A lot of people out there keep having this reoccurring idea of a Super-Cycle that keeps getting proven definitively wrong. The concept is simple enough: once Bitcoin gets big enough it is assumed that attain a pretty much only-up status where a lot of the volatility just goes away while the price action would look a lot more like the stock market rather than being on a 4-year cycle.

Granted it does make a lot of sense that Bitcoin would eventually break free of the 4-year cycle created by the halving events. In fact this could happen as soon as the next halving or the one after that. At a certain point it's not going to matter at all if the block reward goes from 1.5625 to 0.78125 or 0.78125 to 0.390625 or 0.390625 to 0.1953125. Once the numbers get that low the halving won't mean anything on a fundamental level and things like operation fees and worldwide demand should completely overshadow the effectively-zero inflation rate.

That being said it is also ridiculous to assume that Bitcoin will stop being volatile.

There are several known economic principals that prove that Bitcoin will always be volatile and extremely prone to the whims of the market cycle. The most classic one being Gresham's Law. "Bad money drives out good money."

It might sound ironic, but bad money is the best money. Everyone likes to spend bad money and nobody wants to hold it. The bad money just has to be good enough that vendors are willing to accept it as payment. Bad money then becomes a game of hot-potato in which everyone is spending the currency. This creates something called "high velocity" which is actually good for the economy in question.

Good money (commodity), on the other hand, well no one likes to spend good money. Good money is that thing you only spend if you absolutely have to because good money like Bitcoin is constantly going up over time. Every time someone is forced to let go of good money they cringe. Everyone wants to horde good money, which makes its limited supply even more limited. It makes deflation more deflationary. The velocity of good money is terrible and it is prone to violent valuations depending on market conditions. And yet maximalists don't seem to understand any of this and blindly believe that Bitcoin will rule the world.

Bitcoin is better than stonks

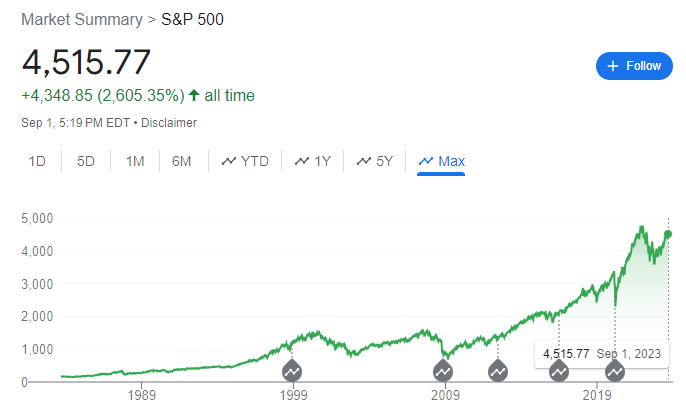

And yet people keep trying to compare Bitcoin to stocks because there is nothing else to compare it to. The chart looks like a tech stock, so lets just call it a stock, eh? But there is a reason why stocks tend to trend up slowly over time in an only-up fashion.

The reason why stocks trend upward is because they don't.

It's just a fantasy that exists in our minds because the zoomed out timeline has a longer history than Bitcoin. We can zoom out on the S&P 500 and see it's up x26 since 1983, but at the same time there were plenty of opportunities to hold value in the stock market for 10 years and the market would just trade sideways or only slightly up during that time.

Could you imagine such a thing happening with Bitcoin? I can't. It would be interpreted as a complete failure. The stock market and crypto operate on a completely different level that is constantly being conflated as the same.

All stocks are premined.

Every one of these securities is created with the idea that those who built the company are basically going to print money out of thin air and then sell it to the public. Each share counts as some percent ownership of the company. Again, Bitcoin doesn't work like that. It doesn't matter how much Bitcoin someone holds, they don't really have any power over the governance structure.

Bitcoin also can't print money out of thin air. Bitcoin has no "stock splits" or anything like that. When the number goes up, the CEO of Bitcoin isn't going to take gains. There is no equalizing force to make number go down except the natural market cycle.

So it makes sense why stocks go slowly up over time. It's a rigged system from the beginning. This is why securities law and the SEC exist to begin with. It has been decided that the system must be rigged through the proper channels in just the right way. Meanwhile, when Bitcoin spikes or dumps that's all just pretty much the free-market doing its thing. This is especially true if we include manipulations as included within the concept of a free market.

Finally getting to the point here.

It is assumed that institutional investors are smarter and more steady handed than retail and companies like Blackrock moving in will make Bitcoin less volatile. Of course by "less volatile" I mean less volatile in a downward direction. No one seems to consider that volatile up also implies volatile down. That's simply just how it works.

How's that theory working out so far?

First we had Michael Saylor. This is how we should expect institutions are going to act when they first get a taste of Bitcoin. The guy is a maniac. He's got the crypto definition of diamond hands, which tends to be the opposite of the institutional version. MAX LEVERAGE ALL IN BITCOIN TO THE MOON BITCH! Guy is bipolar for sure. Never a dull moment with Michael Saylor.

And then we have Elon Musk

Dude is the biggest troll ever. Also a very entertaining guy. What did he do? Again, another billionaire buying the top and selling the bottom. That type of behavior creates more volatility, not less. On top of that he was openly shilling Doge and legit manipulating the market with simple Tweets, which is crazy. Whatever happened to those lawsuits by the way? Oh yeah they were complete vapor; he did nothing illegal. Getting sued for financial advice is a bit more nuanced than that.

What about Gamestop and AMC?

Remember those? Some might have decided that Michael Saylor and Elon Musk are outliers and not to be taken seriously... but I assure you they are the standard. Hedge fund managers are just as stupid and greedy and impulsive these days, despite it being their literal job to behave in exactly the opposite manner. Melvin Capital was caught with their hand in the cookie jar shorting Gamestop into the dirt in one of the most famously overleveraged shorts of all time. Then they got absolutely wrecked by some autists on Reddit. Wild times we are living in right now.

The point here is that, NO, rich people are not going to play it safe and safely DCA the markets and create this up-only scenario people are talking about. This day in age rich people are bored as hell. Why else would Jeff Bezos create Blue Origin to galivant around with Musk and play space pirates? Look at what Bill Gates is doing. WTF. Why? It's like the world collectively is starting to break down in mental health crisis left, right, and center.

When people make a decision they tend to maximize that decision and go all in. Crypto is no different. Rich people are so rich these days that when they make a decision: the market they want to enter is no longer big enough for them to do so without making a huge splash and becoming illiquid. Bitcoin is that x1000, so the idea that it could somehow become less volatile at the precipice of institutional adoption is absurd.

Here's how it will go down:

Big money will keep tricking into BTC, but next market cycle it will become a flood. Everyone will feel invincible just like they always do. Most will overleverage their positions under the age-old adage of "the market can't fall that far from here". And then not only will the market eventually fall that far, but it will fall twice as much as that or more. This happens every time, and it's not going to stop just because various rich people jumped on board. I guarantee it.

Conclusion

Hedge fund managers and other institutional investors have proven time and time again that they are degenerates just like everybody else. Bitcoin catalyzes this stupidity with the insane gains that materialize during a bull market. No matter who they are, most feel that they "can't lose" during a crypto bull market. Anyone who hasn't yet participated in a Bitcoin bull market is going to make all the same noob mistakes as those before them. It doesn't matter if it is their professional job to play it safe. They won't. We know they won't. The pattern is clear.

There is another variable in play here as well, as Michael Saylor has already shown us. A lot of these rich entities are going to be able to hold their underwater position for an entire 4-year cycle. Many of them aren't going to be too broken up about making a big splash on entry and having to suffer through a bear market with everyone else. Some institutional investors will be diamond-handed like Saylor, and others like Musk will have paper hands and sell everything at the lows. This is all just part of the game. The winners will often be determined by actual experience with crypto. In fact experience with other assets can easily create overconfidence and a false sense of security.

The volatility must flow.

Count on it.