The Bitcoin VS Ethereum is always an interesting debate! Will Ethereum surpass the Bitcoin market cap? The flipping! Will Ethereum be more valuable than Bitcoin?

Let’s take a look at some on chain data in the last period.

We will be looking at data for:

- Unique wallets

- Active wallets

- Number of daily transactions

- Fees

- Market cap and BTC dominance

The data is extracted from https://www.blockchain.com/charts and https://ethscan.com/, for the period July 2015 – March 2022.

Bitcoin is around since 2009, but Ethereum started with operation in 2015 and from then forward we will be making the comparisons.

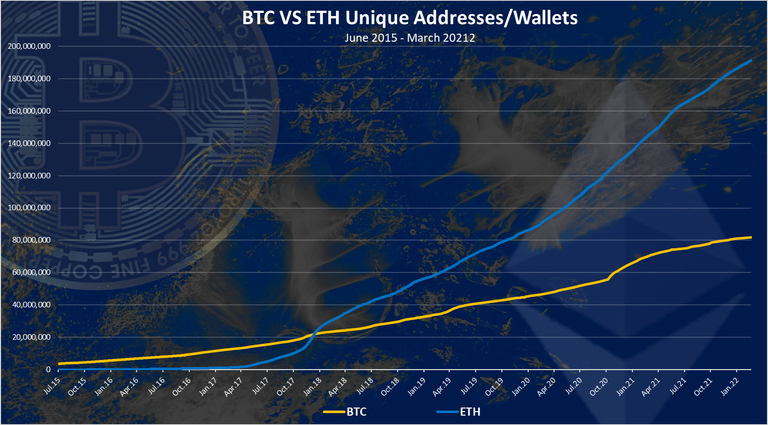

Number of Unique Wallets Created

Here is the chart for the number of unique wallets on Bitcoin and Ethereum.

Up until 2017 Bitcoin was leading in the numbers and then in January 2018 Ethereum took the lead in number of wallets and has been increasing the lead ever since.

In January 2018 the number of Bitcoin and Ethereum wallets was just above 20M. Today Bitcoin has 82M wallets and Ethereum 191M. Ethereum has more 110M more wallets then BTC, and the trend is that ETH wallets will grow faster than BTC.

What this data shows is that probably there is more custodial BTC wallets, BTC on exchanges and apps, not controlled directly from the owners. ETH on the other side has apps and defi and if someone wants to use them, they need to make wallets by them self. There are more factors then this two, but for now it looks like BTC is going more custodial.

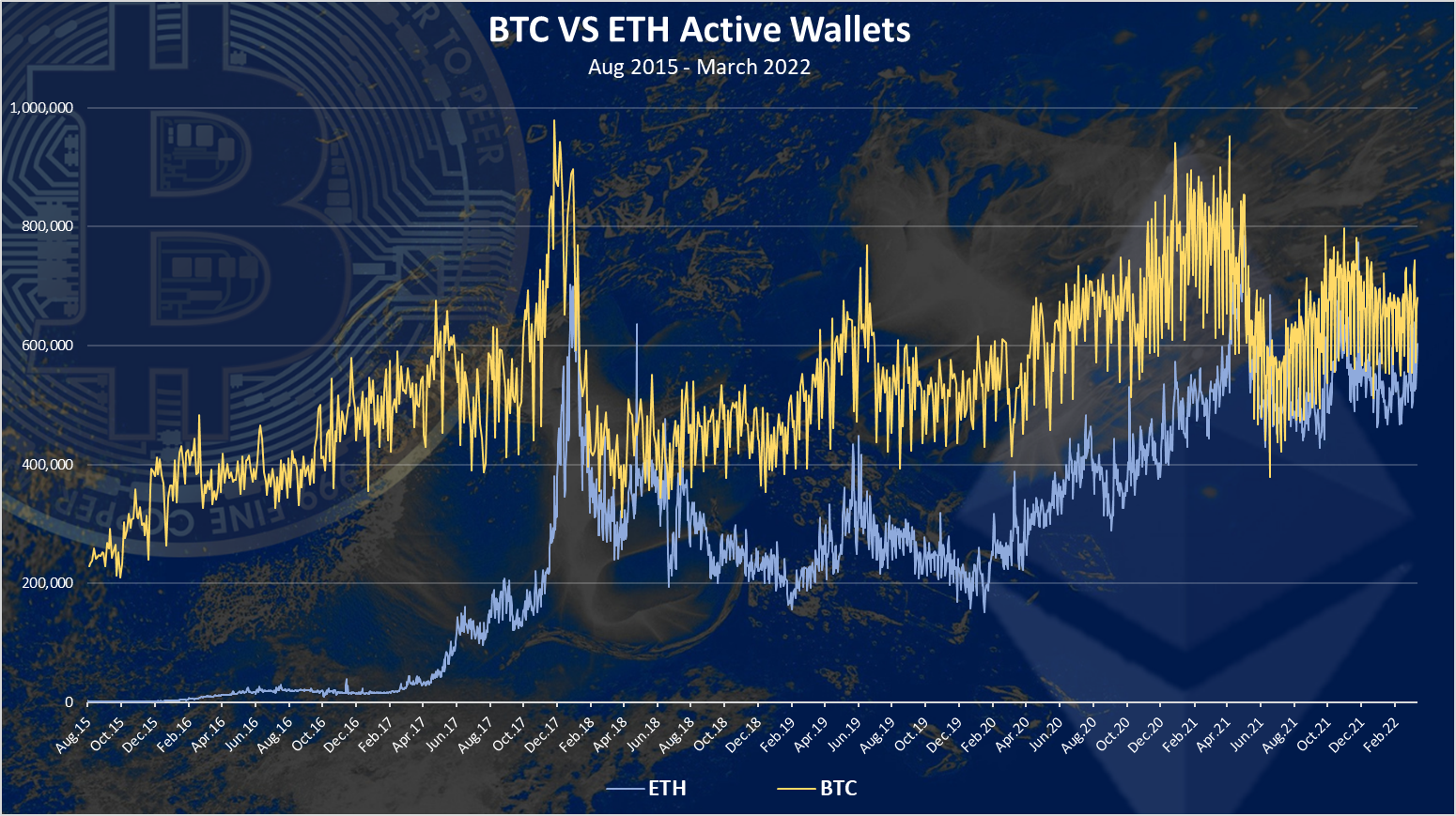

Active Wallets

The above was in terms of wallets created. How about active wallets? How many of those wallets created are actually been used? Here is the chart.

When we look at the numbers of active wallets Bitcoin is in the lead. Ethereum has come close to Bitcoin in the previous bull run, at the end of 2017 and the beginning of 2018. On few occasions ETH has surpassed BTC in number of daily active wallets. It has happen recently in April this year.

In the last weeks these two are close with BTC hovering around 650k and ETH around 550k daily active wallets.

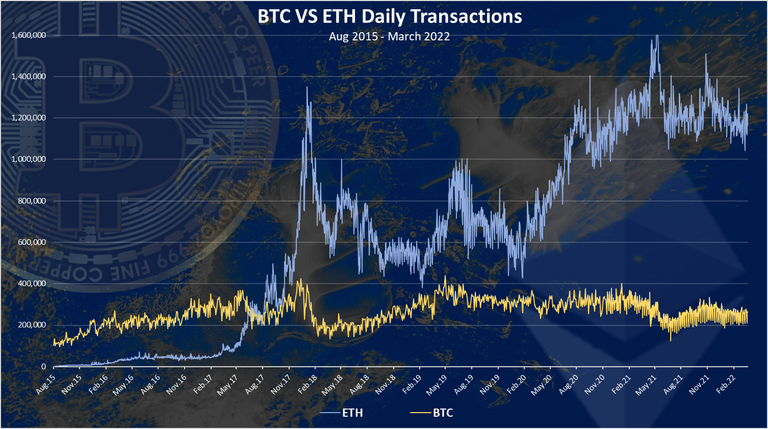

Number of Daily Transactions

Here is the chart for the number of daily transactions.

In terms of daily transactions Ethereum is now in a big lead in front of Bitcoin.

Ethereum has overtaken Bitcoin in the previous bull run in 2017 and has been leading since then. In the last period Ethereum has increased the lead with more than 1.2M transactions per day, while Bitcoin is around 250k transactions per day.

As we know Ethereum as a smart contract’s platform has a lot of different operations and transactions that can be made on chain, while Bitcoin is used only for one purpose, and that is transferring tokens from one wallet to another.

Ethereum has a smaller number of daily active wallets than Bitcoin, but obviously those wallets are making much more transactions than the Bitcoin wallets.

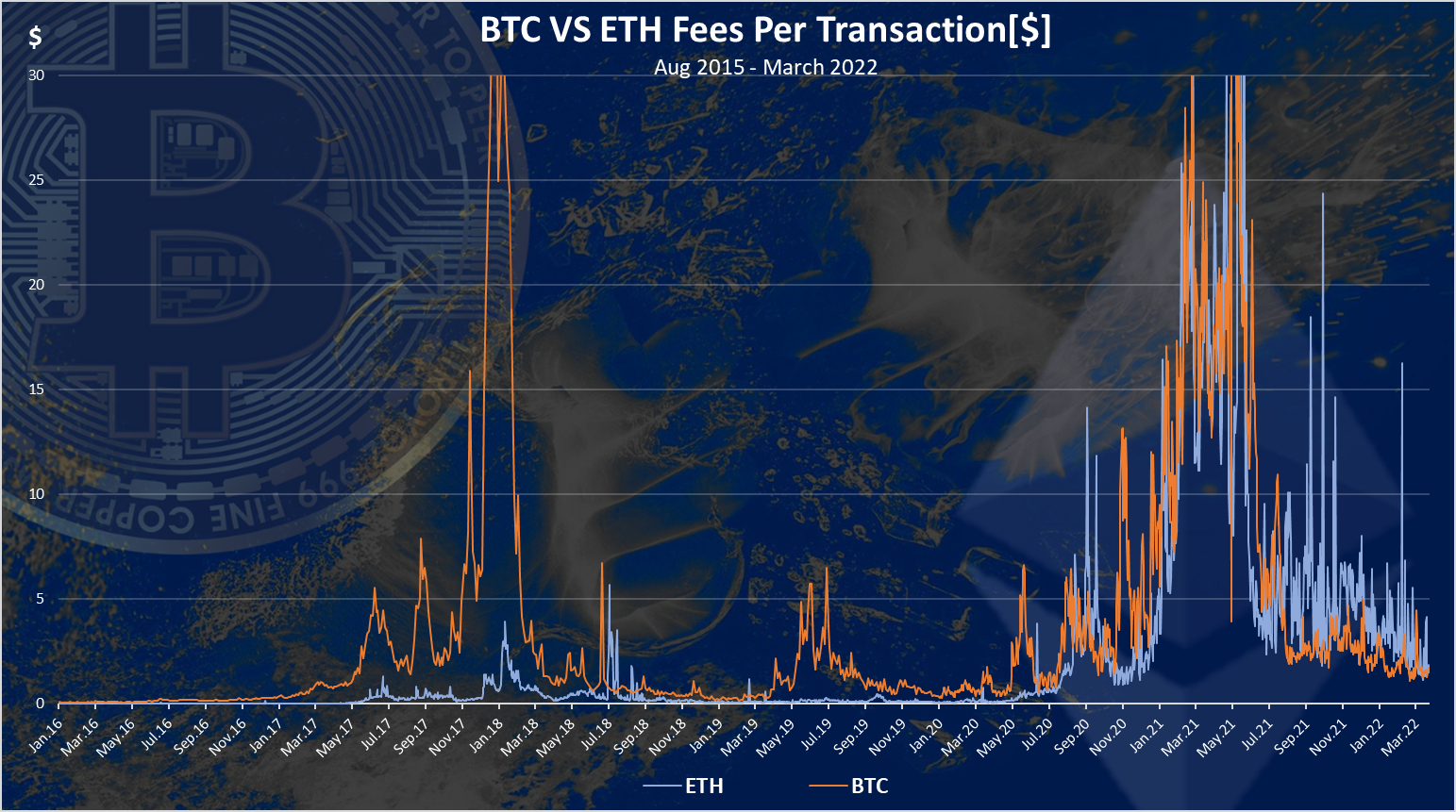

Fees

The chart for the fees looks like this.

These are the average daily fees per transaction in $ value.

We can notice that during the previous bull run the Bitcoin fees have gone much higher than the Ethereum fees. Back then BTC reached more than 50$ fee per transaction for a short period of time. The Ethereum fees in the previous bull market were bellow 5$.

These days both, Bitcoin and Ethereum fees are increasing in parallel with Ethereum taking the lead in the last period.

At the peak in 2021 the fees on both chains reached more then 30$. In the last period the fees have dropped to a few dollars per transactions and are very close compared to each other, with ETH leading by a small margin.

For Ethereum the fee depends a lot on the type of operation, usually a lower fee for simple transfers, a higher fee for swaps on DEX’s like Uniswap, and even higher fee for minting NFTs etc.

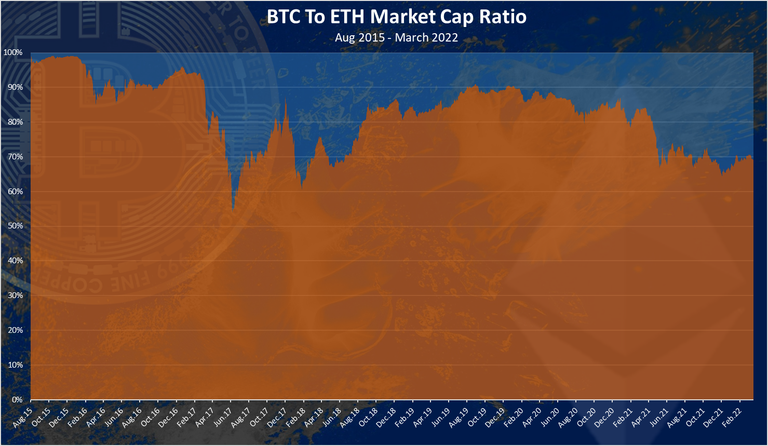

Bitcoin And Ethereum Market Cap

The interesting topic for Bitcoin and Ethereum is the flippening, or will Ethereum surpass Bitcoin in terms of market cap and become no.1 crypto.

Here is the historical chart for the Bitcoin VS Ethereum market cap.

We can see that at first in 2015 Ethereum has a very low market cap compared to Bitcoin. As time progressed in the bull run of 2017 Ethereum has come close to the market cap of Bitcoin on few occasions, but only for a short period of time.

In 2018 the ratio of Ethereum to Bitcoin market cap dropped from above 30%, to under 20% and it stayed there until now.

In the last period the ETH increased again and the BTC vs ETH ratio has is around 70% to 30%.

At the moment Ethereum has around 360 billions market cap, while Bitcoin is around 800 billions.

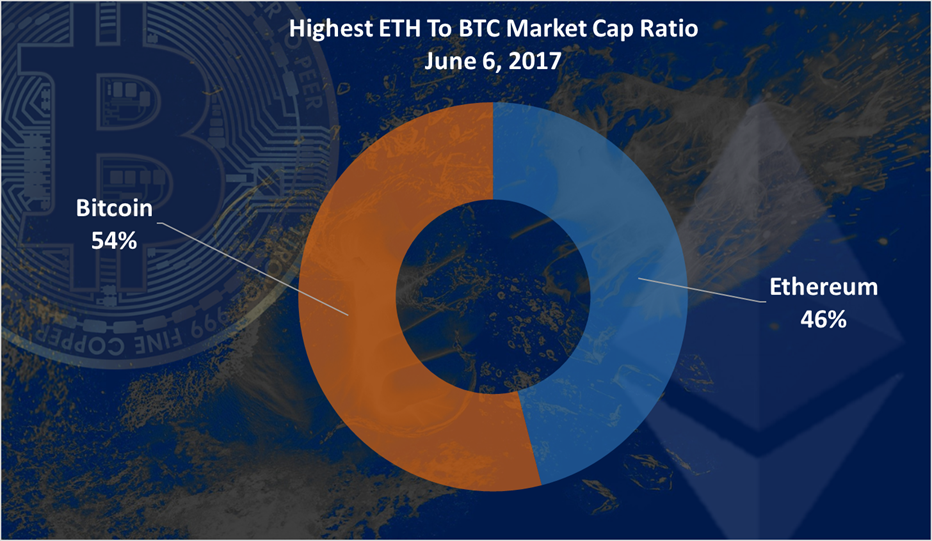

Ethereum came closest to Bitcoin on June 18, 2017

On this date Bitcoin had a marketcap of 43 billion and Ethereum 37 billion. This is before the major bull run that happened late in 2017.

The chart for the share in marketcap on this date looks like this.

The closest that Ethereum came to Bitcoin.

This is pretty close. A 41B to 34B! A 7 billion more ant Ethereum would have flipped Bitcoin. Looks like the flippening is not impossible 😊. A 54% to 46% ratio.

Finally on the above metrics things stands like this:

- Unique wallets – winner ETH

- Active wallets – winner BTC

- Number of transactions – winner ETH

- Fees – draw?

- Market cap – winner BTC

Two for BTC, two for ETH and one draw, with BTC going for the win if ETH fees stay high for a longer period of time.

A note at the end that comparing these two blockchains just in terms of the numbers above is quite interesting and useful but might be misleading as well.

These two blockchains have taken a different role now. Bitcoin as a scare’s asset a digital gold, while Ethereum as the leading smart contract platform enabling innovations, new dApps and use cases for crypto. Personally, I would like to see both of this two perform well.

All the best

@dalz

Posted Using LeoFinance Beta