The out-roar of the Special Purpose Acquisition Company (SPAC) in the last three to four years had propelled many investors to consider casting their bread upon the waters with the expectation of finding it after many days.

These retail investors thought they found a one way direct ticket to the reservoir of riches. But sad enough, that ticket, as glittering as it was, really was not reserved for them but rather for the back- ups or sponsors of the SPAC.

SPAC is a traded company exclusively formed for the purpose of being a merger with an already existing unlisted company.

For example, Shell companies generate huge amounts of money, list their shares and telegraph their interest in acquiring some private companies. Many people refer to SPAC as blank check companies.

Whenever retail investors buy shares in these SPAC companies, the back ups of these SPAC will now be the ones to decide how the money will be spent.

The moment SPAC reaches an acquisition target and has merged with that target, investors will now decide to either swap their share for that of the company which has been merged and they can as well decide to request for their investment with the interest their investment had accrued over the period of their wait.

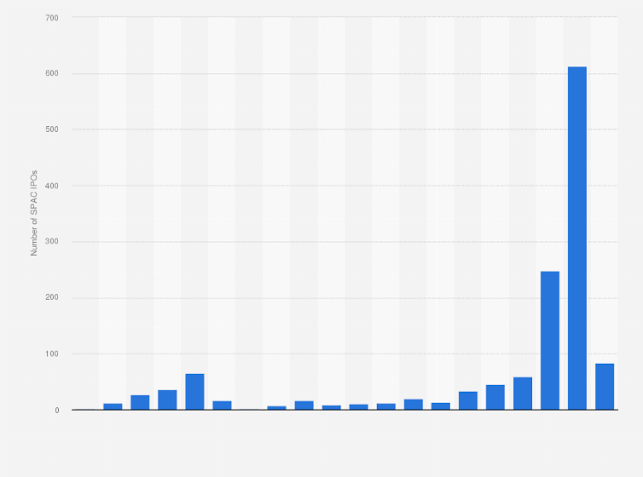

SPAC has been in existence for many years but not many people knew about it. But in the last 3 years, it began to pick up steam.

In 2019, a total of 59 SPACs were created in the market. In 2020, it drastically increased to 247. In 2021, it skyrocketed to 613. This increase of SPAC creation was because investors held on to the belief that SPAC investment was the easiest way to start up an investment at the same pace as Wall street. Also, merging with a SPAC seems to be more convenient and easier than having to do a listing via the traditional IPO.

SPAC began to flourish in 2020, perhaps the circumstances created by the pandemic and the lockdown were responsible for the flourishing of SPAC. So much money was sunk into SPAC during that period.

In 2019, $13.6B was raised, $83B in 2020 and a whopping $162B in 2021.

There were high profile SPAC mergers during these flourishing years of SPAC, the biggest merger being the United Wholesale Mortgage having the biggest SPAC deal record ever which valued the company with $16B.

As recorded in the holy book that for everything there is a season, it was the season of SPAC.

The Federal Reserve (Fed) needed to ensure that the interest rate was kept in check because the consequences of money printing were becoming more obvious. Therefore stimulus began to be reversed by the Fed. The Fed began to pump interest rates from 0 to 4.5% in a period of just 9 months of last year. This caused liquidity to be sucked out of most financial markets.

Some of SPAC mergers began to experience some drawdowns. For example, Lucid Group has been down by 35%, Draftkings down by 75% , Virgin Galactic down by 84% and SoFi down by 78%. Wework, United Wholesale Mortgage and Grab Holdings are seen to be below their listing prices. This has made a lot of people wonder if the SPAC module has been flawed because what was presumed as a structure to help retailer traders to dive in on the same terms as institutional traders turned out not to be so.

Right now, the future of SPAC seems to be very cloudy with a chance of thunderstorms. Enough damage has been done to the psychology and emotions of retail investors.

While all hopes are down in the trenches, we hope to see if the Fed will be ready to give back what they took or if they'll continue taking.

Posted Using LeoFinance Beta