How is the Ethereum network doing before the upcoming merge?

The long awaited update for Ethereum is finally here. The merge as it is popularly called is set to happen on September 15, 2022.

A lot of things will change after this for the network. Let’s take a look at some key data points at the moment.

source

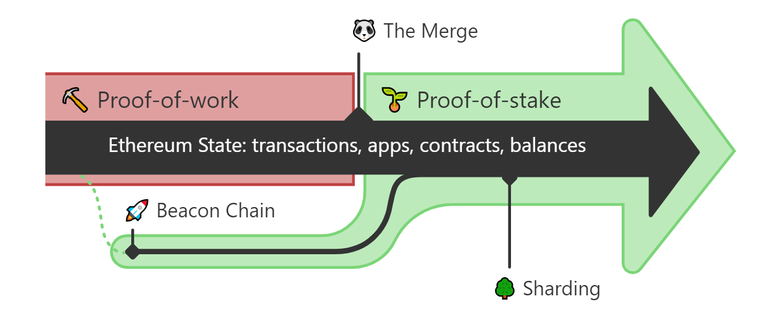

A short reminder that the upgrade of the Ethereum network is a process that is set to happen in multiple steps. The merge is neither the start nor the end of the process. It is right in between. What this means is that this is a just one step and it doesn’t represent the final step. This said it is still one of the most important steps in the process.

The three phases are:

- Phase 0, Beacon Chain

- Phase 1, The Merge

- Phase 2, Sharding

The whole process started with the launch of the beacon chain back in December 2020. It’s been а year and nine months since the launch of the beacon chain. Now we are into the second phase, the merge.

Phase 0 | Beacon Chain

As mentioned, the beacon chain is live since December 2020. Prior to the launch of the beacon chain there was a period where a minimum of 16,384 registered validators set, each with 32 ETH staked. This condition was met, and the beacon chain went live on December 1st.

Until the merge the beacon chain doesn’t affect the Ethereum network in any way. It runs in parallel with the Ethereum mainnet.

If the beacon chain doesn’t affect the current network, what it actually does?

In short, the role of the Beacon chain can be summarized in the following:

- Introduce staking

- Establish validators

- Setting up for shards

Unlike some other PoS or DPoS chains that have somewhere around 20 block producers, Ethereum has went for a lot more block producers or validators as they are called. The only barrier is the staked ETH (32) and the hardware of course that is a lot less than all the mining rigs now. This model is trying to provide security from the large numbers of validators.

We will be using the Beacon chain explorer https://beaconscan.com/ to get some data.

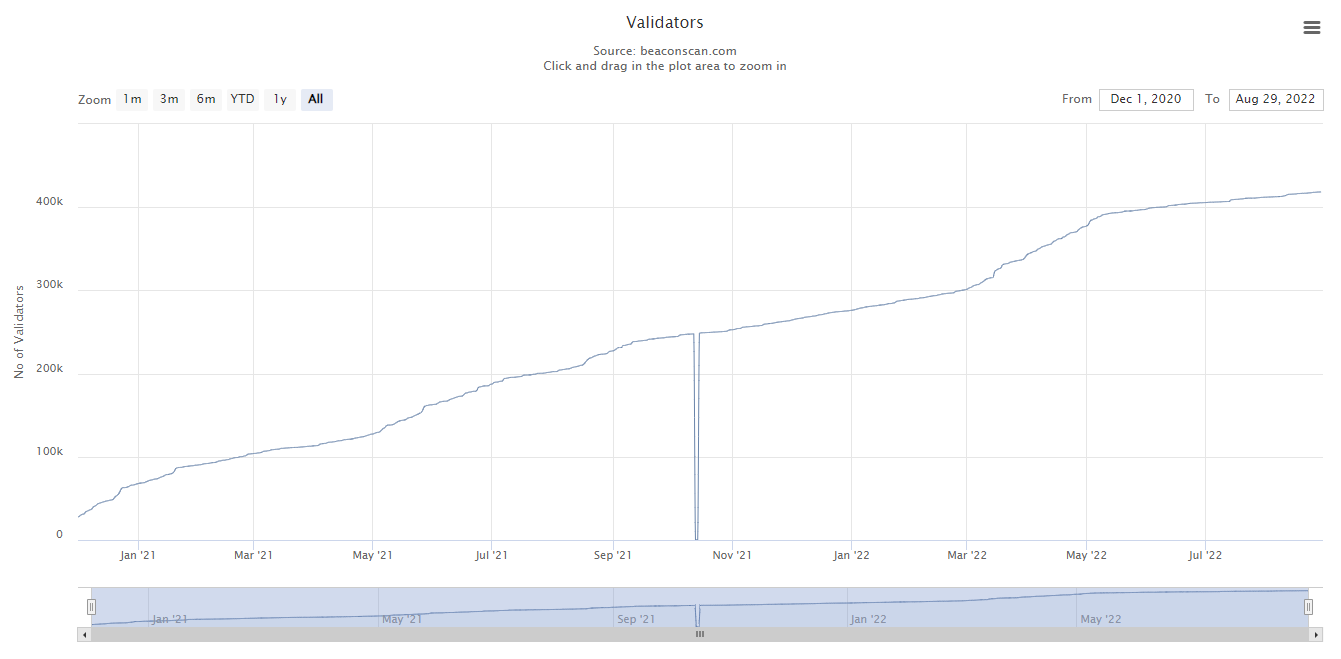

Number Of Validators On The Beacon Chain

Here is the chart.

source

At the moment there is 418k validators!

That’s a lot more than the minimum of 16k. Thing is a lot of them are run as pools from single entities but still there is a lot.

The ETH staked is locked up and it is a long term commitment from the validators, as they cant unstake at any time.

All the validators are staking/depositing 32 ETH to be able to participate in the beacon chain and receiving staking rewards.

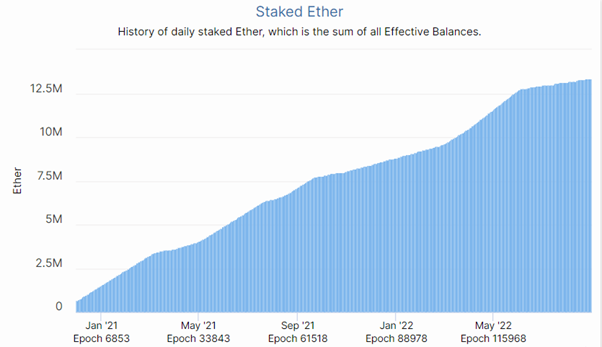

The staked ether chart looks like this.

source

More than 13M ETH staked, that is around $20B at the current prices.

While this looks like a lot, if we compare it to the total supply of 120M, it is around 11% of the total supply staked.

Phase 0 has launched the beacon chain, introduced staking, established validators and it has prepared the ground for the merge.

Phase 1 | The Merge

The merge is expected to happen on September 15, 2022.

What will the merge do?

What changes will the merge bring? One of the biggest changes that the merge will bring is the transition from proof of work to the proof of stake. The merge, as the name implies with put together in one chain the two separate chains that runs at the moment. The PoW mainnet will be merged to the PoS chain, discontinuing the PoW Ethereum network.

- Miners will stop receiving rewards

This is one of the main reasons why we are seeing some people that want to fork the ETH network and continue with a PoW ETH.

Going forward all the security of the Ethereum network will come from the PoS validators that have staked the ETH above.

- The ETH inflation will drop from 4.3% to 0.43%

Because the PoS consensus is much easier to incentivize, there is no need to issue the amount of tokens that the network issue now to miners for securing the network.

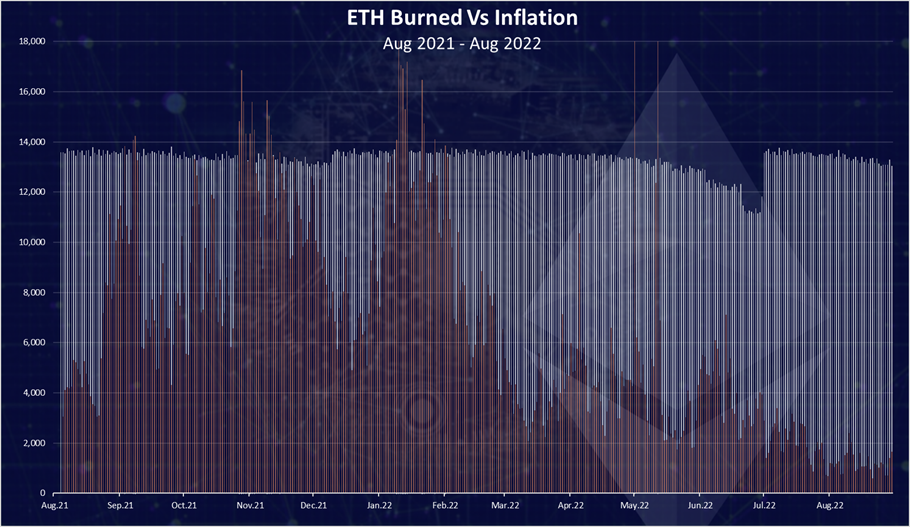

Since August 2021, a part of the transaction fees are burned.

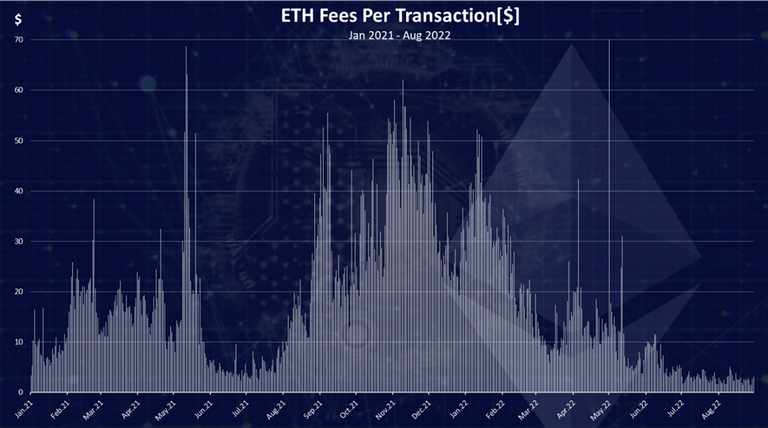

Here is the chart.

Will Ethereum become deflationary?

This depends on the economic activity on the network. Ethereum is burning the fees that are paid for transactions. More activity, more fees, equal more ETH burned.

We can see that even under the current emission there have been days when more ETH was burned than created. This happened in November 2021 and again in January 2022. In the last months there is less ETH burned because of the overall stagnation in the market, less transactions on chain and less fees. In the period above around 50% of all the new ETH was burned.

Under the current emission there is around 13k ETH per day created. After the PoS transition there should be around 1.3k new ETH per day. The average ETH burned per day in August 2022 has been 1.2k and this is a yearly low. This means that under the worst market conditions and a low amount of fees burned ETH should at least be inflation neutral, meaning no growth in the supply. If the market conditions improve and there is more than 1.3k ETH burned per day, then ETH will be deflationary.

What about the yearly inflation?

| Year | ETH Inflation |

|---|---|

| 2016 | 12.95% |

| 2017 | 9.57% |

| 2018 | 7.15% |

| 2019 | 4.56% |

| 2020 | 4.36% |

| 2021 | 3.24% |

| 2022 projected | 1.6% |

2022 will be a mix from the old and the new system. How will Ethereum perform under the new upgrade will be more visible in 2023. Will it be 0%, or maybe negative? Will see.

What will not change after the merge

While a lot of users think that Ethereum will have lower fees and will be faster, this is not the case.

Fees and transactions speed will remain the same as now.

The merge is not a scalability upgrade for the network, but a consensus mechanism change.

Another thing to note is that there will be no option for staked Ethereum from validators to be withdrawn after the merge. This should come later with a separate upgrade called Shanghai. There are some fears in the market that when staked ETH withdrawals will be enabled for validators, a lot of them will withdraw and sell. But this will not happen with the merge.

Shards

Shards are expected to launch in 2023. This is the scalability solution for Ethereum that can increase transaction output and maybe lower the fees.

Sharding is the process of splitting a database horizontally to spread the load – it’s a common concept in computer science. In an Ethereum context, sharding will reduce network congestion and increase transactions per second by creating new chains, known as “shards”.

At first shards will serve only as a data storage with no smart contract capabilities. The thing with the blockchains is when they serve only as a data storage, they are pretty easy to run, but once smart contracts are introduced this requires logic and processing and it put burden on the chain.

There is an ongoing discussion how will the smart contracts be implemented in the shards, and should each shard have this capability or only a few of them. Some other options like Zero Knowledge (ZK) snarks are also mentioned, but these are still in development.

Conclusion

After years of waiting the Ethereum upgrade is now in a full swing. Things are happening. The ball started rolling since December 2020 when the beacon chain launched. Now we are before the second step of this process. There is still a lot to come in 2023 when the scalability solutions like shards should come. Hope that this phase goes smoothly first 😊.It should end the PoW phase for Ethereum, reduce inflation and prepare the ground for upcoming scalability solutions.

All the best

@dalz

Posted Using LeoFinance Beta