Alright, whelp, I'm officially now not 100% convinced about Binance solvency issues. When you get asked the question: "Can Binance withstand 2 Billion dollars worth of withdrawals," and you respond, "We'll let the lawyers handle it..." What? lol

The correct answer is that no amount of money being withdrawn from the platform would cause them to go insolvent. All assets backed 1:1.

So in addition to the stock market dipping recently, also the news that the company that was doing Binance's audit has frozen all their operations for all exchanges (including Binance)... which is weird and seemingly unexplained. Unsurprisingly, most are taking this as a huge red flag that something is wrong, which may or may not be the case.

Subsequently I moved to exit even more crypto off of Binance. Got my Rune out of there just fine but when I tried to do more the withdrawal emails stopped popping into my inbox. This has happened to me before but comes at a very very bad time considering these circumstances. I guess I'll have to just do a full exit ASAP assuming that's an option in the near future.

It wouldn't be the end of the world if I lost my crypto on Binance... only a couple thousand dollars, which is nothing during a bull market but times and tight in the bear market and that would certainly sting at a time like this. It's been fun playing with fire and leaving a bit of change of exchanges during all this but... I think I'm done. lol.

Bitcoin crashed from $18k

I mean I said it would. $18k is that critical level. If we would have broken through that we could start talking about the end of the bear market. Alas, it will probably take until February or March before we can discuss such matters. Too bad so sad.

Ah well I just got a flood of Binance withdrawal emails... so I guess doomsday has not arrived. Still, I guess I'll make the full exit anyway. If I just dump everyone on Binance I can pay bills for perhaps 4 months. With any luck the entire bear market will have blow over by then. If 2019 is any indication, a massive run is coming this summer despite economic conditions. Crypto moves faster than any market or economy. It is known.

CZ claims that all assets are pegged to liabilities 1:1, but that's what every exchange operator says. I miss the good old days when centralized agents only went bankrupt because they got hacked, and not due to their own blatant incompetence.

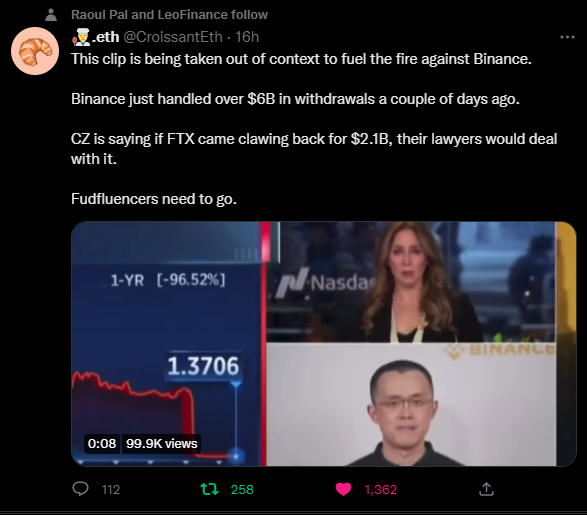

Hopefully CZ just didn't understand the question because English is a second language. She did ask it in a very weird way. "Including you have 2.1 Billion dollars to give away."? "If someone came to reclaw it" "to claw that back"??? LOL who talks like that? I will admit that the look she gives him when he answers in a stupid way is priceless. The Golden Eyeroll it will henceforth be so named.

I don't need to tell anyone that if Binance did actually go insolvent (which still seems pretty unlikely) that Bitcoin would crash even lower. How low? I'm still targeting the $14k area pretty aggressively. These are rock bottom levels. We just had a 3% dip and everyone is losing their minds and volume is up x5. Even a huge institution like Binance going under can't tank the price much more, but I guarantee most speculators would assume we'd hit at least $10k. Not gonna happen.

On a positive note all my credit cards are fully paid off, which gives me a huge buffer of money that again I could probably live off of for at least 3 or 4 months. Considering that the APRs on these cards are absolutely abysmal I wouldn't want to do that, but it is an option if I feel like "going long" and not selling the bottom.

lol of course

Yeah I had a feeling this must be taken out of context... duh.

So the 2.1 Billion is in reference to Binance owing FTX money... which is obviously not the case... or maybe it might be? I assume that the amount that FTX owes Binance must be more than the other way around, which is why lawyers would be involved. It all makes sense now. The Binance FUD continues.

But that's really no excuse to hold funds on exchanges at a time like this. It's long past time to GTFO and eliminate all centralized attack vectors. Luckily most people on Hive have maneuvered these situations quite gracefully, or better yet avoided them altogether.

Conclusion

No matter what happens Bitcoin is at or very near the bottom. It's also been inspiring to see the alt market standing on its own and not bleeding market cap into Bitcoin like it did in 2018/2019.

The next crypto bull market very well may be fueled by decentralized exchanges. Regulators are moving in with overaggressive hands, and crypto will move to stop them dead in their tracks. It will be interesting to see how they react when they realize that the exchanges themselves are immune to regulations.

If one thing is certain, it's that the need to decentralize is a permanent constant within this arena. Every time we get comfortable and start trusting authority a bear market comes along and everyone gets backstabbed. Even those who don't get rugpulled like me and you still get backstabbed because the entire market gets temporarily tossed into the shitter. Next time lets try and take a bit more gains during the bull market, shall we? Easier said than done, to be sure.

Posted Using LeoFinance Beta