The Hive stabelcoin has been around for a long time. Since the creation of the Hive chain, March 2020 it has been continuously improved and tweaked. Some core features still remain though, like the haircut, meaning there is a cap on the amount of HBD the chain can support and in extremely bad market conditions HBD can loose its dollar peg. Something that every HBD holder should have in mind and adjust their positions accordingly.

Let’s take a look at the HBD supply and its evolution in time.

As already mentioned, a serious of small but significant improvements for HBD were made. Some of them required hardforks, some not.

Some of these are:

- Two ways conversions for HIVE <-> HBD,

- The introduction of the @hbdstabilizer providing and incentivized internal market

- Increase of the interest for HBD in savings to 20%

- Allocating HBD interest only to HBD held in savings

- Increase in the Hive debt from 10% to 30%

- Increased HBD liquidity although still a long way to go

HBD is being created and destroyed/burned in multiple ways. Like many things on Hive, it has its nuances. Here are the ways that HBD is being created and removed.

HBD Created:

- 10% share of the inflation to the DHF

- HBD author rewards

- Interest payouts

- HIVE to HBD Conversions

- Ninja-mined HIVE to HBD conversions in DHF

- HIVE transfers to DHF and converted to HBD

HBD Removed:

- HBD to HIVE Conversions

- Transfers to null + null as post beneficiary

If the above was not enough, there is also different ways the HBD in the DHF is treated than the rest of the HBD. HBD in the DHF is not considered as freely available HBD on the market so it is excluded from debt calculations and similar.

The focus here will be on freely circulating HBD, excluding the HBD in the DHF.

We will be looking at the different HBD allocations here as well.

The period that we will be looking at is starting from 2021 to Oct 2022 , with a focus on 2022.

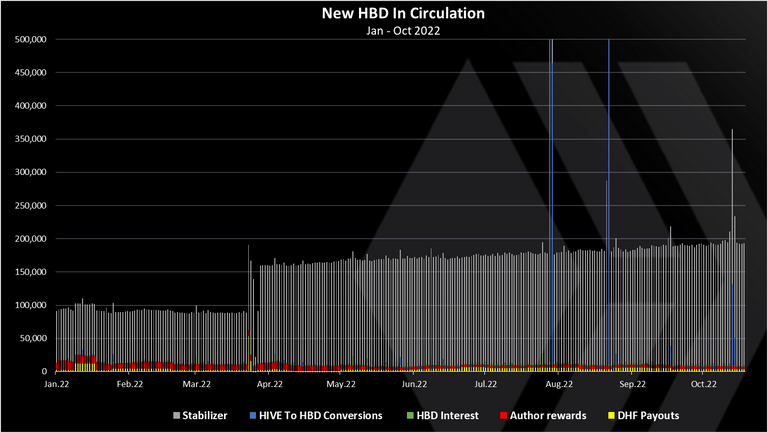

New HBD Added In Circulation

Here it the chart.

The chart includes the following:

- Payouts to the @hbdstabilizer

- DHF Payouts

- HBD author rewards

- Interest payouts

- HIVE to HBD conversions

As already mentioned, the focus here is the freely circulating HBD, not the HBD balance in the DHF.

When a payout is maid from the DHF only then the HBD enters the market as freely available. I have separated the payouts to the @hbdstabilizer, as it plays a major role in the HBD tokenomics now.

We can see that most of the HBD that enters circulation is for the purpose of the stabilizer. Then are the HIVE to HBD conversions, author rewards etc.

Note that most of the HBD that the stabilizer receives it sends back as HBD to the DHF or convert it to HIVE.

We will check the net effect from this bellow.

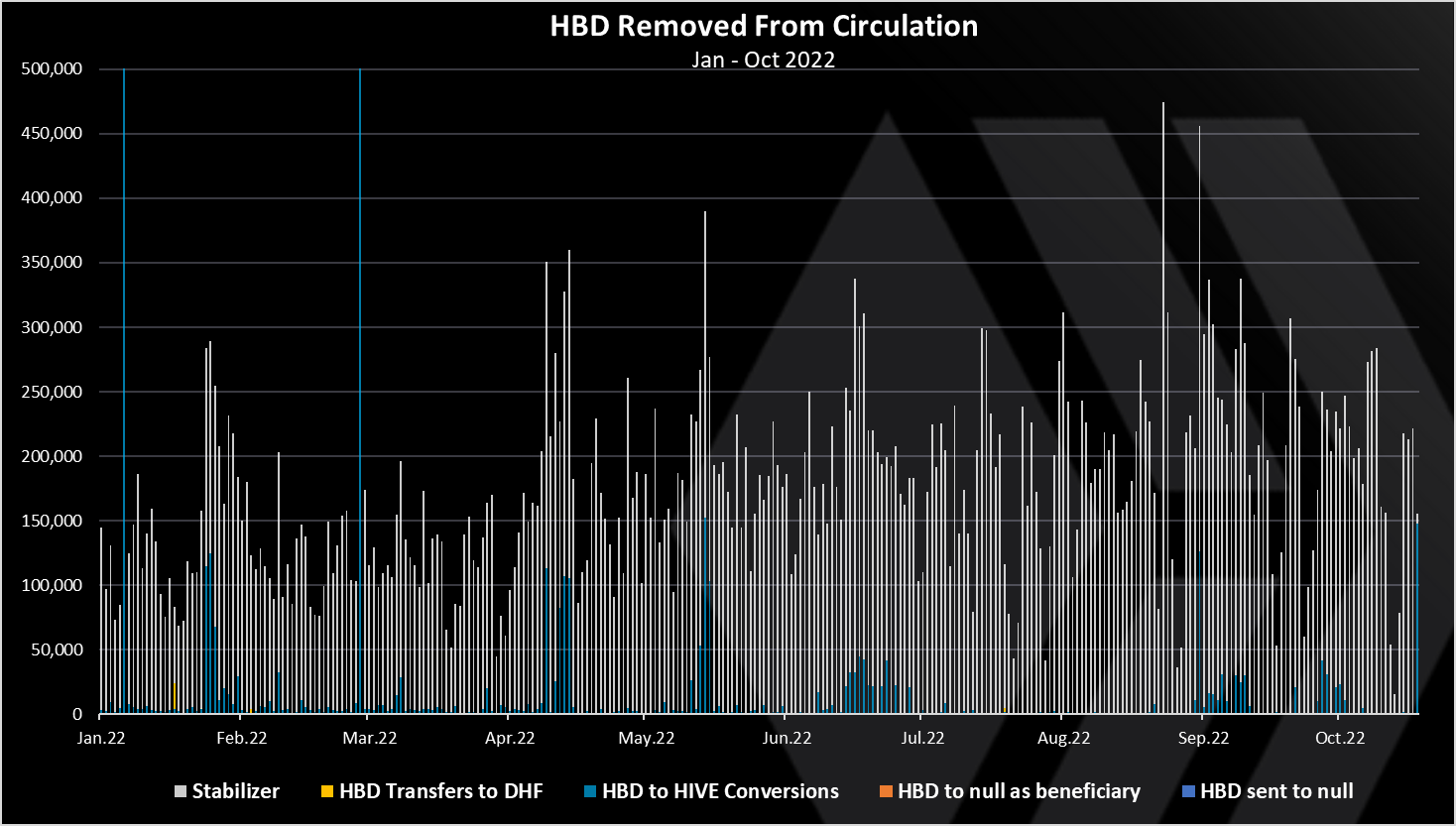

HBD Removed From Circulation

Now let’s take a look at HBD removed. Here is the chart.

We can see that the stabilizer is dominant here as well. It removes HBD from circulation either transferring it to the DHF or by converting it to HIVE.

Next are the HBD to HIVE conversions.

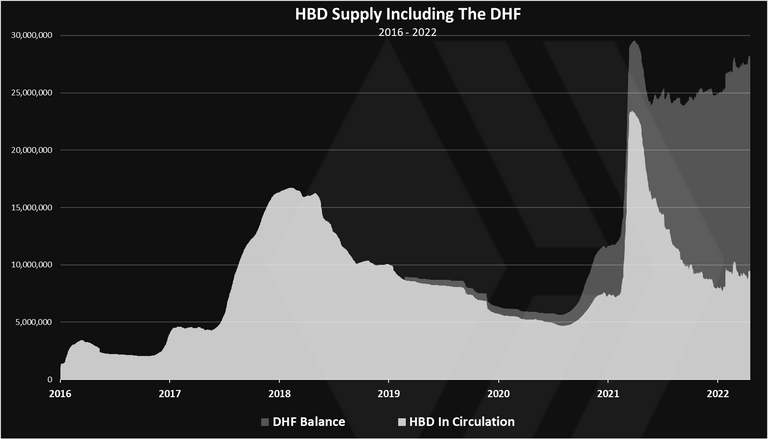

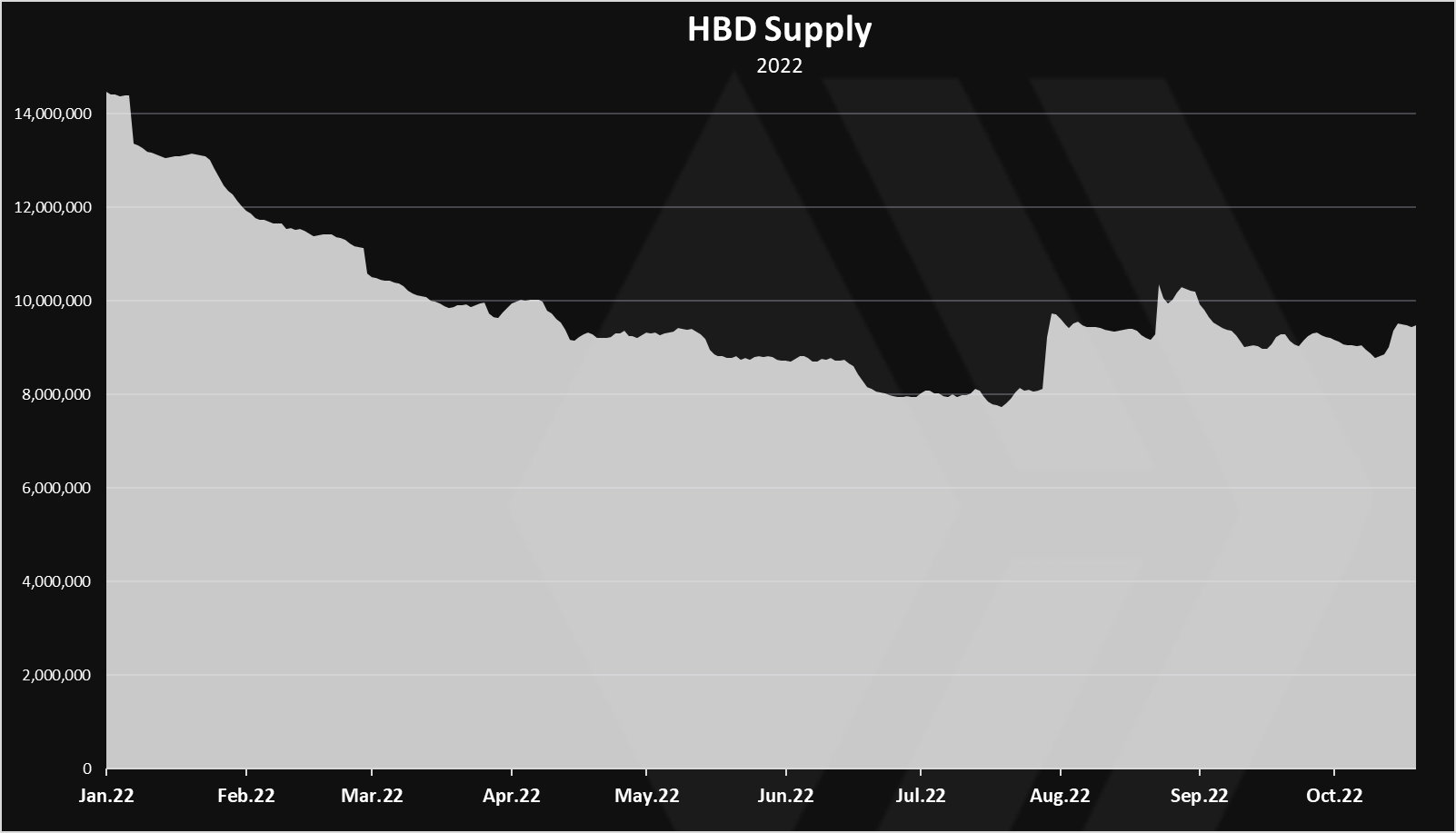

HBD Supply

First a look a the all-time HBD supply including the DHF balance.

It has been an up and down ride for the HBD, with a massive increase in 2021 and a drop in 2022. The HBD in the DHF balance has grown significantly in the last two years. At the moment of writing this the DHF balance is 18M, while the freely circulating HBD is 9.5M. The amount of HBD is double in the DHF from the freely available.

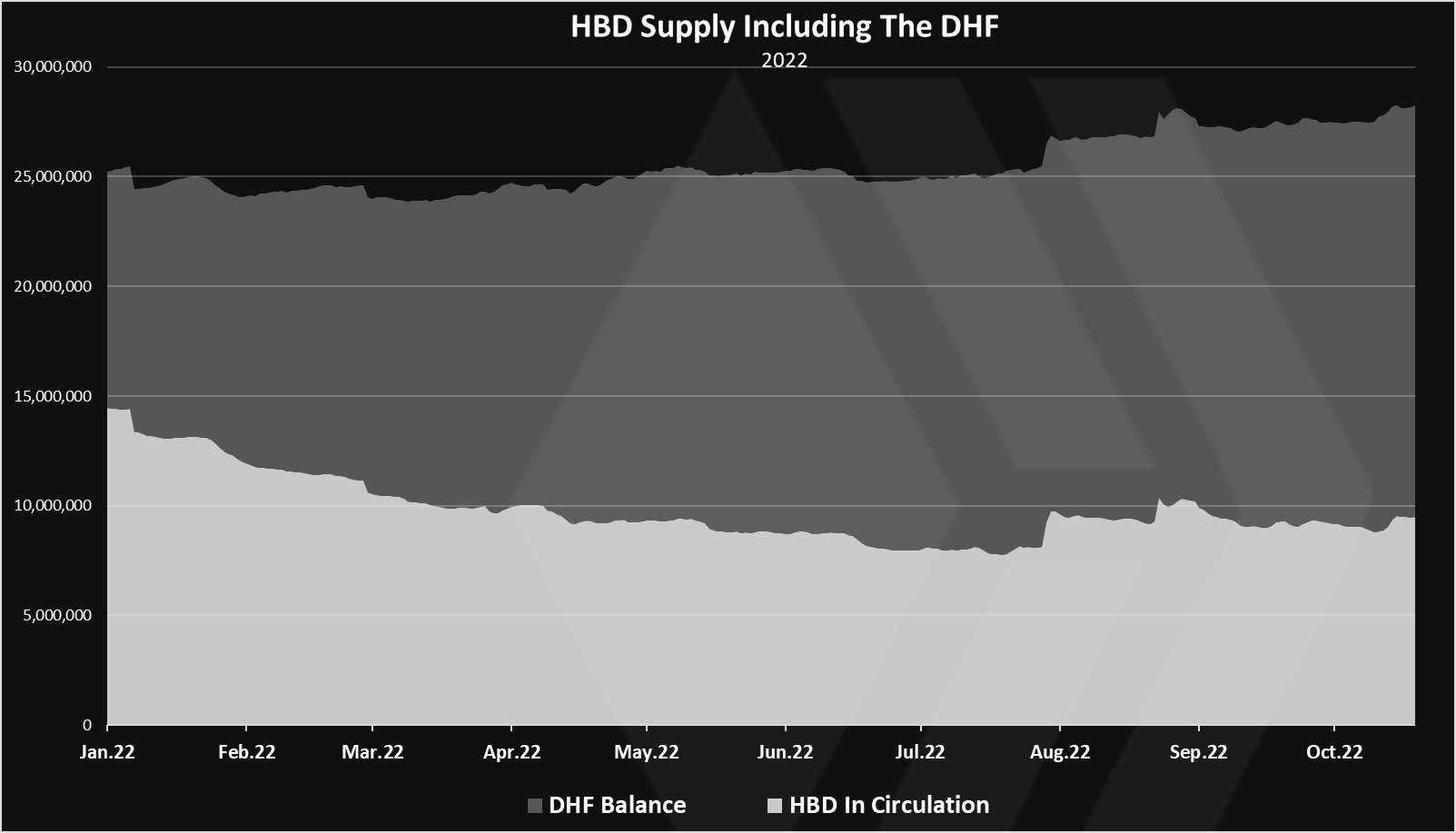

When we zoom in 2022 we get this:

We can notice the drop in the freely circulating HBD (the data used for debt calculation), while the HBD in the DHF has kept growing in 2022 as well. This is because of several reasons but mainly from the ninja mine conversions in the DHF and the work of the stabilizer as well.

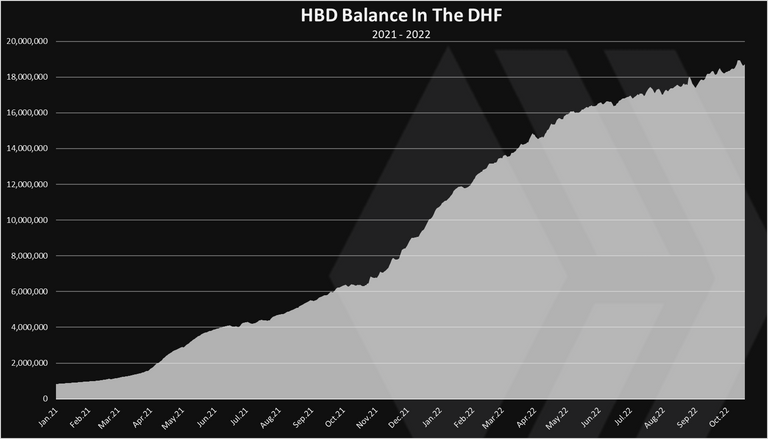

HBD Balance in the DHF

If we look at the HBD balance in the DHF we get this.

From here we can clearly see how much the HBD in the DHF has expanded in the last two years. Going from just around 1M HBD at the beginning of 2021, to more than 18M now.

HBD Supply Without The DHF Balance

This is probably the best representation of the HBD supply as it shows only the freely available HBD, that is truly in circulation. The HBD in the DHF is a sort of potential HBD that can enters in circulation, but even then it can be only at a rate of 1% per day.

We can see the decline in the HBD supply in2022. This is because of the bad market condition and users converting or selling their HBD. From more than 14M at the beginning of the year to 9.5M at the moment.

As we can notice there has been an increase in the supply in the last few months, after the low point in July 2022. In the last days there has been an increase in the HBD supply for 0.5M HBD.

Rapid expansions of the HBD supply usually happens when the price of HBD is above 1$.

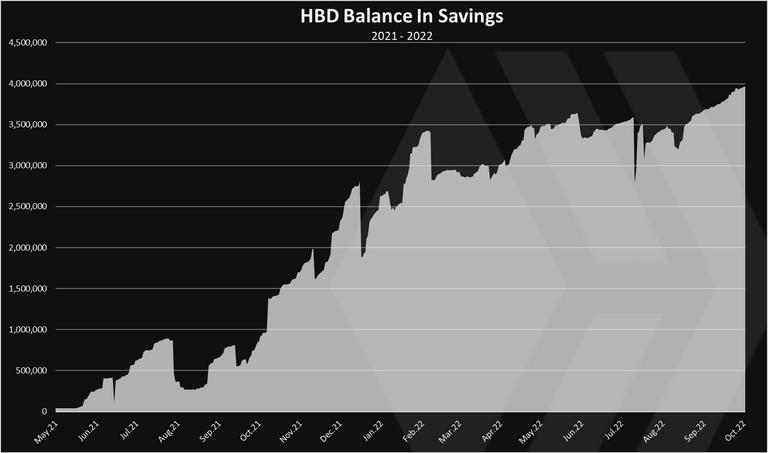

HBD Balance In Savings

Savings is another important metric for the HBD supply. The HBD held in the savings is receiving 20% interest.

Prior to July 2021 there was somewhere around 150k in the savings. Then they stated growing and continue an aggressive expansion up until March 2022, with some bumps in the way. In March 2022 the ATH for HBD in savings was at 3.6M. As steady growth since then and we are now at 4M HBD in savings, out of the total 9.5M supply.

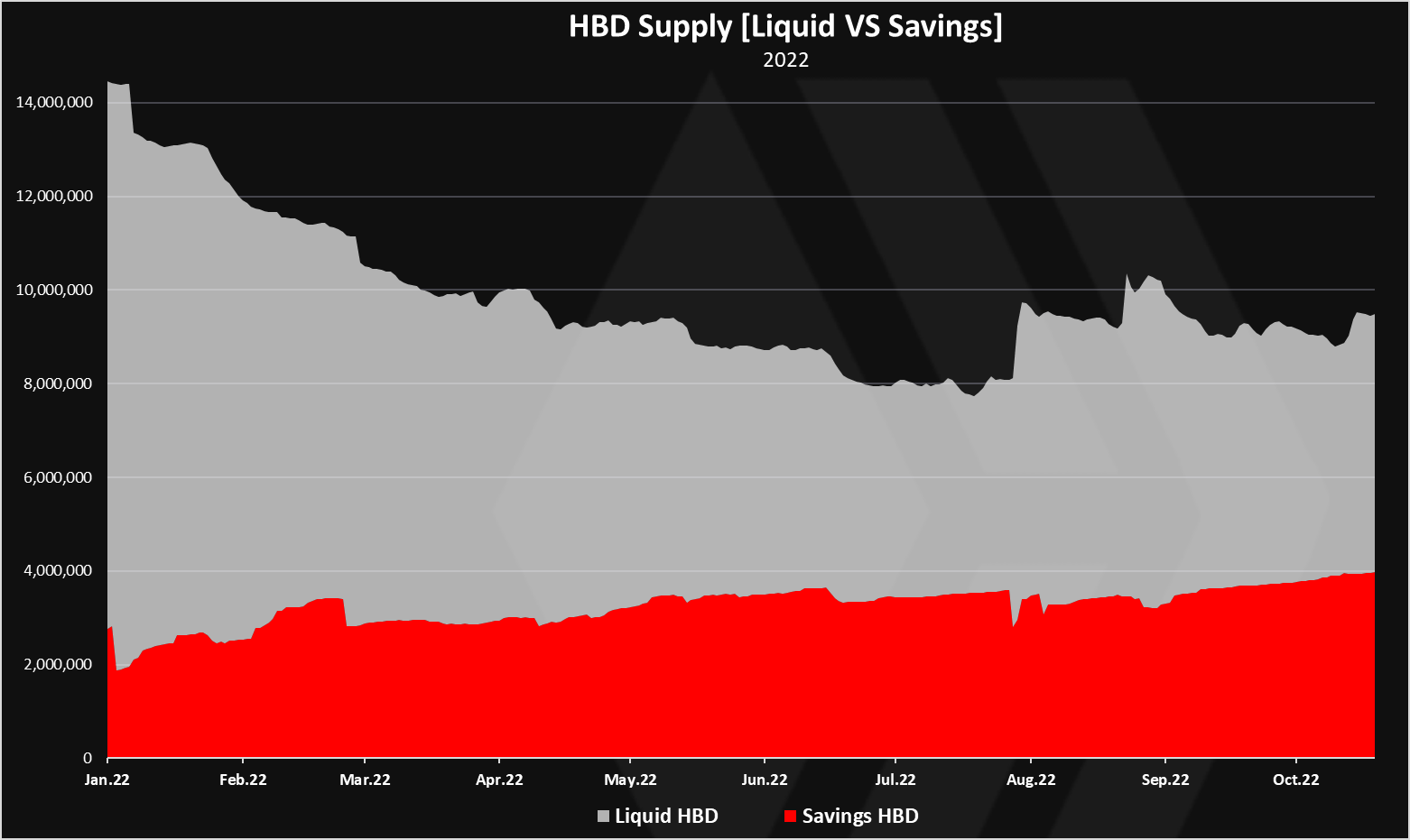

HBD Liquid VS Savings Supply

When we plot the savings against the HBD supply we get this.

We can notice that while the HBD supply has dropped in 2022, the amount of HBD held in savings has steadily increased in 2022. While this is not an explosive growth in the savings it is still remarkable to see this happening in such a bad market conditions.

Summary For HBD Added And Removed From Circulation In 2022

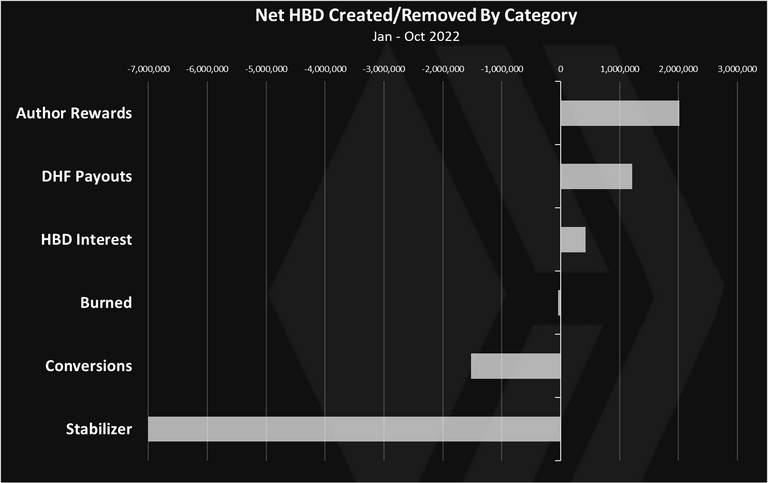

When we sum it up, all the above, and check what has caused the HBD supply to expand or contract we have this.

The authors rewards are on the top in terms of new HBD added in circulation with 2M HBD, followed by the DHF payouts 1.2M (excluding the stabilizer), and then the interest for HBD 400k.

The @hbdstabilizer is the number one reason for the reduction in the HBD supply with more than 7M HBD NET removed from circulation. As pointed out this is a net amount, or the difference between HBD received from the DHF, HBD sent back to the DHF and the HBD converted to HIVE. I have made a post recently for the profitability of the stabilizer where there is 1.6M in profit, when we look at it from the DHF perspective. Here we are looking at the HBD in circulation perspective, as the HBD converted to HIVE is used to trade on the market etc.

The HBD to HIVE conversions come on the second spot in terms of HBD removed from circulation with 1.5M HBD.

The main conclusion here that the stabilizer has provided the main support for the HBD and it has acted as sort of exit liquidity for people that want to sell fast and instant without using the conversions. As we can see this has been the main method for the contraction of the HBD supply in 2022. Just in the last few months we can see that the supply has started growing again.

All the best

@dalz

Posted Using LeoFinance Beta