Just in case you haven't heard or haven't checked your Hive wallet yet and noticed, the interest rate for HBD in the savings account has been raised to 20%. This is huge!

If you go visit LeoFinance, many of the posts on the front page are talking about this. They are all very excited over there, and you, my dear followers, should be as well. I've posted before about the advantages of keeping a large portion of your earnings in HBD. Those previous posts were made when the interest rate was set at 12%. Now that it's 20%, keeping your money in HBD makes even more sense than ever!

At 20%, HBD now offers a better APR than any bank on earth. 20% is better than returns from most stocks. It is even better than some Defi projects, and with none of the risk; with Defi you have to worry about the base token dropping to nothing while you are invested in it, completely nullifying your gains from their insane APR, but with HBD you don't have that worry at all because it is stable.

The advantage of holding your money in HBD saving can not be understated.

In this post, @themarkymark writes:

Let's pretend you start with $0 and deposit 100 HBD into your savings on a monthly basis. In just 20 years that will turn into 311,000, but if you just put 100 HBD into your account without interest over 20 years, you would only have 24,000 at the end of 20 years. Compound interest is one of the most effective financial strategies to become financially independent.

This is true and amazing. Let's break it down so that you can more easily imagine now this happens.

I created a spreadsheet that looks at monthly and yearly gains, assuming you compound the interest (ie reinvest it back into the savings account).

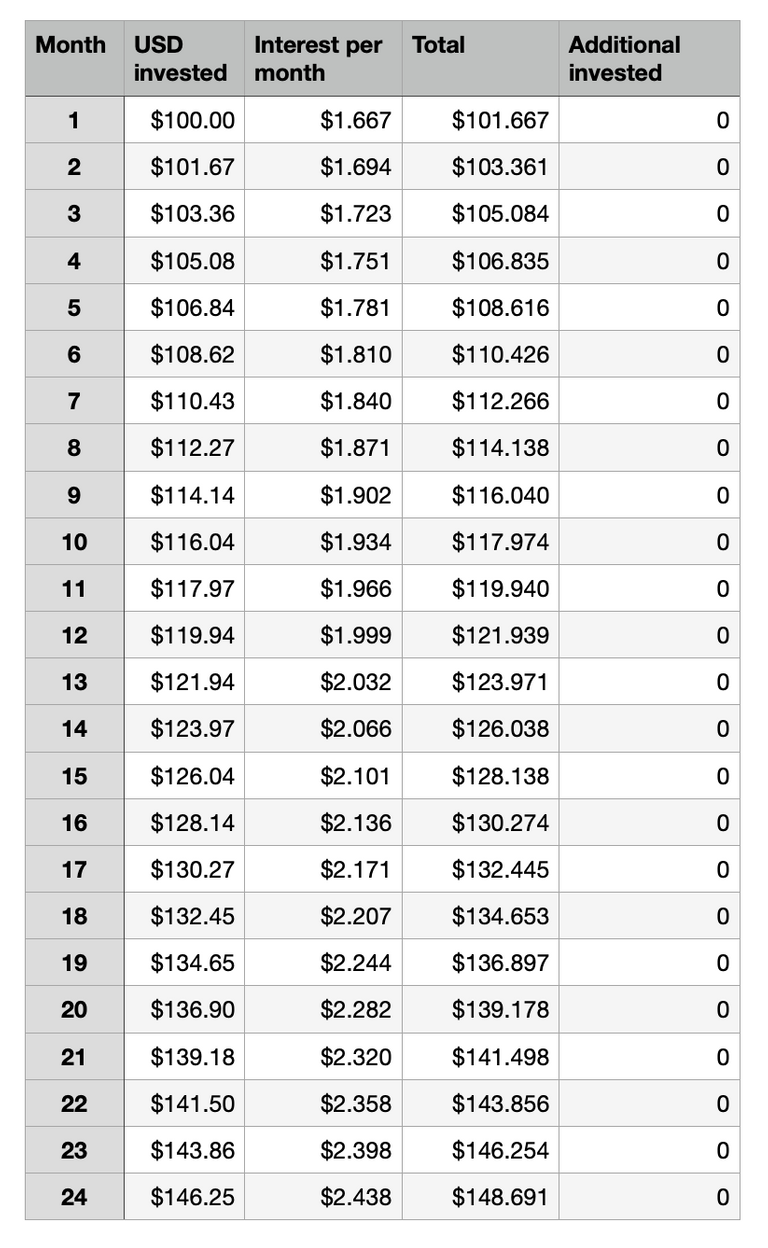

First, if you just start with 100 and do nothing, 20% will get you this.

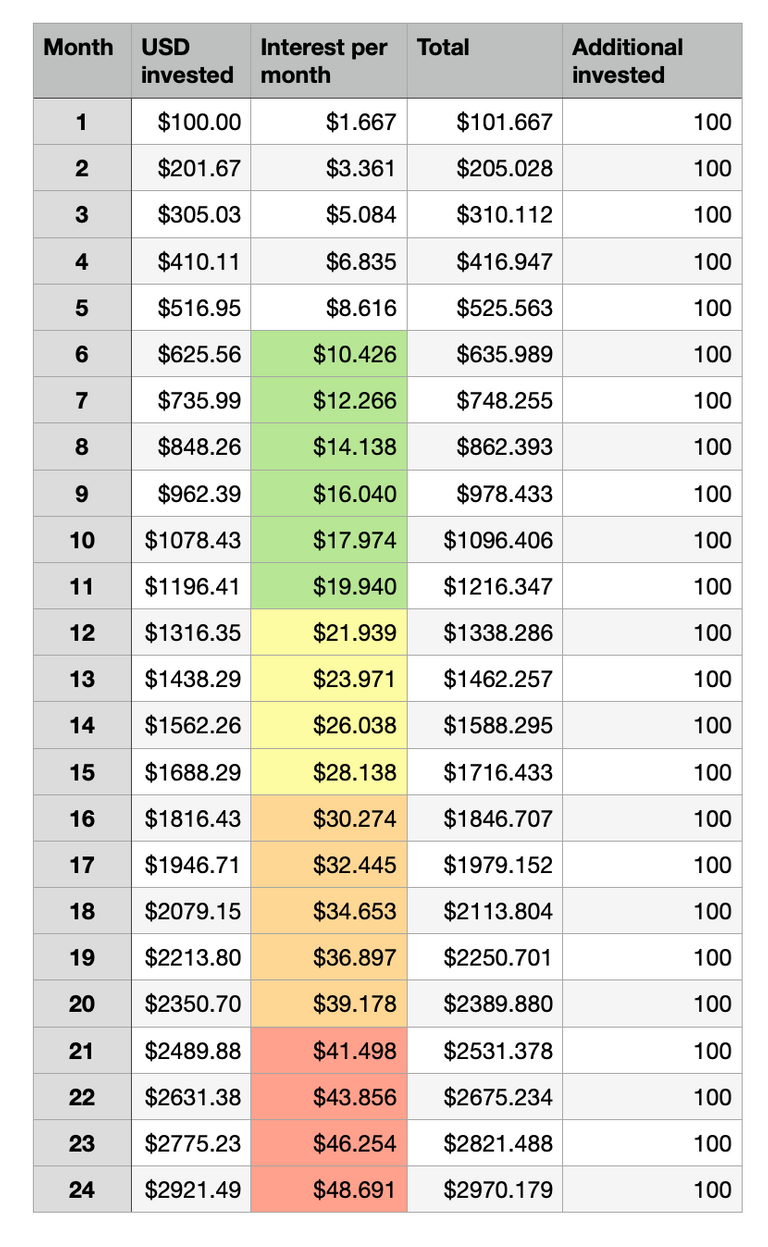

Not bad for not doing anything except providing an initial amount. Now, if you invest an additional $100 per month, it turns into this:

(note: Sorry if my color changes don't make sense. My column order isn't the most logical either. I just made this quickly and wanted to easily show the changes.)

You can see that after 1 year, we are at $1338.286 and after two years at $2970.179. If you just stacked $100 a month, you'd only have $2400 after two years. Using HBD would give you an additional $570.179.

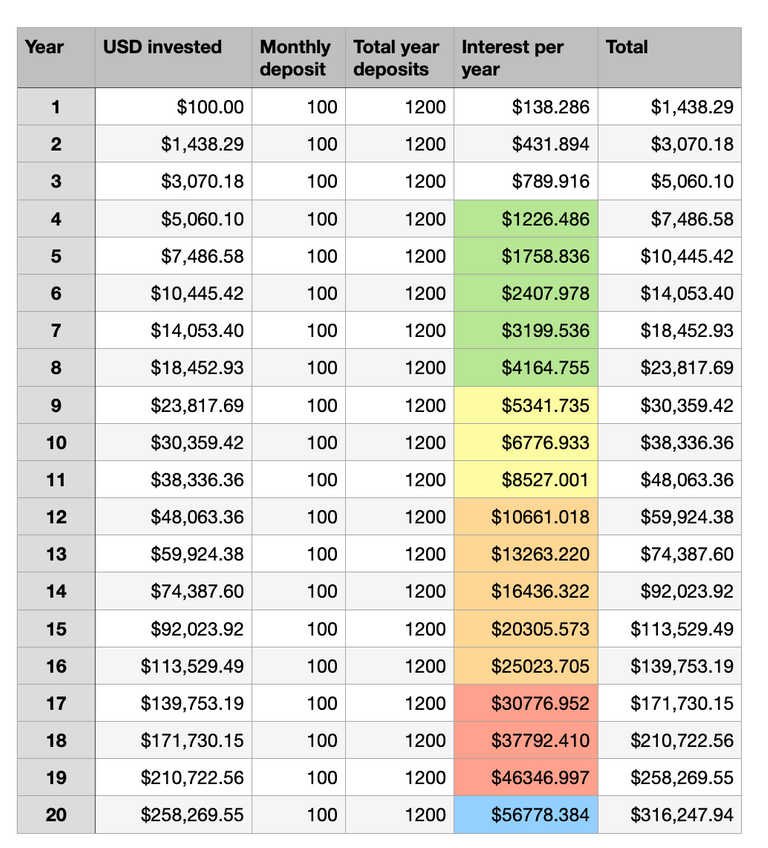

Let's bring this out to 20 years.

At just $100 per month, after 20 years you would be sitting on slightly over $300k. Well, I show $316,247.94 which is slightly more than the $311k Marky gives, but it's close enough for our purposes without tracking down the formula mistake. This $316k is in comparison to just $24k if you had only been stacking it. That is the power of compounding interest.

Here is the spreadsheet I used, so you can play with the values if you want to invest more or less than $100 per month. I made this with Numbers on my Mac. Here is the Numbers file and here is an Excel version. I exported that Excel version from Numbers, so I can't guarantee it will work, sorry.

(You may have to right click and "save as..." to save these spreadsheets)

Now we have no idea if Hive will last for 20 more years. Even if it does, odds are the 20% APR won't last that long. These charts are just to show you the power available when we start talking about high interest rates.

I strongly suggest you take advantage of the 20% HBD Savings while it lasts. Make a plan to add in a certain amount every month. If it makes it easier to remember and you have enough daily Hive income to support it, do it daily. For example, if you want to add $100 per month, that is 3.33 per day (or 3.23 per day on months with 31 days).

Anyway, there you go. HBD is now at 20%. Take advantage of it!

(header based on this photo licensed under the CC0 Creative Commons)

❦

|

David LaSpina is an American photographer and translator lost in Japan, trying to capture the beauty of this country one photo at a time and searching for the perfect haiku. |

If this blog post has entertained or helped you, please follow/upvote/reblog. If you want to further support my writing, donations are welcome.