In the last year the witnesses started increasing the interest for the HBD in savings and since April 2022 it has been set to a very attractive 20% APR!

But what this means? Where does the new HBD come from? Is it sustainable?

I have been following the Hive inflation and supply for a while now, with a special focus on HBD. Let’s take a look at some numbers.

First to answer the question where the HBD interest comes from?

It is a new additional inflation on top of the regular one. Because HBD is a derivative of HIVE this means we are increasing the base inflation for HIVE. The thing is the Hive inflation and supply have always been a bit complex and with a lot of details especially with the HIVE to HBD conversions and the opposite.

At the moment the regular inflation is around 7%, but for example Hive inflation for 2021 was deflationary -2.7% because of the conversions. In the past conversions have also pushed the inflation above the regular one, like in 2019 when the regular inflation was around 8%, but with conversions it ended more than 12%. July 2022 has yet again been deflationary.

How Much HBD Is Created From HBD Interest?

HBD is created from HBD in savings. To get the data we need two things:

- HBD in savings

- interest rate

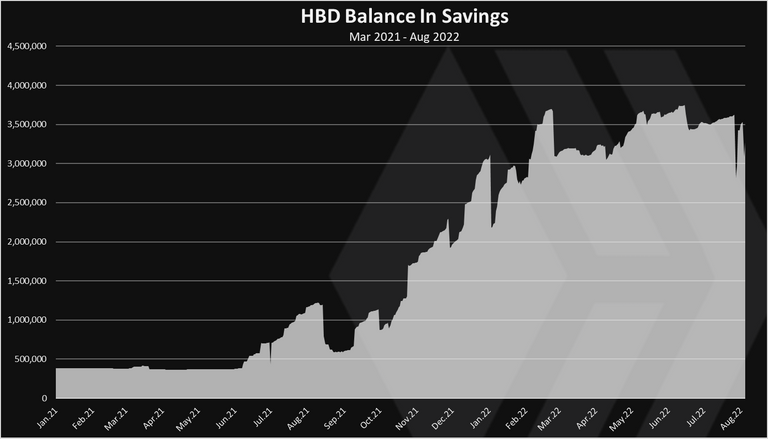

First the chart for the HBD balance in savings.

As we can see the amount of HBD in the savings has increased overtime and now it is at 3.2M HBD. It has been in the range between 3 to 3.5M since February 2022.

The above is the principal for the HBD interest.

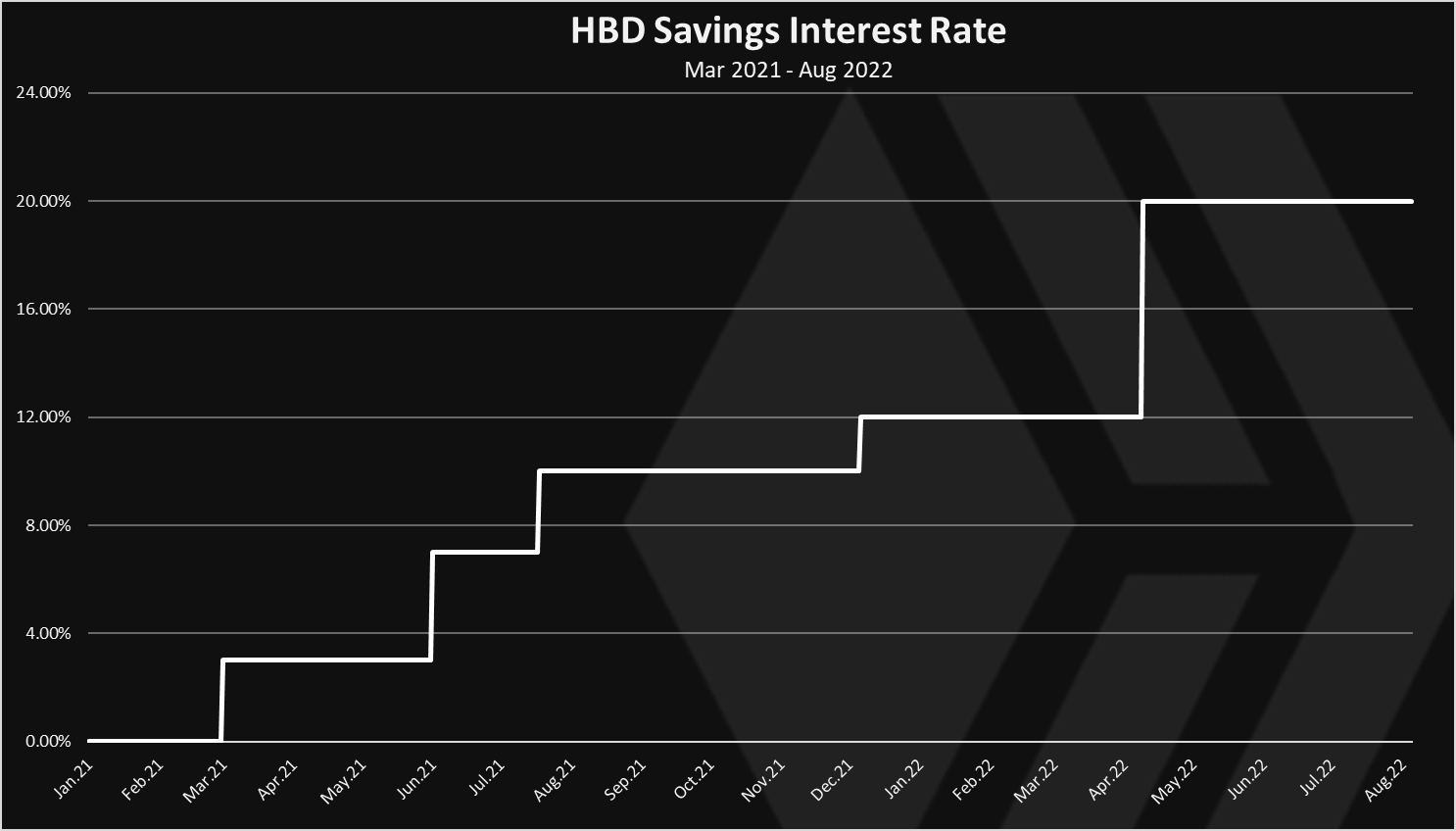

What about the HBD interest rate?

Here is the chart.

The changes for the HBD savings interest rate:

- Mar 2021 – 3%

- Jun 2021 – 7%

- Jul 2021 – 10%

- Dec 2021 – 12%

- Apr 2022 – 20%

The latest change from April 2022 is by far the most significant increase in one step.

Now that we have the principal and the interest rate, we can calculate the interest in HBD.

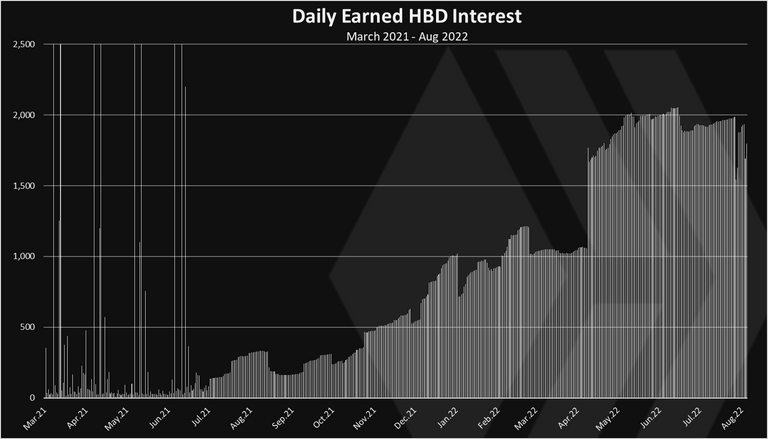

Here is the chart for the daily HBD interest.

Note that prior to July 2021 all HBD in circulation was eligible for earning HBD interest and there was some big amounts paid in that period.

After July 2021 only the HBD in the savings is eligible for HBD interest and we can see that the amounts were small, at first with a few hundred per day and in the last period it has reached a 2000 HBD interest per day and it has been around that level for months.

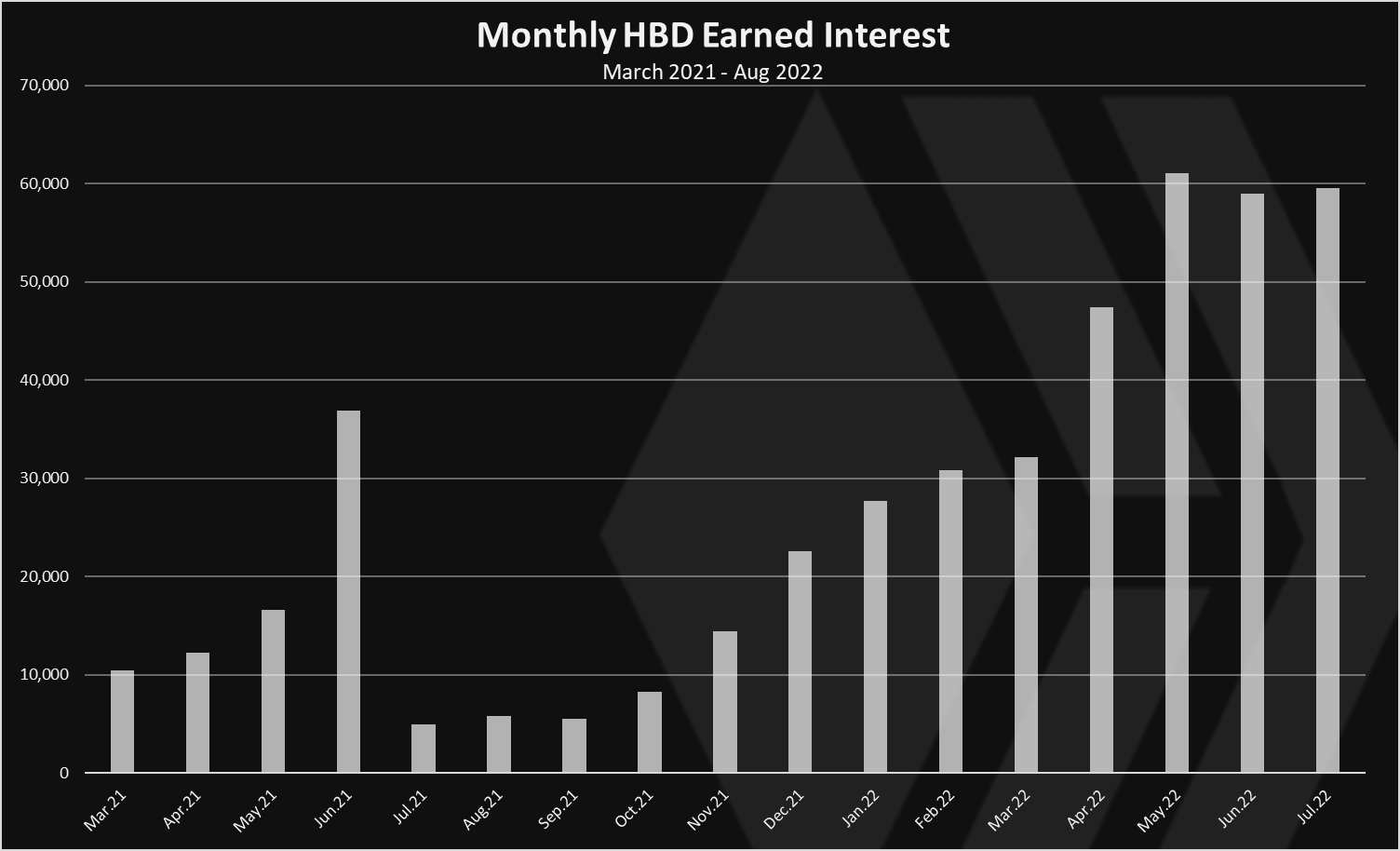

The monthly chart looks like this.

Again, we can see the large amounts of HBD paid at first due to all HBD receiving interest and then smaller amounts gradually increasing in time. In the last three months the interest paid per month is at 60k HBD.

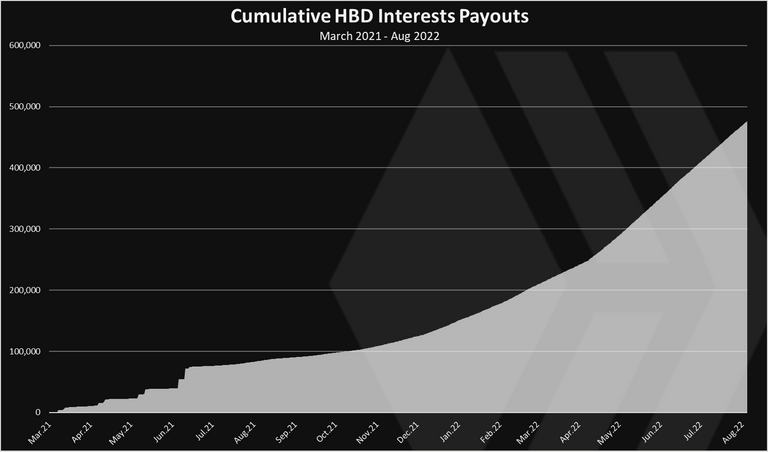

This is the all time chart for the HBD created from HBD Interest payouts.

A total 475k in HBD was paid since March 2021, a year and a half ago.

Inflation From HBD

Ok so we got the absolute amount of HBD paid daily, monthly and overall. But what this means when we compared it with the overall HIVE supply and inflation.

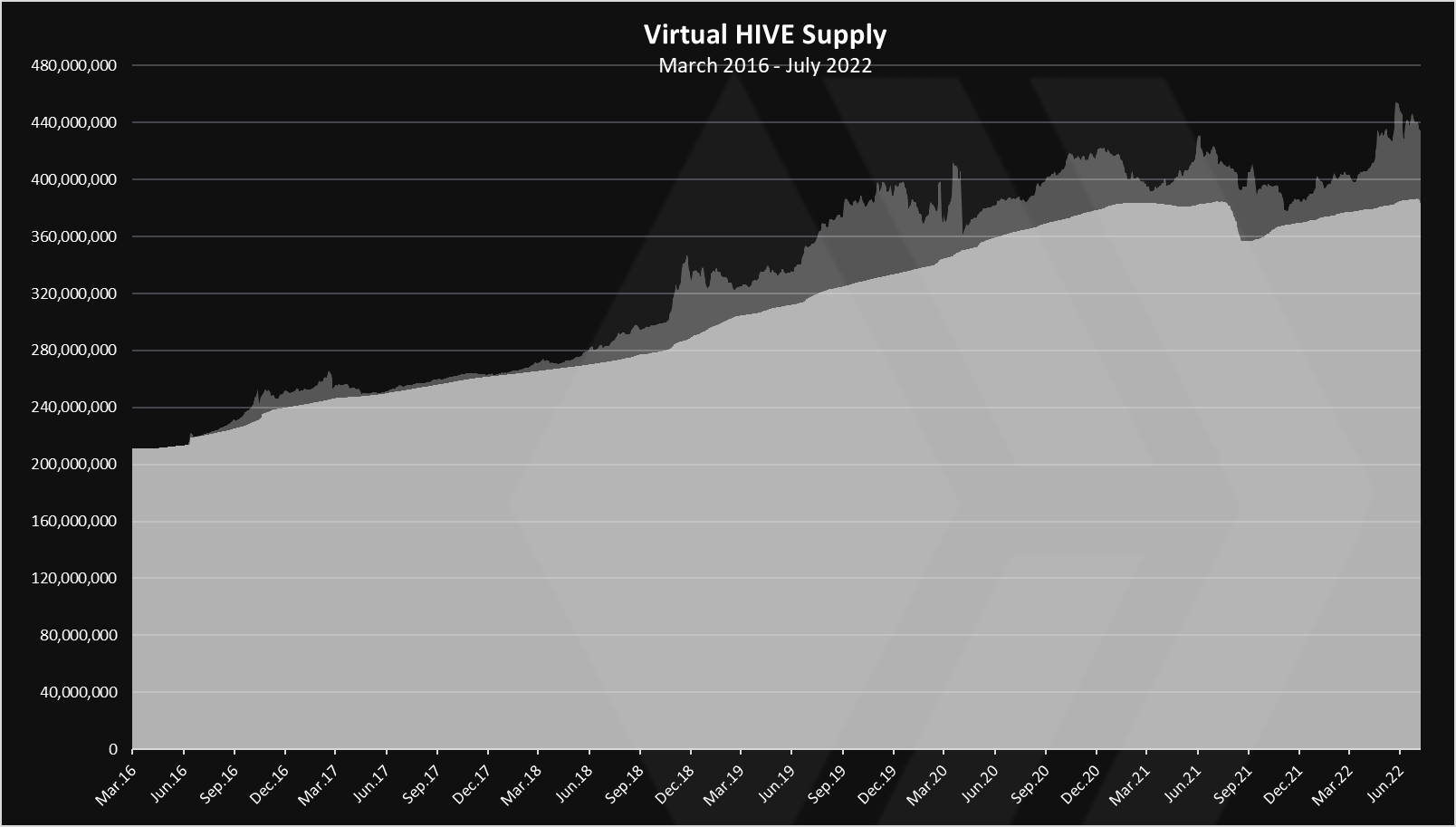

Fun fact. The current HIVE supply of 384M is at the same level as the supply from last year at the beginning of August 2021.

If we take a year to date as a base for calculating the realized inflation in the period of August 2021 till July 2022 there is a total of 375k HBD paid as interest. The virtual HIVE supply at the moment is around 430M.

To be able to calculate the inflation from the HBD we need to convert the HBD in HIVE. When we convert the 375k HBD it is equivalent to 800k HIVE with the price of HIVE per date in the last year. An 800k HIVE from 430M is 0.23% additional inflation on top of the regular one. The regular HIVE inflation in absolute HIVE is around 25M per year.

A 0.23% realized yearly inflation from the HBD interest playouts

A reminder that the regular inflation for the last year is 7.5%, (25M HIVE per year) while the realized, on a yearly basis from August 2021 till now is 0%. The HIVE to HBD conversions has bring down the Hive inflation to zero.

Projected inflation from HBD interest

The last year is a mix of different interest rates and the HDB in the savings has been changing a lot. In the last few months, the overall playouts form the HBD interest more stable, and we can make prediction for a yearly inflation from HBD interest on a yearly basis.

As we have seen the monthly interest is around 60k HBD under the current conditions, meaning a total of 720k HBD per year if the HBD in the savings remains around today’s balance and the 20% interest rate holds.

How much is 720k HBD per year adding more inflation?

To be able to answer this we need the price for HIVE. For the realized inflation we have used the past prices, but for the projected one we will need to set some price targets that will be the average for HIVE on a yearly basis.

We will be using three scenarios for this. A base scenario with the current prices for HIVE ($0.58), a depressed scenario with lower HIVE prices ($0.25) and optimistic scenario with higher prices ($1.5).

- 0.25$ HIVE price, 720k HBD is equal to 2.9M HIVE, equals to 0.65% added inflation

- 0.58$ HIVE price, 720k HBD is equal to 1.2M HIVE, equals to 0.28% added inflation

- 1.5$ HIVE price, 720k HBD is equal to 480k HIVE, equals to 0.12% added inflation

As we can see in all the three scenarios for the HIVE price the added inflation from HBD interest is bellow the 1% per year. This is simply because of the fact that the HBD supply is constrained and small. There is now pre-mine or any type of source from where a significant amount of HBD can come on the market. If users want more HBD they will need to get it on the open market, that will cause pressure on the price of HIVE, and lowering the actual inflation.

The other thing that can change is the HBD in savings. It will be hard to significantly increase this amount without impacting the price for HIVE.

If the amount of HBD in savings goes 10X to 30M HBD and the HIVE price remains the same as now we will have an additional inflation of 10M HIVE, or 2.3%. 30M HBD in savings is not that far away. At the peak in September 2021 there was 23M HBD in circulation outside the DHF. Also as already mentioned an 10X increase in the HBD supply in a short period of time is almost impossible without pushing the HIVE price as well.

Without any extremes happening, and I mean real extremes (100X up and down), the inflation from HBD is totally manageable in the next year, and probably in the next five years. As we have seen in the last year the HBD supply adjust itself according to the market conditions. When the HIVE price was high so did the HBD supply, and when the HIVE prices stared declining so did the HBD supply. It went from 23M HBD to a recent low to 7.5M HBD in circulation. Everyone knows the rules upfront, the haircut rule for HBD and users adjust their HBD holdings in time.

But this is crypto, and everything can happen. If at some point in the future we come above 20% debt level for a long period of time (three to six months), then this might be a good reason to adjust the HBD APR, but even this is up to debate.

All the best

@dalz

Posted Using LeoFinance Beta