I've come to the realization that going x10 above the doubling curve on Bitcoin is likely a thing of the past. This is actually a good thing. Great even. This is the gift given to us by institutional adopters.

You see, institutions are sharks. They are diamond hands. They are steady hands. They are better at this than retail. They don't FOMO in at the top and sell and the bottom. They are here to make money, not trade like a chump like all the other retail investors out there.

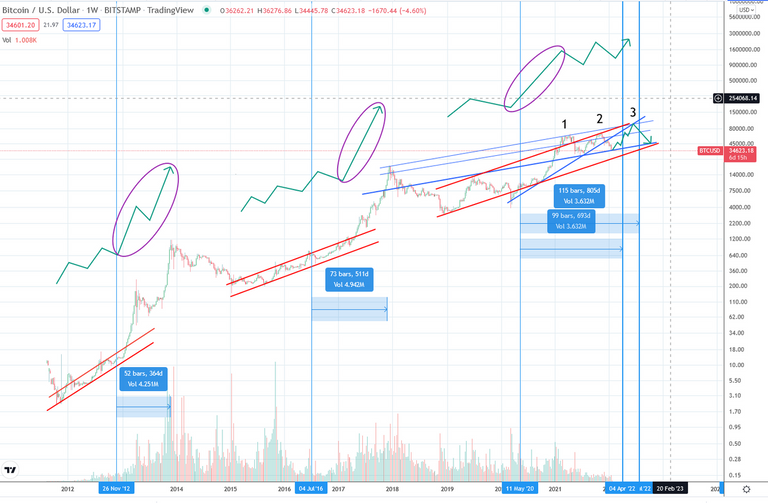

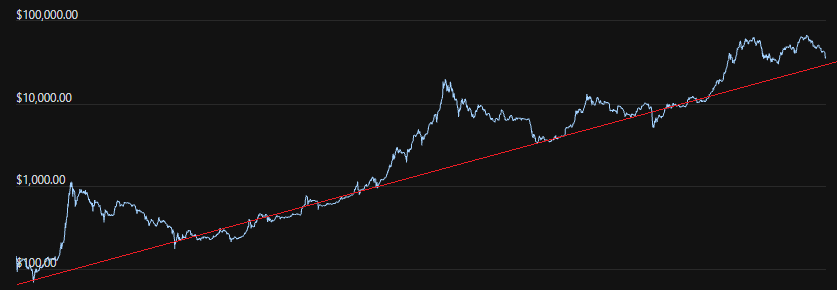

Many complained in 2018 that the CME futures market is the thing that crashed Bitcoin and ushered us into a multi-year "bear market". Yeah, last I checked Bitcoin is still doubling in value on average every year. Try again.

Bitcoin Doubling Curve

| 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|

| $100 | $200 | $400 | $800 | $1600 |

| 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| $3200 | $6400 | $12800 | $25600 | $51200 |

Trying to claim that the Bitcoin bubbled popped because the CME needle popped it, is like saying that the bubble was never going to pop. Just because the futures market gave users the ability to aggressively short a wildly overblown market, doesn't somehow equate to $20k being a sustainable number for BTC in 2018. It was going to pop no matter what happened. A catalyst just makes it happen faster; no reason to shoot the messenger.

With so much institutional adoption in play at this point, there really is no way for BTC to go 10x above the doubling curve anymore. There's simply too much liquidity and too many reasons to short the market long before it gets to that level. Now with all the infrastructure in place, it's literally impossible for retail to do something as stupid as bubbling prices by x10+. The institutions will not allow it; they will simply take gains and push the price back down to earth where it belongs.

And again, this is a good thing.

Institutions are bringing in liquidity, and half of that equation is pushing the price down when it's overbought. This is exactly what we want. What we want is elasticity and stability, not illiquid volatile markets. Institutions have shown that they will be the market makers, and they will get paid handsomely for the value they bring to the network.

Example short sale.

The ability for institutions to short the market creates liquidity where none existed before. Let's say you're the CFO of a company, and you're holding BTC on the reserves. All of a sudden, BTC goes x3 and you're thinking, 'Wow, this is amazing, how should I play this?' The obvious answer is obvious: short the market, idiot!

So you sell 10% of the $10M you had on the books, you now have $1M USD and $9M worth of BTC still. However, you take the $1M USD and you leverage that phat stack into a collateralized debt position. You x2 short sell, borrowing another $1M worth of BTC and dumping it onto the market. Now you have $2M USD and owe back $1M worth of Bitcoin, in addition to still holding $9M worth of Bitcoin.

But then BTC goes up another 20%.

And you'd think the CFO would be like, "Shit, I fucked up, I just lost money, I shouldn't have done that." But no, the CFO is ECSTATIC. He's thinking, WOW THIS IS THE BEST THING EVER I CAN'T BELIEVE THE PRICE IS GOING UP!!!

Why?

Because corporate sharks are not degenerate gamblers. He only sold 10% of his stack as a hedge. The price has gone up 20%, and thus the $9M in Bitcoin on the reserves is now worth $10.8M.

Assets after the 20% BTC increase:

- +$10.8M in BTC

- +$2M USD

- -$1.2M worth of BTC owed back to lender.

- Net worth: $11.6M

Yep.

Of course the CFO is pumped, he literally just made another $1.6M.

A degenerate gambler would see this as an opportunity cost.

But if I hadn't of short sold I'd be up $2M, omg!

But retail investors are idiots, so there is that.

So what does the CFO do?

- He doubles down on the short position, duh!

- Sell off all the profits that were made ($1.8M in BTC).

- Add the $1.8M to the $2M collateral for $3.8M total.

- Take out another loan of $1M BTC; dump it on the market.

New position:

- +$9M BTC

- +$4.8M USD

- -$2.2M BTC owed back to lender.

- Net worth: $11.6M

BTC spikes 30%

The CFO is floored... this is the best thing eva!

- +$11.7M BTC

- +4.8M USD

- -$2.86M BTC

- Net worth: $13.64M

So again, the CFO sells the profits ($2.7M BTC) and increases the hedge.

If you can't tell by now, the CFO can aggressively short the market like this... forever. If Bitcoin goes up, he makes money. If Bitcoin goes down, he still looks like a genius during quarterly reports because he took massive gains off the table. Now they can buy the dip or do whatever else with that money.

But you forgot about interest rates!

Oh yeah, didn't I mention it? The CFO mitigated all the interest from the loans he took, by loaning out some of the Bitcoin on his reserves to another CFO buddy of his in another company. You see, both of these CFOs were simply loaning money to each other and dumping those loans on the market for the short sale.

What?! Why didn't they just sell their own stacks?

Because if you sell SOMEONE ELSE'S money, guess what?

It's a loan.

A TAX FREE loan.

Loans are not taxable, so if you let someone borrow your Bitcoin, you are not responsible for what they do with the Bitcoin. They simply owe you back Bitcoin later, with interest. If you are the one borrowing the Bitcoin, well, you can't be expected to pay taxes on money that isn't even yours! lol. You see, this is how rich people can avoid taxes altogether in many circumstances. They have all the tools, and only now do we plebs get to be our own central bank.

Short selling lowers volatility & increases supply

We can see that this tactic of short selling as the price goes up basically makes it impossible for Bitcoin to 10x at this point. The more overblown Bitcoin gets, the more aggressive the short selling becomes, adding massive downward pressure to an already overblown market.

Impossible to lose

When short-selling is used as a hedge rather than a gamble, there is no way to lose money on the outcome. These corporate sharks will simply be locking in gains and setting up positions where if the price goes up they gain/lose nothing and if the price goes down they gain/lose nothing.

Once they realize that the bulls have lost complete control of the market they can stomp on the gas and start making actual money as the price drops, but even if they are wrong and the price goes up... they still won't lose that much money. They can tweak the variables and take as much or as little risk as they want using these financial tools at their disposal.

Many of us try to claim that the market is an unknowable beast and there is no way to trade this it, but Bitcoin is honestly pretty easy to predict when doubling curve support is just a straight ramp upwards on the logarithmic chart.

We must also realize that the goals of retail are much more ridiculous than the goals of institutions. We are over here trying to 10x our money, and institutions are going to be happy with a 20% year over year gain. Extremely happy in fact. When Bitcoin surpasses their wildest expectations they aren't suddenly going to start making stupid FOMO decisions like retail would. Again, they are the real diamond hands. They know what they are doing, and they've been doing it for decades.

Only one mega-bubble left possible.

At this point the only way Bitcoin can mega bubble is pretty much if every government, bank, and corporation on Earth suddenly realizes that their own fiat is worthless. Highly unlikely considering CBDCs are already on the way and people will always be gullible enough to trust what the government says.

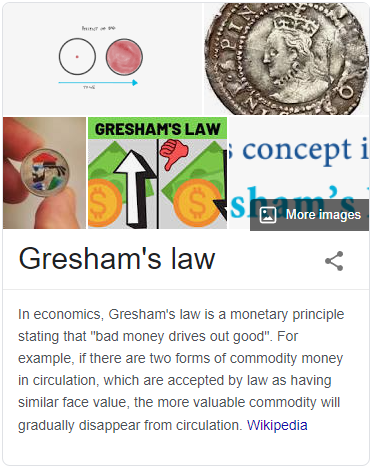

The way I see it Bitcoin will essentially be co-opted by these institutions and used to trade value among themselves, while at the same time trying to sling their respective shitcoins to anyone willing to buy them. According to Gresham's Law, this strategy will work perfectly.

Bad money drives out good.

It's hilarious to me that maximalists think that Bitcoin will become a currency used by everyone, while at the same time making the claim that it is, "The best money possible." Yeah, that doesn't mesh with about 2000 years worth of known economic principals. If Bitcoin is the best money, then it is guaranteed to be horded and exit circulation entirely, being used only for large transfers of value or as collateral for a loan. I think it's pretty obvious that this is exactly the direction that BTC is headed in.

Ironically it looks like the function of Bitcoin will not be to undermine the powers that be, but actually to prop them up and make it so they don't collapse into their own corruption. What a surprising twist of fate!

And you know what, I'm not even complaining about this likely reality, because it's probably the best one we could have hoped for. Society collapsing completely isn't going to serve anyone's best interest. This is not a zero-sum game. We can all lose, and we can all win as well. Bitcoin adoption puts us in a position of everyone being better off than they were before, even if it doesn't usher in some grand utopia that delusional maximalists shill constantly.

Conclusion

So what do you think? Will there be another mega-bubble? I'm highly doubtful, as simply the concept of short-selling puts way too much pressure on an overblown market without even incurring any risk. In fact, short-selling as a hedge LOWERS risk while bringing down the price, so the likelihood of a mega-bubble at this market cap seems absurd given this information.

Still, I would say these are all good things. No mega-bubble means no crypto winter. How can we complain about 2-month "bear markets" when the other 8-10 months out of the year are bullish? Only a greedy degen who feels entitled to a 10x gain for little to no work would think in such a way. Funny enough, that does seem to apply to 90% of the retail investors out there, and those unreasonable expectations are only going to burn us in the long run. Stay frosty.

Posted Using LeoFinance Beta