The competition for smart contract chains is higher than ever! It seems that every few days we are getting some new Ethereum L2 scaling solution based on a “revolutionary” technology. Even Bitcoin is now getting smart contracts. The noise is extreme in the sector! This shows that the smart contract market obviously has a high value and more big player are competing for it.

In the last bull run in 2021 there was an explosion in the smart contracts platforms. More and more kept coming online and a lot of them did well. A lot of them are EVM (Ethereum Virtual Machine) compatible and users can switch between them using the same wallet as Metamask. Some are unique and have their own wallets like Solana, Cardano etc. When we thought we have enough, there is now x10 more 😊.

Let’s see how things are standing during the current market conditions.

We will be looking at:

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

The period that we will be looking is the latest data from September 2023.

We will be looking into the following blockchains:

- Ethereum

- Polygon

- Solana

- BSC

- Cardano

- Avalanche

- Optimism

- Arbitrum

- Base

- Fantom

I have added three new chains, all L2 on Ethereum. Optimism, Arbitrum and Base. This have now gain some recognition. Furthermore there are now chains like Aptos, Injective, Selestia, Sui, Sei. The Cosmos ecosystem as well. As said there is no shortage of smart contract chains these days. Even with these more are on the way: Scroll, Linea, zkSync, Manta, Polygon ZK, etc.

The data for the chains will be extracted from their blockexplorers or some other data providers.

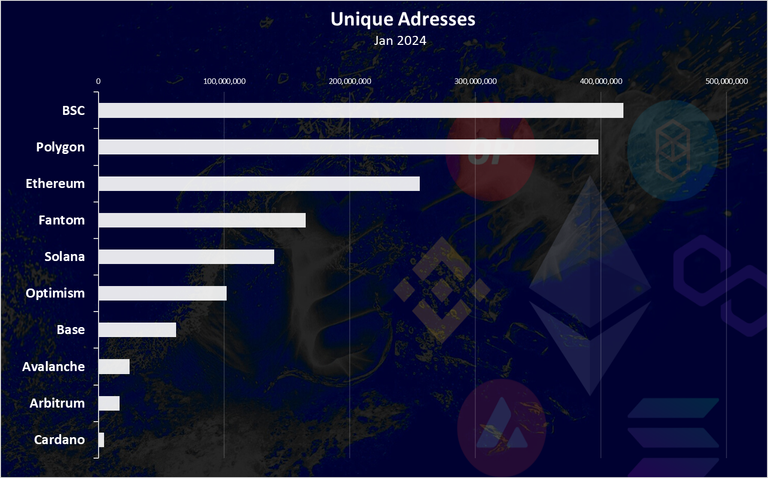

Number of Addresses

One of the key metrics for crypto projects is the number of wallets.

Here is the chart.

The round up numbers look like this:

| Chain | Wallets |

|---|---|

| BSC | 418,000,000 |

| Polygon | 398,000,000 |

| Ethereum | 256,000,000 |

| Fantom | 165,000,000 |

| Solana | 140,000,000 |

| Optimism | 102,000,000 |

| Base | 62,000,000 |

| Avalanche | 25,000,000 |

| Arbitrum | 17,000,000 |

| Cardano | 4,500,000 |

In the past Ethereum dominated this chart, but that is no longer the case.

Ethereum is now in the third position in number of unique wallets. Binance Smart Chain is in the first spot, closely followed by Polygon. Both of these are around the 400M mark. Ethereum has 256M wallets. We can notice the other L2 ETH chains here as well, Optimism with 100M wallets already, while the Coinbase, Base chain is at 62M.

Note that the Solana data is approximate.

Obviously BSC and Polygon have grown faster than Ethereum in this metric and have outperformed it in terms of wallets.

One thing to note about these types of wallets is that they are free and there is no cost for creating a wallet, like for example on Hive. Because of this there can be a lot of wallets created and even spammed.

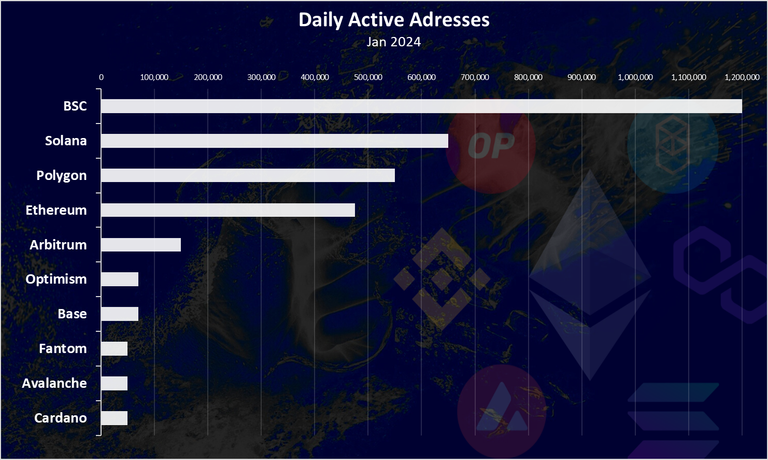

Active Addresses

What’s more interesting in times like this is how many wallets are transacting. How many of those addresses are actually active?

Averages from the last days.

The round up numbers look like this:

| Chain | Active wallets |

|---|---|

| BSC | 1,200,000 |

| Solana | 650,000 |

| Polygon | 550,000 |

| Ethereum | 475,000 |

| Arbitrum | 150,000 |

| Optimism | 70,000 |

| Base | 70,000 |

| Fantom | 50,000 |

| Avalanche | 50,000 |

| Cardano | 50,000 |

BSC is on the top here with 1.2M DAUs.

Solana and Polygon are next, followed by Ethereum.

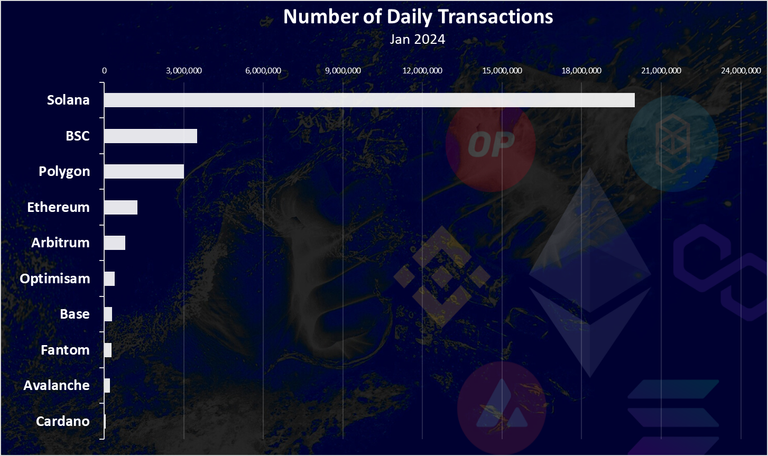

Daily Transactions

The activity on the networks is mostly represented by the number of daily transactions. Here is the chart.

The round up numbers look like this:

| Chain | Daily Transactions |

|---|---|

| Solana | 20,000,000 |

| BSC | 3,500,000 |

| Polygon | 3,000,000 |

| Ethereum | 1,250,000 |

| Arbitrum | 800,000 |

| Optimisam | 400,000 |

| Base | 300,000 |

| Fantom | 280,000 |

| Avalanche | 220,000 |

| Cardano | 70,000 |

Solana is holding the number one spot by far here. It has around 20M daily tx in the recent period. That is what the blockchain is known for. Its speed.

BSC is in the second spot with around 3.5M transactions, followed by Polygon. Ethereum is on the fourth spot here.

When looking at the transactions, the cost of them should be kept in mind. Solana has the lowest fees per tx and is on top. In the case of BSC and Polygon it is interesting that Polygon is cheaper than BSC, but BSC still outperforms Polygon in the number of transactions. We can see that Arbitrum is ranking just after Ethereum here.

Ethereum is obviously the highest fees, and it comes lower in the ranks.

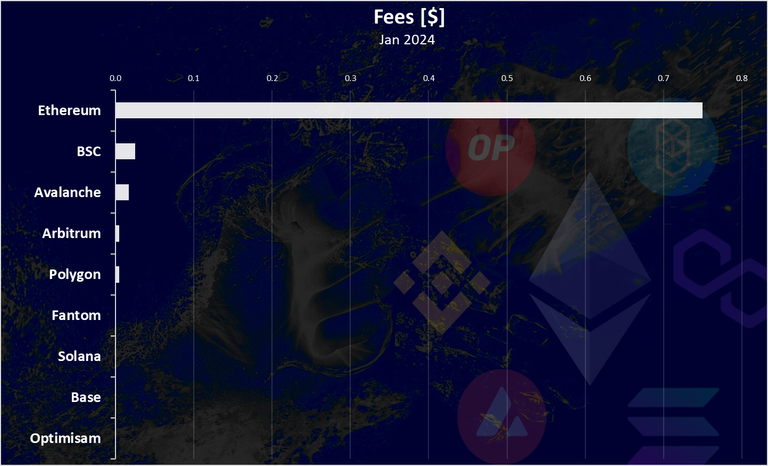

Fees

Fees are quite the unpopular topic and one of the main reasons for the new EVM chains, as users are trying to find a way to escape ETH high fees.

Here is the chart.

The round up numbers look like this:

| Chain | Fees [$] |

|---|---|

| Ethereum | 0.75000 |

| BSC | 0.02500 |

| Avalanche | 0.01688 |

| Arbitrum | 0.00515 |

| Polygon | 0.00500 |

| Fantom | 0.00070 |

| Solana | 0.00044 |

| Base | 0.00005 |

| Optimism | 0.000002 |

The fees here are in dollars.

While ETH is on the top here, these fees are nothing compared to the fees in the bull run. At times ETH fees were going up to 200$ per transaction especially if it was a smart contract transaction.

The other blockchains now have low fees, with BSC at 2 cents, is in the second spot.

Historically Solana is the cheapest, but we can see that the L2 solutions on Ethereum like Optimism are now in the race for a chain with the cheapest transactions.

Contracts

These three are smart contract platforms so here is the chart for verified contracts per day.

The round up numbers look like this:

| Chain | Contracts |

|---|---|

| BSC | 800 |

| Ethereum | 350 |

| Polygon | 150 |

| Arbitrum | 120 |

| Fantom | 40 |

| Optimisam | 40 |

| Base | 30 |

| Solana | - |

There is no data for Solana to compare against.

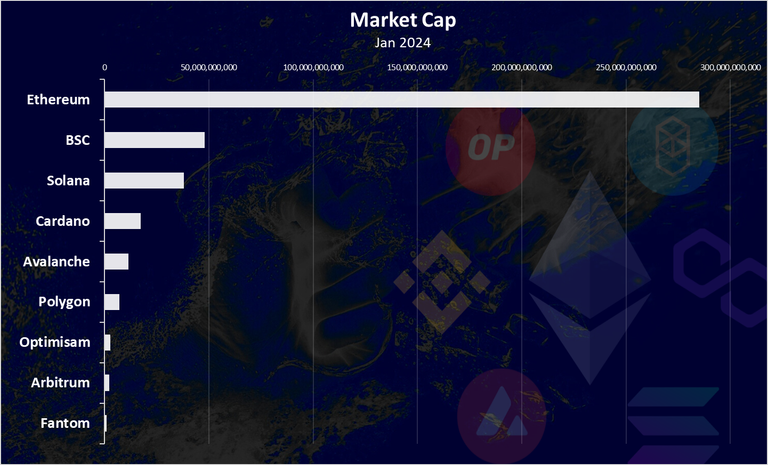

Marketcap

At the end the most important metric the market cap.

| Chain | Market cap |

|---|---|

| Ethereum | 285,088,513,172 |

| BSC | 48,033,089,653 |

| Solana | 38,163,734,158 |

| Cardano | 17,261,434,971 |

| Avalanche | 11,399,470,770 |

| Polygon | 7,069,721,043 |

| Optimisam | 2,886,289,985 |

| Arbitrum | 2,198,971,061 |

| Fantom | 981,527,192 |

Ethereum is still dominating the space with 285B market cap at the moment. BSC is in the second spot, followed by Solana.

All the best

@dalz