The APR for the HBD in savings at the moment is 20%. It is set by the witnesses and in the last two years it has been increased and improved upon.

The way HBD interest is set is by a consensus mechanism by the witnesses. It doesn't require a Hardfork, meaning it can be flexible.

Since the interest rate for HBD was increased we are seeing more use cases and apps leveraging it and building around it. Thing is if this change at some point in the future and all the work and products builds around it will face challenges going forward. This doesn’t gives a lot of certainty about it.

As mentioned, changing the interest rate is witness decision, but having some general rules around it, or some principals that each individual witness will say he/she will follow will give users and projects a lot more stability to build upon and use it.

Having a stablecoin, even with flexible stability as HBD is, and the option to control the interest rate for it, is a massive thing. That is what the FED main job is and how they control the entire economy worth trillions of dollars.

Having some discussion and ideas where we are going with HBD, what will be our principles for the interest rate is valuable and not to be undermined.

What are the options for the HBD interest rate?

When we think about it there are two main options:

- Fixed interest rate

- Variable interest rate

We can say that in the last year HBD had variable interest rate with the APR going up.

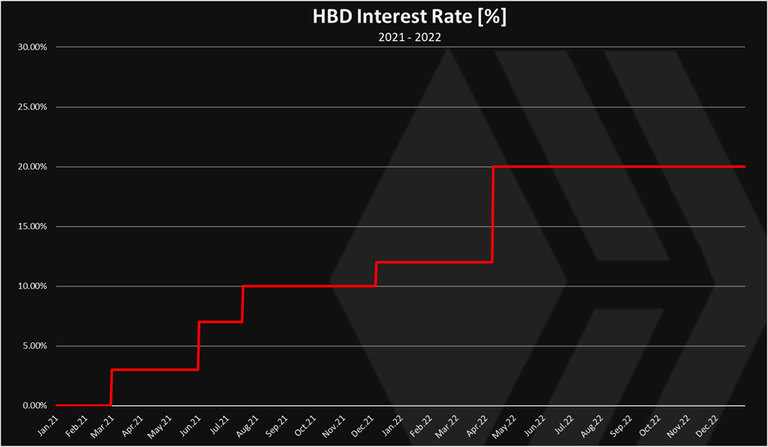

Here is the chart.

As we can see the HBD interest rate was changed five times in the last two years.

- Mar 2021 - 3%

- Jun 2021 - 7%

- Jul 2021 - 10%

- Dec 2021 - 12%

- Apr 2022 – 20%

The last adjustment is the longest living for now.

So here we are at the 20% and the question is how we should continue forwards?

There are concerns in the community that the 20% interest rate is not sustainable, because it comes from inflation, and it is additional inflation on top of the current one for HIVE. I have looked into the data what is the additional inflation from the HBD interest, realized and projected, and the main conclusion from there is that for 2022 it will be around 0.5% on top of the current 7%.

Yes, but what will happen in a few years when this compounds?

Having a long term overlook on thing is always a good thing. Let’s see some data. At the moment there is around 8.5M HBD in circulation, out of which 4.4M are in the savings. At the current interest rate of 20% this will generate 880k HBD per year. In theory in five years’ time this can double, having around 9M HBD in the savings, grown only from the interest. This 9M will generate 1.7M HBD additional yearly inflation. At the current HIVE price (that is quite low) a conservative scenario, this will be additional inflation of 1% per year. If the HIVE price doubles, we are back at 0.5%.

There can’t be a significant increase in the savings without expanding the HBD supply. By significant I mean X5 or X10 the current supply. For the HBD supply to expand for X10, the HIVE price needs to go up. But let’s say the HBD supply expands slowly without a large impact on the HIVE price. With this slow rate of expansion, it can probably double, maybe triple in the next five years. This will add an additional 0.5% to 1%, on top of the 1% with the interest included. Meaning a total of 2% additional HIVE inflation per year. Let’s push this even further to be safe to a projected 3% additional yearly inflation in a five years’ time.

At the same time the HIVE inflation is going down by design at 0.5% per year, or in five years the HIVE inflation will drop for a total of 2.5%.

From the conservative scenario above we can see that the inflation from HBD is sort of balanced out from the projected contraction of the inflation. On the optimistic side we will have an expansion in the HBD supply followed by appreciation in the HIVE price, that will result in a large market cap for HIVE and low additional inflation, less than 0.5%, or even a deflation in the HIVE supply.

I must put a disclaimer on the napkin math above, even though it should be a pessimistic scenario with no appreciation in the HIVE price, some other factors that are not taken into consideration might distort this.

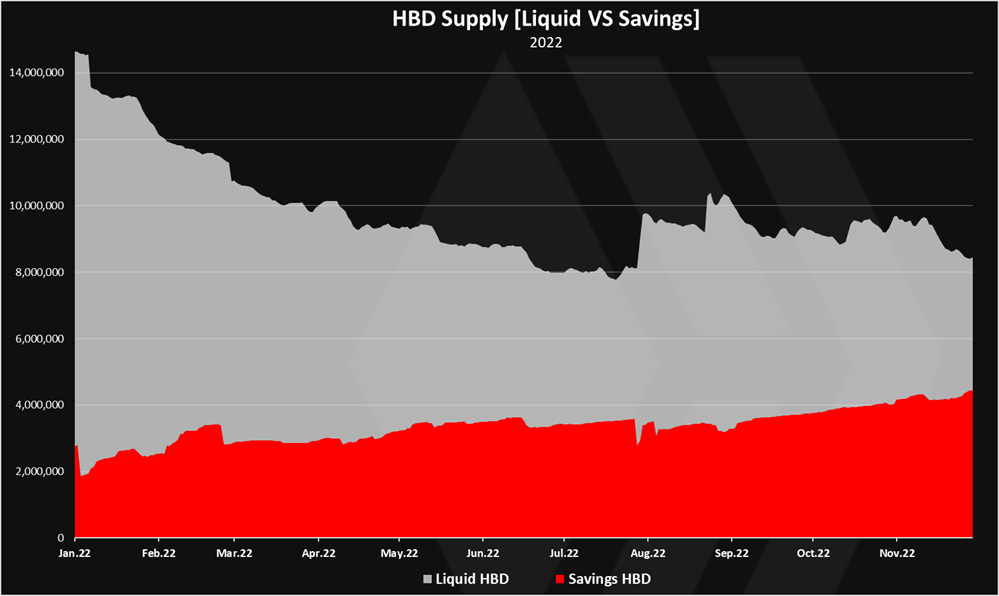

If we take a look at the HBD supply in 2022 we get this.

The amount in the savings has been constantly going up, while the overall supply has been going down!

At the beginning of the year there was 14M HBD and now we are 8.5M. The savings has grown from 2M to 4.4M.

How can it be the overall supply to go down and the savings up? It is because the HBD supply outside the savings has mainly been subject to price speculation especially on Upbit. In this year the supply there has been going down while in the savings up. Tokens are transferred from speculators to holders.

One of the main things driving the HBD supply is the HIVE price and the debt ratio! Not to forget about the Haircut rule, HBD will not be valued at one dollar if the Hive Debt increases above the debt limit. It used to be 10%, and now we are at 30%. This means that the blockchains allows maximum HBD to be printed to 30% of the Hive market cap.

As the price of HIVE goes down, if the HBD supply stays the same, the debt goes up. But in most cases the HBD supply decreases as we have seen from above, allowing a healthy debt ratio to be maintained.

The top limit of the chart is 30%, representing the debt limit itself. This to have a visual representation where we are in terms of the debt limit and the haircut rule.

As we can see the debt has increased in 2022, from 2% to 5% where we are now. This has happened while contracting the HBD supply from 14M to 8.5M. If the HBD supply remained the same, now we would have been at around 10% debt. The current 5% debt is still far from the 30% limit that is now allowed. If BTC drops further, we will most likely see further reduction in the HBD supply and the HIVE support price for HBD that is now 5.9 cents. At the beginning of the year this support price was at 20 cents.

The main conclusion from the above is that the HBD supply is mostly driven by the HIVE price and the debt ratio, not the interest rate

This might change in the future, but for 2022 this is the case.

Having in mind the above let’s dig into the pro and cons of the fixed and variable HBD interest rates.

Fixed Interest Rate

The pros of the fixed interest rate will be the obvious predictability and expectations from users and projects. Everyone can plan and build around it, without fearing that witnesses might come up with arbitrary decision to change it overnight. It also provides a long-term incentive and demand for HBD as it is a yield bearing semistablecoin 😊.

The cons of fixed rate is that it removes the flexibility and the option to try to increase or decrease the demand for HBD. Meaning there is no possibility to try to steer things in a preferred direction if something unexpected happens.

Variable Interest Rate

The pro and cons for the variable interest rate will be the opposite from the fixed. The variable interest rate introduces uncertainty for users and projects. Everyone who is building around HBD cannot plan accordingly. The pros are that it gives a flexibility space to try and adjust the interest rate and the demand for HBD and trough HBD the demand for HIVE.

If we were to implement variable interest rate policy, what would be some of the principles around it? Depending on the market conditions, high or low HIVE price, we would change the interest rate for HBD.

What would be the right thing to do with the interest rate, in a bull or a bear market?

Does a high interest rate for HBD supports the price of HIVE? This is up to debate, but we can say that if an assets has yield there is a higher chance for users to want to hold that asset, while if there is no yield there is a lower chance for users to want to hold that asset. Especially if it is a stablecoin like asset, that has no expectations to appreciate in the future. On the cons side if there is to much of the token users might start cashing out and selling. It is a balance!

With the reasoning above, we can conclude that if a variable interest rate for HBD is implemented, it should be done in a way that the interest rate is decreased during the bull market and is increased during the bear markets.

Decreasing the interest rate for HBD in a bear market condition like we are now, for sure will cause users to sell HBD, that will trigger HBD to HIVE conversions putting more pressure on HIVE when its price is already depressed. We want to increase the demand for HBD and by that increase the demand for HIVE. When prices are up there is no need for incentives.

Final Thoughts

The above is just ideas up for discussion. All inputs are welcomed. Making predictions is extremely hard, and here I have touched on some predictions, that might turnout wrong.

I’m not sure what the right answer for the HBD interest rate policy is, but one thing is sure, it is a powerful and important instrument to have, and having principles how we go about it and how decisions are made, will paint a picture for a more serious community, than just arbitrary decisions based on individual feelings or market conditions.

At the end this is all experimental. We don’t know all the answers ahead of time. Practice is needed. One possible scenario for the HBD interest rate would be to give it a fixed rate for the next five years, that will give stability for the community and incentivize growth, and revisit after that. Then depending on where we are in the market, what have we learnt, we can try to change the HBD interest rate, remove incentives during bull market and introduce them during a bear market. Things is, its hard to say when we are in a bull or a bear and there should be some additional principles for this.

Another major thing to add is that the main controller for HBD supply still remains the debt ratio and the haircut rule. If there is a treat for the HBD price to drop users don’t care much about the interest rate. This is the ultimate safeguard for the system.

All the best

@dalz

Posted Using LeoFinance Beta