Before we begin:

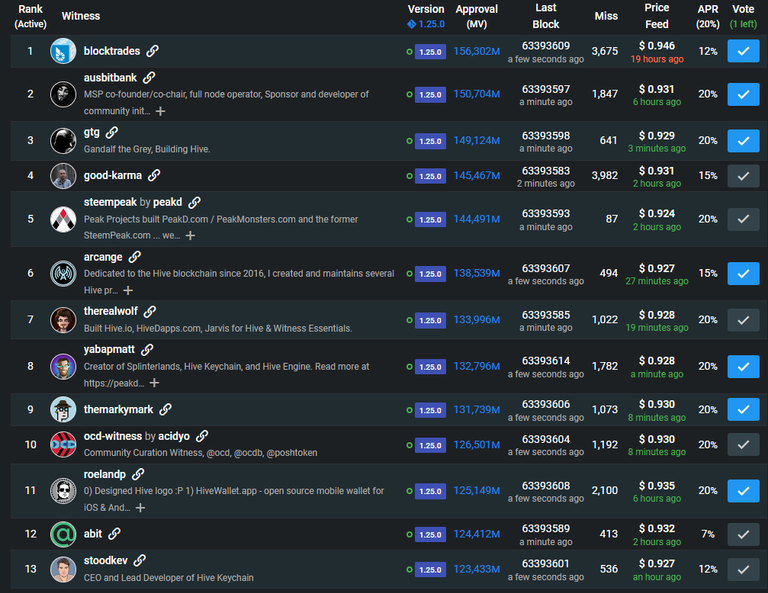

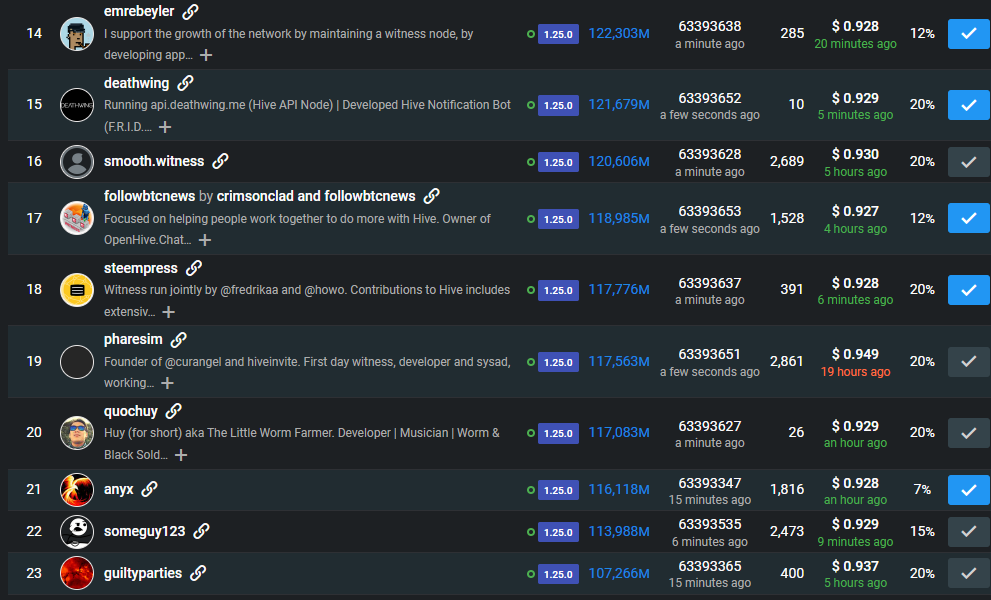

It's really nice to see that @deathwing is #15 and not at risk of being bounced out of the top 20. He does good work. I can also see that perhaps some of my witness votes need to be moved around a bit. I haven't even looked at my votes in a while, and with 210k HP at my disposal my vote is actually of minor significance within these rankings. I don't like that @anyx has been bounced as I use his full node like all the time in my scripts. Oh well, clearly the top 20 is being shaken up, and that's a good thing. A stagnant top 20 is a bad sign.

20% though

The ROI on savings accounts is determined by median value as signaled by the witnesses. Here's a refresher of the 3 main ways to average things, as the vast majority of the time we always use the mean average (sum all and divide by total elements).

- Mean Average: (10+4+3+2+1+1+1)/7 = 3 (standard)

- Median Average (10,4,3, 2 ,1,1,1) = 2 (in the middle)

- Mode Average (10,4,3,2, 1,1,1) = 1 (most common number)

We use median average to determine ROI on savings accounts because that's clearly the best one to avoid manipulation and corruption by a small group (or even one) of witnesses. Mean can't be used because a single block producer could signal 10000000000% and manipulate the average to whatever they wanted. Mode can't be used because if no one agrees on the exact number then two witness signaling the same number can set the value. Median is best for this purpose.

After @taskmaster4450 posted a video yesterday saying he was going to change all his witness votes to support the 20% change... today we see that 20% is activated (coincidence?). I know if I was a top 20 witness near the bottom I'd change it immediately when the top rewarded author says something like that. The politics game on Hive is just getting started. The next 5 years are going to be crazy. Maybe I'll write a post to that affect one day.

I was also going to say that clearly @blocktrades must approve of something like this for it to happen, but his node isn't even signaling 20%; it's still at 12%. I actually think that is great and it showcases our actual decentralization in action, whereas most other chains are pretending to be decentralized.

Is 20% ROI a good idea?

Yes and no. It's a pretty bad long-term strategy but a pretty good short-term one that requires zero effort, as the code to do it was already in place. 20% will be a good marketing ploy and garnering attention from the outside while staying competitive with the best algorithmic stable coins out there. This is especially true because we can likely outlast other algo-coins and HBD is more robust than a lot of the new stuff out there. Sure, HBD is one of the most volatile stable-coins out there, but it is also one of the least likely to suffer from systemic failure (like crashing to zero or being captured by regulators). There are also a lot of things we can do to stabilize this asset and become the top derivative algo-coin in the world.

Is 20% sustainable?

20% is very high and a liability to the network.

20% is significantly higher than curation on blog posts. It outstrips inflation on the reward pool, which is pretty insane when you think about it. That being said, I personally have zero intention to hold any HBD even with this change being implemented, as the change itself is almost guaranteed to make the price of Hive go up over the next 2-6 months. The reason being is that HBD lacks liquidity and the only way to "buy" it in mass is to create it out of thin air using the conversion feature, or buy it extremely slowly and patiently on exchanges (internal and external), something that no one wants to do (bad UX) unless they are operating market making bots.

Is 20% sustainable?

Look at it this way: do we think that Hive itself will have more than 20% growth year over year? I have to assume this will be the case, which means a 20% return on the stable-coin is totally sustainable, and it feeds into the growth-rate and makes it even stronger and more desirable to be here. Bitcoin has a 100% per year growth-rate on average. 20% is actually a pretty low target in crypto, even if it's a massive target in legacy finance.

Sure, but why is it a bad idea?

Like I said, the 20% interest rate is a TERRIBLE long-term play, and better for short/mid term marketing to get attention. Once we have said attention, it would be best to 'rug-pull' the interest rate back down to 10%-12%. There's no reason to have it that high unless we are trying to stay competitive with other networks, and other networks are dropping like flies when it comes to high ROI on stable coins.

But there's so much more to be said.

The main reason why 20% ROI on savings accounts isn't great is that it doesn't provide any value to the network itself. We should be trying to incorporate features into the network that provide value to the network and to the users. 20% ROI on savings is a liability to the network (a debt that must be paid back later). It is a gamble for the network and depends on outside growth to be sustainable.

As I have already explained, manipulating yields has a delayed reaction. Say we enter a crypto winter and the witnesses realize that 20% is too high and we are bleeding value. Lowering interest rates at that moment (which is exactly what will happen in a reactive network like Hive) is actually going to make the problem worse. The reason for this is that the number (ROI%) can change instantly, but the results of the number changing take time to play out.

Take right now for example.

The number has been changed to 20% from 12%. That's a HUGE jump. Just massive. Enough to make the Federal Reserve blush. But how much extra HBD have we actually printed? Basically zero. The number just changed today, and it will take months and months before a significant amount of HBD has been printed.

The same is true in a crypto winter.

Being reactive isn't good enough. If the market is bleeding and we try to stem the bleeding by lowering interest rates, that makes it even less attractive to hold HBD and that would obviously accelerate the dumping and conversions of HBD back into Hive which creates more dumping. It's a vicious cycle. Again, the benefits of raising or lowering the rate don't kick in for months and months. This is one of the reasons why fiat itself has such a difficult time regulating the economy. There are just so many variables to consider all at once, and exponential unintended consequences can pop up.

But that's not even the worst part.

The worst part is that Hive needs more liquidity, and allocating yield to the savings accounts accomplishes the exact opposite of that. The savings accounts are time-locked for three days. We are paying users to lock up their debt and take that debt off the market, while at the same time we are in dire need of that debt being on the market.

Tired of beating a dead horse here.

It is comically obvious how badly Hive needs an AMM internal atomic swap market between HIVE/HBD. This is how liquidity is achieved. This is how we create deep pools and stabilize risk. This is how we stabilize HBD. This is how we offer passive income while providing value to users and the network. This is how we give users a way to opt-out of downvotes without delegations. This is how we achieve entry and exit liquidity. This is how we get more HBD listings on centralized exchanges. This is how we vastly increase the demand to hold the network's debt in perpetuity. This is how we statistically 'force' token holders to share the burden of slippage with new users as the price goes up. This is how we scale up.

And as long as we were working towards this goal, I see no issue with setting the HBD ROI high and then bringing it back down to earth when we actually have an AMM to allocate yield to. But as far as I can tell we are not working toward this obvious inevitability. Like, it's going to happen; I just want it to happen ASAP instead of 5 years down the line. Waiting 5 years for something this obvious is just... embarrassing really. It makes us look like children that don't know what we are doing.

Look ma I made a crypto.

To be fair I think Hive is amazing which is why it is my biggest bag and I even went so far to buy more recently. We are going places. Good things come to those who wait. One day soon™ I'll be a whale. It's not about the money it's about the tech and community; building something that has equity for a large group of people (not just myself).

HBD sinks

With characters like @theycallmedan running around creating HBD sinks that send HBD to @null, it becomes even more clear that 20% yields on our debt will easily be sustainable. The Ragnarok game is going to burn a lot of HBD, and he's not going to stop there. I also personally have plans to destroy our debt with Magitek and whatnot. There are many applications that thrive on these kinds of deflationary measures, which is exactly why we need to be printing more tokens to counteract the bad results of deflation. The HIVE >> HBD conversions implemented in HF25 were a huge gain in this regard, but we can do better.

Conclusion

Increasing HBD to 20% is a bit of a gambit. I'm a bit of a glass-cannon myself so I actually approve of this move in the short-mid term (even though I'm personally not considering holding HBD at this point). It's not a good long-term solution but it took zero dev work to get us here so that's a big plus.

The only problem I see with this move is that the witnesses are playing with fire and they might not even realize it. Economies are not easy to regulate. This move can damage the economy like a sunburn, and we don't realize we're burned until it's too late, then when we try to fix the problem it will get even worse (we have to walk into even brighter light just to get into the shade). Economies are like that sometimes.

However, this is all a process and it will take time for the network to learn how to regulate itself. We just need to be aware of these pitfalls before they come around and everyone starts blaming the wrong reasons (like when everyone was saying we should lower inflation or remove the reward pool entirely to make the price go up at 10-20 cent Hive; no one makes this argument anymore because they were obviously wrong).

The biggest real problem is complacency. This network needs more liquidity, and we are doing the opposite of that by issuing higher rewards for timelocking liquidity. This is a trap that many networks fall into and will continue to do so: trying to make number go up without realizing there's a debt to be paid later. The chickens will come home to roost eventually. Make sure they have a place to do their business. Nobody wants to shit where they eat... so don't. Stay frosty.

Posted Using LeoFinance Beta