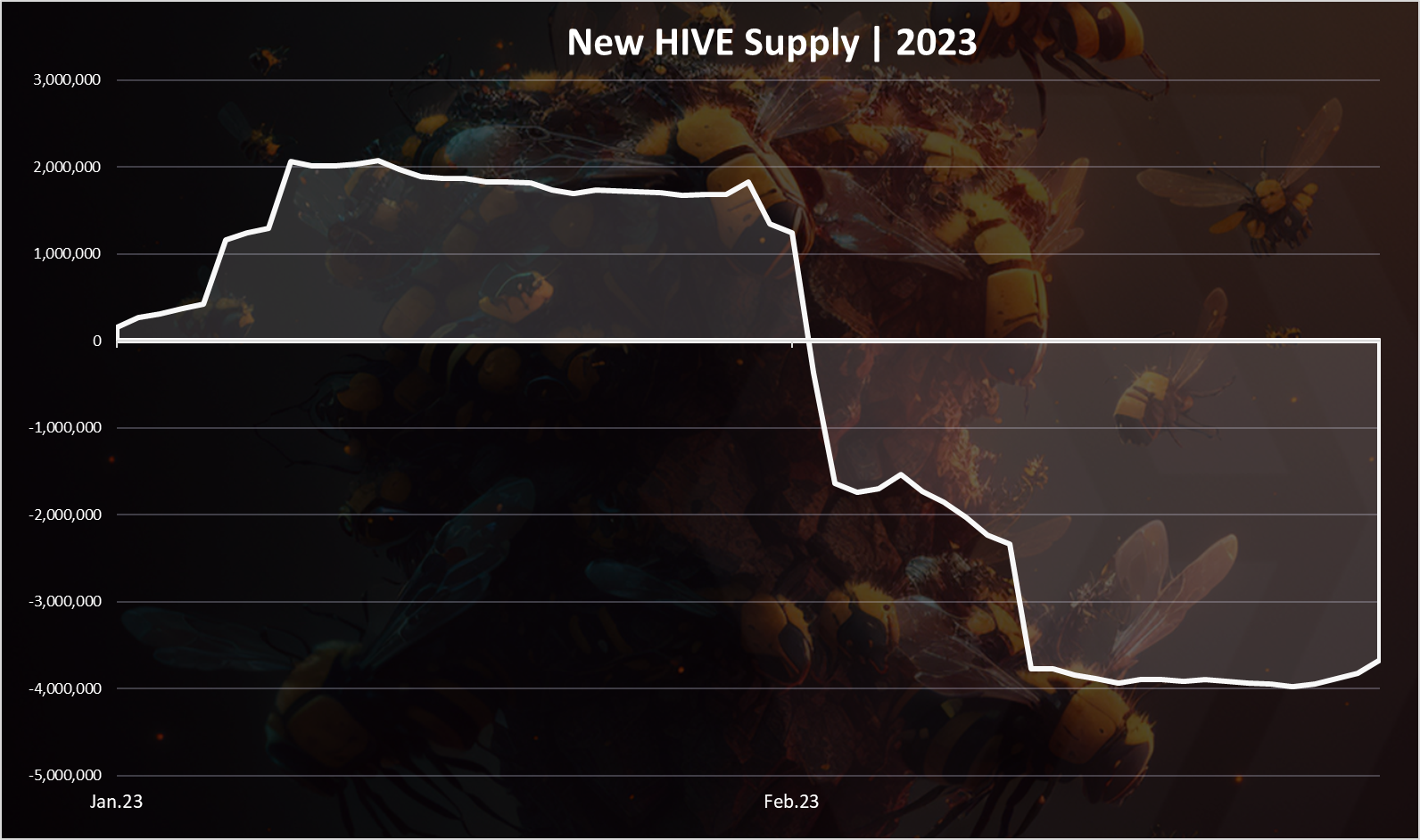

New HIVE Supply in 2023:

This chart is telling the story of the new HIVE entering circulation in 2023. There was some uptrend in the first week of the year, a slow downtrend since then, and a sharp drop at the beginning of February. The HIVE supply has contracted for -3.8M in 2023.

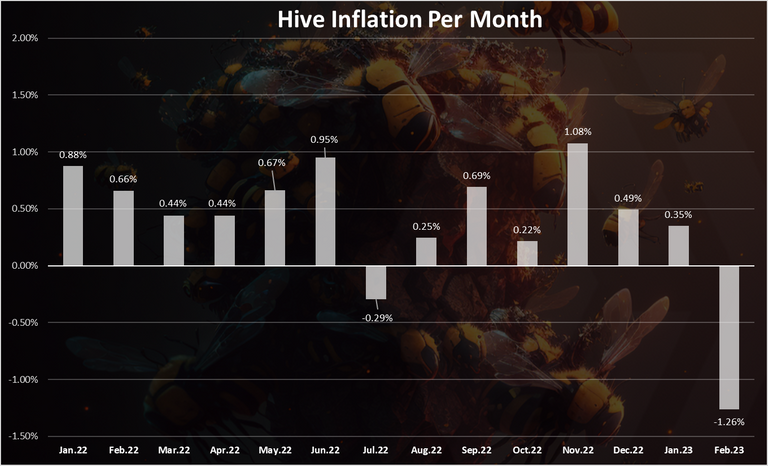

Monthly Inflation

If we plot the monthly inflation, we get this.

February ends deflationary with -1.26%

It’s the most deflationary months in the 2022 – 2023 period. This is because of the few spikes in the price of HBD and conversions from HIVE to HBD.

A reminder that these are monthly numbers, to get the yearly equivalent we need to add the monthly ones.

In terms of absolute numbers the HIVE supply in February has decreased from 396.4M to 391.3M, removing -5.1M HIVE from circulation. For comparison the projected monthly inflation is around 2M HIVE.

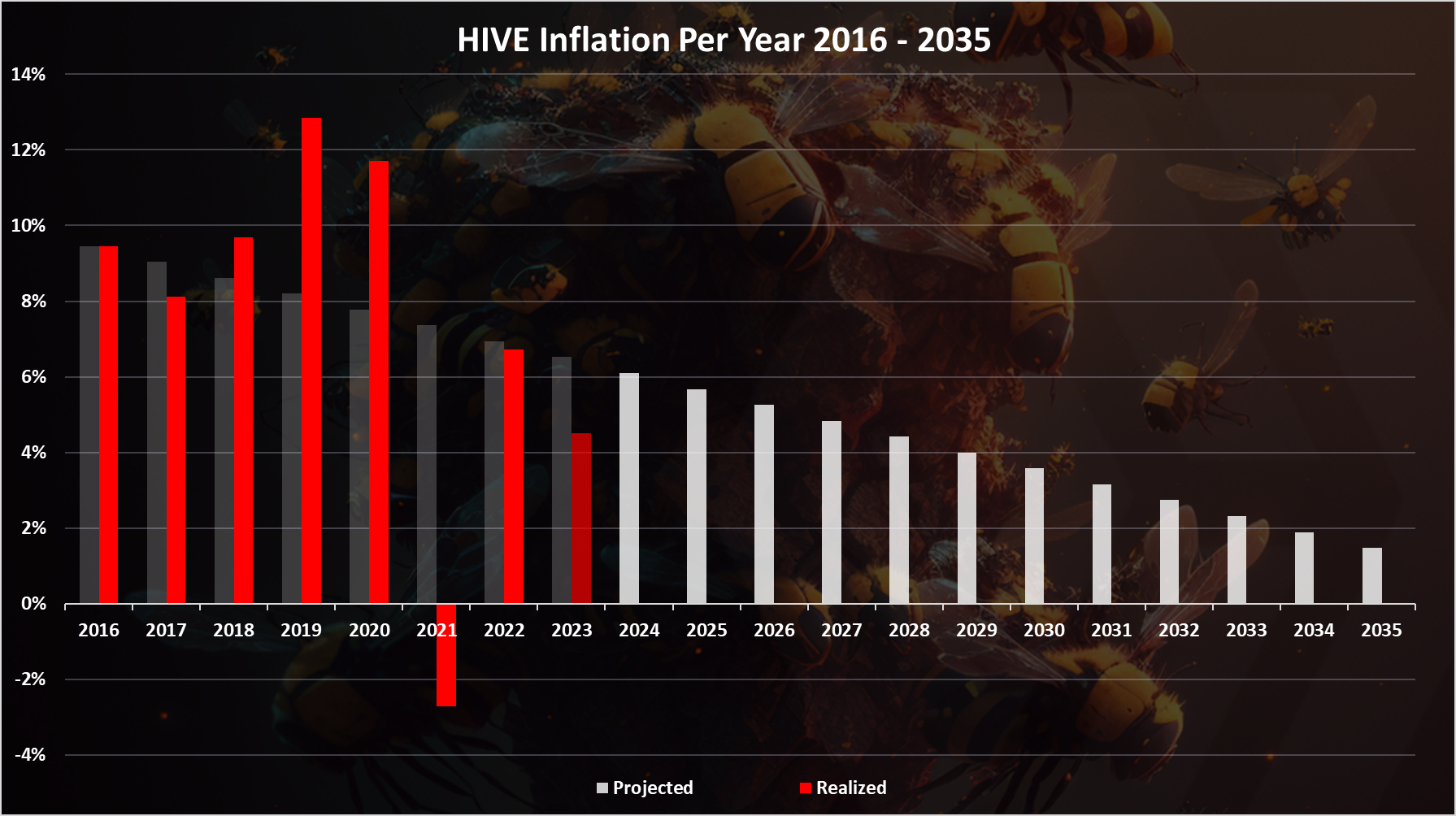

Yearly Inflation

The yearly, projected and realized inflation looks like this.

From the first two months we can see that Hive is on the way to have lower than the projected inflation. Will see how it ends.

2022 ended slightly below the projected one, while 2021 has been deflationary.

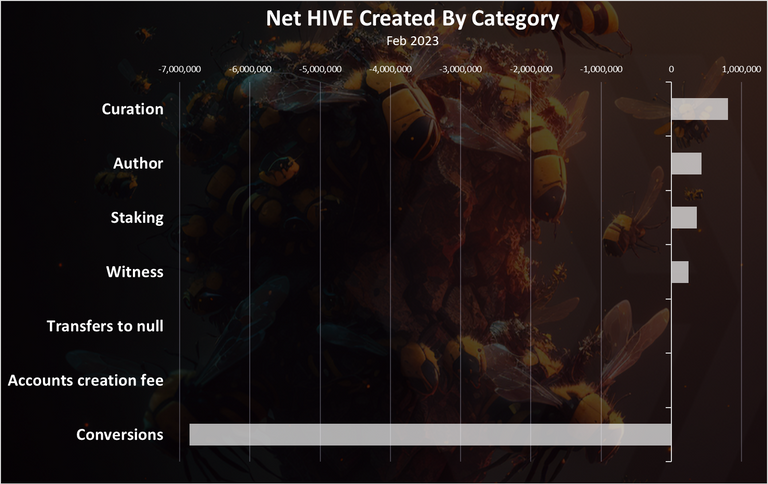

Net HIVE Created By Category In February 2023

Here is the new HIVE put in circulation by category for the month.

A total of -7M HIVE removed with conversions!

On the positive side we have the curation rewards as number one with 800k HIVE.

It’s been an interesting month for HIVE tokenomics. The demand for HBD has done its thing and HIVE is now deflationary. Will see how the years goes as we are still at the beginning, and the amount of HBD in circulation is still in moderate, especially having in mind that most of it is in the savings.

All the best

@dalz

Posted Using LeoFinance Beta