As a decentralized ecosystem the Decentralized Hive Fund (DHF) plays a vital role for Hive. Being able to self fund from a DAO exclude the need for VCs therefor pushing the decentralization of the network even more. The DHF has been around for a while but ever since the HF that created Hive its role has become much more important since there no central entity to do the heavy lifting and push the development.

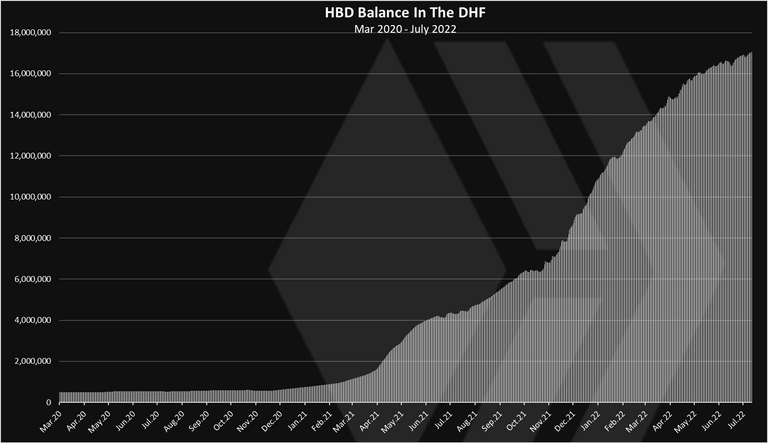

The DHF has a balance of 17M HBD now. It holds a lot of HIVE as well but those are not available for use. Since the birth of the Hive blockchain in March 2020, the funds under management in the DHF has gowned from under 1M HBD to 17M HBD at this moment.

Let’s take a look at the data.

The account that holds the DHF funds is the @hive.fund. Only 1% of the HBD holdings in this account are available for daily payouts and funding. At the moment this budget is 170k HBD per day. Projects can create proposals for funding and if they are voted out from the community, they will start receiving funds.

There is only one way funds can exit this account and that is for proposal who have been voted from the community to get the funds. But when it comes to funding, or how funds are added to the DHF there is more than one way.

Funds added to the DHF:

- 10% share of the inflation

- Ninja mined HIVE conversions to HBD

- HBD transfers to the DHF

- HIVE transfers to the DHF

- DHF as posts beneficiary

The core source of funding for the DHF is the inflation. In recent history a few more significant sources for funding were added. The most significant would be the HIVE that was transferred from Steemit Inc to the DHF. At the time of the fork March 20, 2020, there was more than 80M HIVE put in the DHF. Later with another HF in October 2020, this HIVE was put in a slow conversion mode with 0.05% of it being converted to HBD daily, or full conversion for a period of 5.5 years. This to avoid price shocks.

Another significant source of funds are the transfers to the DHF that are made by the @hbdstabilizer. This account is receiving fundings for the purpose of stabilizing the HBD. It trades HBD or HIVE on the internal market to maintain the peg and then it sends the funds back to the DHF. Depending on the price of the HBD it sends back HBD or HIVE. When HIVE is sent to the DHF it is being instantly converted to HBD at the feed price, making this funds available for use. The stabilizer send and receive funds, but overall it has been a net positive with more than 1M HBD added to the DHF in this way.

At the end there are the funds from post beneficiary. Whenever someone makes a post and set the DHF as a beneficiary, the rewards are paid to the DHF adding more funds to it.

The period that we will be looking at is March 2020 to July 2022.

Let’s check the charts.

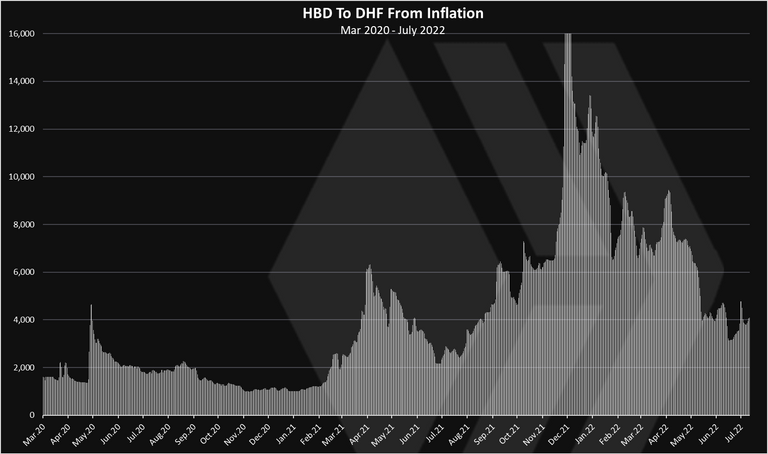

Funds From Inflation

As mentioned, 10% of the inflation goes to the DHF. Here is the chart.

The amount of HBD added in this way is corelated with the HIVE price. 10% in HBD is not the same when HIVE is 2$ or when it is 10 cents. We can see the spikes in the chart, those are basically whenever the HIVE price went up. In total a 4M HBD was added in this way.

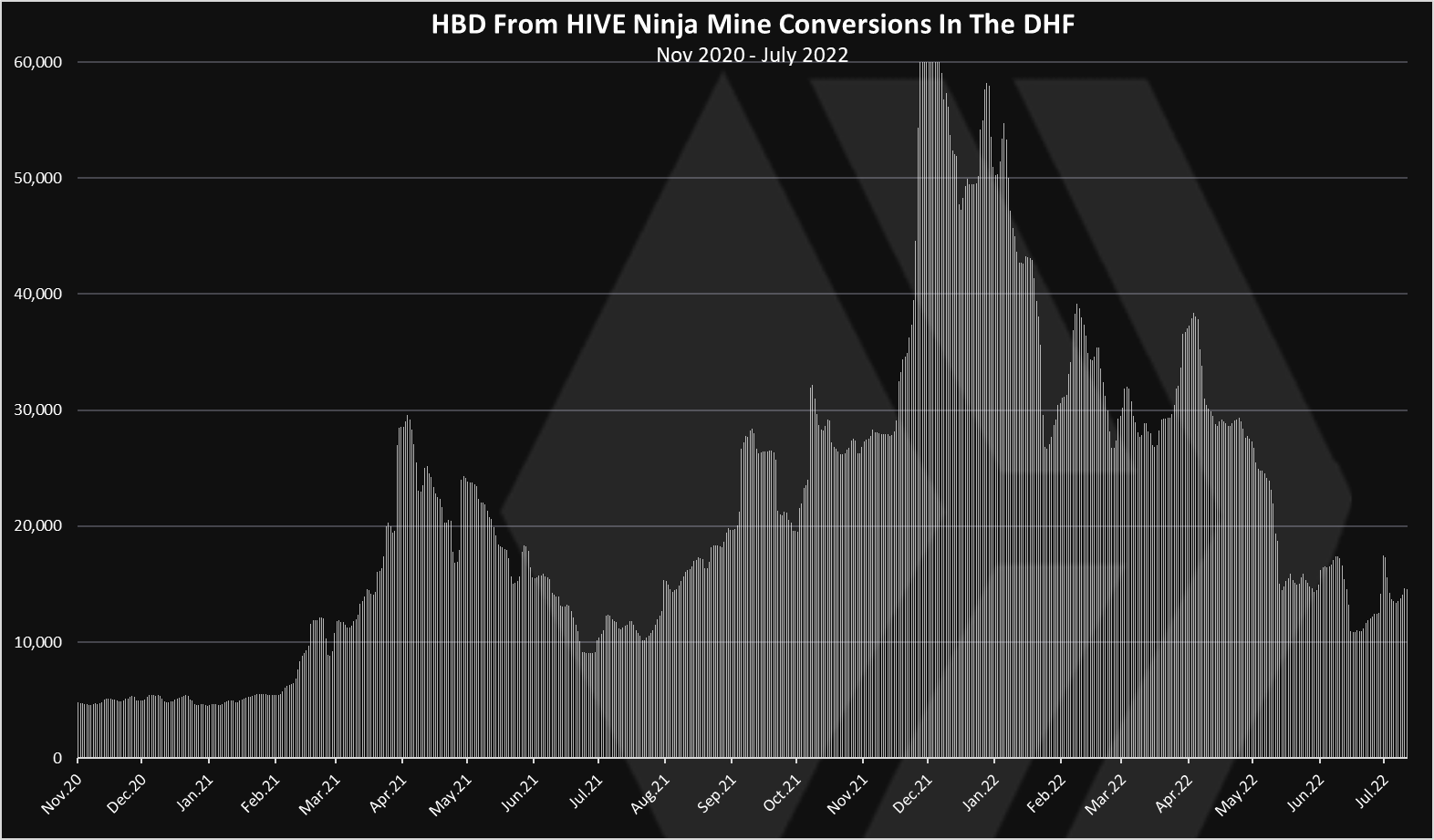

Funds From Ninja Mined HIVE Conversions

Here is the chart for the HBD added in this way.

We can notice this funding started at the end of October 2020. This is when the HF happened that enabled this. These conversions are also heavily dependent on the HIVE price. At the beginning there was around 5k HBD added per day and now it is around 50k HBD per day. A total of 13.5M HBD was added in this way.

We can notice that these funds are actually bigger than the inflation itself. A multiple times bigger on a daily level. Thing is they wont last forever and will end in a few years’ time. Also, as time progress they will become smaller in terms of HIVE. At the moment there is 60M HIVE left to be converted from the 80M plus when started.

HIVE Transfers To The DHF

Here is the chart.

These transfers are mostly made by the @hbdstabilizer. When the price of HBD is higher than a dollar the stabilizer sells HBD, receive HIVE and sent that HIVE to the DHF where it is being instantly converted to HBD at the feed price. Also the stabilizer converts HBD to HIVE in order to buy HBD, but if at the time this HIVE is not needed, it sends it back to the DHF.

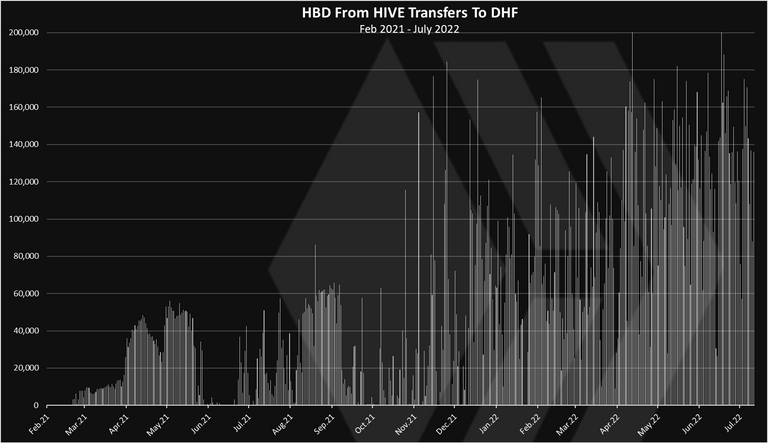

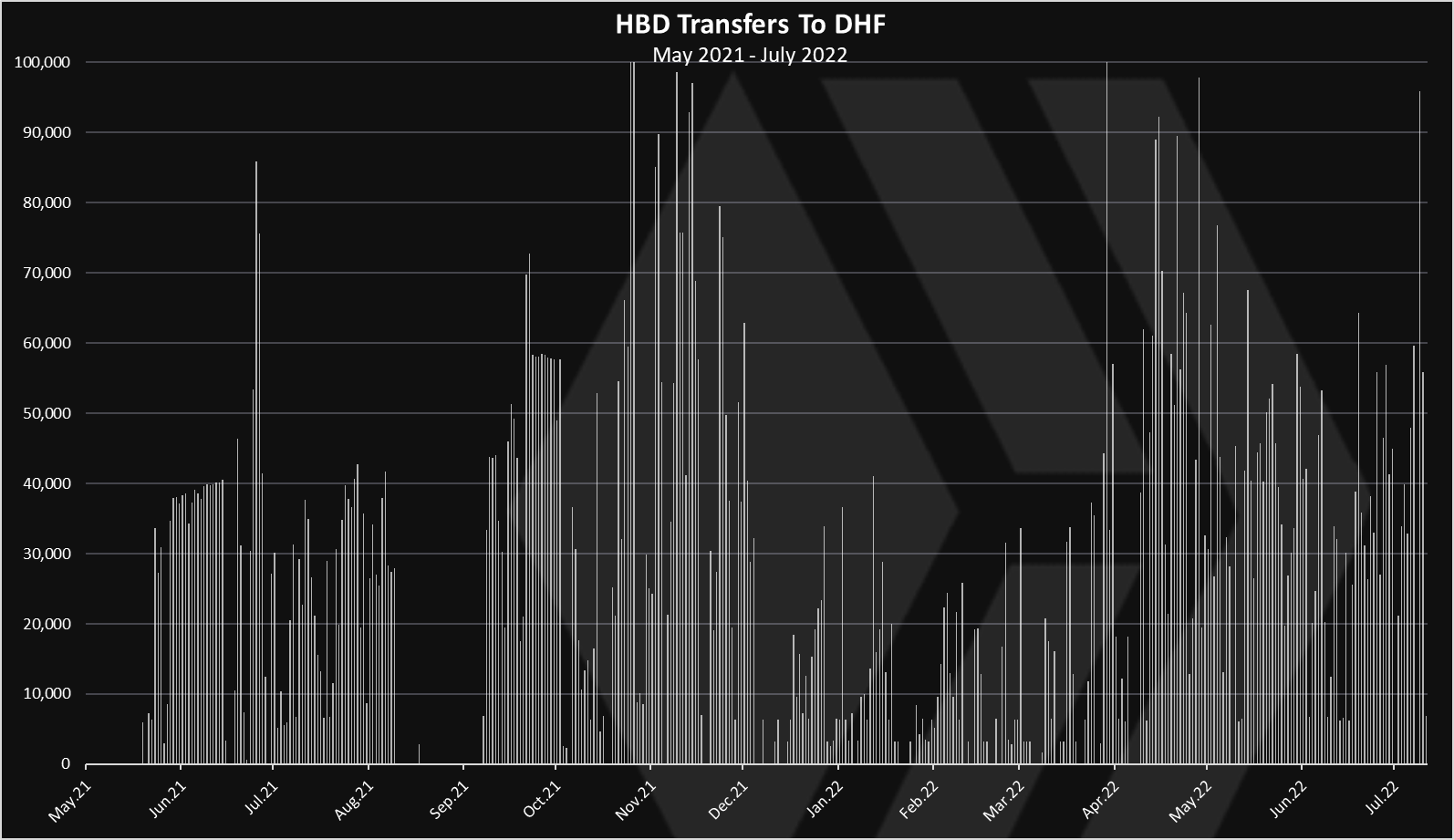

HBD Transfers To The DHF

Here is the chart.

These are usually excess funds from the @hbdstabilizer. When the peg of HBD is close enough to the dollar if there are no needs from funds, the stabilizer sends the funds back. It doesn’t hold or accumulate them.

To have an idea what is the net added HBD in the DHF from the HBD and HIVE transfers to the DHF we need to look in the stabilizer works, and from the recent post it has been a net positive for 1.4M HBD.

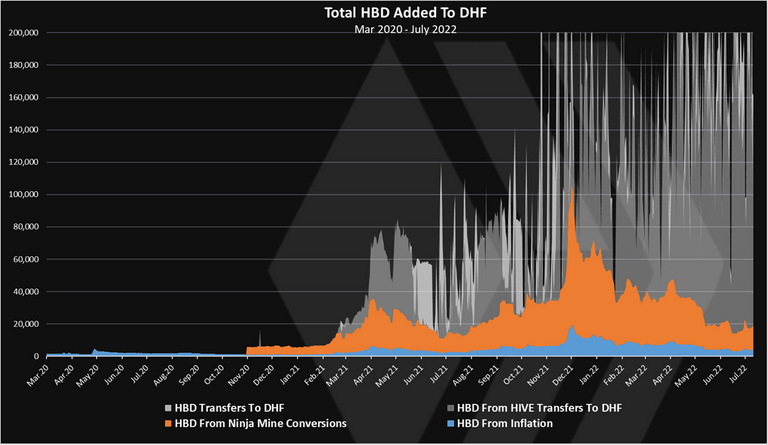

Cumulative HBD Added To The DHF

If we combine all the above, we get this.

Note the inflation in blue. It has been a small share for HBD added to the DHF. The conversions from the HIVE in the DHF (orange) has been a significant income for the DHF. As for the transfers go, we can see a lot of spikes created from HBD and HIVE transfers, but a lot of these funds are send back to the stabilizer, so the are much smaller, as we have seen in total of 1.4M HBD over the period.

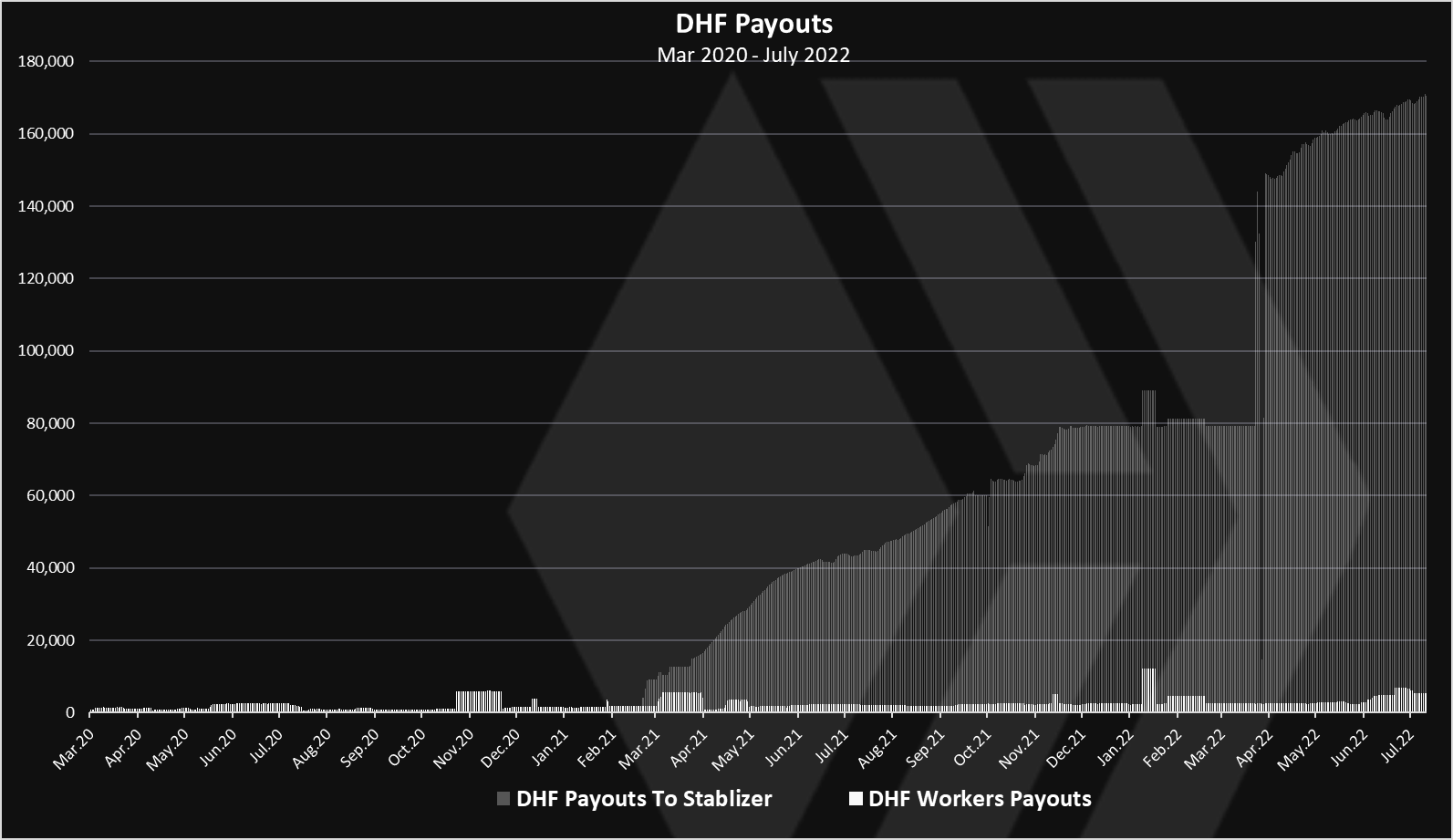

Payouts From The DHF

As mentioned, this is the only way HBD leaves the DHF. Here is the chart.

At first sight this chart might be a bit confusing. We can see the continues growth in payouts from February 2021, but this is mostly because of the stabilizer and the pegging of the HBD. These funds are sent back to the DHF.

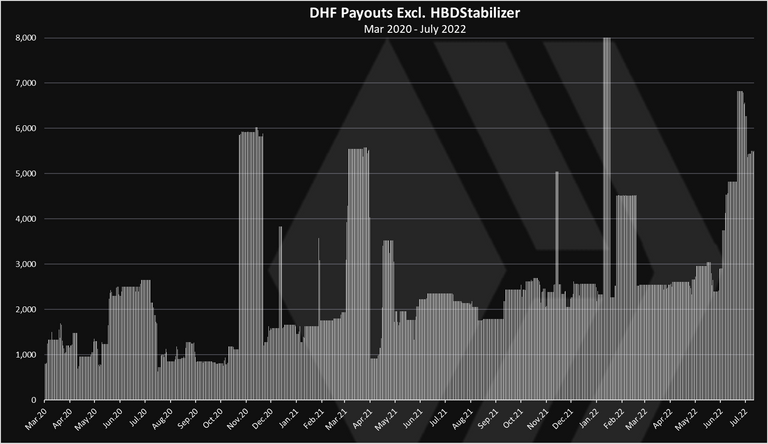

If we exclude the stabilizer the daily payouts from the DHF we get this.

The chart above represents realized payouts. In the last month there is a jump in the daily payouts, that now have reached more than 5k HBD daily. What is interesting is that at these levels for the HIVE price the HBD from inflation is around 4k daily, so if the DHF was dependent only on that source of funding it would have started to reduce its balance. But because more funds are added, especially from the ninja mine conversions the HBD in the DHF is still growing and will most likely continue to do so until the conversions are over.

Almost 160k HBD was paid out in June 2022 to a 17 active projects. This number of active funded projects in one months has been the highest since the beginning.

On a yearly basis the total payouts in 2020 were 600k, in 2021 900k, and for 2022 we are at 600k in H1, so we will most likely end around 1.2M HBD paid for proposals.

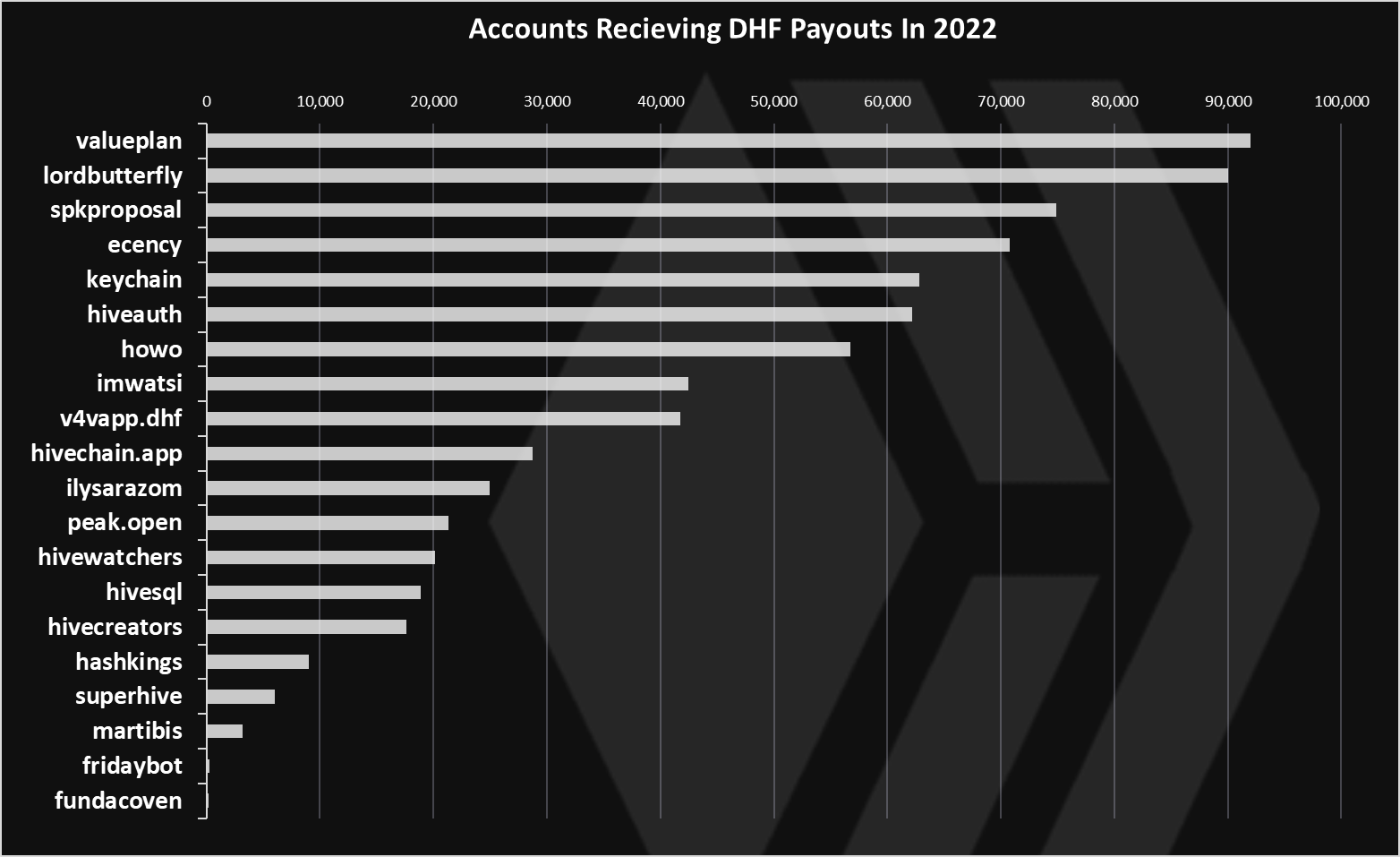

Accounts Receiving Funding From The DHF In 2022

A total of 20 accounts received funding from the DHF in 2022.

Here is the chart, excluding the stabilizer.

The @valueplan is on the top for now. It is a proposal for outreach and sponsorship from Hive. The wells in Ghana were sponsored by it, the hivefest received some funds, etc. Second is @lordbutterfly with the marketing proposal. Other know projects in the top as 3Speak, Ecency, Keychain etc.

As mentioned, a total of 20 projects received funding in 2022 only. From the beginning of the chain, back in March 2020, a total of 45 accounts received some form of funding. Would be nice if up this number to a 100 at some point in the future 😊.

HBD Balance In The DHF

Here is the chart of the HBD balance in the DHF over time.

As we can notice when Hive was created the DHF had only around 400k HBD in the account. This amount slowly increased and from March 2021 it started growing rapidly. This is mostly due to the increase of the HIVE price. Since then, it has been growing nicely and we are now at 17M HBD.

A larger balance in the DHF is an assurance for the projects that are currently using it that the funding will continue without issues, and it will attract more developers. Seeing more than 40 projects received some form of funding from the DHF is great.

One of the key gainer from large DHF fund has been HBD itself. With more funds in the DHF, the @hbdstabilizer has more power to maintain the HBD peg on a daily level. As the funds continue to grow this will cement HBD further, that will improve its overall usability.

All the best

@dalz

Posted Using LeoFinance Beta