2023 is getting extremely mixed reviews.

We all know we're already in a recession and have been for a while, no mater what POTUS has to say about it, but many assume that the worst has yet to come. Everyone is expecting some grand disaster to happen that we can all point to and say, "See? There it is: that's the bottom of the recession." But what if that moment never comes? How will we know and when will we finally stop waiting for it to happen.

My guess is that by the time this year is over the recession will be over, and at the very least the worst part of it will be behind us, which is the most important aspect for the markets, as markets tend to speculate in advance. Meaning that crypto will be in a full blown bull market pretty much immediately on recognition that the worst of the recession is behind us.

However this will be no use to people interacting with the physical economy. For example, if you got laid off it's not going to matter if the worst of the recession is behind us; you still may find it difficult to find a job long after that. On a personal level I find myself very furtunate to have such amazing tenure here at Hive blockchain (not Technologies).

Tech companies are absolutely scrambling.

Basically every tech company out there is laying off their workforce, and everyone is sounding the alarm and claiming that the recession has begun. And yet, we already know that we've been in one for over a year. Did people suddenly start believing the administration when they say that we're not in a recession yet? I find this weird.

To be fair some of this is also the FED's fault and how they have completely mishandled their war against inflation. At this point I'm all but convinced that everything they've done is by design, and that they've baked a deflationary 2023 into the cake. There will be no growth this year economically. Prices will continue to decline and people will continued to be laid off.

What does this mean for crypto?

Well my opinion is that Bitcoin is comically oversold right now because the doubling curve is above $50k right now. Any price below $50k BTC is a massive discount. The move from $15.5k to $23k was largely irrelevant. We'll all look back at this time 3 years from now and realize that anyone that bought anything even remotely near this level was able to increase their bag size by several factors (if measured in USD of course).

We would all do well to remember that even though crypto is connected to the legacy system, it still exists outside of it at the core. The Titanic can sink and the crypto lifeboats will still be floating (some of them anyway). Any network with a defined and valuable niche will survive and be an important part of our future (more on this in another post).

Like I said, there are many alarmists out there talking about the tens of thousands of people being laid off in tech. Tech was extremely overextended during the bull market, and for good reason. It's easy to over leverage tech and get massive gains in the process. We got rewarded for so long in tech by increasing our risk that we got caught with our pants down in 2022. Now capitulation has been accelerating. However, can we really apply this same level of alarm to other industries? Not so much.

Even my girlfriend's company laid off a couple people, and this is a company that largely views themselves as "recession proof". In fact it was a company that was founded in the middle of the last recession during the housing crisis. It's a construction company that focuses on cheaper materials and high insulation R values, which is something many are looking for even in the middle of a recession.

The fact that my girlfriend's company laid off just 2 people is actually more alarming to me than Google laying off 12k people.

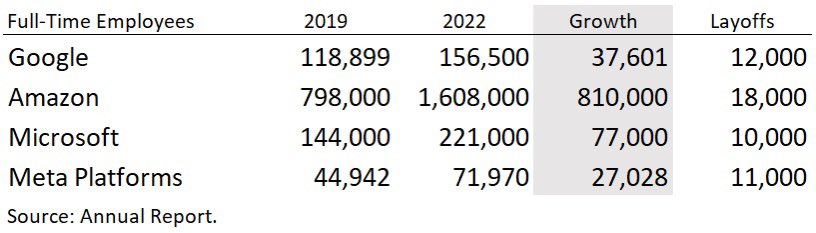

However, we can see that many people in the comments of these alarmist posts are quick to point out other numbers that show us that this recession is actually being heavily exaggerated. Look at the growth on Amazon since 2019. They basically doubled their work force. That's insane. A couple thousand layoffs in the face of that is nothing. Who cares?

And then there is the way that companies are laying off their employees. Google botched their layoffs so badly and now everyone is pissed. There was no rhyme or reason to them: just seemingly random and without warning. Very unprofessional.

And then there are gems like this that advise you to be BAD AT YOUR JOB if you don't want to get laid off. So funny hearing this as an aspiring Hive developer. Don't make modular code with good documentation: if you do that you're replaceable. If you make spaghetti-factory code that makes no sense and has no documentation then they can't fire you. lol. Classic and amazing example of how crypto will eventually take over everything. Capitalism financially incentivizes bad practice by design. So many doors are closed to the legacy system that are open for crypto.

Parul Koul, executive chair of Alphabet Workers Union-CWA in a statement Friday. “This is egregious and unacceptable behavior by a company that made $17 billion dollars in profit last quarter alone.”

And then there are comments like this one...

People who talk like this are completely blind to the reality of the system we live in. It does not matter how much money Google has made or lost. Google is a business, and businesses make money. Welcome to capitalism.

It's being heavily implied here that because Google is a successful company they should be willing to take a profit loss in order to avoid layoffs and retain dead-weight. What kind of logic is that? Not only is it bad practice, but it's also how we end up with zombie corporations and institutions that are "too big to fail" and then end up getting bailed out by the taxpayer in a failing-up situation. Is that what we want?

Again crypto shows that the new path we will eventually take is building robust communities that don't treat their people like cattle. Citizens aren't pieces of meat. Citizens are not collateral, but that's exactly how the legacy system treats everyone. Crypto will eventually change the paradigm and make it so the currency, networks, and platforms are actually in alignment with community and long-term growth and investments. It might take a few decades, but we'll get there.

And then there are the speculators.

Let's not forget that sometimes perception is reality. If the Chinese believe the year of the rabbit is lucky, then maybe it will be. Like I said in a previous post, it looks like February is primed to be a good month, and Feb is often a very volatile month (in both directions). We also need to remember that our country is not the only country, and China isn't doing nearly as bad on the economic side right now as some are reporting. I saw a report that shows that the average worker in China actually is better off than Americans, if you can believe that (not sure that I do but simply the claim is interesting nonetheless as I wouldn't have even considered that before).

Conclusion

Markets move faster than the lumbering beast of the economy. By the time this recession hits its lowest, assuming it hasn't already, markets will be in a full blown bull market. Speculators gonna speculate.

In all cases: recessions only hit a percentage of the population. Some people will not be affected, as I remember very well from the housing crisis as I was not affected one bit except that a mutual fund that my dad set up had some losses on it that took a while to recover. That was it. I expect that may be the case again in 2023, even if the 2022 crypto bear market was un..bear..able.

2023 will likely be a year of zero overall growth and deflation created by the recession and exacerbated by the FED's response to inflation. Luckily crypto exists outside the system and will continue to grow, no matter what the price valuations are. Crypto is the solution for sustainability and balance within an otherwise cancerous ecosystem that relies on constant growth. We just have to keep building to get out of this awkward infancy phase we find ourselves in.

Posted Using LeoFinance Beta