Peter Schiff is rolling in his grave right now.

Oh wait, that dinosaur is still alive?

My bad.

Hahaha wtf.

Worth $12T

LOL! WHAT?!?

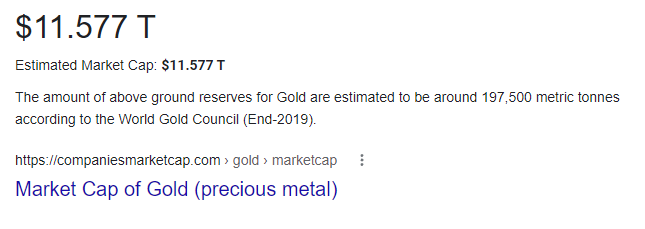

What's the market cap of gold again?

Uganda has announced that it has struck a deposit of 31 million tonnes of gold ore, with extractable pure gold estimated to gross 320,000 tonnes.

Hm so if the 320k and 197.5k tonnes estimates are to be believed, Uganda just found 162% of the entire circulating supply of gold in a single deposit. They just found more gold than the world has ever mined since the beginning of time. Insane.

Notice the language:

Worth $12T

All of the articles reporting on this use the same foolish, naïve, and childish language. This idea that supply and demand don't matter and that market caps are set in stone and price doesn't change based on the most obvious factors. As if the price of gold doesn't go down when it gets dumped onto the market. Comical.

When it rains, it pours

This is happening at the worst time ever. We are on the precipice of a financial disaster. Lot of people around the world wanted to hedge against that disaster by storing their value in gold, and then Uganda goes and finds a deposit of gold bigger than all gold in existence? That's insane. You can't make this stuff up.

I knew I preferred silver for a good reason!

Must be my psychic powers.

To be fair, mining gold is difficult.

It will take years if not decades to mine all that gold. Definitely no reason to mine it as fast as possible and tank the value of the asset being mined. The overhead cost of a huge mining operation is significant. No reason to spend a ton of money to mine more gold only to get less money out of it.

In other news, USA goes to war with Uganda to 'protect democracy'!

Pretty much every war is a war of resources and spoils. This gold deposit seems like a boon for Uganda at first glace, but a deposit that big could become a heinous liability down the road. Also, who owns this gold? THE GOVERNMENT? I assume so... Do we really trust any government to efficiently consolidate and allocate resources in a fair way? Scratch that... do we trust ANYONE IN THE WORLD to distribute resources in a fair way? No. To my knowledge I can't think of one single person or entity I'd trust with that much gold. I expect a lot of drama to pop up over something like this.

More like $6T max

It is absurd to think that the world supply of gold could be more than doubled and Uganda would be able to magically extract as much value as they wanted out of that market without making the price go down. At best we can assume that this amount of gold is worth half as much as is being reported. Of course nothing stops demand for gold from going up while supply is also going up, but to simply assume that will be the case is ignorant on the most fundamental levels of economics.

In fact, demand for gold could just as easily decline as the supply rises, crashing the market very quickly. What happens if we enter a massive recession and everyone stops buying gold jewelry? What happens if manufacturing processes change and less gold is used in electronics? What happens if crypto rises up as the new store of value, leaving gold in the dust? All of these things could happen at once, in addition to Uganda dumping more and more supply onto the market and getting whatever they can out of their insane claim.

Seriously though who's going to invest in gold after a discovery like this? First of all, gold isn't even an investment in my opinion. It's a robust hedge. It's that ultimate oh-shit button super low tech solution that only comes into play when all the higher-tech solutions fail. We never want this hedge to actually play out in our favor, because if it does everything is completely fucked.

Derivatives are worthless

With this concept in mind, a piece of paper that says we own gold is rendered null and void. If gold is a low-tech hedge, then buying the higher tech piece of paper/digital-ledger that says we own some is completely useless. In the event that the higher tech stuff fails we will inevitably lose all the gold we thought we owned as a hedge against the exact scenario that happened. Oops! Irony!

The only relevant way to hedge with gold is to physically hold it and secure it ourselves without the trust of a third party. It's one thing to do this with crypto and a completely different story with a physical commodity like gold.

Compare how easy it is to secure millions of dollars of crypto directly in our own homes. Nobody even needs to know if we just learn to keep our mouths shut. Contrast that with securing million of dollars worth of gold in our homes and that becomes a liability nightmare. People get killed for much less than that, which is why everyone wants to outsource that security to the professionals in the first place.

For me it becomes obvious that there's a definitive limit on how much gold a single person should ever own. Probably something like a single gold bar. The big ones are 400 troy ounces (12.4 kg / 27.3 pounds) which has a current value of $724k.

However, at the same time, gold is a hedge and not an investment, so it should really only be 1% of our portfolio max. Which means owning a $724k gold bar implies our net worth is a hundred time greater than that ($72.4M). Certainly possible given the crypto of it all, which is why I believe that crypto will make gold more valuable, not less. The people who believe in crypto (libertarian mindset) are the same ones who will use gold as a robust hedge.

The problem comes into play when the money is spent.

Crypto is easy to spend. I can spend crypto anonymously (or at least pseudo-anonymously) whenever I want. If I send Hive to Binance, no one knows if I actually sold the Hive or where that money went (except Binance: who actively protects customer privacy). Things get even crazier if I start transferring a privacy coin like Monero around.

Meanwhile, If I have a $700k gold bar in my basement, uhhhh... how do I spend it? It's not divisible and nobody accepts gold as payment. I basically just have to sell the entire damn thing all at once and hope I get a fair price without garnering too much attention. So many variables and ways that things can go wrong. Gold is still profitably counterfeit to this day.

Conclusion

The entire concept of money and value itself is purely abstract. Money isn't real. We make it real through our abstract economic systems.

This whole situation with Uganda shows us that physical money can literally just be found sitting in the ground even after scouring the Earth for this resource for thousands of years. Seems like the whole "gold asteroid" scenario is coming into play after all, but Uganda doesn't even have to go into space to get it.

I hate to take the crypto vs gold angle, but do we see this problem in crypto? Look out someone might dig a hole and find 400M Hive inside! lol, yeah not gonna happen. Truly, crypto is grossly underestimated. Most people out there simply do not understand the value of a provably scarce digital asset controlled by no one that is impossible to counterfeit. I suppose at the end of the day this is a show-not-tell situation. Trust is earned and proof is required. Mainstream adoption awaits.

Posted Using LeoFinance Beta