The TerraUST has shaken the crypto industry on a large scale. UST is not just another crypto project that failed, and it is important to the overall industry because of its size. Before the implosion of the project the combine market cap of LUNA and UST was more then 40B.

In the traditional industry when a project from this size goes down its usually a cause for government intervention.

With this said lets see how the market cap of the top stablecoins looks in the last month.

Apart from the fiat backed stablecoins (USDT, USDC, BUSD….) that are keeping USD in banks there are tokens like DAI, UST, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Binance USD [BUSD]

- Dai [DAI]

- Terra-UST

There is a few more out there like TrueUSD [TUSD], FRAX, Huobi USD [HUSD], etc, but we will focus on the above as the biggest ones in market cap.

The period that we will be looking at is from April and May 2022. In this period most of the stablecoins market cap was generated.

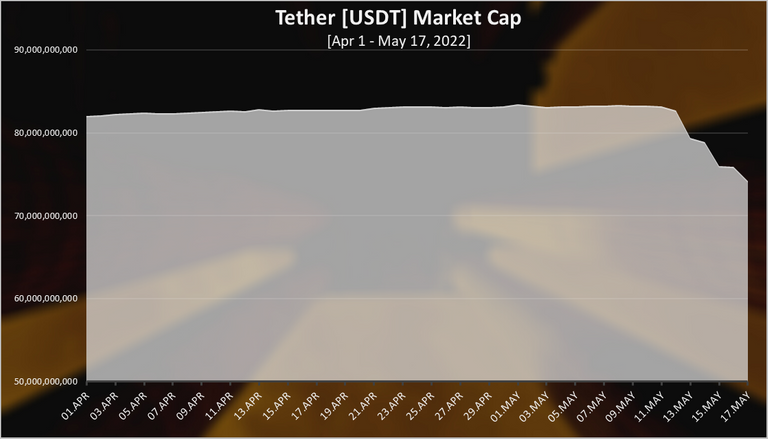

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly its founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank.

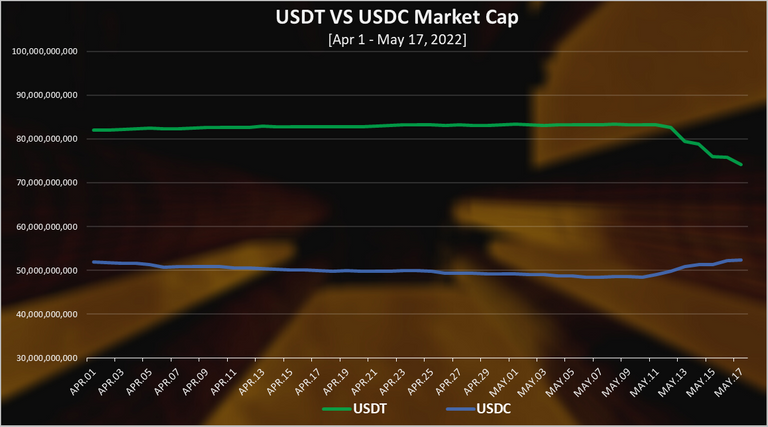

Here is the market cap for Tether in the last period.

Tether has seen a massive growth in 2021, starting from a 20B market cap to 80B!

But in 2022 we can see slowdown in the growth with the market cap staying stagnant around 80B up until May 12, 2022 when the market cap for USDT started declining. In the last week the market cap for Tether declined for 9B, from 83B to 74B. There was a short turbulence in the USDT peg as well, but it restored its peg fast.

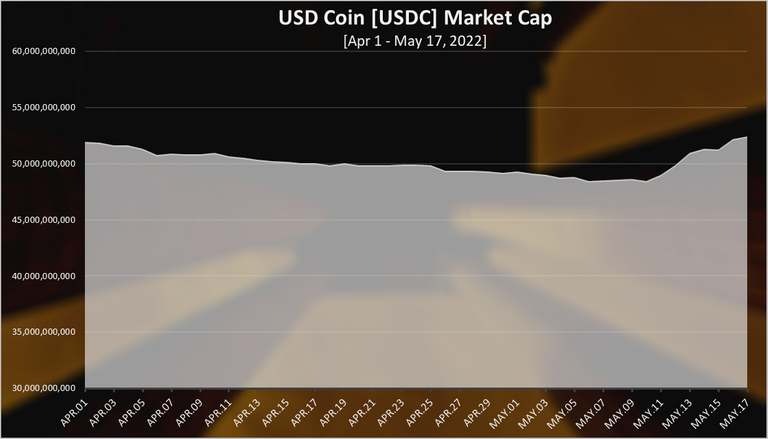

USD Coin [USDC]

USDC is a common project between Coinbase and Circle. Its supply should be more legit.

Here is the chart.

We can see an opposite trend for USDC and obviously it has the most trust as a stabelcoin in these turbulent times. The USDC market cap increased for more than 3B in the last week, going from 49B to 52B.

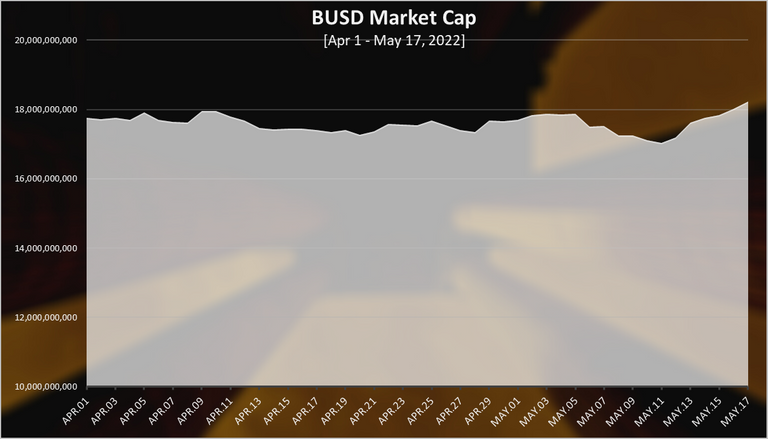

Binance USD [BUSD]

The Binance exchange stablecoin. It’s mostly used on Binance and BSC as well as a trading pair against other cryptos.

We can see an increase in the market cap of BUSD in the last week as well. The BUSD market cap increased for 1B from 17B to 18B.

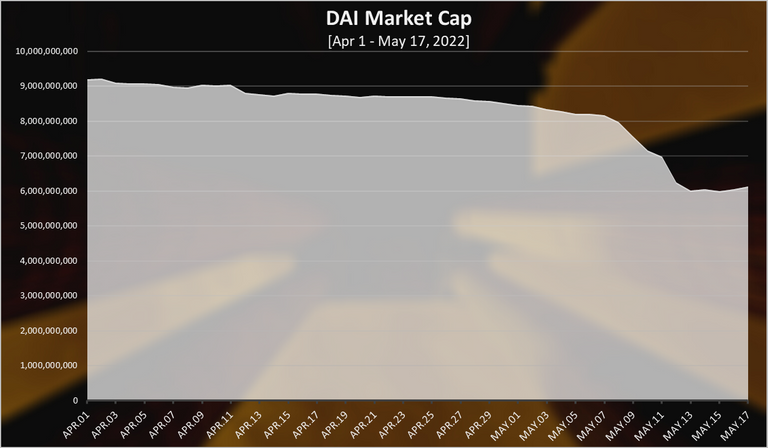

Dai [DAI]

DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

DAI as the number one crypto backed stablecoin has reduced its market cap as well. DAI works as overcollateralized stablecoin, where users put in 150% or more of other crypto assets to mint 1DAI. Since its backed by crypto asset, and the price of those has dropped it is logical for the overall market cap of DAI to drop as well.

It is a significant drop going from 9B to 6B at the moment.

TerraUSD (UST)

The star of the show 😊.

The UST implosion is probably going in the history of the crypto books. UST is backed by LUNA, through instant conversions. But there is no limit how much of it can be printed, neither absolute nor relative to the market cap of the underlying asset LUNA.

Because of this there was an attempt, to put additional reserves in form of Bitcoin, but obviously this was not enough.

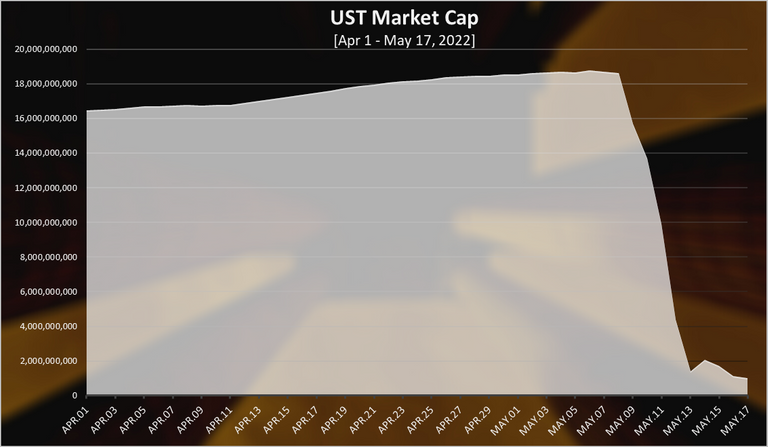

Here is the chart.

Starting from May 8th , the UST market cap started to decline in a free fall. From 18.2B to 1.3B on May 13th. More than 16B implosion in a market cap of a stablecoin in five days.

From the chart above we can see that there was more then 10B capital that wanted to exit UST. The few billions BTC that the team had obviously was not enough to provide the instant liquidity that the market needed. For a parallel we can notice the USDT market cap, that has 9B in reduction, that made the price of USDT to deppeg a bit, but USDT jumped in and provided all the liquidity that the market needed and restore the peg.

Cumulative Stablecoins Market Cap

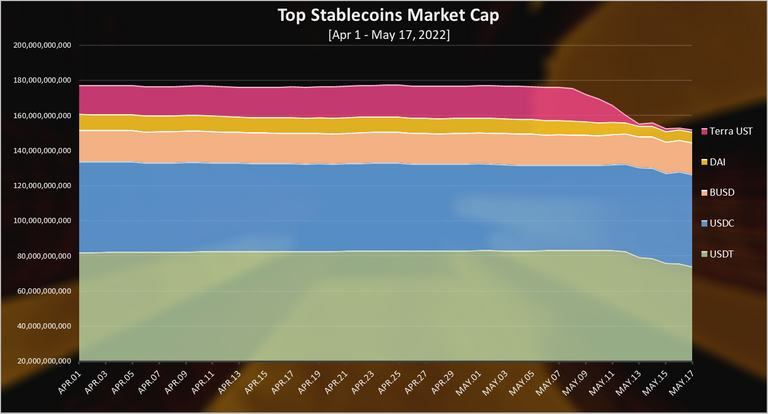

Here is the chart for the total stablecoins market cap.

The market cap of the top stablecoins reduced from 177B to 151B in the last period. A total of 26B reduction in a short period of time.

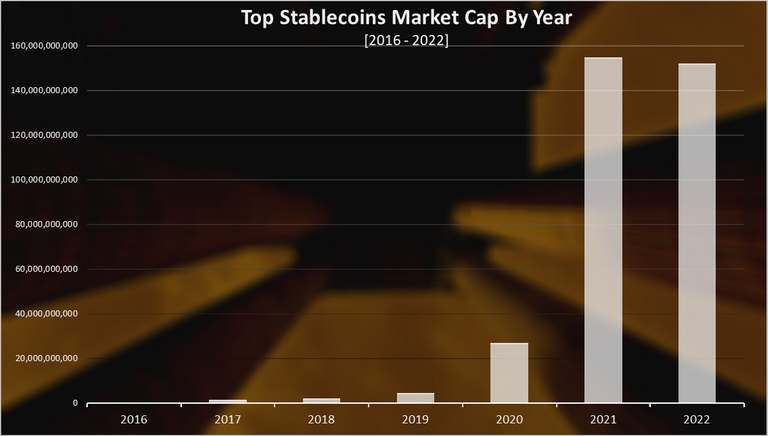

On a yearly basis the market cap for stablecoins look like this.

After an explosive growth in 2020 and 2021, the stablecoins market cap has started dropping in 2022. Will see how will the year end, but obviously the trend is down.

Top Stablecoins Rank

Here is the chart for the latest market cap of the top stablecoins.

Tether is still on the top, but USDC is closing in now. A 74B to 52B in market cap. BUSD is now on the third place, followed by DAI. UST is now lower on the ranks, TUSD and FRAX are above its market cap.

A massive shock for the stablecoin market caused by UST. The number one stablecoin Tether has also dropped in marked cap, while USDC has increased its market cap.

BUSD has also increased its market cap, and together with USDC it is the stablecoin that the market is showing the most trust in these volatile period.

DAI has also seen a significant drop in its market cap.

All the best

@dalz

Posted Using LeoFinance Beta