HBD is the best crypto investment out there.

Weird claim, right?

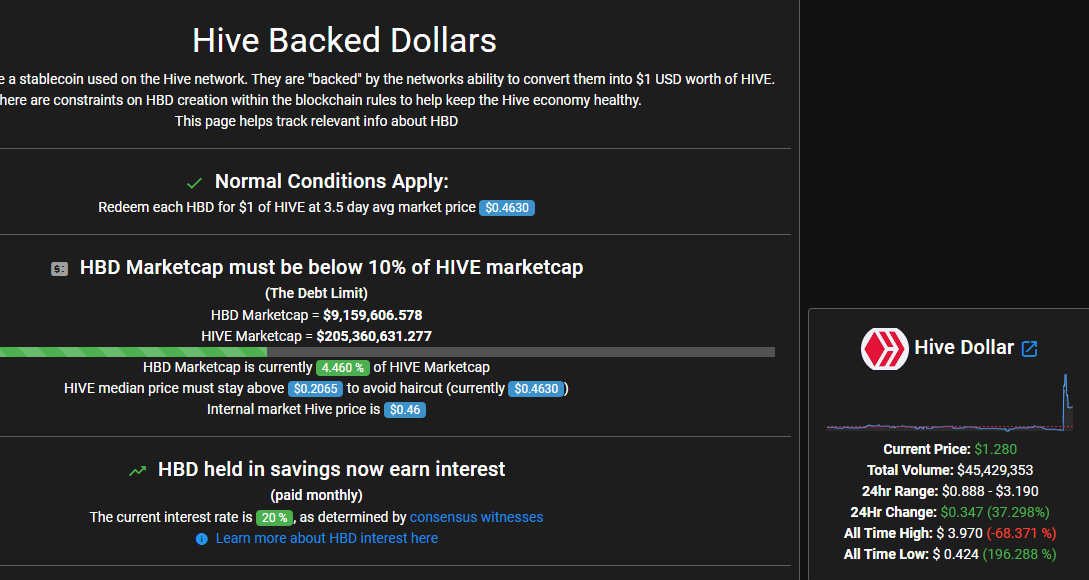

The best investment is some not-so stable-coin near the #3000 rank on the market cap? But there is some truth to the statement. The ability to earn 20% yield in the savings account is a better return than professionals make year over year in the stock market. Think about that a tick. All that's required is that the HBD be worth the same or more (in terms of USD) than you paid for it.

We've already seen that HBD has a robust history of staying alive (even if the peg hasn't been so great over the years). Several upgrades have come into play as well such as the HBD stabilizer and Hive >> HBD conversions.

I was actually going to write this post a couple of days ago, but now I have to now that Hive and HBD have spiked up so hard. We haven't seen HBD break it's peg to the upside like this since before conversions from HIVE >> HBD came into play. Now I'm realizing from my talks in Discord that I actually have no idea how this conversion mechanic works.

I thought it was the same as HBD >> Hive conversions

In this contract, HBD is destroyed, and then 3.5 days later Hive is created using the new average price of Hive. You might destroy HBD because it's worth 90 cents, but in 3.5 days this could end up being a loss or a gain depending on what the average price of Hive did. If Hive goes up you'll get less of it from a conversion, and if it goes down you get more.

I assumed that HIVE >> HBD conversions were just the opposite of this plus a 5% conversion fee to prevent arbitrage exploitation. This is absolutely not the case. Hive >> HBD conversions are extremely convoluted and a bit ridiculous (but have some interesting advantages). The documentation on this contract is also terrible.

Where to begin?

Oh I know, let's try the documentation found at Hivesql...

https://docs.hivesql.io/technical-informations/operations/txcollateralizedconverts-hf25

- let's say the current HIVE price is $0.10

- the user issues a collateralized_convert operation with 2000 HIVE (worth $200)

- 2000 HIVE are temporarily removed from the user wallet.

- the user gets 100 HBD (half of 2000 HIVE => 1000 HIVE converted to HBD) immediately.

Yeah no...

The fee is taken before the HBD is issued... so no, you wouldn't get 100 HBD. This example is wrong. Also this:

- the remaining 1000 HIVE are put on hold as collateral

- At the end of 3.5 days, if the price of HIVE hasn't changed, the user gets 950 HIVE back, that is 1000 HIVE - 50 HIVE (the 5% fee on the 1000 HIVE collateral)

AND THEN THEN DOCUMENTATION ENDS

lol what the fuck. If the price of Hive hasn't changed? Show me a single time that the price of Hive hasn't changed and is EXACTLY the same after 3.5 days. Way to explain what happens in the scenario that literally never happens. And then the doc just ends as if it was explained correctly. Mindblowing.

So I've been chatting a lot in LEO Discord about how this all actually works, and it's surprising complicated. Even if one figures out how the conversion works... good luck trying to parse how the contract interacts with the DHF and the stabilizer.

Long story short.

When a user does a Hive >> HBD conversion, they get the HBD instantly upfront. However, only half of it is converted. The other half is stored as collateral (plus a 5% fee is taken away right at the start). Obviously, minting the HBD instantly makes it a lot easier to stop HBD from pumping. But also an HBD pump inevitably pumps Hive because Hive is getting destroyed to mint the HBD. Because the HBD is minted instantly it can be dumped for Hive immediately and that Hive can again be converted in an arbitrage loop with 50% diminishing returns (because half of the Hive is stored as collateral).

Then, after 3.5 days, the collateral is returned to the user. How much collateral depends on how much the price of Hive has shifted in the 3.5 day period. I'll spare the details because I still don't fully understand it, but apparently there is a "lowest median price" blah blah blah. Trust me it's more complicated than it needs to be.

For arbitragers, by arbitragers.

Our lead dev, Blocktrades, runs an exchange. All exchanges are inherently arbitrage factories. Smooth runs the stabilizer. The stabilizer is an arbitrage factory. Thus it makes perfect sense as to why these conversions would be so complex and ridiculous. It fuels the arbitrage factories of the people who created the system. More conversation on this topic by Blocktrades and Smooth themselves can be seen here on Gitlab:

https://gitlab.syncad.com/hive/hive/-/issues/129#note_47514

Here's how I think it works:

This is not exactly how it works

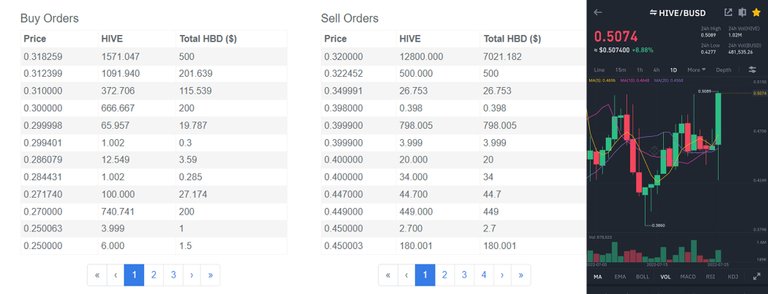

- Right now Hive has a 3.5 day average of 43 cents.

- Anyone can convert Hive into HBD somewhere around this price point.

- However, because Hive has pumped from these conversions it is selling on exchanges for 53 cents currently, the chance that the conversion is not worth it at this point is high because a conversion will sell the hive at 43 cents instead of 53 cents.

- However... again... after 3.5 days has passed the collateral needs to be returned to the user, and this collateral that gets returned uses the newer price point of Hive.

- To reiterate, if you converted 2000 Hive at 50 cents, 1000 of that gets converted into Hive instantly. That's 475 HBD (after factoring in the 5% fee). Now we have something like 1900 Hive sitting in collateral for this "loan" that will be liquidated 3.5 days later.

- After 3.5 days has passed, say Hive is now worth 60 cents due to all the pumping. The 1900 Hive collateral is now worth more money ($1140 instead of $900). The HBD "loan" was for 475 HBD. The user will get back something like $1140 - $475 = $665. At 60 cents a token that's a return of 1108 Hive. After everything was said and done 892 Hive was converted into 475 HBD (53 'cents' per hive; but this becomes much more worth it when HBD breaks the peg to the upside). It's also worth noting it required an upfront deposit of 2000 Hive to convert less than 900 of them by the end of the 3.5 day period.

Again, I have no idea if this is how it works.

It works something like this, but the details are convoluted as shit and the documentation is hammered dogshit (as is most documentation on Hive). Again, this is what happens when your lead devs run an arbitrage factory. Not saying it's a bad solution... it's actually pretty cool that we can get HBD on demand instantly. I'm just saying it's very complex, which makes sense given who programmed it and what their business is. Context matters.

5,546,763 HIVE in total were converted so far.

Pretty wild, eh? The Discord conversations we've had about this in LEO general have been extremely enlightening. Kudos to @engrave for being such a good sport and providing so much valuable data. I voted his witness today with my last remaining vote (currently #24 in rankings).

$0.437 (3.5 day) average

Hive's average price is way lower than the listed price. Someone on UPBIT apparently made a limit order for $60M dollars worth of HBD at a price point of $3 per HBD. What a jack ass. The Korean whales must be up to something.

We need to be very careful at this point.

The bearish new moon cycle is starting and the FED meeting is in two days. If you guys recall... I planned to sell crypto on July 25th. That's today. This HBD/HIVE pump was the best possible outcome. I dumped everything liquid I had into stable coins when I woke up. Now I can pay bills and buy the dip if and when it should happen. It almost certainly will happen if the FED announces another rate hike, which I expect to happen because it seems like the insider traders are already dumping the news. I guess we'll see.

2.4M HBD printed?

If 5.5M Hive was converted to HBD at a price point of 44 cents, then surely 2.4M HBD was just printed? Although, like I said, it might be half that because only half gets printed upfront as HBD. Still, seeing as there is only...

There's only 9.1M HBD in circulation... wut?

So even if we only printed 1.2M HBD today, that's still 13% of all HBD in circulation. That's a 15% increase from where we were at yesterday. Pretty wild.

debt ratio

This is what makes HBD such a good deal.

Not only do we offer 20%, but that amazing deal isn't even being scooped up. When considering our debt ratio is still less than 5%, we can see that HBD is incredibly sustainable at the moment. Especially true when looking at the haircut, which wouldn't kick in until a Hive price of 20 cents. Essentially all we have to count on is that Hive won't crash to zero and HBD instantly becomes one of the most valuable assets out there that seemingly nobody wants. Stable-coins aren't exciting. I have $0 in the savings account just like many of my peers. Hopefully that will change one day.

Conclusion

This post is a bit raw and unchecked. I gotta say I was pretty frazzled when I found out (sort of) how Hive to HBD conversions work. Still, it's nice finding out something new about Hive. Just when you think you know it all a curve ball pops up like this.

Hive and HBD are always being upgraded. The yield on HBD is better than professional brokers make trading the stock market. These pumps are always exciting but I've used this one for exit liquidity, as that was always the plan anyway. Now I'll easily be able to make it through a new bottom if we happen to get one. If not... no complaints either way. Balanced positions are key.

Posted Using LeoFinance Beta