So... there has been this debate going on amongst traders in the financial market concerning which analysis is best to use in making trading decisions in the financial market. Just so you know, there are majorly two types of analysis that dominates the subconsciousness of traders. The first is Technical Analysis and the second is Fundamental Analysis. Though there is still Sentimental Analysis but a lot of traders ignores it even though it is very important too.

Technical Analysis simply is the use of trading tools like indicators, candlestick patterns, trendlines, support and resistance, etc... put to together to have a confluence in making trading decisions.

Fundamental analysis purely has to with the happenings the around the world which could affect the economic growth (positively or negatively) of some countries. Traders use the information derived from this analysis to decide if to go short (sell) on a particular currency or go long (buy) on that currency.

So many traders are of the opinion that technical analysis is the king in the financial market, while others believe that fundamental analysis over-rules technical analysis. Technically, some maybe right to say that technical analysis supercedes fundamental analysis, and practically, they maybe wrong. They may also be technically wrong to say that technical analysis supercedes fundamental analysis and may be practically right. But in the real sense, this two types of analysis are very important for traders as they have key roles to play.

But when this two types of analysis conflicts each other, what should a trader do. For example technical analysis is telling a trader to go short, while fundamental is telling the trader to go long. At this conflicting point, what exactly does a trader need to do. Stick around as I will share my opinion (based on experience) towards the end of this article.

From the technical point of view, I have been analyzing Bitcoin the past two days. The pair look so bearish as we anticipate it to go down to the Point of Interest (POI) I have highlighted with the green rectangle. But since we cannot really tell what the market will do, and Bitcoin is paired to USD, USD being the quote currency, fundamental factors which could make USD more stronger could cause USD-quote currencies to plummet, while USD-base currencies could skyrocket, or vice-versa. By USD-base currencies, I mean the USDxxx currencies. For example USDCAD (US dollar paired to Canadian dollar). And talking about USD-quote currencies, I mean the xxxUSD currencies. For example BTCUSD (US dollar paired with BTC).

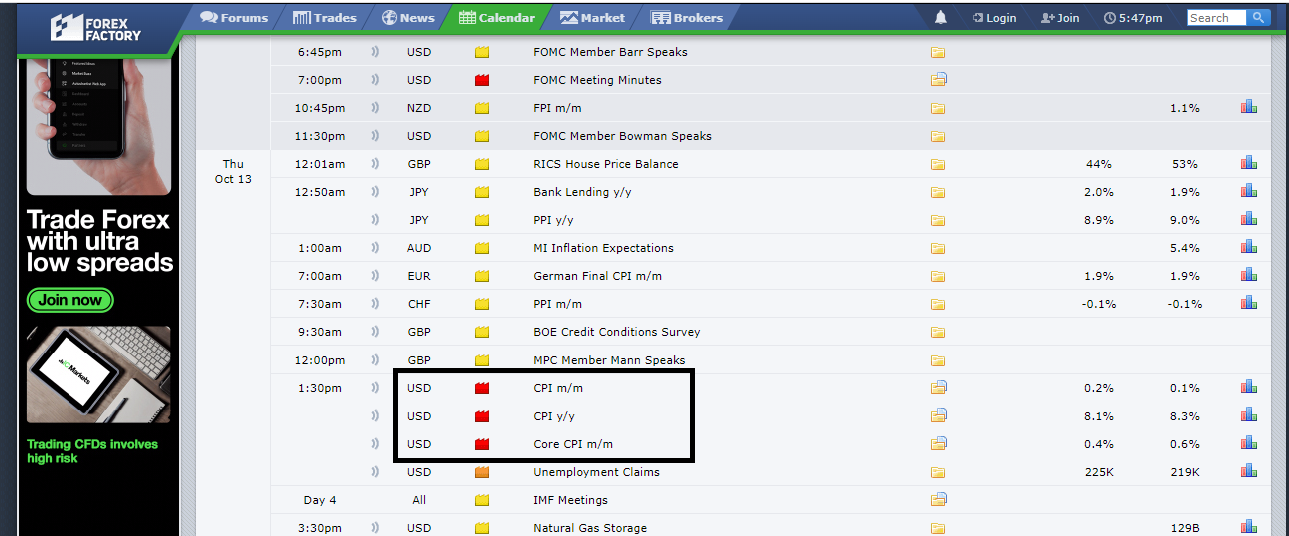

According to the forexfactory calendar, we have a major news tomorrow which could send USD-quote currencies to the upside and USD-based currencies to the down. That news is the Consumer Price Index (CPI) news. This is one of the fundamental factors that most times has a high impact in the financial market.

Imagine a trader who knows nothing about fundamentals and then decides to swing a particular trade, and then the CPI news move the market against him, that will be a loss to take.

Also, imagine a fundamental analyst who believes that the CPI news will be in favor of USD and then decide to go long on USD-based currencies, and then the CPI news goes against him, that's also a bite for him.

In my opinion, fundamental analysis do not supercede technical analysis and technical analysis do not supercede fundamental analysis. They both play their role. So, as a trader, I prefer to stay out of the market during high impact news such as the CPI news. I allow the dust caused by the news to settle before I make my trading decision.

Which type analyst are if you're a trader or if you intend to be one, which type of trader would love to be.

N/B: Every information in this article are just for the purpose of educating and informing the folks here. None of it is in any way a financial advice, as I am not a financial advisor.

Posted Using LeoFinance Beta