Yesterday I had the pleasure of speaking at the CTT Community Token Talk.

Was a good chat. We kept it civil, which is always nice with so many diverse opinions on such an important topic.

If I'm being honest...

The title of the CTT itself was a little triggering due to the debates on Twitter that occurred earlier in the day. "How to expand the HBD supply without using APR." When put into context with the previous discussion this very much feels like a strawman argument. That's because the main discussion is rooted in the idea that the 20% interest rate on HBD should be lowered. No one is worried about expanding the HBD supply. Hive >> HBD conversions will do just fine in combination with the stabilizer on that front.

Long story short the idea is that a 3 day locking period for 20% yield is "not fair".

It's too little risk for too big of a reward.

We need to increase the timelocks to a more "reasonable" level.

Of course I don't agree with any of that.

I remain quite unconvinced that the locking period matters at all when it comes to long term sustainability. Is a 1 year locking period really more sustainable than 3 days? What about 5 years? Aren't we just delaying the inevitable with that strategy? Engaging in the same Ponzinomics that governments employ to keep printing more and more debt to pay off the old debt? I'm not interested in that kind of "solution".

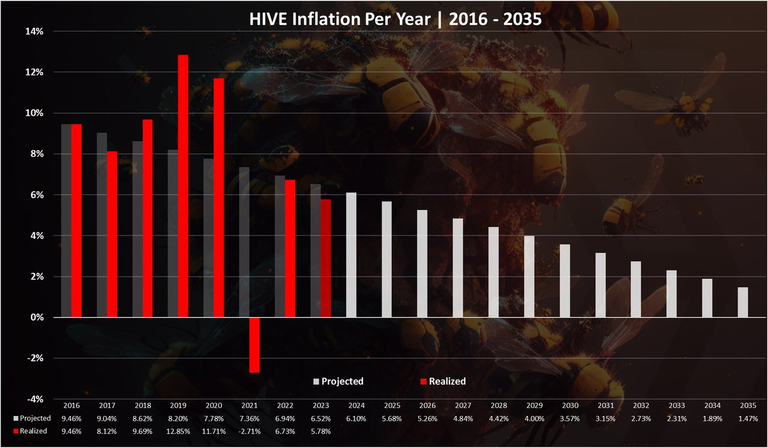

I've already discussed this topic at length so I'll try to move past it, but that's hard to do when all the data tells us that 20% yields on Hive are perfectly sustainable in this moment. Hive is not creating extra inflation to pay off this debt. The numbers don't lie. We are actually printing less inflation than expected. Creating Hive >> HBD conversions and offering 20% yields is a big part of that.

Three reasons why 20% is totally fine:

- USD is losing purchasing power every year.

This decreases the amount we owe back to HBD holders. - The demand for HBD is increasing and 20% bolsters that demand.

- The Hive market cap is 20 times the HBD market cap.

This reduces the cost to Hive to 1% even in the worst case zero-growth scenario.

The assumption that a 3-day locking period is the only risk of farming 20% yield is patently false. HBD absorbs the risks of both Hive and USD at the same time. If Hive fails, HBD fails. If USD fails, HBD fails. If USD loses 20% of its purchasing power in a year then the Hive network loses nothing by printing 20% yields to offset that dilution. If Hive's debt ratio ascends to 30% then the haircut gets activated and HBD holders are trapped within the system without the ability to exit for the $1 peg they were originally owed. Many of these talking points were parroted in the CTT.

https://peakd.com/hbd/@dalz.shorts/hbd-created-by-category-in-2023

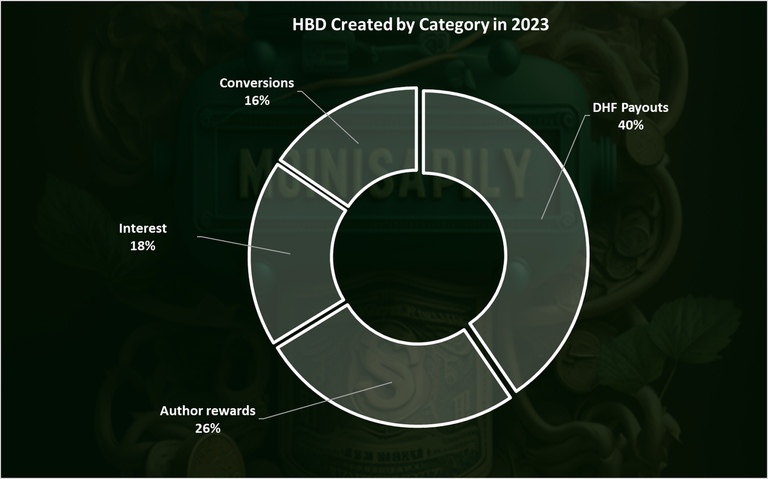

The HBD breakdown

If a 20% yield on HBD is so unsustainable then how is it possible that interest on HBD only accounts for 18% of the total emission rate? Make it make sense. @dalz was very good to generate this data the day after CTT, and from what I can tell pretty much all the analysis he generates points to the thesis that there are zero on-chain red-flags at the moment. Emissions are low and tinkering with the system without any kind of safety net will almost certainly result in a backfire. If it aint broke don't fix it.

But what about bonds though?

All good things must come to an end! If I had to guess I'd say that my opinion on the matter at this point is perhaps a bit irrelevant. Hive is moving in this direction of longer timelocks and potential bonding systems, and that's actually pretty exciting.

What is a bond?

A bond is just a loan. Usually it's just a loan to a "trusted" centralized agent. A government might issue bonds to fund a war, while a corporation might issue bonds to scale up operations (or buy Bitcoin). At the end of the term the institution that took out the loans is obligated to pay them back with interest. Because the issuers of bonds are often highly-regarded institutions that don't default on their debt this is considered a "safe investment".

With Hive it's a bit different.

This is because Hive is decentralized. That makes the issue very tricky. Why should Hive offer bonds if there isn't a centralized agent that can capitalize on the loan and make it profitable?

Locking HBD creates a "liquidity event".

Basically it makes number go up. Hive has to be taken off the market in order to get the HBD into the bond. So Hive price will increase, but if we create too much volatility by taking aggressive loans that would not be a great situation to find oneself in. Rather the best case scenario would be utilizing bonds to make Hive more stabile with a higher elasticity level during the market cycles we find ourselves in.

This creates a double-edged sword.

As is always the case with taking out a loan. If we don't leverage the loan into even more value than we have to pay back then the entire situation becomes a boondoggle. But how do we ensure we can capitalize on a loan when literally anyone can Hive can extract value from the spot price on the open market? This is why the situation is much more confusing than just issuing a normal bond from a regular centralized agent. The lack of centralized leadership makes it very tricky.

Conclusion

There's a ton more to cover on this topic so this post will basically just serve as an introduction to the issue at hand. It seems as though this is the path that Hive is destined to take. Three day locks for an interest rates are perhaps just a stepping stone to something much more interesting. I'll likely continue this discussion tomorrow as I attempt to organize my thoughts into a more coherent analysis.