The only BRC I know are the bean-rice-cheese burritos from El Pollo Loco!

Of course this used to be a dollar menu item and now costs like $3 so...

inflation amirite?

How do I invest in beans?

Oh okay that escalated quickly.

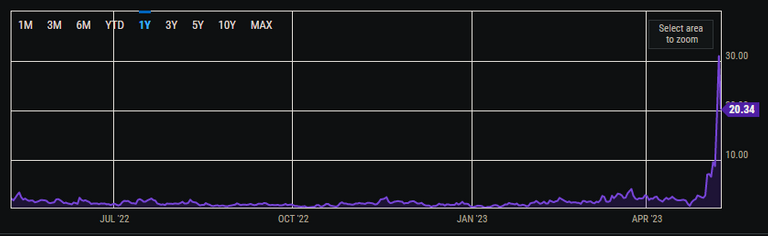

For those of us that have been living under a rock (like myself), tokens now exist on the Bitcoin blockchain. Unsurprisingly, Bitcoiners are not pleased. Hell, I'm not pleased! Can these people kindly piss off? Seriously though, as much as I hate agreeing with maximalists this is all getting very ridiculous. Before Ordinals came around a few months ago I transferred some BTC around for 1 sat per byte. Seems like a lifetime ago at this point. It didn't take long for fees to spike from 10 cents to $30.

Gross:

Now Bitcoin maximalists are coming out of the woodwork claiming that "low value transactions" need to be censored from the chain. Uh huh, and who determines what a "low value transaction" is? Gee, sounds like a censored and permissioned system they're talking about, which is exactly the opposite of what Bitcoin stands for. I take this as a sign that maximalists are so triggered that "shitcoins" have been built on the network and jacking up the fees that they've become even more delusional than usual; cannibalizing their on principals in the process. Classic blind zealotry.

Of course maybe I shouldn't put "shitcoins" in quotes

After all nothing interesting has been built in this regard.

It's all garbage meme tokens.

I must admit I had no idea that the recent meme-coin rally was essentially fueled by this technology. Did not realize the PEPE coin was built on Bitcoin using Schnorr Signatures and ordinals tech. I must be slacking... or perhaps I'm just engaging in my own form of maximalism by putting more of my focus on the Hive ecosystem. I guess not logging into crypto Twitter for a couple of weeks can have disadvantages after all.

Funny that I don't see many maxis claim that Schnorr Signatures need to be rolled back and no longer allowed on chain. They'd rather censor their own operations by getting majority consensus of the miners? That's interesting. Also seems like it would fail and only slow down the shitcoiners. How can you convince miners to ignore operations that are paying more than everyone else? Seems like a losing battle to me.

I will admit that it's a bit satisfying to see Bitcoin's 'infallible' tokenomics get rampaged by meme-tokens. Serves the maxis right honestly. However bittersweet such a victory is it's still bad for everyone at the end of the day. Bitcoin is the ultimate security chain. Now the ultimate security chain is absurdly expensive, not because users are paying for security but because they are dicking around with meme-coins on a network that isn't equipped to handle that kind of bandwidth. We need to be using the right tool for the right job.

Conspiracy theorists have even gone so far as to say that Ordinals and BRC-20 are a direct and purposeful attack on Bitcoin. As dumb as that sounds there is a bit of truth to it. This is an attack... just not a purposeful one. NFTs do not need Bitcoin's security. Meme-coins do not need Bitcoin's security. This is a blatant waste of resources and there's really nothing anyone can do about it. As far at the Bitcoin network is concerned: if you pay the fee and the operations gets picked up by miners then the operation is valid and valuable to at least one user. That's what 'permissionless' means. Deal with it maxi. These are your rules.

There is no such thing as spam when you have to pay the fee to send the message. Image what it would be like if it cost a penny to send an email. All of a sudden spam email would disappear (or at least become extremely intelligent and targeted). This is the difference between WEB2 and WEB3. WEB2 is free and easily attacked, while WEB3 is not free and that makes it much more difficult to attack. The cost of using WEB3 is mitigated by the fact that the operation itself can create more value than the cost. Thems the rules. Funny how maximalists just want to throw away the rules whenever it suits them. Of course not all of them do, and coming to consensus on this issue is going to be extremely difficult.

So what's the solution?

The solution is to do nothing and just let this scenario play out. The NFTs on Bitcoin are worthless. The meme-tokens on Bitcoin are worthless. They are a novelty and a new casino during a time of boredom and sideways chop in the market. The second these assets experience any kind of adversity everyone is going to cut and run and dump them all to zero. There is no community here willing to stick through downswings and keep it running. And that's fine. Let them learn the hard way.

One more thing

I see a LOT of people regretting they never bought the PEPE token before it mooned. Really? What about the thousand other meme coins that did nothing and then crashed to zero? These casino tricks are getting into people's heads thinking they could have easily been a winner without taking any losses. Please focus on something more productive. Retrospective gambling is such a fool's errand. Yes if you had a time machine you'd go back and buy some PEPE... sure. Welcome to real life though. Nice to meet you.

Conclusion

This entire situation makes me a bit more bullish on Hive. It's not a pleasant feeling to watch Bitcoin's fees skyrocket while the price trades flat. Of course I've already foretold this exact same scenario will eventually happen to Hive as well. It's inevitable. There's no such thing as free transactions. One day users will be paying for RC delegations and the rent-seekers market will return, reminding us all of the bid-bot era. Of course the difference being that bid-bots could be downvoted and RC-delegations can't. INB4 some jackass on Hive suggests we implement RC downvotes. LoL what a terrible idea. Almost as bad as removing the reward pool.

At the end of the day we just have to let these things play and see where it goes. Sometimes the best action is inaction. Allow the casino to fizzle out on its own terms and everyone can learn something.