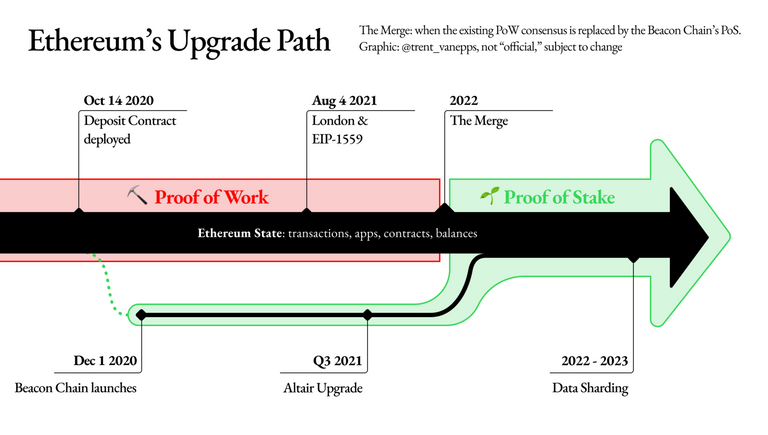

Ethereum 2.0, or the consensus layer as it been called recently has been a long time in the making. It has been delayed and pushed over and over again. For those not aware this update should move Ethereum from Proof of work PoW to Proof of Stake PoS chain.

The transition from PoW to PoS is not a single time event but a process. The process has already begun, but the next steps are quite significant since they will mark the end of PoW mining Ethereum.

Ethereum 2.0 will be deployed phases in what should be less than two years time. Not a quick fix!

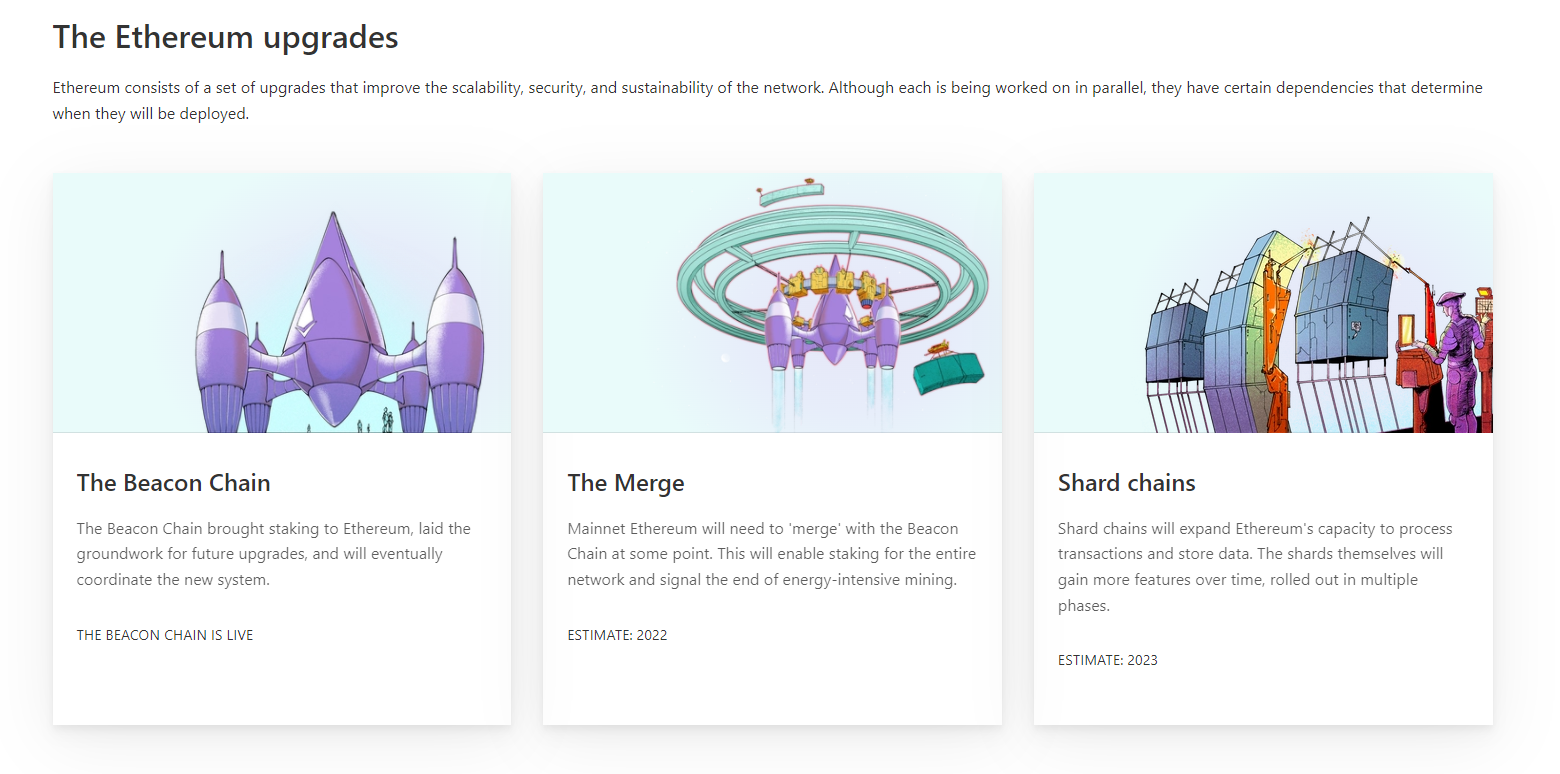

The three phases are:

- Phase 0, Beacon chain

- Phase 1, Shards (now phase 2)

- Phase 2, Docking (now The Merge - phase 1)

source

In the process described above the current state of the Ethereum network and the new Proof of stake Ethereum network will run in parallel until the final switch happens and everything is transferred on the new chain.

This update of the Ethereum network is quite a big operation, while billions of dollars are stored and transferred on the chain. Therefore the transition will last long and with more steps in between.

At the moment we are in phase zero, Beacon chain which main role is to create a registry of validators and deploy a proof of stake consensus mechanism.

Phase 0 | Beacon Chain

Status: Live since December 1st 2020.

Yes, the beacon chain is already live, and it made some news in December 2020. More than a year now in operation. Prior to the launch of the beacon chain there was a period where a minimum of 16,384 registered validators set, each with 32 ETH staked. This condition was met, and the beacon chain went live on December 1st.

As already mentioned, this doesn’t affect the current Ethereum network in any way. The beacon chain runs in parallel with the Ethereum mainet.

What Does The Beacon Chain Do?

In short, the role of the Beacon chain can be summarized in the following:

- Introduce staking

- Establish validators

- Setting up for shards

Unlike some other PoS or DPoS chains that have somewhere around 20 block producers, Ethereum has went for a lot more block producers or validators as they are called for ETH2. The only barrier is the staked ETH and the hardware of course that is a lot less then all the mining rigs now. There is no voting or other mechanism to put in place a small number of trusted nodes, but a lot of nodes put in place that will be hard to collude against some for of chain data manipulation. This model put its security in the large numbers of validators.

Setting up such a big number of validators (min. 16k) is needed for the security of the chain. Proof of stake does sacrifice decentralization and maybe some security (up to debate).

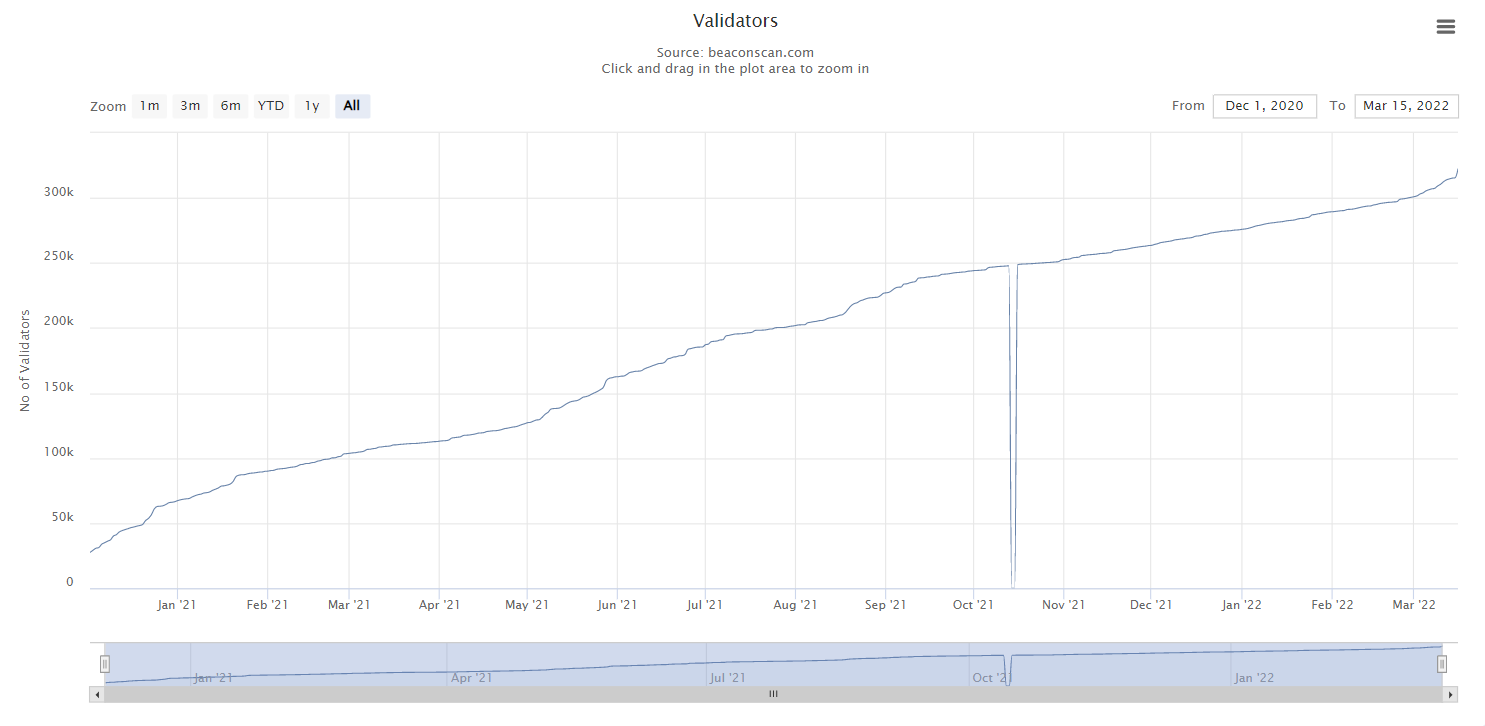

We will be using the Beacon chain explorer https://beaconscan.com/ to get some data.

source

At the moment there is 322k validators!

That’s a lot more than the minimum of 16k. There was more than 70k validators registered in the first month only (December 2020) and then the grow steadily up until now. The

The ETH staked is locked up until the ETH2 network is launched. Meaning a long term commitment from the validators above.

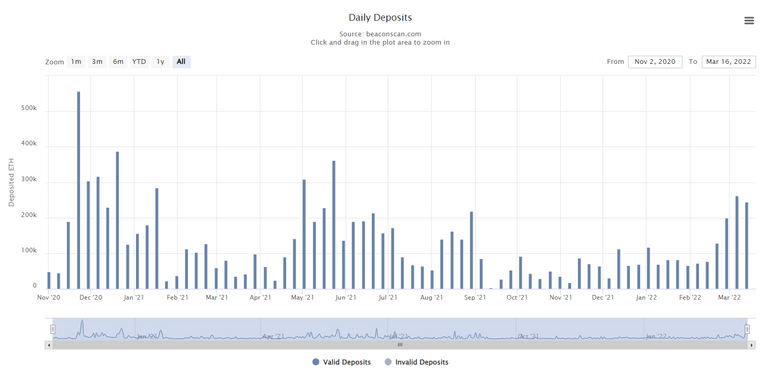

Ethereum Deposited

All the validators are staking/depositing 32 ETH to be able to participate in the beacon chain and receiving staking rewards.

The daily deposits charts looks like this.

source

We can see that at first there was a spike in the deposits, then a slowdown, a spike again in May 2021. In the last month there is again an increase in the ETH deposited and new validators coming online.

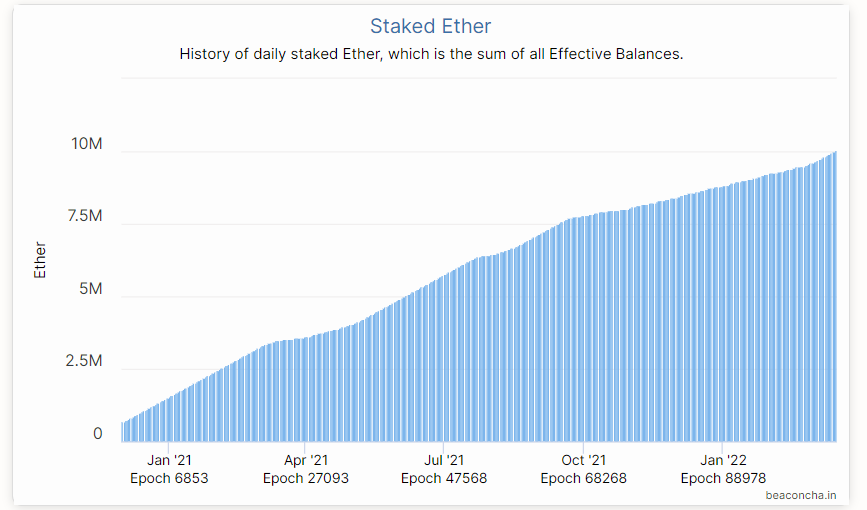

The chart for the cumulative staked Ether looks like this.

source

Just recently the staked Ether surpassed 10M ETH!

The chart above shows almost a constant increase in the amount of staked ETH, with some small fluctuation in the process.

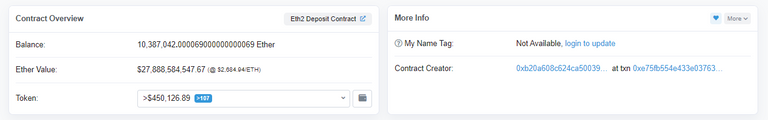

The deposits looks like in the contract address.

source

As mentioned More than 10M Ether locked. At the current value of around 2.6k USD that is 26 billions in USD value. Quite an achievement. This shows the support, and the trust people have in the Ethereum network.

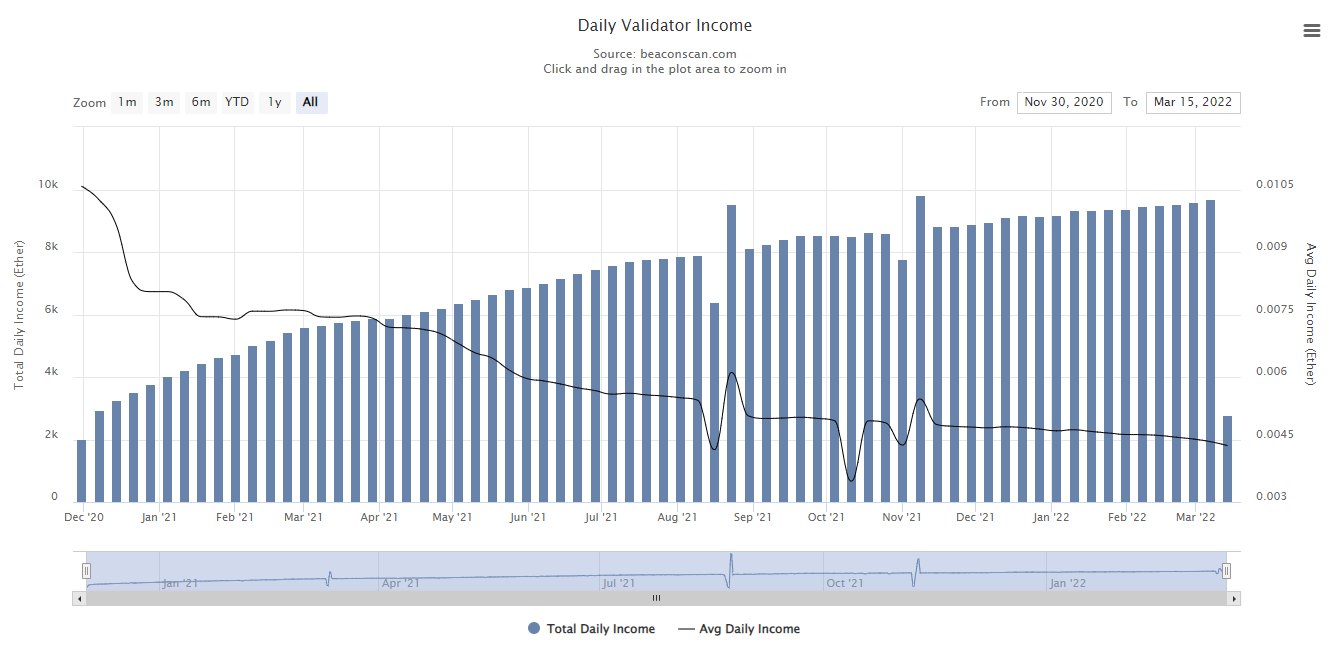

The daily income for the validators looks like this

source

We can see that the cumulative Ether has been growing, but the average is on a downtrend as competition is growing.

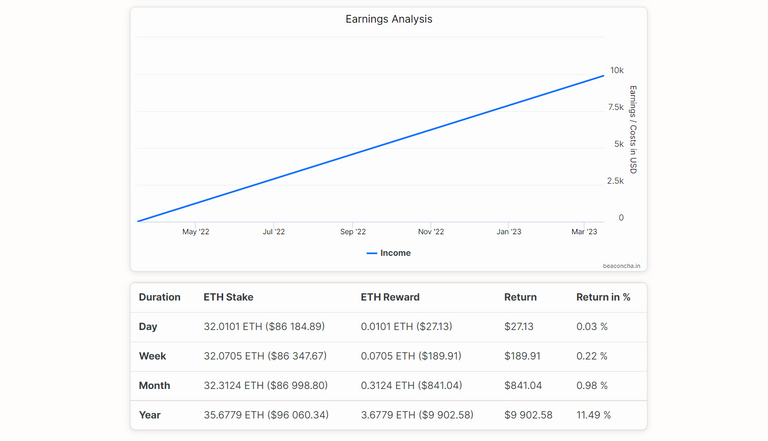

Staking Rewards

Validators get staking rewards for staking ETH and confirming blocks. It’s the equivavlent of the mining rewards that miners currently receive.

source

Looks like at the moment the yearly rewards for staking ETH are 11.49%. Not sure how this is calculated and does it change in time. I remember it being lower then 7% a few months back. Maybe they changed something in between. More then then 10% is quite good for ETH.

What is next?

https://ethereum.org/en/upgrades/

As mentioned there have been some naming changes recently, and the ETH 2.0 is now consensus layer, ETH1.0 is execution layer.

The next thing that is yet to come is The Merge, or previously know as Docking.

The Merge

Status: Expected to launch in 2022.

Eventually the current Ethereum Mainnet will "merge" with the beacon chain proof-of-stake system. This will mark the end of proof-of-work for Ethereum, and the full transition to proof-of-stake.This is planned to precede the roll out of shard chains.

The proof of work Ethereum mainnet will merge with the new beacon chain. The proof of work ETH will then stop to operate, and the miners will no longer need to secure that network. Only the validators on the new chain will be active.

Shards

Status: Expected to launch in 2023.

Sharding is the process of splitting a database horizontally to spread the load – it’s a common concept in computer science. In an Ethereum context, sharding will reduce network congestion and increase transactions per second by creating new chains, known as “shards”.

In the first version of the ETH 2.0 update, shards were before the merge, but now they come later, as the focus has been put on the merge/docking.

At first shards will serve only as a data storage with now smart contract capabilities. The thing with the blockchains is when they serve only as a data storage, they are pretty easy to run, but once smart contracts are introduced this requires logic and processing and it put burden on the chain. There is an ongoing discussion how will the smart contracts be implemented in the shards, and should each shard have this capability or only a few of them. Some other options like Zero Knowledge (ZK) snarks are also mentioned, but these are still in development.

When the beacon chain launched in December 2020, there has been a sense that things are finally moving with the ETH 2.0 update. But as we have witnessed, they have been pushed back again.

The ETH 2.0 update has been revised in the last year and apart for some naming convention that were changed, there were changes in the steps as well. The merging is now next on the to do list, frontrunning the shards that were previously set as the next step. When the merge of the PoS and the PoW chain happens, this will mark the end of mining for ETH.

It is envisioned the merge to happen in 2022, but having in mind the history of the process, and the constant delays, it wont be a surprise if this is been pushed again, as for example for early 2023 😊. Hoppe I’m wrong. After the merge, the shard upgrade should come next in 2023, but here again I’m being skeptical, and I would not be surprised if this is being delayed for a year of few years.

All the best

@dalz

Posted Using LeoFinance Beta