There has been some more powering up in the last period and the total HIVE powered up has grown from around 147M in December to 152M at the moment.

Let’s take a look at the data.

@thepeakstudio image

We will be looking at:

- Hive Powered Up By Date

- Hive Powered Up By Month

- Hive Power Supply

- Hive Power Share

- Top Accounts That Powered up

- Top Accounts That Powered Down

The period that we will be looking here is from the creation of the old chain 😊, March, 2016, since it influences the hive power overall.

Hive Powered Up

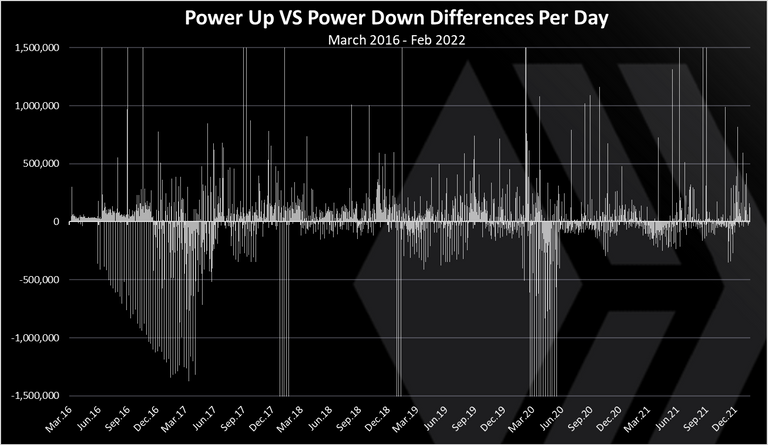

Here is the chart for the all-time Hive powered up.

These are daily net columns that sum up the HIVE powered up and down for the day. Positive column means that there is more powering up on that they, and negative more powering down. The HIVE power from rewards/inflation is also included.

Here is the monthly chart for better representation.

The war for the chain in March 2020 is dominating the chart. It really has left a mark on the chain. More than 40M HIVE was powered in that month, a lot of which from exchanges that were holding user funds.

In the last months, we can notice more positive columns.

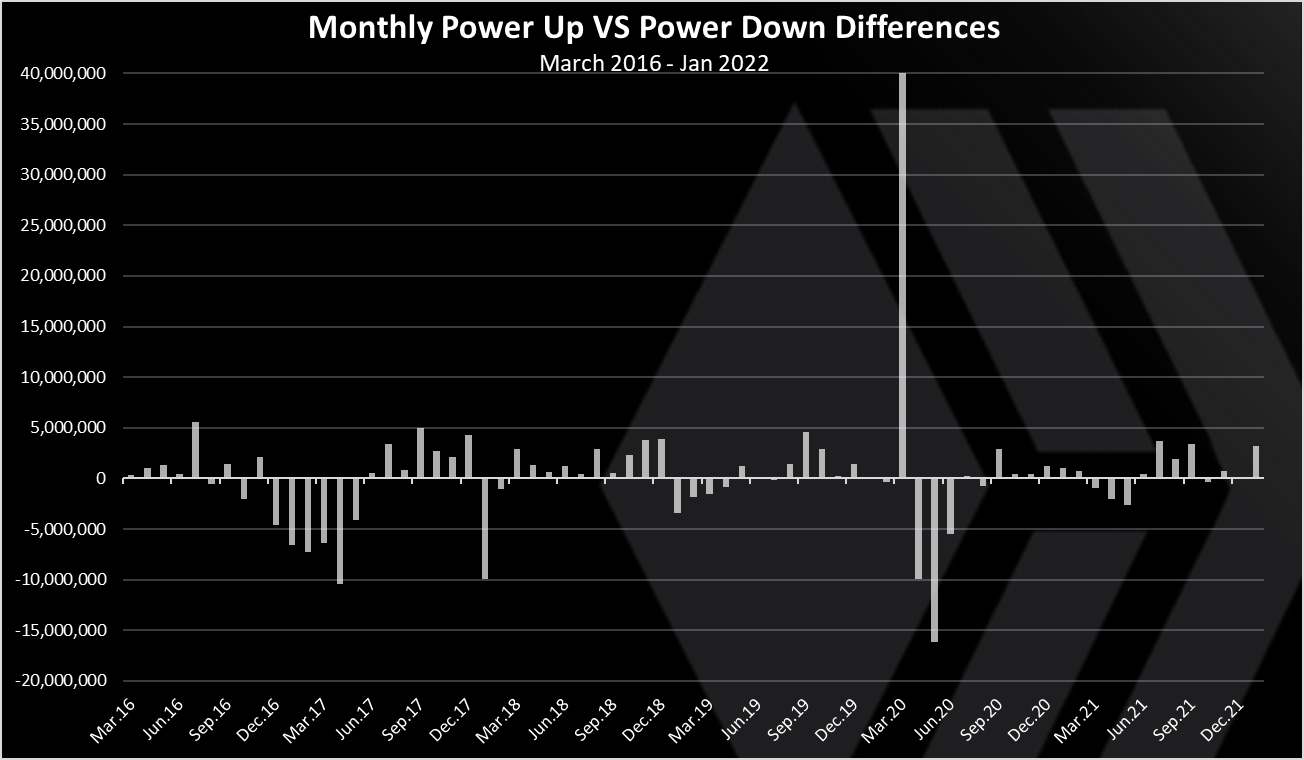

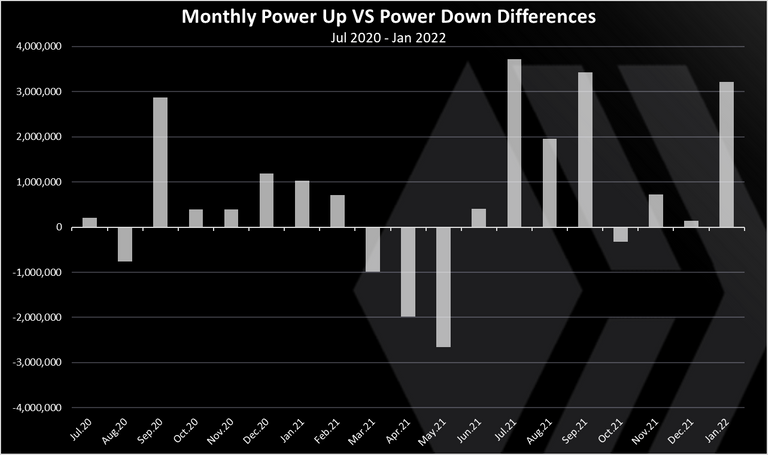

If we zoom in for the last year we get this.

This is a period from July 2020 until January 2022.

We can notice that in January there is more then 3M net positive HIVE powered up. November and December are also positive but with a smaller amounts. October 2021 is the only month in the last eight months that is negative and has more powering down, but with a very small amount. In the summer of 2021 there was also a lot of powering up with numbers higher then 3M on few occasions. Starting from June 2021, until now there is net positive 13.2M HIVE powered up, pushing the total HIVE power from 139M to 152M.

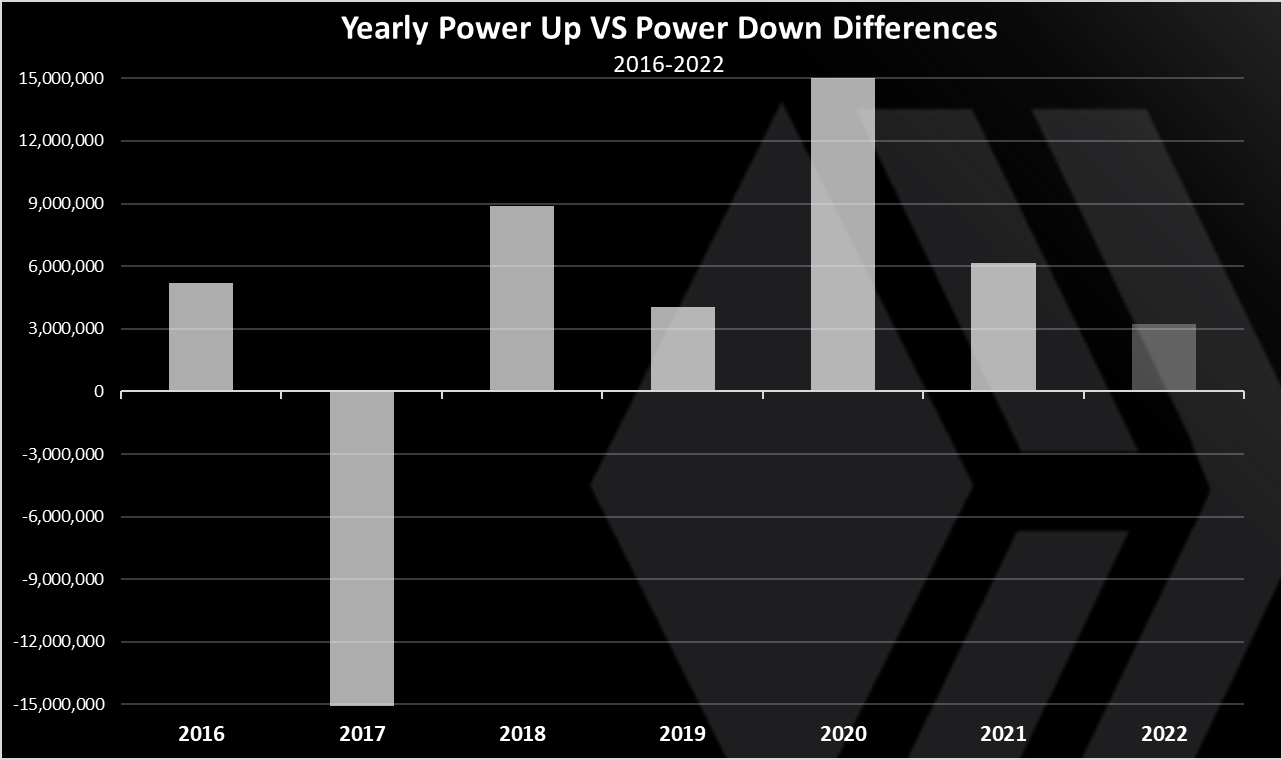

The yearly chart looks like this.

2017 has been the one year with more HIVE powered down. A net 15M HIVE was more powered down then powered up. 2020 has been a record year powering up, with 15M more HIVE powered up.

HIVE Power Cumulative Supply

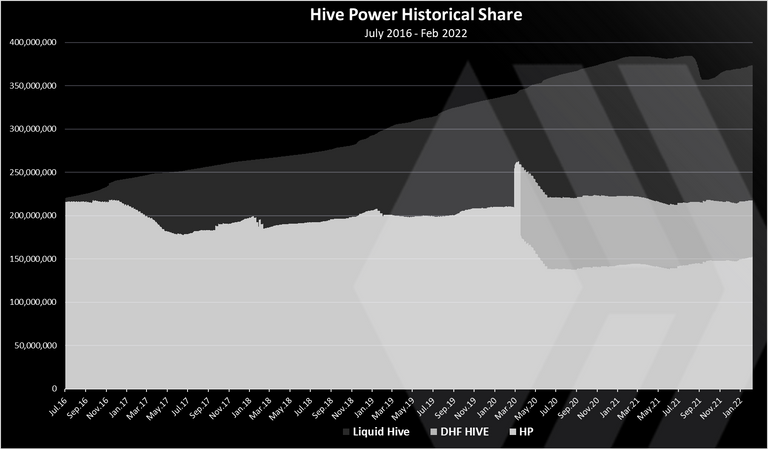

When we plot the cumulative HIVE power in the period, against the total supply we get this.

The strong white is the HIVE power share. The light is the liquid HIVE. Notice the HIVE in the DHF, that was previously powered up, but then was transferred in the DHF and is now slowly converted to HDB over a period of five years.

Overall, the HIVE power has been growing slowly in the whole period, starting with under 200M, and has increased to around 218M where is now. Note that in the 2018M is included the HIVE from the DHF that is around 65M.

The liquid HIVE has been growing faster up until the last year when it dropped. A 156M liquid HIVE at the moment.

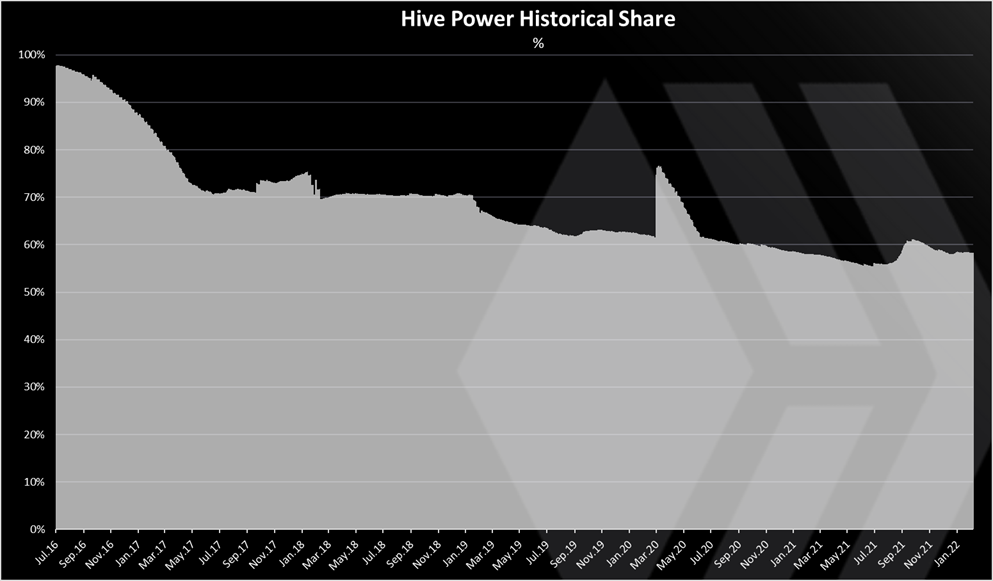

If we show the HIVE power in the period as a percent [%] of the supply we get this.

We can notice the sharp increase in March 2020 here as well. A vertical line 😊.

A jump from 62% to 75% in HIVE powered up in a single day.

Overall, the HIVE power share has been going down. This is understandable as it started with a almost a 100% powered up. In the first years the drop has been more significant and then slow drop in the following years, up until 2021 when the Hive power share increased from 56% to 61%, and a slow decline to a 58% where it is now.

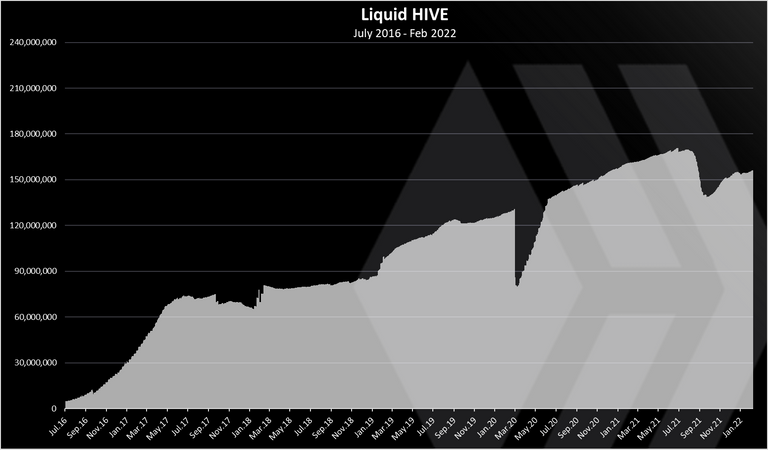

The share of liquid HIVE looks like this.

A faster growth at the beginning, then a slowdown, a drop during the war, an increase afterwards and a drop last year.

Note that the liquid HIVE is not only corelated with the HIVE power, but also to HBD. Last year was a lot of HIVE converted to HBD and that removed HIVE.

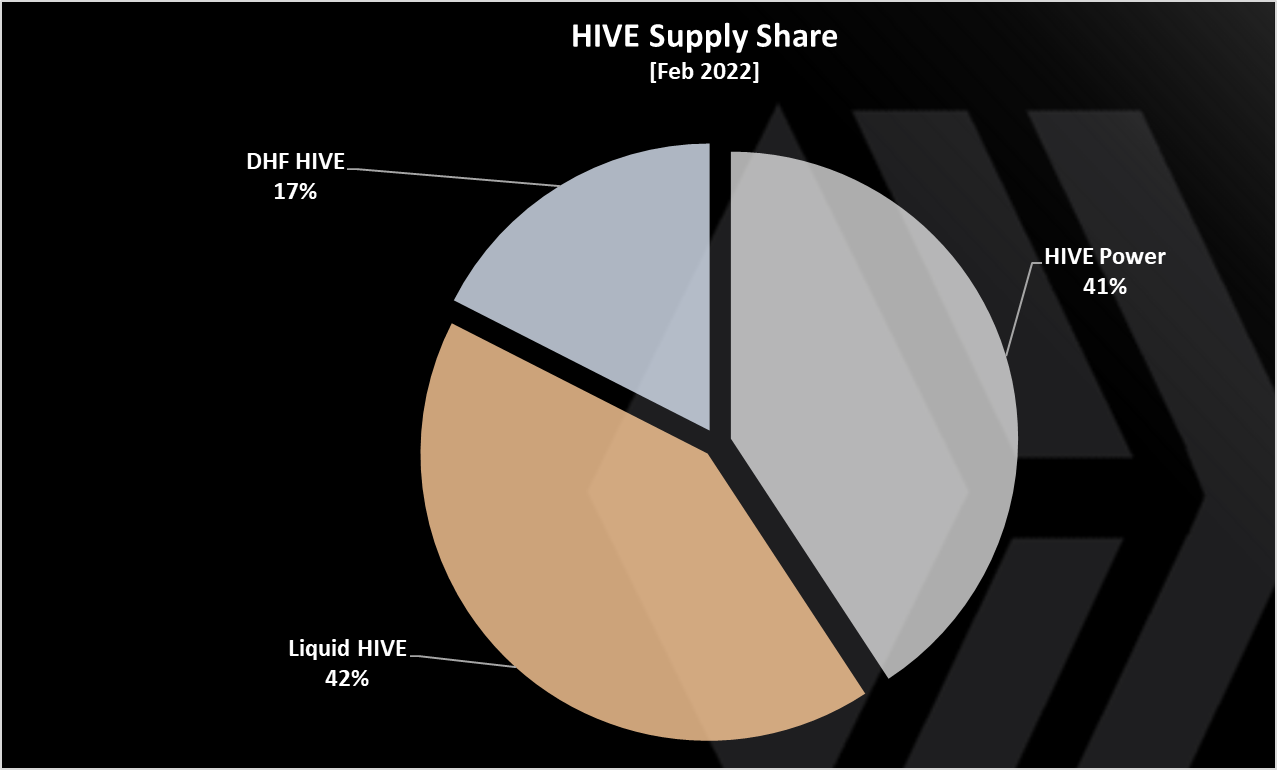

The overall supply of HIVE at the moment looks like this.

A 41% of the HIVE supply is powered up, a 152M. A 42% is liquid or 156M, and 17%, or 65M is in the DHF slowly converting to HBD. We can say that basically 58% of the HIVE supply is locked/powered up.

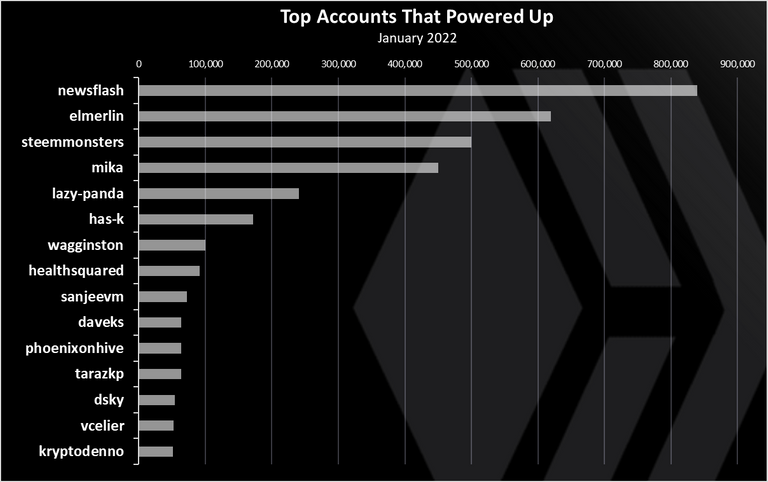

Top Accounts That Powered Up In January 2022

Who is powering up the most?

Here is the chart for January 2022

The @newsflash account is on the top with a total of 840k HIVE powered up, followed by @elmerlin and then @steemmonsters.

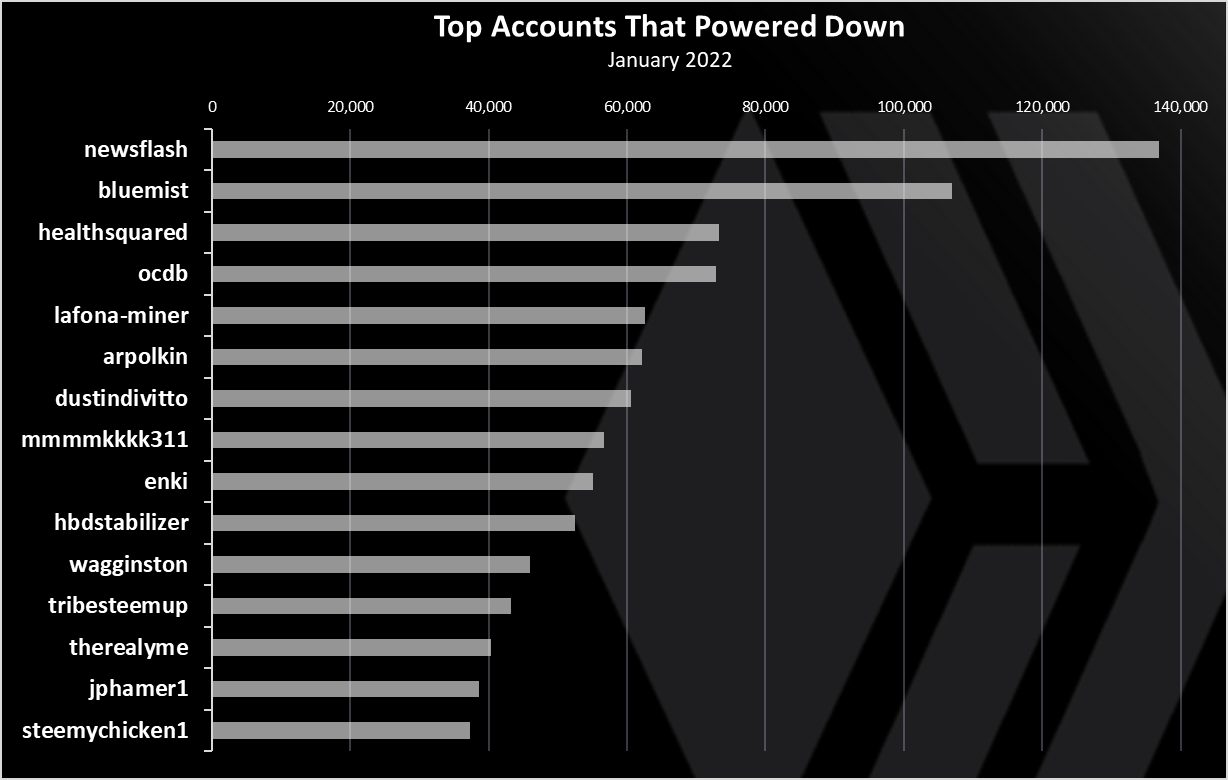

Top 20 Accounts That Powered Down In January 2022

Who is powering down the most?

Smaller numbers here with @newsflash again on the top with 136k HP powered down. @bluemist and @healthsquared are next.

As we can see starting from June 2021, each month has been net positive in HIVE powered up, with the exception of October 2021. A total of 13.2M net HIVE was powered in the period, increasing the total HP from 139M to 152M. In terms of percentage, after years of slow decline we have seen an increase in the percent in 2021 from 56% to 61%. The amount of liquid HIVE has dropped as well, but this is mostly because of the HIVE to HBD conversions.

In January 2022 the top 3 accounts have powered up more then 500k, while the top accounts have powered down just above 100k.

All the best

@dalz

Posted Using LeoFinance Beta