THIS IS NOT A DRILL

Banks are not a safe place to store one's money. Everyone outside USA realizes this a little better than our more tame citizens. Bank runs have been going on across the globe in response to the FED raising rates and "fractional reserve banking" practices.

I put "fractional reserve banking" in quotes there because these days a bank can get away with having zero reserves. Used to be they were required to keep at least keep something like 20% liquid, but that number has dwindled ever since COVID began in 2020. Some of these banks are operating on 1% reserves; just enough to cover small withdrawals and to resume normal day to day operations.

The bond market is fucked

A lot of these banks love to throw their reserves into bonds because that's just "free money". Bonds are considered to be a very safe investment. Unfortunately now with the inverted bond curve we can see that many many bond investors are being forced to sell their unmatured bags at a loss, making the yields even more juicy for anyone willing to enter now and provide liquidity to the floundering market. This will not end well. Banks will continue to go insolvent as they are forced to sell their "safe investments" back into liquidity at a loss just like we saw with Silvergate.

At this point in time I'm absolutely floored that people still don't believe we are in the middle of a recession right now this second. We so obviously are... but everyone is waiting for the other shoe to drop and for something massive to collapse before we call it a "real recession". It's a real recession right the hell now... just because it can and will get worse doesn't mean we aren't in a recession today.

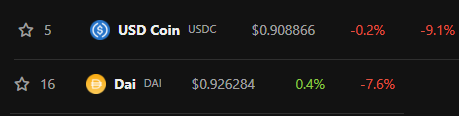

I've had so many conversations back in the day about how USDT FUD is ridiculous and how alternative regulated stable coins are not better. Oh... would you look at that. USDT hasn't broken its peg but both USDC and DAI did. DAI proving how worthless it is, just like I claimed years ago when they allowed USDC to collateralize it and I exited ETH entirely.

The interesting thing here is that it's probably still worth printing DAI and dumping it when it's at the $1 peg because the worst that can happen is that DAI crashes to zero and you owe nothing back on the loan... assuming the protocol will allow you to unlock your stake when you buy back the DAI for pennies on the dollar. I'm not sure why or how that wouldn't be the case but it's something to consider for sure.

Money Funnel:

A lot of people are out there trying to say if USDC crashes to zero then BTC will also crash to local lows. I'm not so sure. Wasn't the entire point of Bitcoin to provide a safe haven for bank collapse? Now we are on the brink of bank collapse and everyone is losing their shit. Cowards: all of them.

If USDC crashes to zero and the crypto sector loses faith in stable coins pegged to dollars in the legacy financial system... where is that money going to go? If users are selling Bitcoin into cash then where is that money going to go? Into a bank? Into another stable coin? Make it make sense. There is no safe place to park your money except within the Bitcoin network at this juncture.

Given this kind of systemic failure there is only one place for the money to go: and that's right back into Bitcoin. We are on the verge of The Great Decoupling with Bitcoin. There's no place to run except right back into granddaddy BTC's arms. Hardware wallet or better recommended.

Significant resilience across the board.

We're monitoring...

Don't play games with the US economy.

GOP is going to risk a financial default over their demands.

(Quite unreasonable demands)

Nobody is going to be holding the US financial system hostage by saying if they don't get their way they're going to default the US government and have an unprecedented financial catastrophe.

lol?

Sounds like a prophecy more than a consolation.

Gotta love hove CNBC leverages a bank run into left-right partisan politics; blaming republicans for the failures of the current administration. Love it. Not that I have any respect for republicans but I've got to call it like I see it. To be fair CNBC is not wrong, and GOP main brand is to simply obstruct democrats without the ability to actually get anything done within the party. But is now really the time to bring this up?

The FED is going to keep increasing rates, and the chance of this bank-run contagion spreading is going to increase exponentially. I've been talking about this exact moment for multiple years now. Bail-ins are firmly on the table. Banks are going to steal client funds and call it "an investment". I guarantee it. It's only a matter of time... and given these red flags time is short.

This is not a bullish or a bearish situation.

This is a lose/lose situation no matter how one slices it on the short term. Even if I knew BTC was going to collapse to $10k I wouldn't sell any or short it because selling it or shorting it runs the risk of losing everything. Where would I store that value? On an exchange? In a bank? lol pass. No thanks.

HBD

Once again the Hive network comes out of all of this smelling like roses. HBD doesn't even have any exchange listings right now... which has always been a huge detriment but puts us in a really good position right now. We are largely disconnected from all of this, and HBD will maintain the $1 peg all the way down to a 7 cent Hive price or less. Truly, HBD might be one of the safest and best deals within the entire cryptoverse and hardly anyone knows about it. Mindblowing.

Conclusion

Usually when the legacy system experiences systemic issues Bitcoin will enter the bear market along with everything else. Risk-on assets are risk on. However, we have yet to see what happens when the banks themselves are the problem and capital is running away from them as fast as possible. This is the entire reason Bitcoin was created in the first place... just look at the genesis block. Bitcoin was always meant to be the long-term risk-off solution

There is only a very small chance that a contagion like this can be contained. This is especially true with Powell continuing his hawkish crusade against "inflation". As rates continue to rise and faith in the banking sector diminishes, it's almost guaranteed that there will be some kind of chain-reaction domino-effect. All we can do in hunker down on crypto assets and weather the storm. There is no safe place to hide in a scenario like this, especially in the short term. But we do know that crypto is the long term solution. Stay the course. Keep stacking.

Posted Using LeoFinance Beta