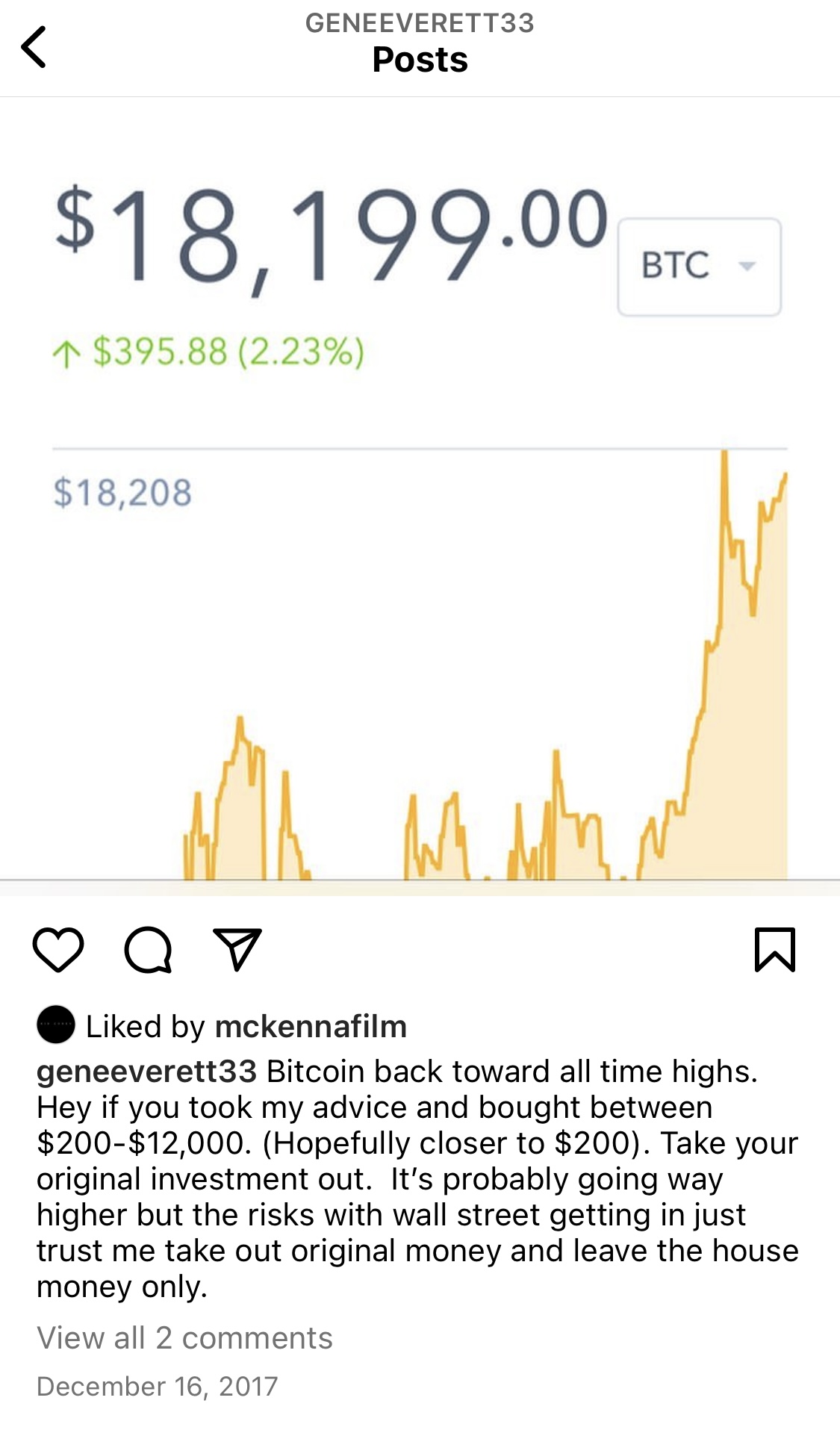

So the Bitcoin ETFs have officially been active for a second and we are seeing some interesting trends. First, we wicked down from $47k to $41.5k, so obviously that's annoying for anyone other than those looking to buy the dip. It appears as though "sell the news" is in full effect, but that's not the entire story.

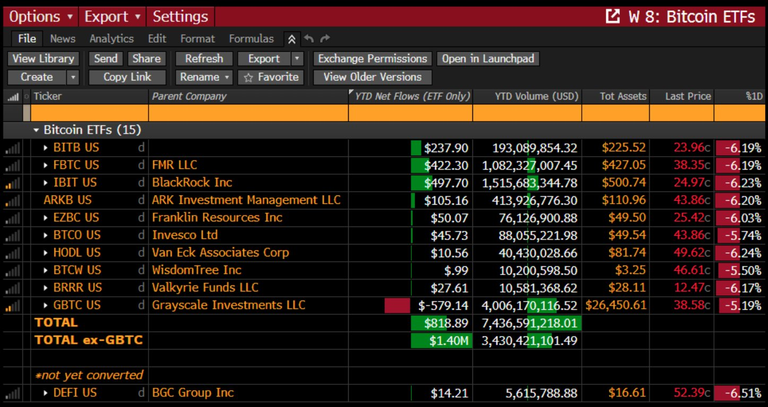

To get a more well rounded picture we have to look at the inflows.

And what does this data tell us? Well it looks like Grayscale is bleeding pretty badly into the other funds. Why would this be? Because Grayscale still insists on having the highest fee. They recently reduced it down from 2% to 1.5% in an attempt to stem some of the bleeding, but they still charge the most by far out of all 11 funds. Why would they do this? Don't they want to stay competitive?

Well if we run the math on this: Grayscale is actually doing shockingly well so far. Other funds are offering insane deals. Galaxy reads like a car commercial: 0% APR for the first 6 months. Other funds are pulling the exact same tactics, but Grayscale refuses, and there is a very good reason for why it is going down exactly the way it is.

Grayscale is the incumbent

They already have billions of dollars under management. I think someone was saying something like $29B. The fact that they've lost less than $1B to the competition is telling. Imagine what the numbers would have to look like in order to force them to actually compete. If they were to go from a 2% fee to a 0.4% fee then they'd have to x5 their assets under management just to make exactly the same amount of money. That's not a tenable business model for an incumbent, but it is for the thirsty newcomers.

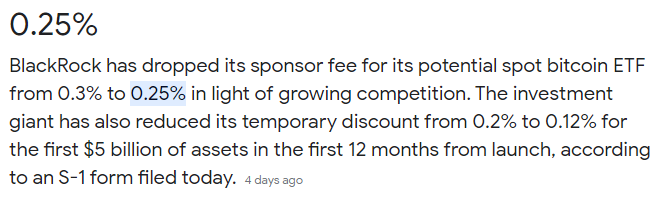

Race to the bottom

Every one of these new funds is trying to outdo each other in the only way they can: undercutting the fees. This is a loss leading strategy. Lose money today in order to make money tomorrow; the ultimate bait and switch. There is no rule that says they can't jack up the fees after they get billions upon billions of dollars of assets under management.

This is exactly why so many Grayscale investors are refusing to sell and get a "better deal" somewhere else. When a user goes to sell their Grayscale derivative for someone else's they're forced into a tax event. Why would you pay 15% on unrealized gains to the IRS when you can just stick with Grayscale's 1.5% yearly fee? That's potentially 10-years worth of fees simply trying to transfer somewhere else. And, like I said, there is zero guarantee they won't just jack the fee up later.

Basically what's going to happen is that as soon as the assets under management are hugely in the green, these ETF providers will be much more confident in jacking up the fees because their investors are fully trapped by the tax event. The financial incentives are overwhelmingly clear. This is the situation that Grayscale is already in, which is why they refuse to compete with the newcomers on the fee structure. They already have the fish right where they want them and have been farming for a while.

Number go down

The Cash-Creates rule that's been imposed on these ETFs has created some interesting logistical issues for these institutions. When someone at Grayscale sells in order to get a better fee somewhere else, Grayscale is forced to dump the BTC on the market to create "cash" USD. Likewise, when they move that value into Blackrock they are forced to use the cash to buy BTC.

However, it doesn't have to happen instantly.

A lot of the BTC that Grayscale dumped onto the market hasn't been bought back up yet. Legally I'm hearing that institutions have a couple days to get that done and they can choose an opportune moment. Some are speculating that the sell-the-news event we are seeing is really just Grayscale BTC being dumped onto the market while other institutions now have to buy it back up. I guess we'll see over the next couple of days if it plays out this way.

Volume

I'm told the volume on the ETFs was record breaking right out of the gate. It can take years for some of these funds to hit $5B in daily trading volume but that seems to have been achieved instantly here. It's a good sign for sure.

Vanguard

There are a few investment firms like Vanguard who are refusing to allow their clients to buy into these ETFs, and people are pissed. Will be interesting to see what kind of blowback this decision has. Imagine telling someone that they aren't allowed to spend their money the way they want to. Those who refuse to jump on this bandwagon may get left behind, especially if the 4-year cycle plays out and we see BTC go x10 in 2025 as is so often the case. I for one can't wait to see how stupidly rich El Salvador and Michael Saylor become during the peak of this next market. They will be sitting their with their "I told you so faces" making everyone else FOMO in at the top as always. Couldn't be me.

Imagine a BTC 10x within this context.

Say Blackrock controls $30B worth of Bitcoin in their spot ETF. Then Bitcoin goes 10x. Now they have $300B in the ETF. Not only that... they jack up the fee to 1% a year. Now they're making $3B a year... for what? It's just funny because Coinbase is the entity doing all the heavy lifting securing the actual BTC. Blackrock is just a middle man in this scenario. Easy money.

Conclusion

Now is an absolutely terrible time to attempt to trade this market. A 30% dip into the $30k-$35k range is a great place to buy, while a spike into the $50k-$60k range might be a nice spot to take gains. Until we hit one of those targets there's really no telling what might happen. Hopefully we have momentum and continue upward up to halving event in April, but the market does seem to be signaling that it's out of gas. Is that just a bluff from temporary Grayscale selloff and temporary short-selling by the competition? I guess we'll find out.