September has been bearish for the crypto market with prices going down, as it’s been for most of the 2022. HIVE has dropped from 0.55 to 0.48, while HBD has been stable throughout the month with no moves on the upside or the downside.

Let’s take a look at the data!

The projected inflation for 2022 is around 7% on a yearly basis, or 0.58% on a monthly basis.

The thing is Hive has a double currency system HIVE and HBD and there are conversions between them that add or remove HIVE from circulation on top of the regular inflation. Furthermore, there is HIVE in the DHF that is slowly being converted to HBD and also HIVE sent to the DHF is also converted to HBD.

Because of this additional mechanics the HIVE inflation and supply can be drastically different in real time then the regular one.

To be able to follow the HIVE supply we need to take a look at all the different ways HIVE is created, author, curation, witness rewards, conversions etc, then net that out with the HIVE burned from conversions, accounts fees, null transfers etc. To get the virtual supply we need to do the same for the HBD supply as well.

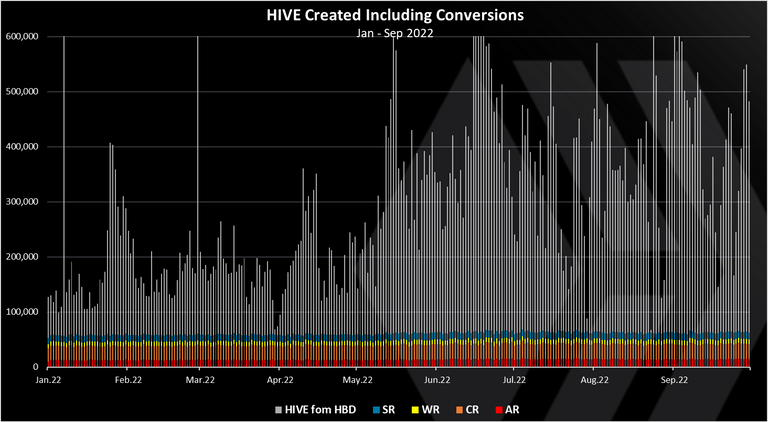

HIVE Created

Here is the chart.

- HBD to HIVE conversions

- Curation Rewards

- Author rewards

- Staking Rewards

- Witness Rewards

All the above are paid as Hive Power or VESTS, except for HBD to HIVE conversions.

We can notice that the HBD to HIVE conversions are the dominant in the chart. Thing is this work both ways and a big part of them is converted back to HIVE, especially through the work of the stabilizer.

The regular inflation is around 60k HIVE per day. In September there was on average around 360k HIVE per day from HBD conversions, although as noted most of them are converted back to HBD.

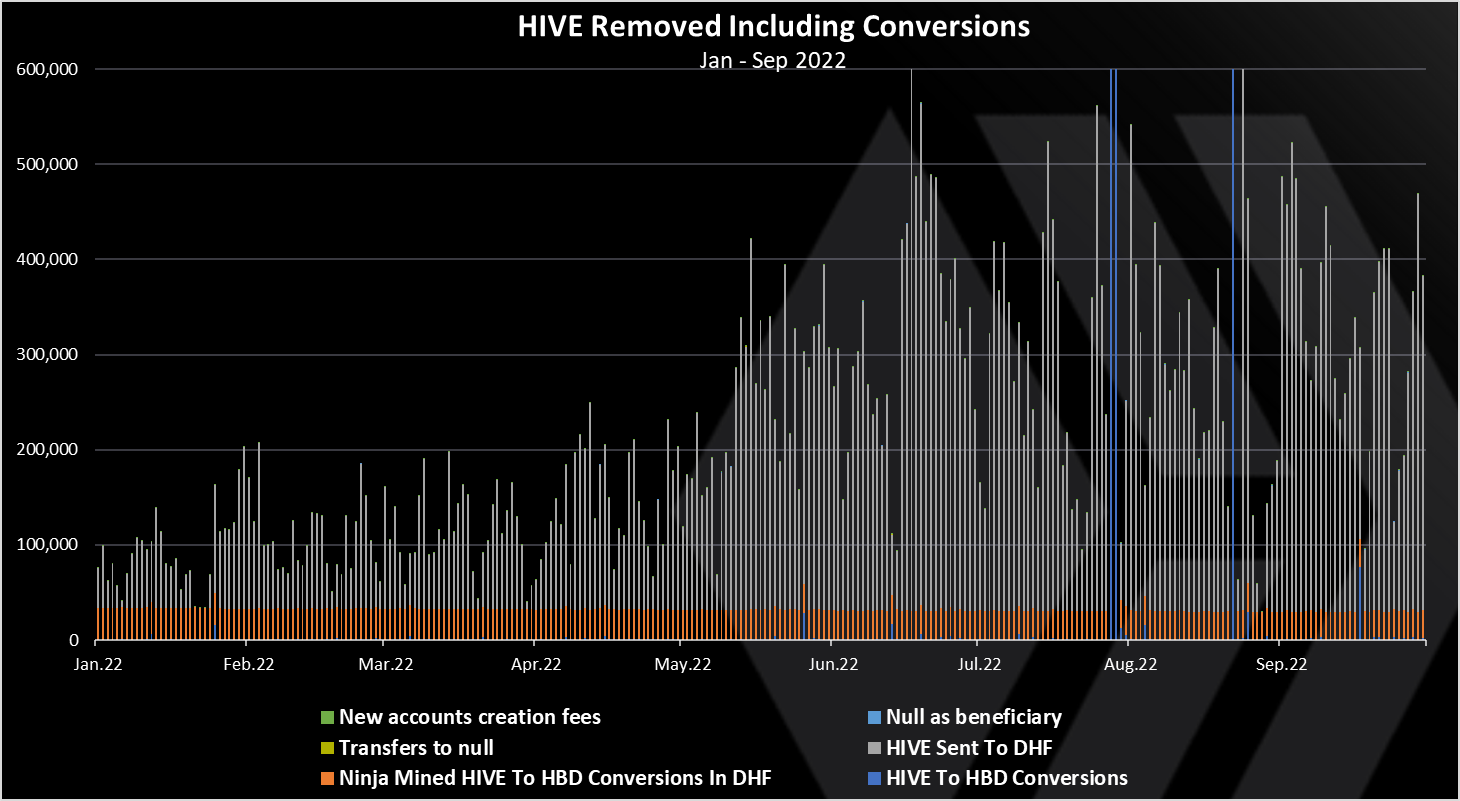

HIVE Removed From Circulation

Here is the chart.

The above takes into consideration six different ways of HIVE removed

- Ninja Mined HIVE To HBD Conversions In DHF

- HIVE transfers to DHF and converted to HBD

- Transfers to null

- Null as post beneficiary

- New accounts creation fee

- HIVE to HBD conversions

The HIVE transfers to the DHF are now dominant. These are transfers made by the stabilizer. We can see a few spikes in the HIVE to HBD conversions back in August and one smaller one in September. These were due to the increase in the HBD price.

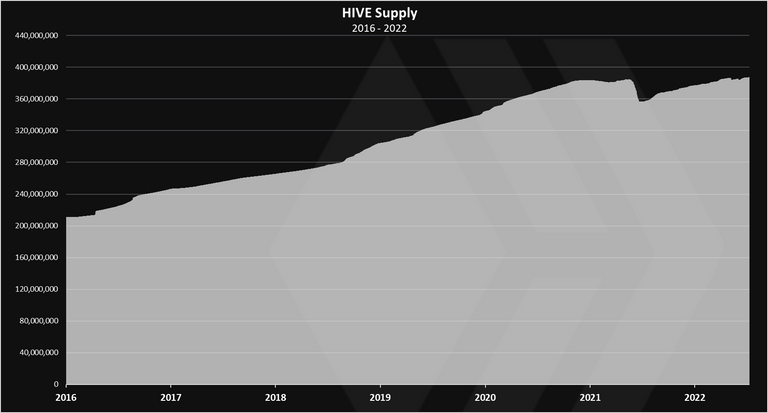

HIVE Supply

When all the above is added and removed, we get this chart for the all-time HIVE supply.

Up until August 2021, the supply was almost steadily increasing with a small fluctuation. Then a huge drop in the supply in August and September 2021.

In the last months we have seen some small drops in the supply again, because of the HBD price increases.

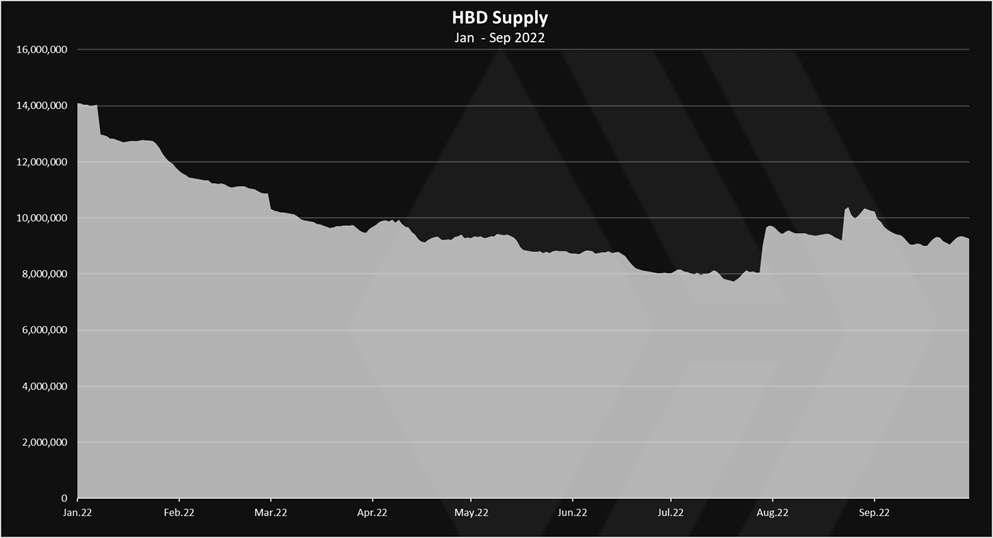

HBD Supply

Here is the chart for the HBD supply.

HBD is being created and removed in a various ways, but the conversions play the major role here in the both directions. Other ways HBD is created is DHF proposal payouts, author rewards and interest.

Overall, the HBD supply has went down in 2022, with some spikes in August when the HBD price increased.

At the beginning of the year there was more than 14M HBD in circulation and now we are at 9M.

In the last month the supply of HBD (excluding the DHF), decreased for around -1M, dropping from 10.2M to 9.2M. This comes after a small expansion that HBD had in August and July where the supply increased from 8M to 10.4M.

Note that the HBD in the DHF is not included in the chart above.

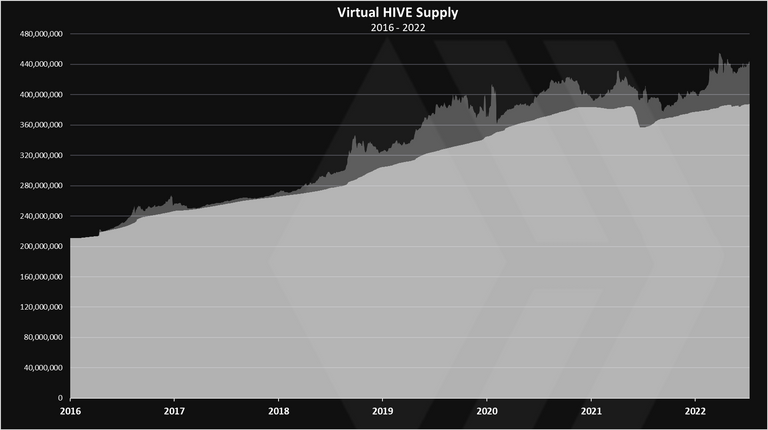

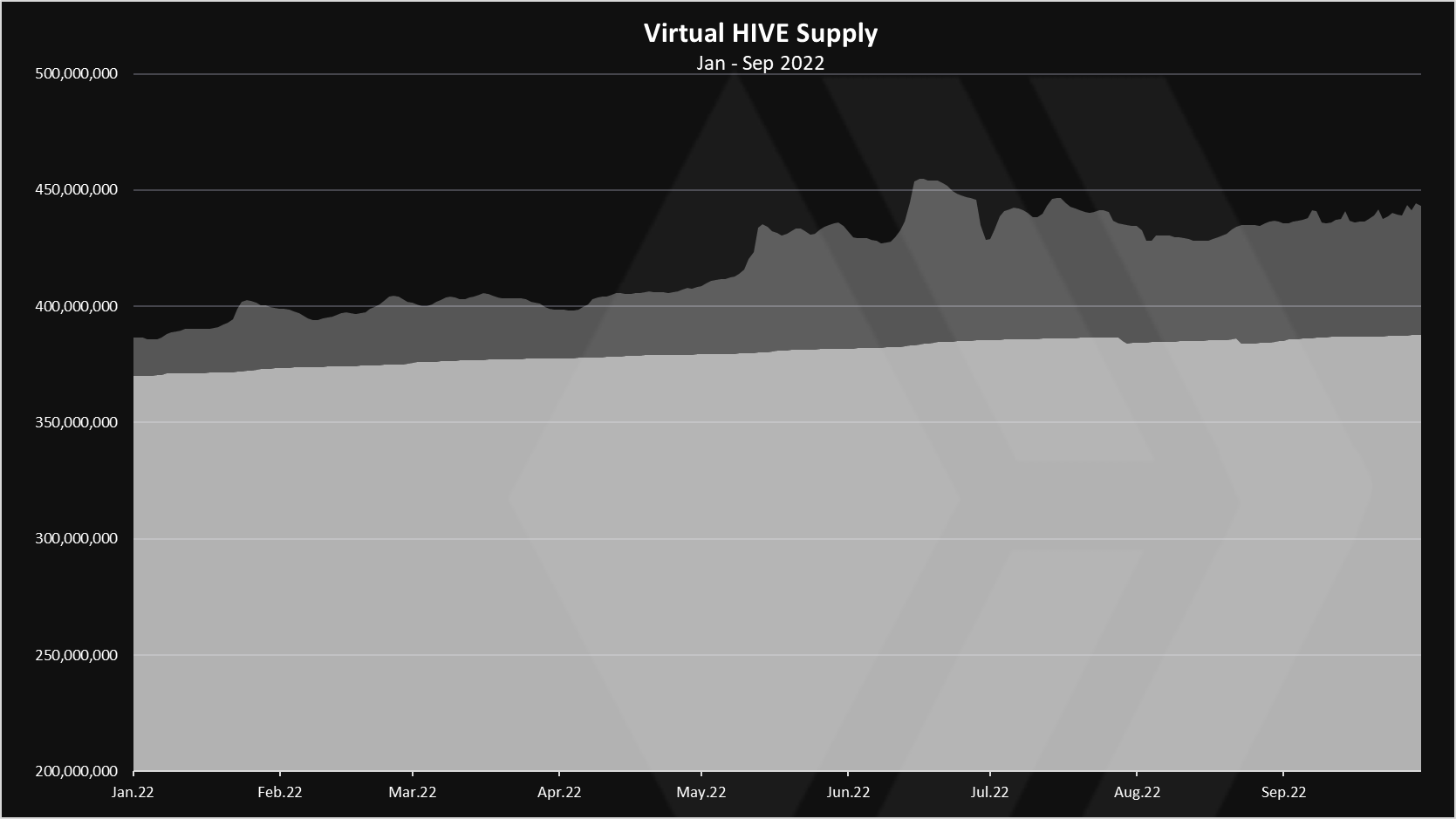

Virtual HIVE Supply

When we add the HIVE equivalent supply from the HBD to the HIVE supply we get the chart bellow.

When we zoom in 2022 we get this.

The light color is HIVE that in theory can be converted from HBD at the current market prices for HIVE.

We can see that the virtual supply fluctuates a lot, mostly because it is tied to the price of HIVE. As the price of HIVE increases, the virtual supply decreases and the opposite.

At the beginning of the year there was around 370M HIVE in circulation, while we are now at 387M.

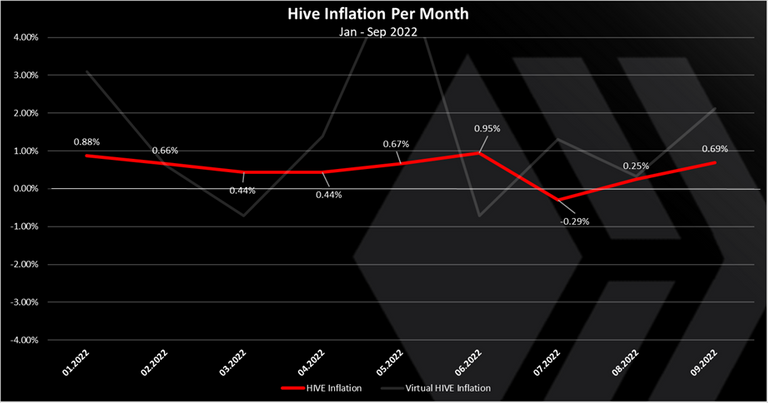

Monthly Inflation

If we plot the monthly inflation, we get this.

The red is the HIVE only inflation, the light white VIRTUAL HIVE inflation.

The monthly inflation in September is 0.69%!

The projected monthly inflation is around 0.58%, meaning that the realized inflation for September is slightly above the projected one.

In terms of absolute numbers the HIVE supply has increased from 385.3M at the beginning of the month to 387.9M now, or a 2.6M HIVE inflation.

The highest the monthly inflation has been in 2022 is in June with 0.95%, and on the low side it has reached negative -0.29% in July. A reminder that these are monthly numbers, to get the yearly equivalent just multiply *12.

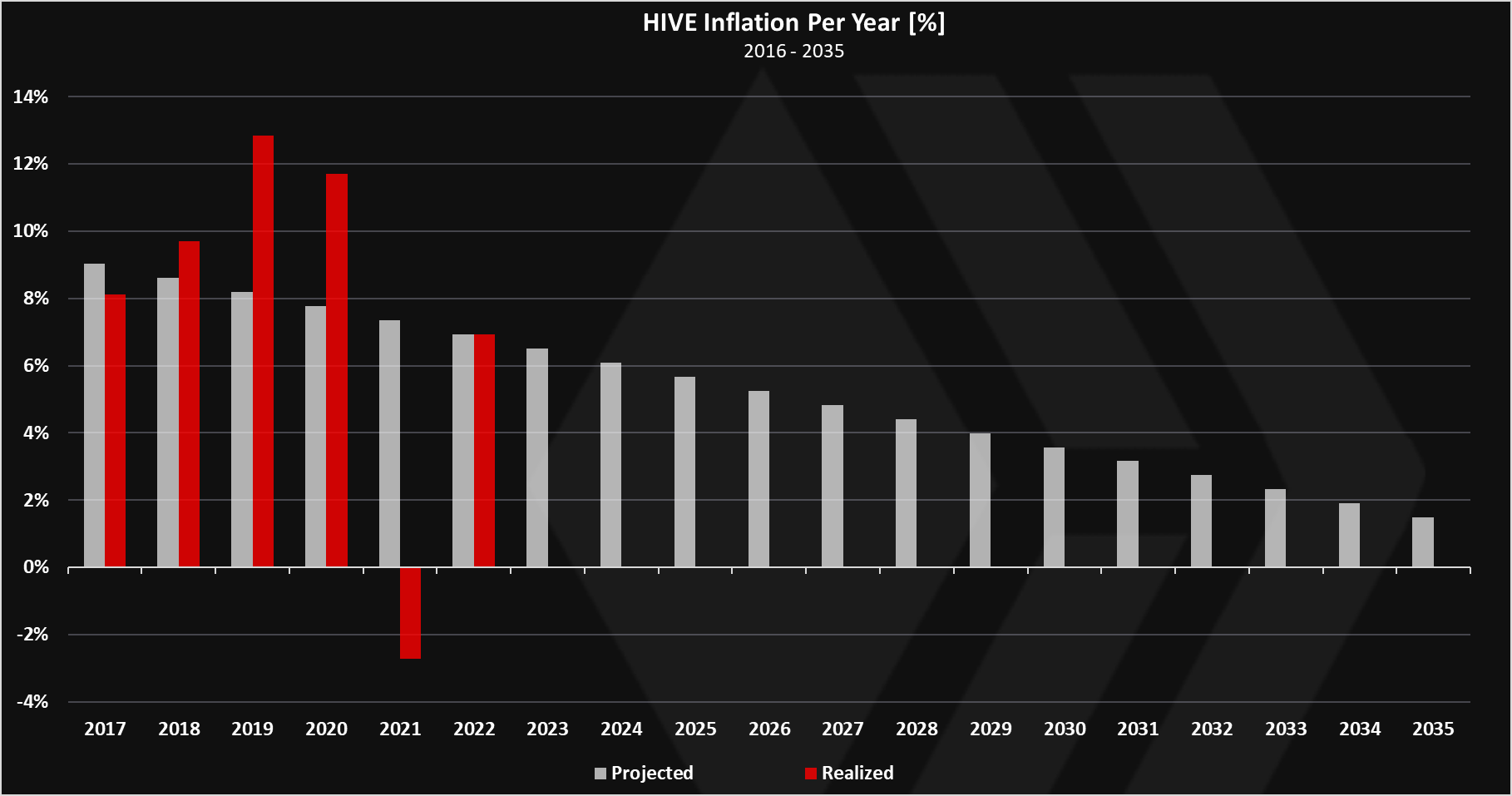

The yearly inflation, projected and realized looks like this.

Quite the differences in the past years between projected and realized inflation. Again mainly because of the HBD conversions. In 2019 and 2020 we can see that the realized is quite above the projected, while in 2021 the inflation is negative -2.7%.

2022 is projected at around 7% (0.58% monthly). For the first nine months of the year the inflation is at 4.8%, and it is set to go to projected level in the remaining three months of the year.

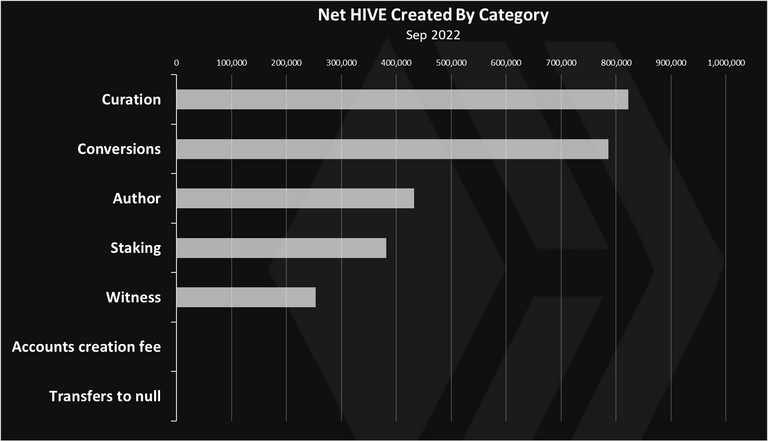

Net HIVE Created By Category

Here is the new HIVE put in circulation by category in September 2022.

The curation rewards come on top in terms of HIVE created with 820k HIVE.

Conversions are now positive and come on the second place with 785k HIVE. In August and July conversions were negative.

Net HIVE created in September 2022 = 2.6M.

All the best

@dalz

Posted Using LeoFinance Beta