After #januarystreak, a month in which I published an article on Hive every single day, I thought to take a short break. Heavily influencing that decision was the fact that, before #januarystreak, I also published a blog post every single day of 2021 on my blog.

So, in total, 13 months of writing every day. A pause was well deserved.

But hey, never make plans in crypto. Or, to paraphrase a nice saying, you making plans are the way of making crypto markets laugh.

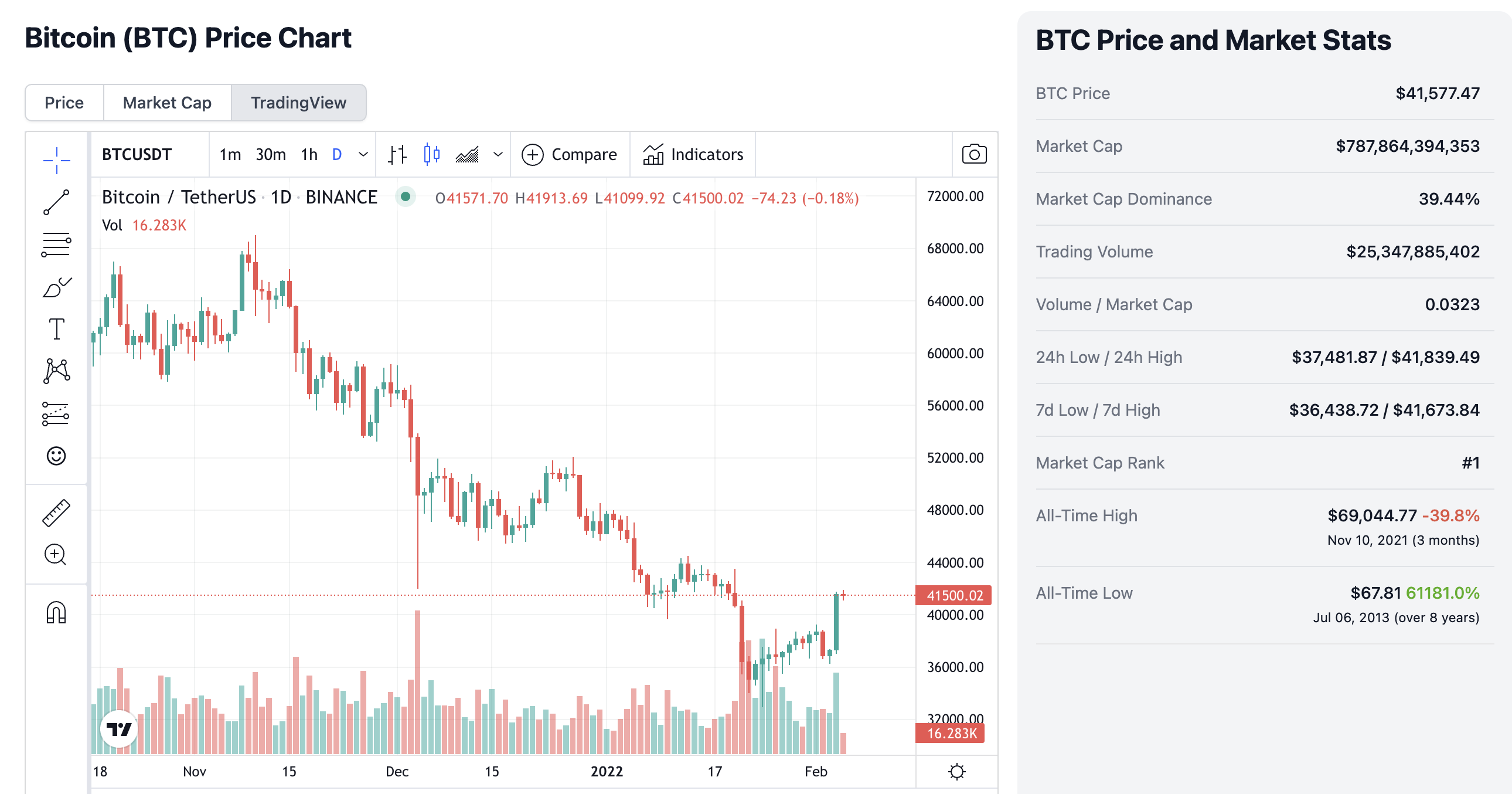

At the moment of writing this, Bitcoin is trading slightly above $41k. Smarter people than me consider this a key level. It's something with support and resistance, I've never been good with that stuff. Wink-wink.

But, as satisfying as this 11% surge may be - and it is, I'm not gonna lie - it's coming at the end of a tormenting downward cycle, as you can see from the daily chart above. So it might be just a temporary respite on the downwards slide.

Which brings me to the topic of this post. I believe we can all live a better life if we ask the right questions. They may never be answered, these questions, but just knowing what to ask might shed some necessary light on the road ahead.

So, here we go:

- is this disconnection between stocks and crypto real? Facebook, Paypal and a few others dropped dramatically a few days ago, while crypto is surging. Is this movement based on a real shift of money from one store of value (stocks) to the other (crypto)? Or it's just a short term hedge, a blitz pump that will just draw in some newcomers only to get burned a week from now, in another massive dump, as institutional investors will cover their stock losses?

- will Bitcoin dominance under 40% (we're at 39.44% now) eventually trigger an alt season? Traditionally, this was the case. Whenever Bitcoin flew under 40%, alts soared. This cycle is definitely very different (as the entire world we live in is, in case you didn't notice) so that's a very important question.

- is this move upwards some sort of political support for countries / large organizations adopting Bitcoin? A couple of countries announced intentions to make Bitcoin legal tender, while India legalized crypto (taxing it akin to capital gains, though). Are we seeing a "this thing is already too big to fall, so let's pump it until more are digging in" kind of move? We've heard that stance before, and it didn't end well, as some brothers called Lehmann can tell us (symbolically speaking).

I'm just asking questions here.

Posted Using LeoFinance Beta