That escalated quickly...

From breaking into the critical speculative level at $18k+ to completely busting out of the FTX collapse range ($15500-$18000) within the next two days. Impressive. But then again this is how we've seen crypto operate time and time again. There's often very little middle ground. All or nothing. Pass or fail. Glass cannon.

The current volume on the exchanges right now is outstanding. Better than I could have possibly hoped. Billions of dollars are trading hands across multiple exchanges independently. This gives us a lot of buffer in terms of mitigating a fresh dip. In fact, the market could crash all the way back down to $19k and we'd still be firmly out of FTX territory.

All of this comes in the wake of the SEC initiating a lawsuit against the Gemini exchange for selling unregistered securities in relation to their loan protocols. It seems like pretty bad news that the market would usually react to, but the market seems to be ignoring all FUD at the moment: something we often see when the bull market is back on and the price becomes untouchable.

Is this... a bull market?

Well, when you know, you know. And honestly at this juncture: we don't know. It's still pretty safe to assume we are still in bear market territory, and that the price action is just reaching more reasonable levels rather than being comically oversold. As much as I hate to admit it, in order for a real bull market to appear we might have to wait for the legacy economy to bottom out first. There are simply so many horrific signals popping up in that department that claiming victory over the current bear market at this moment would be extremely premature.

Of course whether we are in a bull market or not doesn't really speak to what we should actually do. We all know what REAL bull markets are like: completely and utterly irrational. Degen gambling on a new token ever other day. Money flying everywhere. Easy come easy go. Obviously we haven't even begun to see those days come back to us, but I'm still pretty confident that Bitcoin can bull trap all the way up to $50k before collapsing back down to the $20k-$30k range, even within the context of a bear market.

I've also seen quite a few people imply that Bitcoin spiking up like this before alts implies an alt-season where Bitcoin will begin to prop up the alts behind it. They even go so far as to say that anyone who hasn't noticed this pattern before hasn't been around long enough. Ah yes well, I have been around long enough to remember in 2019 this is not how it went down, and instead of propping up the alts, Bitcoin sucked liquidity from them and pretty much outperformed the entire market. As I've stated many times before, this can easily happen again with all the regulatory overreach we are seeing.

Then again the Ripple lawsuit with the SEC remains an absolutely Goliath wildcard in all of this. If they actually win it's a no-holds-barred guaranteed rampaging mega-run that very well could last for an entire year before coming back to Earth. We all know that they shouldn't win given common sense, but the application of the law is anything but common sense within these situations. Ripple has a much better chance of winning than they should, and that's good for everyone. The regulators and Gary Gensler are not our friends.

How could someone so boring be unreasonable?

Comparing the SEC to requiring seatbelts inside cars? Wow that is some dry stuff! I'm yawning just thinking about it... but at the same time, isn't he kinda right? I mean, sure, regulation by enforcement is totally counterproductive and doesn't make any sense. How can the SEC protect investors if they habitually wait for crypto to fail before initiating a lawsuit? That's not protection: it's just an added level of risk that kicks crypto investors when they are already down.

However when I watch that video on @garygensler's twitter... I honestly can't help but agree with him. There's nothing special about crypto banks (exchanges) that should make them exempt from the current laws. You know what should make crypto exempt from laws? Actually being decentralized and self-regulating, which the vast majority of services are provably not. For as much distain as I have for government and regulators: they are actually playing a critical role in the evolution of crypto.

The more heavy-handed regulations get, the better. Even the regulators know that they can't apply their rules to actually decentralized systems. They aren't dumb, they're just a bit power-hungry while at the same time like to exaggerate their own need to exist. Who doesn't? Everyone likes to be important and to justify their own actions as part of the greater good for society. No surprises there.

What is a bit more surprising is how badly some of these centralized agents have completely botched their services while knowing full well that the SEC is going to come after them given the first sign of trouble. The Winklevoss twins played it fast and loose. They offered a service under the pretenses that it was zero-risk, and then the entire thing goes belly up because oops, looks like there was massive counterparty risk the entire time after all.

So what is an agency like the SEC supposed to do in this situation? Just let them get away with their crimes? Sure, regulation by enforcement isn't the ideal scenario, and we'd much rather if they caught these things before the blowup, but at the same time is it really so surprising that an agency that enforces the law would... you know... enforce it? At the end of the day Gary Gensler is doing the exact job he was hired to do. His boring demeanor and freakishly beady bug-eyes be damned!

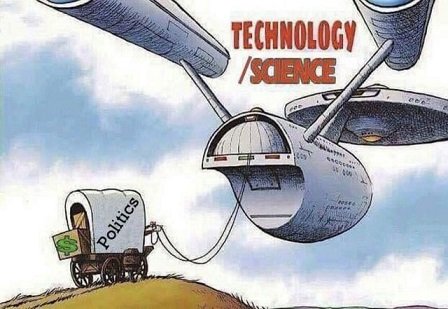

We should not be expecting the law to change so that centralized agents in crypto can run around with more power. That's not going to fix anything, and will obviously make the situation even worse. It's quite obvious that what actually needs to happen is that we remove these agents from power entirely and build systems and algorithms that regulate themselves. Easier said than done, to be sure. It's a journey more than a destination.

The leaders on the cutting edge should always be looking for ways to automate themselves out of the equation. Imagine that! It's the ultimate conflict of interest. No wonder why decentralization happens so slowly: the person in charge needs to sign off on their own irrelevance. This is not something we see happen often in the real world, but much like Satoshi Nakamoto's anonymity, it should be something that becomes more mainstream and accepted over time. Value eventually tends to flow where it is most effective when it comes to new tech.

Conclusion

Having such an explosive green day feels like a new experience, does it not? It's been a while, but the FTX contagion seems to be past us. Now we begin the slow grind upward to undo all the damage that was done by UST and 3AC. We shouldn't expect this to happen particularly quickly, but it's quite possible by summertime that we make it all the way back to $50k.

Unfortunately, given the state of the greater economy, even a spike to $50k will likely end in a short-lived celebration. We have no reason to believe that the legacy markets will claw their way out of this recession within the next 12 months. All we can do is let them flounder and hope our lifeboat doesn't capsize again.

Posted Using LeoFinance Beta