What is an index in finance?

An index is a special kind of derivative in which multiple securities are aggregated into a single asset. This is very common with stocks for two reasons.

- First, it would be impossible to measure how well the market was doing without the index. If some stonks went down 5% while other stonks went up 5% during a given time period, how would we report that? Did the stock market go up or down? An index creates a hard number we can use as a valuable metric to measure success or failure of the macro side of things.

- Second, an index allows investors to diversify and hedge their positions using a single moniker. The index creates a very convenient anchor that investors can use to make sure they don't get wiped out on a single bad trade. Want to put money into a wide range of assets? Buy the S&P 500 index. That's 500 stonks put into one.

Wow 500 stonks? That's a lot...

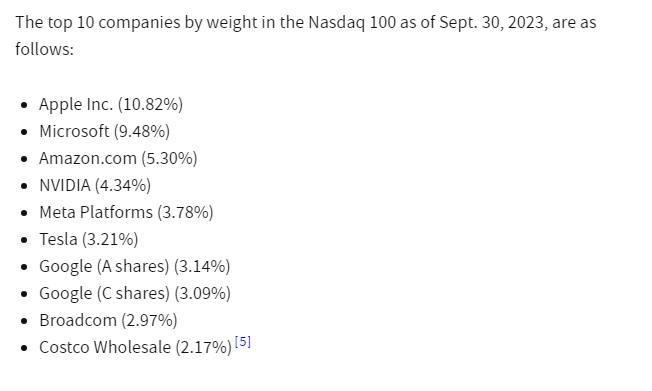

Yes and we can see from this rundown that not all stocks within this index are created equal. Apple alone is 7% of the entire S&P 500, which I no idea before now. In fact, the top 5 stonks: Apple, Microsoft, Amazon, Nvidia, and Google account for 22% of the entire index. Makes sense considering these are the strongest companies. Lower cap companies have lower weights.

We can see that the Nasdaq also includes heavy weights for Apple, Microsoft, Amazon, and NVIDIA, but this particular index only has 100 securities total instead of 500.

Interestingly enough indexes that are heavy on technology companies tend to be a good indicator for crypto. Tech and crypto are linked in that they are both considered risk-on with higher associated reward. When Bitcoin is correlated to legacy markets (most of the time but not at the moment) it's basically impossible for Bitcoin to succeed while these indexes bleed. Luckily a new narrative seems to be forming that is no longer risk-on and instead this "flight to quality" line is being parroted across the investment world for the time being.

Dow Jones Industrial Average

The Dow Jones is a particularly interesting index because it only consists of 30 stonks and has a history of decent performance over time. Of course the measly 10%-20% offered by the stock market means nothing to us crypto degens, so I will forgive those who have little interest in any of these things.

Personally I've only invested in the stock market one time, and that was when my father set up a mutual fund for me with Fidelity Investments. It's 100% crypto for me from this moment on.

So what about crypto?

Turns out that the logic that gets applied to legacy markets can not be applied to crypto, and is in fact completely the opposite in practice. For example, if you did what I did and "diversified" into a bunch of different ICOs in 2018, well then you got wrecked pretty bad now didn't you? Most ICOs were vaporware and eventually crashed to zero. Dead or dying, as they say.

Interestingly enough I have learned that buying Bitcoin is actually what one should do for maximum diversification in crypto. Why? Because Bitcoin is connected to everything and Bitcoin gets a piece of everything. Bitcoin has exponentially bigger liquidity pools. Every single token on every single exchange has a connection to Bitcoin.

I mean just look what happened with EOS. They were supposed to fund development of the network with their billions in ICO funding. What did they do with the money? They bought Bitcoin and hodled it... and if we're being honest that was probably the smartest thing to do with it. What's the point of taking a risk on a business venture when you can just plop the money into BTC and get a x2 return every year on average? The chance of being able to outperform that kind of value generation is very slim indeed.

Diversification is supposed to lower risk.

A diversified portfolio is designed to decrease volatility. That means lower risk and lower reward. However in crypto is plays out much differently. Often degenerates will diversify knowing that 90% or more of the garbage they are buying is going to fail.

This is more akin to venture capitalist investing than anything else. Take the loss on 9 gambles on the off chance that the tenth gamble pays out x100. Such is the lifecycle of VC money. It's no surprise we see so many VC chains in crypto out there. In fact Solana is making huge gains and is up over 20% this week.

Conclusion

If you want to be 'diversified' in crypto: you buy Bitcoin. If a friend asks you which coin they should get into: you tell them to buy Bitcoin. Basically if there's any question at all as to what kind of action should be performed, the safe answer is just buy Bitcoin and don't worry about it, especially at a time like this where my friend just transferred BTC to another wallet for 45 cents yesterday. When the BTC network is cheap enough to use for anyone there's no reason to go anywhere else.

Of course many people would ask me what about Hive. Yes, if you ACTUALLY USE a crypto asset in your day to day life, then by all means stack more of that asset. I use Hive every day. Hive is my biggest bag. This may not be the smartest play, but it is justifiable considering my specific situation. But if anyone were to ever ask me for crypto advice I don't fuck around anymore and I tell them to go BTC every time. The risk/reward on Bitcoin is simply too good, especially now.

Being exposed to many different assets at once in crypto is not "hedging". Don't take anyone seriously who says otherwise. Crypto is very complicated, and there is no way to understand even 20 different networks, let alone keep up with all the developments they make on a year to year basis. Personally I refuse to speculate on new things anymore. Either I'm going to use the thing or I'm not buying. End of story.