The SPS token is closing to its first year in existence since its launch at the end of July 2021.

In the first year the token has seen a large expansion in the supply, mostly coming from the private sale and the airdrop for the holders of Splinterlands assets. The private sale had a vesting period of 10 months, with 20M issued each month for a total of 200M. All these tokens have been issued and there is no more of them. The airdrop is lasting for 12 months with around 33M issued monthly for a total of 400M, and has around one and half months to go.

The total supply for SPS is 3B and they will be issued in a period of 5.5 years. After the end of the airdrop the next big expansion for the token will be the play to earn pool and the rewards for nodes operators, but these will take a longer time frame with a slower rate.

More info about the token in the SPS whitepaper.

Here we will be looking at:

- SPS transferred to BSC

- SPS transferred to Hive Engine

- Top accounts that transferred out SPS

- SPS staked in game

- Top accounts that staked SPS

- Overall supply, liquid vs staked

- SPS Price and Market cap

The period that we will be looking at is July 26, 2021 till June 10, 2022.

SPS Transferred Out Of The Game

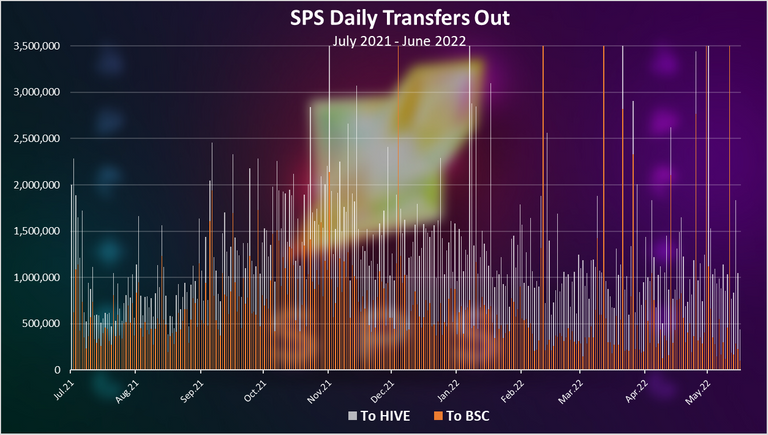

Here is the chart for the both, transfer to Hive and BSC. This is sort of transfers to exchanges for the token.

The orange bar is BSC and the white one Hive Engine.

There seems to be a peak back in November 2021 and a slow decline since then.

Let’s see the monthly chart for better visibility.

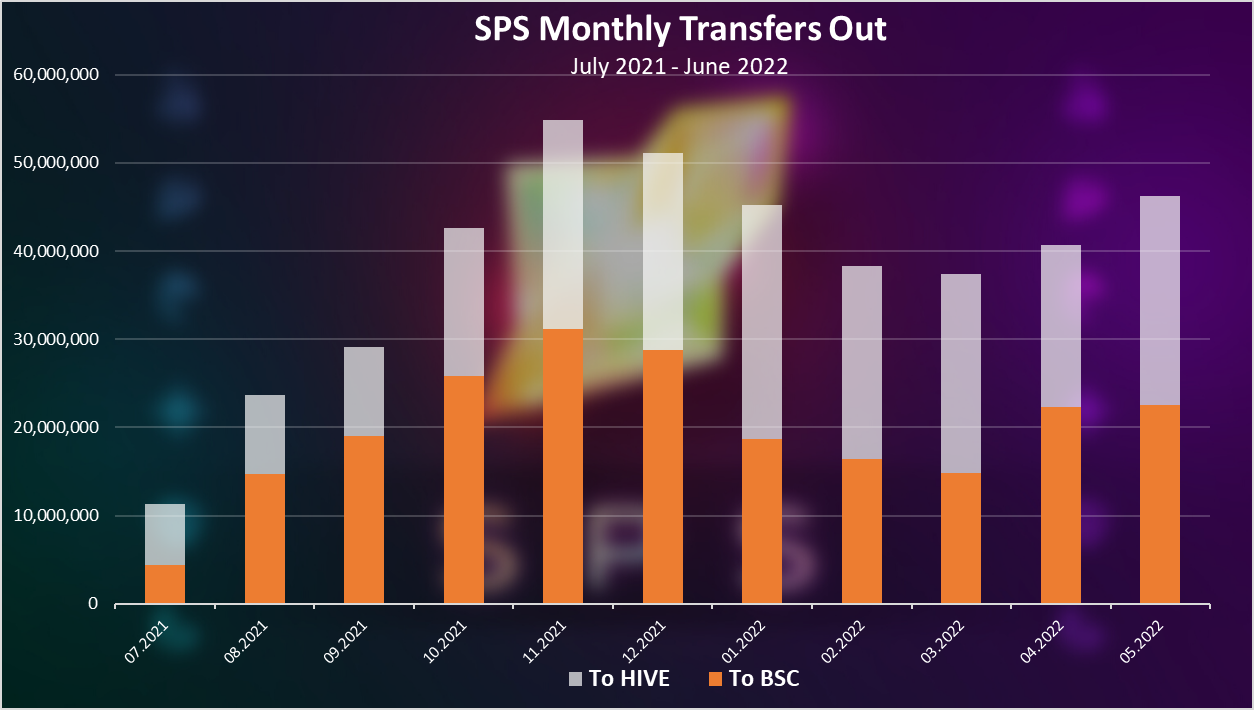

A constant growth at first, up until November 2021, then some downtrend, and in the last month a slight uptrend in the transfers out of the game.

Note that transfers out of the game doesn’t mean that these are claimed and transferred tokens. Transferring tokens between markets, arbitraging, etc is taking a big part of this. The supply of the SPS keeps increasing and the volume for transfers as well. There are also transfers IN the game, from the exchanges, and the overall result in SPS transferred out is lower then the above

The volume between Hive Engine and BSC is now equal.

Top Accounts That Transferred Out SPS

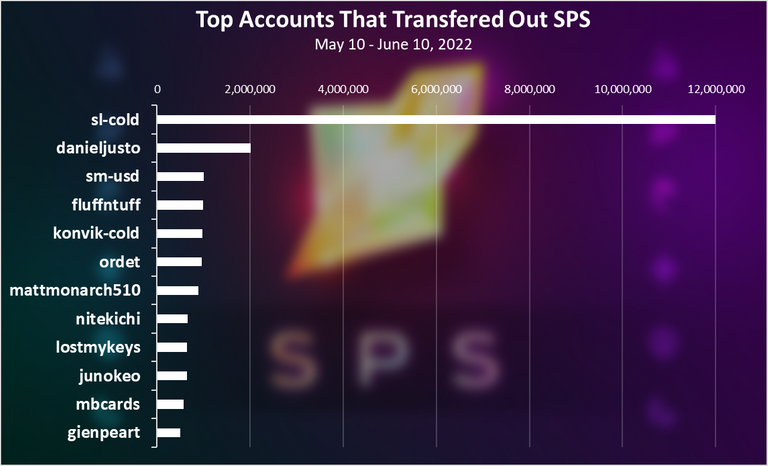

Who is transferring out the most? Here is the chart for the last 30 days.

The @sl-cold account is on the top by a lot, probably some official game tokens. Then @danieljusto and the @sm-usd account.

Staking

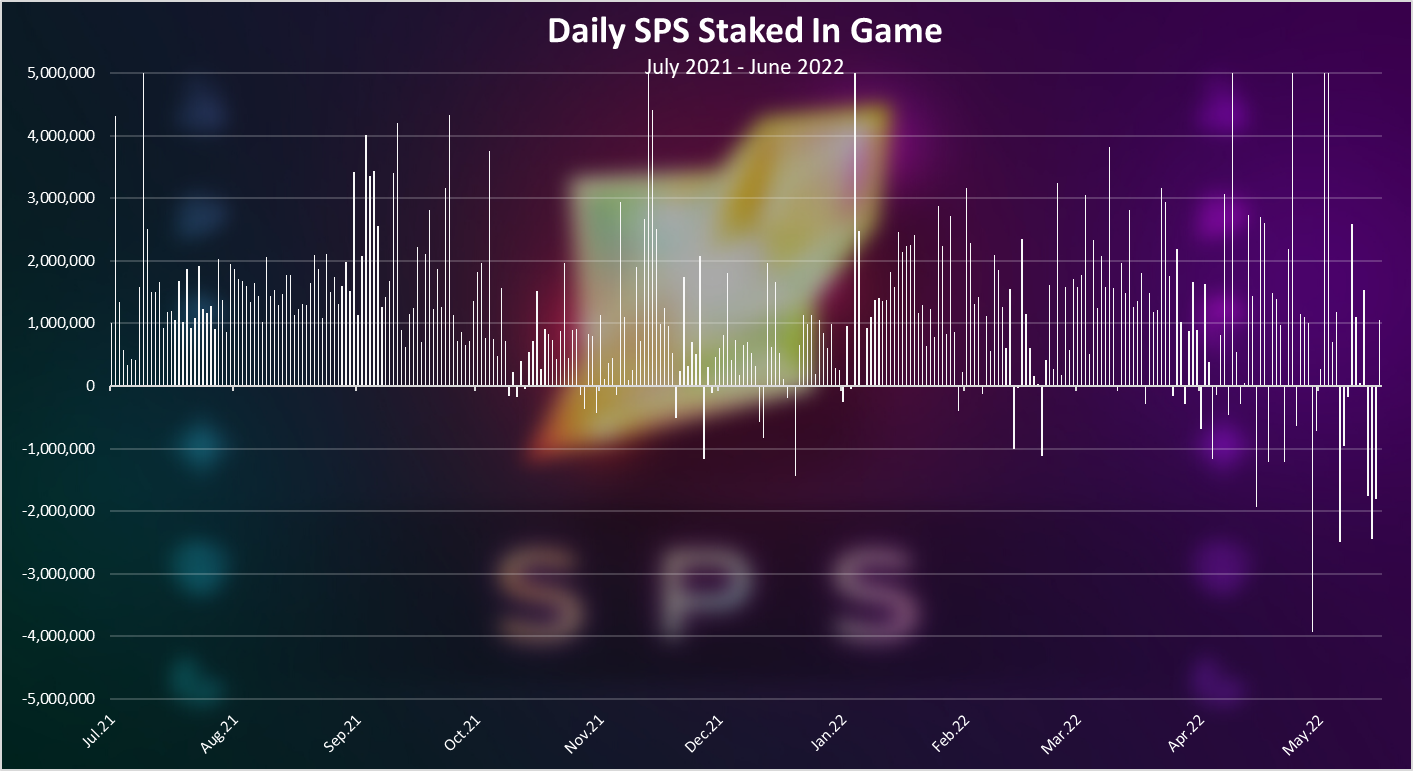

What about staking? Are players staking some SPS? Here is the chart.

A total of 412M SPS staked at the moment. SPS staking has been constantly going up as players receive the airdrop, but we can see that in the recent period there have been days when it is negative. This is mostly because of the node sales and players casing out to buy nodes.

Note: the above is a net staking, meaning staked and unstaked SPS combined. The data is collected from the blockchain. There is no record of cancel unstake operation and I have made some manual adjustments for it. Its not a 100% accurate data.

Top Accounts That Staked SPS In November

Who is staking the most?

The @shimacap account is on the top here with more then 10M staked. @spswhale on the second spot, followed by @kdinv.

An overall data for the top accounts that hold staked SPS can be find on this API.

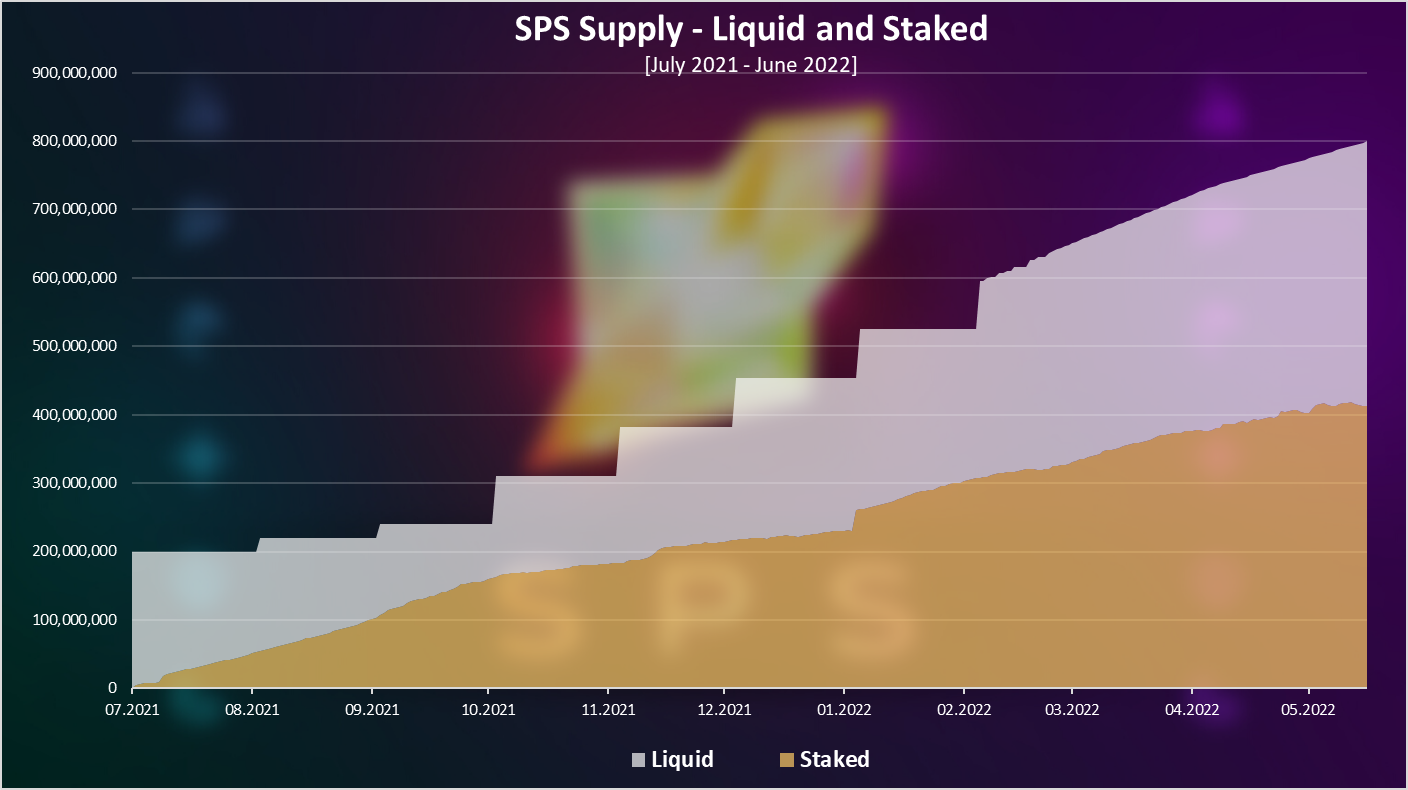

Overall Supply, Staked VS Liquid

Here is the chart for the overall supply and the staked vs liquid tokens.

There was a change back in March in the way how SPS tokens are minted on the BSC chain. Before this there was a lump sums minted once per month, and since then there is a daily amount of SPS tokens minted.

We can notice a bit of a slowdown in the amount of SPS minted just in the recent month.

The private sale tokens stopped now, as they accounted for 20M monthly. Before there was around 70M SPS added monthly and now we are down to around 50M. When the airdrop will end (August 2022), another 33M will stop being issued, but then it depends how much of the play to earn tokens will be issued per month and the tokens for the node operators. It will most likely be lower than what is now, so it is expected from August 2022 the inflation for the SPS to slow down further, probably somewhere 20M to 30M per month. Plus there is a burning mechanics in place now from the nodes sales.

On the staking side we can also notice a bit of a slowdown, that is probably because of the node sales, and users were unstaking and buying nodes.

A 790M tokens in circulation now out of which 412M staked.

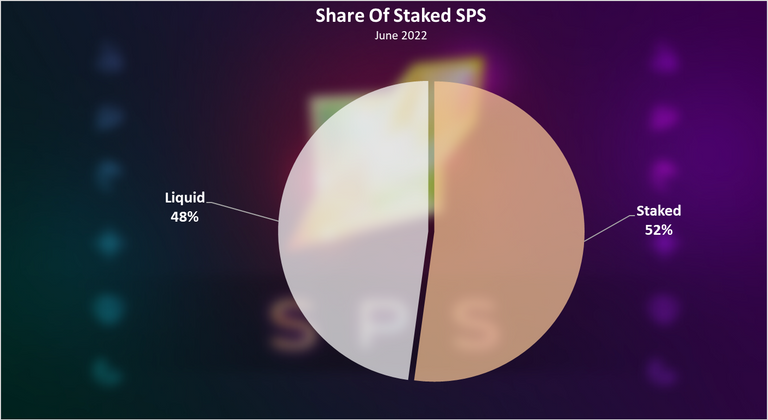

Here is the pie.

A 52% of the SPS supply is currently staked.

Even with the recent slow down in staking, the share is still above 50%. It has been constantly in the range of 50% to 55% for months now.

SPS Price and Market Cap

At the end the price chart.

These are average daily prices.

An overall downtrend for the token since the beginning of 2022. This doesn’t come as a much of a surprise having in mind the rapid increase in the supply in the first year, a privates sale with more then 10X from their price, and an overall bear market conditions that we are now in. The inflation is set to slow down in the coming months and that might push the things. On the positive side, if you are looking to buy some SPS this is a great opportunity 😊.

Because of the aggressive increase in the supply, the market cap might be a better metric.

The market cap for SPS looks like this.

Initially a similar trend as for the price, but in 2022 we can notice that the market cap has been constantly around the 60M mark. It doesn’t have that drop as the SPS price has, but has hold quite constant.

All the best

@dalz

Posted Using LeoFinance Beta