Story of the World Tree.

The symbolism of the cosmic tree repeats time and time again across multiple established religions, philosophies, and long-dead mythologies. The most popular one, Yggdrasil (igg-dra-sil), is rooted in Norse Mythology, with the branches extending deep into the heavens, the trunk being connected our terrestrial reality, and the roots reaching into the underworld; connecting everything together as one.

It is also very similar, if not relatively identical, to the concept of the Tree of Life in which all creation was forged from. Either way the themes of origin, the unknown, balance, and higher powers are heavily prevalent. Even Christian mythology begins with Adam and Eve eating the forbidden fruit of the Tree of Knowledge.

Different parts of the tree are also associated with various common elements of nature. With the top bit representing fire, the middle trunk doubling as earth, and the roots associated with water. The tree is all encompassing with a connection to everything.

As a data structure.

It turns out scientists can also not escape the concept of the tree. A balanced and sorted tree of nodes can scale to infinity due to the exponential nature of forking. A tree with a trillion nodes only has to be searched 41 times even if each node only branches two times (2^40). The number of nodes doubling in size only requires one more lookup. It's a logarithmic solution. Much like the Fibonacci sequence, sacred math has a way of popping up in places where we least expect.

And what of Bitcoin?

We can think of Satoshi's invention as crypto's very own Tree of Life. There is no blockchain in existence today that would have been invented without the Bitcoin blueprint to draw inspiration from. The origin of Bitcoin, somewhat like the origins of life, are categorically unknown; A mystery within a mystery.

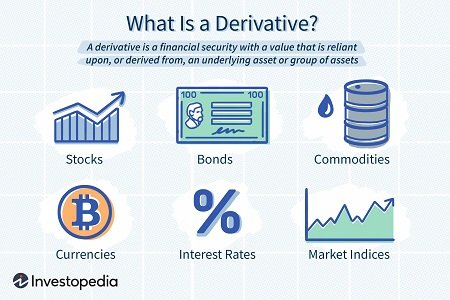

Using this context we might say that all cryptocurrencies in operation today are at least indirect derivatives of Bitcoin. That alone is interesting in and of itself, but also we are seeing several direct derivatives of Bitcoin being generated today.

But it doesn't stop at the futures market.

The first Bitcoin derivative was simply the existence of custodial exchanges. In essence, we give the bank our money and they write us an IOU in return. However, this type of derivative is most deceiving to the frontend user. Look no further than HiveEngine for confirmation. BTC on HiveEngine is actually SWAP.BTC. LTC is SWAP.LTC. Hive is SWAP.HIVE and HBD is SWAP.HBD. This denotes that every asset on HiveEngine is a wrapped asset derivative, not the native thing.

Centralized exchanges and other such banks give the client no such indication of this truth. We think the money belongs to us until something goes wrong and they say, "Oops just kidding that's legally ours." Bitcoin on Coinbase is a derivative IOU, but they advertise it actual Bitcoin, just like the bank leads us to believe that the USD in our account is real dollars. This is a very incorrect assumption on a legal level.

A derivative of...

- A bond is a derivative of debt.

- An interest rate is a derivative of yield.

- An ETF is a derivative of a physical product.

- A stock is a derivative of corporate ownership.

- An index is a derivative of multiple stocks.

Bitcoin as a physical product?

It's funny to see Bitcoin be traded on the open market like it's gold, silver, or orange juice. The ETF approvals are the ultimate evidence of this, even though we know that Bitcoin is already very much a natively digital asset.

Gold would not be digitally tradable without a corresponding derivative to represent it. Of course orange juice and corn would need the same type of support. Food cannot be sent to another person over the telephone line. However, Bitcoin can be sent to another person via ones and zeros. So why create digital derivatives of it if it's already digital?

Many would say it's all a conspiracy for the powers that be to trick plebs into giving them all the crypto. This isn't necessarily wrong, but it certainly is a reductive and oversimplified take. On a very real level Bitcoin is only as decentralized as it needs to be to operate without failure. It's a small database on purpose with low bandwidth and high fees, all by design. Creating derivatives is absolutely necessary to avoid network bloat. If someone else thinks they can create a better solution, then let them. That's what all these other networks exist for.

Creating derivatives is fun.

The first time I collateralized my crypto to create stable coins from it I was quite frankly blown away. Giving ourselves loans without ever having to sell or trade the underlying collateral? It's like magic, until the position gets overextended and we lose everything in a margin call. Still, the ability to perform this function responsibly is something I would have never dreamed of before it existed. That's only just the beginning of derivatives and DEFI.

Pristine Collateral.

Is it the fate of Bitcoin to just sit there and look pretty while we create derivatives from it? Sure, that very well may be the case especially if fees skyrocket to something like $100+ per transaction. The more institutions who decide to adopt the technology the more plebs will get squeezed out from the bottom of the pyramid and kicked off to cheaper (and potentially less secure) platforms. As someone who still uses Litecoin all the time I really have no problem with this. Cryptocurrency is the only system where trickle-down economic theory actually seems to work due to the inherent scaling issues and costs the run the network. Every shortcut has a pitfall, and every tradeoff has pros and cons.

The ultimate collateral of the future.

What happens if Bitcoin proves itself to be a better store of value than real estate, stocks, bonds, and precious metals combined? I mean I'd say it's already achieved this feat, but we still have to wait for that capitulation moment in which everyone actually believes it before the concept becomes truly self-actualized. What other derivatives will we see invented once this occurs?

Ironically enough, fiat itself can easily be printed from Bitcoin reserves should the need arise. Will this be the function that CBDCs actually perform if and when they get implemented? It's certainly a possibility. A backstop comprised of the hardest financial asset humanity has ever seen doesn't seem like such a bad idea in theory.

In fact with the current technology stack already in place it would be possible to create smart contracts that created CBDC currency from Bitcoin backed natively on the main chain. Even if the creators of the CBDC wanted complete totalitarian control over their own token it could be done in this way (in fact the vast majority of tokens are 100% controlled by the creators already). The Bitcoin collateral would be permissionless while the servers that govern the token would be operated by a centralized agent. I'm not saying this is a likely outcome but it certainly is possible, especially with so many people thinking a backtrack to the gold standard is the way to go. A Bitcoin solution would be so much easier to implement than that due to security and logistical issues.

Conclusion

Will Bitcoin be relegated from peer to peer currency to collateralized derivatives? It certainly appears that way from where I'm standing. As operation fees continue to skyrocket we must assume that actual peer to peer transfers of value will continue to decline. What's the best way to put that value to work without storing the data on-chain? Derivatives are the key.

Be it tokens on a centralized exchange, wrapped asset utilized for smart contracts, completely separated networks, or self-granted loans... the answer is all the same. The economy has a pattern of creating derivatives that are somehow worth more than the underlying asset on paper. I think we have to assume that crypto is no different until proven otherwise.