Yesterday's News:

Today's News:

Well that's fun.

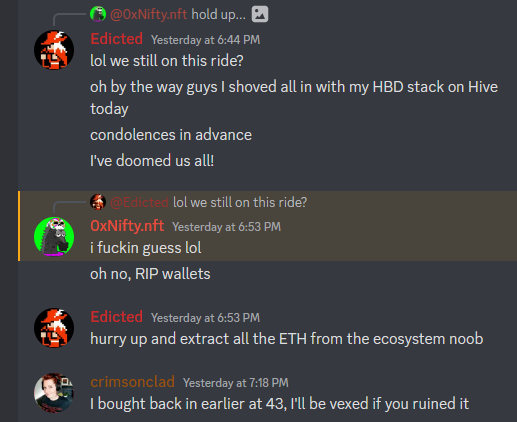

Last night in LEO discord I made a joke about going all in on Hive with my HBD stack. I apologized in advance for the market crash that was about to happen.

Then an hour later what does the market do?

It's actually funny how triggering events like these are.

The market flash crashes 5% and everyone is losing their minds. Clearly there's some major bear-market PTSD floating around even now. During a bull market when price dumps 5% nobody even discusses it; that's just another day ending in 'Y'. Meanwhile this situation is fishtailing in the opposite direction.

Luckily in my last speculation post I was quick to point this out:

I would be remiss if I didn't say I'm a little worried about Hive's position here. The 44.4 cent level that I recommended everyone buy at seems to be doing its job, but we all know how support on Hive can fall away at the drop of a dime.

Interestingly enough, we crashed to exactly the levels I was looking at before. $21k for BTC and 40 cents for Hive. The next support should this happen again will be $20k and 37 cents for Hive. Support at that level should be much stronger than what we are seeing right now. I don't expect to go lower than that.

So what's up with this Silvergate stuff?

Well first of all it's kind of funny that it's even called Silvergate because of the tendency to add the word "gate" after a conspiracy. Watergate, Pizzagate, Gamergate, Donutgate, all the gates.

At the end of the day Silvergate is just a legacy bank that crypto banks use as a middleman for their fiat ramp. Silvergate seems to be another victim of FTX contagion. A delayed reaction to be sure. The end of Silvergate may or may not create some supply chain issues with crypto/fiat ramps used by big players like Coinbase and the like.

The drop came late Thursday night, hours after several crypto companies said they’d stopped accepting or initiating payments to or from Silvergate

– including Coinbase, Galaxy Digital, Circle, Paxos and Bitstamp. Silvergate, which has become the go-to bank for cryptocurrency businesses, gave notice Wednesday that it won’t meet an extended deadline to file its annual report and warned it may not be able to operate another 12 months.

"We can't file our annual report & may close within 12 months"

lol that doesn't sound good...

No wonder why everyone dropped them like a bad habit.

I'm honestly wondering if this news is actually the reason that the market crashed though. It was very much a delayed reaction and it doesn't really seem like this development is going to matter at all. There are plenty of ways to get fiat in and out of crypto. Silvergate was a largely unknown entity operating in the background until this failure was made known. I didn't know anything about it until now... did you?

“The bearish turn could certainly be a delayed reaction to Silvergate’s ongoing issues,”

Since when does crypto ever have such a delayed reaction?

Usually the market trades before anyone even knows what's going on.

Just saying.

The only constant in this market is fear.

When I saw the price drop 5%-10% across the board in 30 minutes it reminded me just how badly rooted I still am in the scarcity mindset. As it turns out, this is a very frustrating experience. If I can't practice what I preach, then how can I possibly expect others with even less discipline to do the same?

It quite obvious that my portfolio is woefully off balance if a 5% dip can trigger any kind of emotional response whatsoever. To be fair the 5% dip happened in record time an hour after I shoved my stable-coins into the market, but still. I shouldn't have to worry about stuff like this anymore, and that's a problem. A 'me' problem to be sure.

In hindsight if the market continues downward many will look to this moment as the definitive trend reversal, but honestly it's still a coinflip chance either way. This seemed to be mimicked by the greed/fear index as well. 50/50

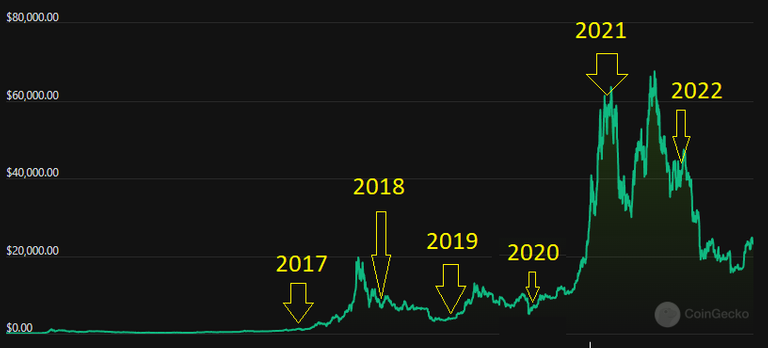

I'm still pretty convinced that this is a bump in the road into an even greater bull trap as we move into the summer. If this is a repeat of 2019, I've already pointed out that it started much earlier in the year than it did four years ago. The 2019 run didn't even start until April 1st. March is very often a pivotal month in which very little actually happens.

Case-in-point, even though March 2021 and 2022 were local tops, the price basically just chopped sideways the entire time. 2017 and 2019 were the base of a massive rally, but again nothing actually happened in March. 2018 was the trough in between two dead-cat-bounces; also a big nothing. The only exception was COVID 2020 which was basically an act of 'god'. I can't believe Hive was born during that same moment how weird is that? Such coincidences.

FTX contagion

Imagine if we could slide over to an alternate dimension where FTX had never collapsed. If we crop out the FTX contagion and the lows of $16k, what are we left with? Basically just boring sideways chop from this moment all the way back to July 2022. What I'm getting at here is that it feels like we had upward momentum because we crawled out of the FTX disaster, but really we've just traded sideways for 9 months straight. It's a lot more similar to 2019 than it looks on paper. But I digress.

Conclusion

As far as I'm concerned my macro outlook hasn't really changed much. I've been talking about a dip to $20k for a while now and nothing has changed. That is still the bullish scenario and a much needed confirmation. At this point any spot price between $20k-$25k is simply chop that should probably be ignored. We've been at this for 9 months now (day traders are very bored and coming up with a new narrative every week). FTX was just a bump in the road. I expect to be out of this range by the time the full year passes. That's a pretty common occurrence given all the consolidation phases we've seen.

2023 is a pretty exciting year for crypto. Looking around on Hive there are a lot of projects and critical infrastructure developments that are about to go live. Bitcoin is still the top dog and the safest bet, but also the most boring it seems. To be fair the two often go hand in hand. Lower risk lower reward.

I have a plan to set up a fund that can carry me through the next 12 months without having to sell any crypto. This will be a very good buffer to have in order to make sure further dips in the market don't have any affect on my stress levels and mental health going forward. Abundance mindset is key. Scarcity mindset bad. More on this some other time.

Posted Using LeoFinance Beta