The decentralized Hive fund plays a major role in the Hive ecosystem. It is the backbone for the development and funding of the platform. Ever since the creation of the Hive chain its role has increased massively since there is no centralized entity that will keep developing. The community members need to continue this and the DHF is providing the funds.

The DHF has a almost a 20M HBD now. It holds a lot of HIVE as well but those are not available for use. Since the creation of the Hive blockchain in March 2020, the funds under management in the DHF has gowned from under 1M HBD to 20M HBD at this moment.

Let’s take a look at the data.

Background generated with Midjurney

The account that holds the DHF funds is the @hive.fund. Only 1% of the HBD holdings in this account are available for daily payouts and funding. At the moment this budget is almost 200k HBD per day. Projects can create proposals for funding and if they are voted out from the community, they will start receiving funds.

There is only one way funds can exit this account and that is for proposal who have been voted from the community to get the funds.

When it comes to funding the DHF, or how funds are added to the DHF there is more than one way. Funds added to the DHF:

- 10% share of the inflation

- Ninja mined HIVE conversions to HBD

- HBD transfers to the DHF

- HIVE transfers to the DHF

- DHF as posts beneficiary

The core source of funding for the DHF is the inflation.

In recent history a few more significant sources for funding were added. The most significant would be the HIVE that was transferred from Steemit Inc and co to the DHF. At the time of the fork in March 2020, there was more than 83M HIVE put in the DHF. Later with another HF in October 2020, this HIVE was put in a slow conversion mode with 0.05% of it being converted to HBD daily, or full conversion for a period of 5.5 years. This to avoid price shocks.

Another significant source of funds are the transfers to the DHF that are made by the @hbdstabilizer.

This account is receiving fundings for the purpose of stabilizing the HBD. It trades HBD or HIVE on the internal market to maintain the peg and then it sends the funds back to the DHF. Depending on the price of the HBD it sends back HBD or HIVE. When HIVE is sent to the DHF it is being instantly converted to HBD at the feed price, making these funds available for use. The stabilizer sends and receive funds, but overall, it has been a net positive with more than 1.8M HBD added to the DHF in this way.

At the end there are the funds from post beneficiary. Whenever someone makes a post and set the DHF as a beneficiary, the rewards are paid to the DHF adding more funds to it.

Let’s check the charts.

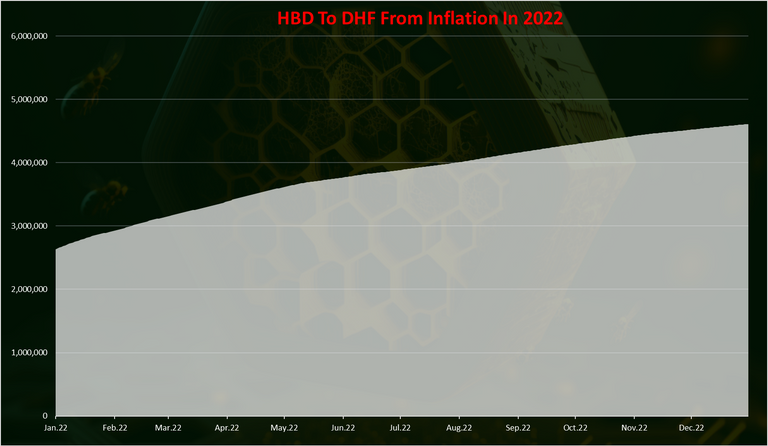

Funds From Inflation

As mentioned, 10% of the inflation goes to the DHF. Here is the chart.

The amount of HBD added in this way is corelated with the HIVE price. 10% in HBD is not the same when HIVE is 2$ or when it is 10 cents. In 2022 there was 2M HBD added in the DHF from the regular inflation. Cumulative, from the start of the DHF in August 2019 there is a total of 4.6M HBD added in the DHF from the regular inflation.

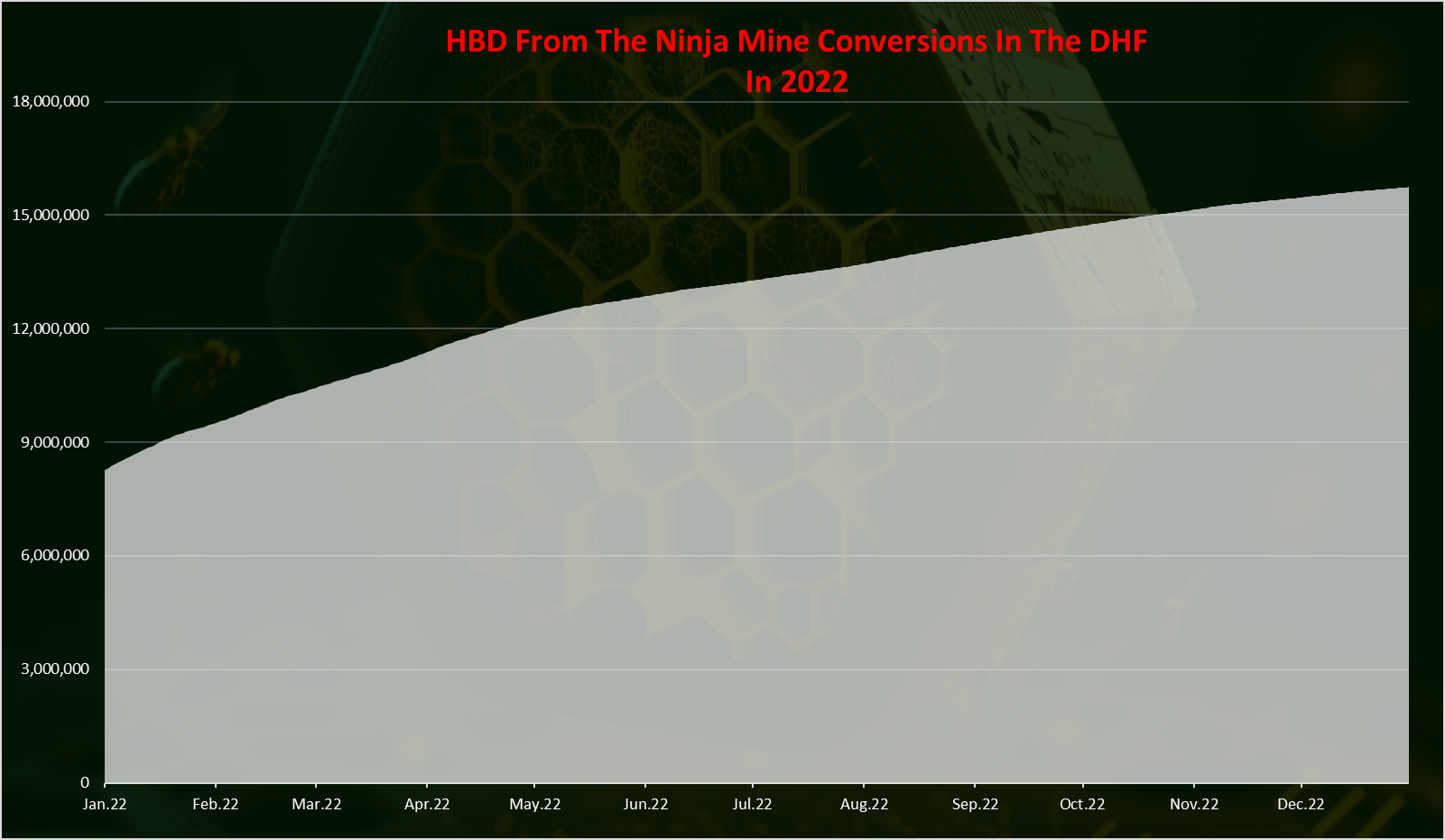

Funds From The Ninja Mined HIVE Conversions In The DHF

Here is the chart for the HBD added in this way.

This type of funding started at the end of October 2020. This is when the HF happened that enabled this. These conversions are also heavily dependent on the HIVE price.

In 2022 a total of 7.5M HBD was added from these conversions. Cumulative, from the start of these conversions in October 2022 a total of 16M HBD is added in the DHF in this way.

We can notice that these funds are actually higher than the inflation itself. Multiple times higher. Thing is they wont last forever and will end in a few years’ time. Also, as time progress they will become smaller. At the moment there is 55M HIVE left to be converted from the 83M plus when started.

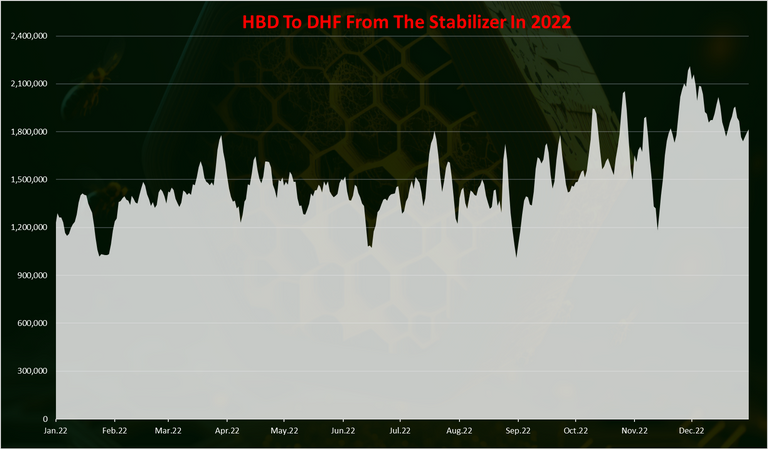

HBD Added To The DHF From The @hbdstabilizer

Here is the chart for the net HBD added in the DHF from the @hbdstabilizer.

As mentioned, the stabilizer receives HBD from the DHF, for the purpose of stabilizing the HBD peg.

If the HBD price is higher than 1$ then it will sell the HBD on the internal market. If the HBD price is lower than the peg, it will convert the HBD to HIVE and then buy HBD on the internal market.

If the price is at the peg, it will simply return the funds. It sends back funds to the DHF both, in HBD and HIVE. The HIVE that is sent back to the DHF is instantly converted to HBD in the DHF to be available for usage.

The chart above shows the net HBD added/removed in the DHF from the stabilizer. More than 1.8M HBD is added in this way in the DHF. I 2022 alone there, the stabilizer is in the positive with 600k HBD.

We can notice there has been some volatility in the year, with funds going up to 2.1M and back.

When there are spikes in the HBD price, it usually marks a period when more HBD is added in the DHF, and when there are drops in the HBD price, the stabilizer is using more funds and is taking funds out of the DHF.

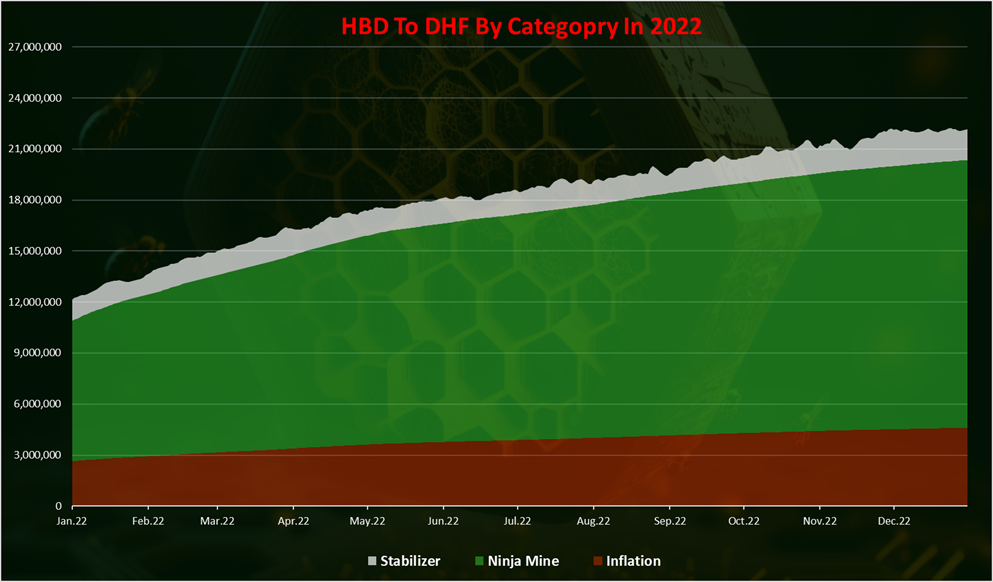

Cumulative HBD Added To The DHF

If we combine all the above, we get this.

From the chart above we can notice that the conversions from the ninja mined HIVE in the DHF are the main way for adding funds in the DHF.

A total of 16M HBD or 70% of all the funds in the DHF has been added in this way. The regular inflation is on the second spot with 4.6M, and then the stabilizer with 1.8M.

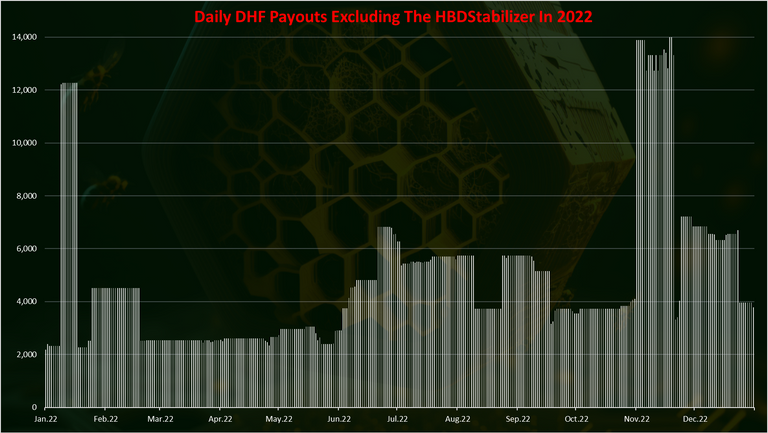

Daily Payouts From The DHF

As mentioned, this is the only way HBD leaves the DHF. Here is the chart.

The chart above excludes the payouts to the @hbdstabilizer.

We can notice a few spikes in the payouts, usually when some project with heavy funding in a short period of time.

On average in 2022 a 4.8k HBD has been paid daily to DHF workers. There has been days when this amounts is around 2.5k, and on some occasions it has spiked to 14k HBD paid daily.

1.8M HBD in total is paid to DHF works in 2022

On a yearly basis the total payouts looks like this:

| Year | HBD |

|---|---|

| 2019 | 30,880 |

| 2020 | 616,784 |

| 2021 | 888,701 |

| 2022 | 1,775,947 |

2022 has been a record high years for project funded by the DHF. The amount is almost double then the previous year, when this number is around 900k.

in 2020 were 600k, in 2021 900k, and for 2022 will probably end with more than 1.5M HBD in payouts.

From the very start, in the four year of operation, the DHF has paid 3.3M HBD.

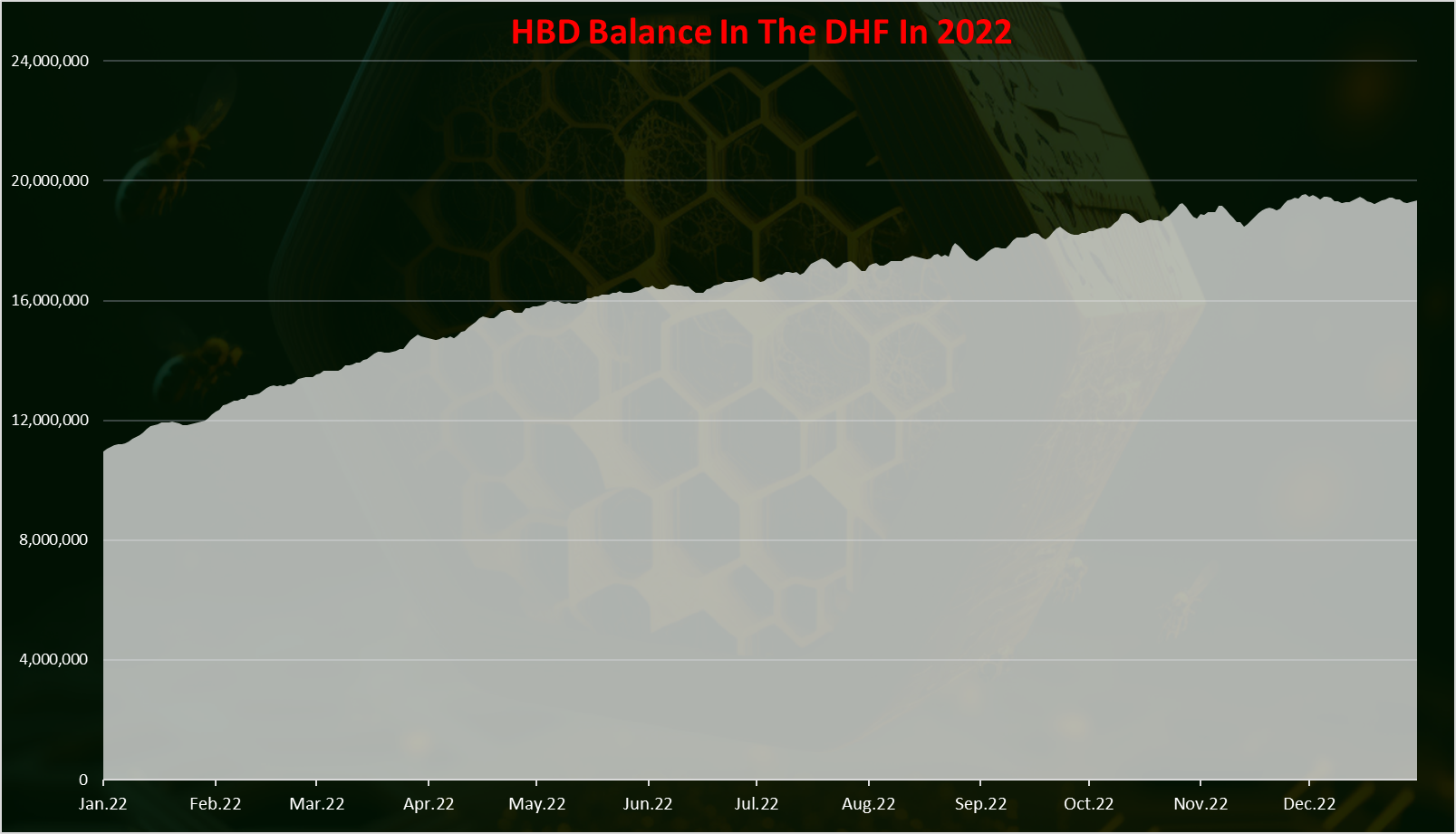

HBD Balance In The DHF

Here is the chart.

When we add the funds added and removed form the DHF we get the chart above. Almost 20M HBD in the DHF now. 2022 started with 10M HBD, meaning the fund has almost doubled in the year.

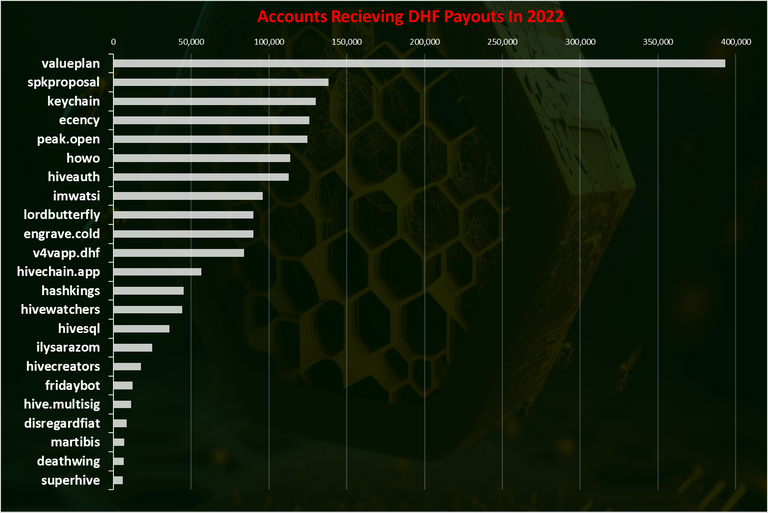

Accounts Receiving Funding From The DHF In 2022

A total of 25 accounts received funding from the DHF.

Here is the chart, excluding the stabilizer.

The @valueplan is on the top for 2022 with 393k HBD, followed buy the @spkproposal and @ecency.

A total of 25 accounts have received funds from the DHF in 2022. Other know projects in the top as Keychain, Peakd, howo etc.

From the beginning of the chain, back in March 2020, around 50 accounts received some form of funding. Would be nice if up this number to a 100 at some point in the future 😊.

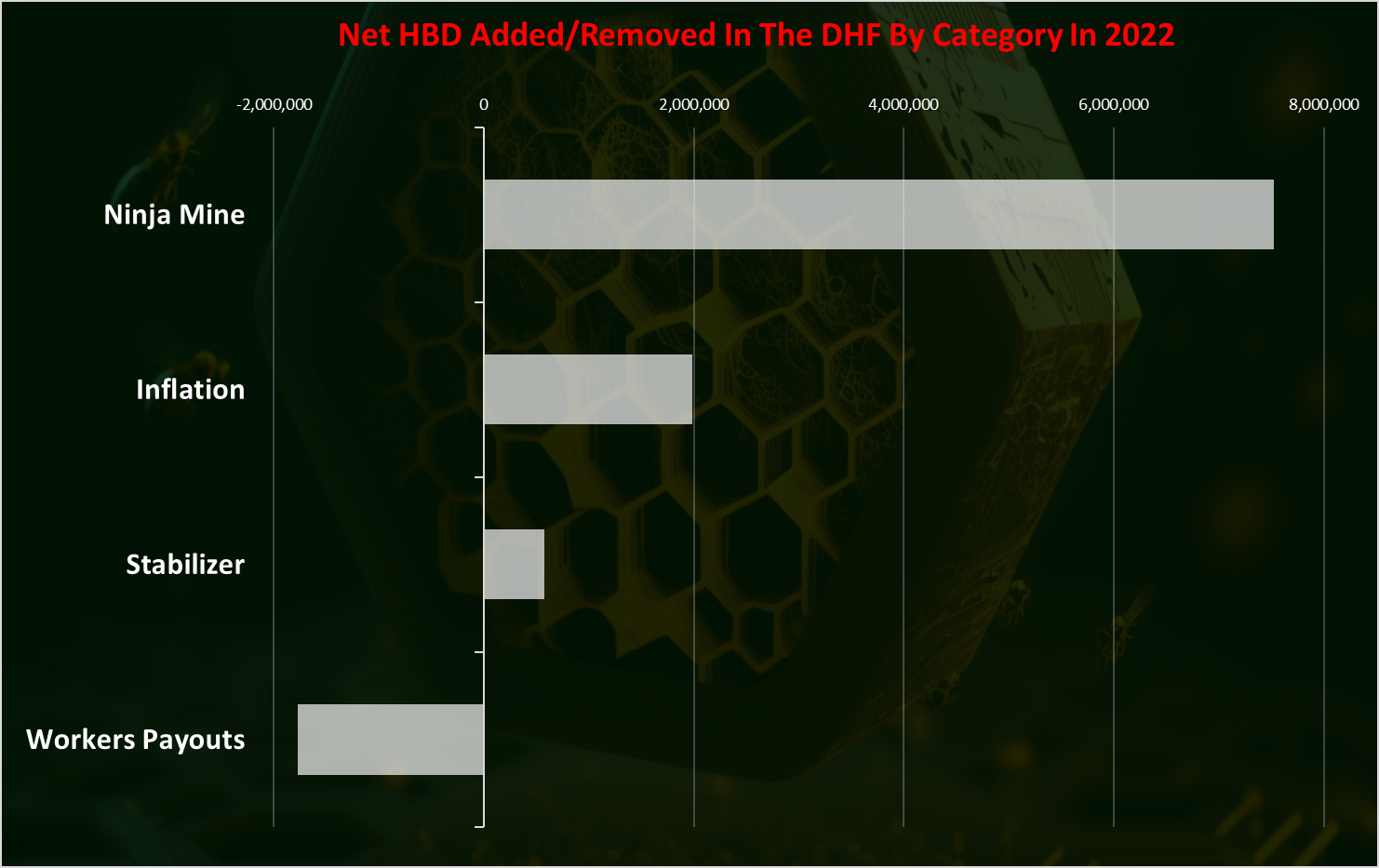

Summary For HBD Added And Removed In The DHF By Category

Here is the chart.

The Ninja mine conversions are on the top with more than 7.5M, the regular inflation has added 2M and then the stabilizer 0.6M. The payouts to DHF workers are at 1.8M and are negative on the chart.

A larger balance in the DHF is an assurance for the projects that are currently using it that the funding will continue without issues, and it will attract more developers. As we have seen the ninja mine HIVE conversions has been the main driver for the growing HBD balance in the DHF.

One of the key gainer from large DHF fund has been HBD itself. With more funds in the DHF, the @hbdstabilizer has more power to maintain the HBD peg on a daily level. As the funds continue to grow this will cement HBD further, that will improve its overall usability.

All the best

@dalz

Posted Using LeoFinance Beta