Dirp a Dirp a Dumb!

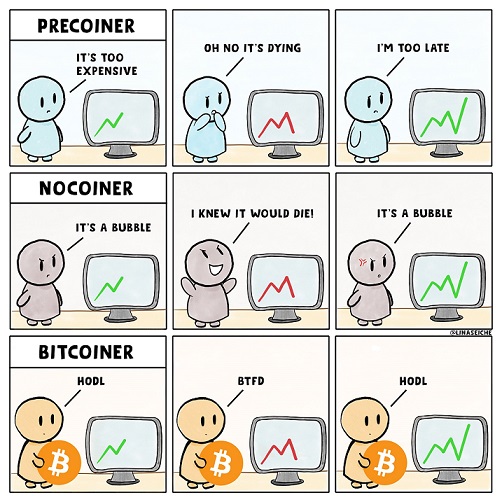

One question that doesn't get asked about the LUNA/UST situation is WHY? Why was there so much demand to buy and hold UST? Why didn't holders realize that UST was one of the riskiest stable coins to hold out of all the stable coins?

From personal experience I can attest that one of the big reasons that people held UST instead of other stables was because it was "decentralized" and had the most stable peg out of all the other algorithmic stable coins. Ironically, the mechanics that made it have such a good peg to the dollar were the exact mechanics that inevitably caused the entire thing to implode.

This mechanic was instant conversions.

The ability to turn LUNA into UST and UST into LUNA instantly at the current market price made it extremely appealing while everything was still in working order. This tightened the peg very closely to the dollar and made it the most stable algorithmic stable coin in the world.

Unfortunately, that which does not bend, breaks.

The relationship between LUNA and UST was so rigid, that as the debt ratio increased, the thing that made UST so appealing was inevitably what led to near-instant systemic-failure. Oh, the irony.

There's also something to be said about the interpretations of how this all went down. Many make the claim that something like twenty billion dollars disappeared instantly. Yeah... that's not how debt works. Read a book or something.

In reality, the combined market cap of LUNA and UST was less than zero even before it collapsed. That's because UST is the debt of LUNA. LUNA owed back that money and was essentially longing itself on leverage. LUNA was able to go x100 in a year because of this development, but then when a bank run occurred everything crashed to zero. Clearly, the actual market cap for LUNA was less than zero because it owed so much debt back to the UST holders. Oops!

And now people are saying UST wasn't decentralized!

So the reason because people bought into UST was because it was decentralized, but the reason why it failed is because it was centralized! God, people crack me up. Crypto bros refuse to admit that it was decentralization that failed here. This was not a centralization problem. The code was flawed. Get over it. Stop saying LUNA was centralized and that's why it failed. It's a silly argument. LUNA failed because the decentralized code that governed it was an absolute joke and doomed to fail. Many predicted this event beforehand, some of them even blogged about it on Hive way before the event took place.

And now we have the hysterical FUDsters coming to chime in.

Now that UST has failed there are dozens of people on Hive trying to say that HBD can do the same thing to Hive. Wow, that's some alarmist bullshit right there. These people have no idea what they are talking about. Good thing none of them are actually in charge. The people in charge of Hive actually know how Hive works, so that's good.

I've already gone over this a couple times so I'll keep it brief

- HBD has a 3.5 day conversion.

- HBD has a 10% debt cap ratio.

- HBD has a 5% liquidity gap between HIVE>>HBD conversions and HBD>>HIVE

All of these things make HBD much more unstable than something like UST (peg breaks a lot), but they also completely prevent the systemic-failure event that UST experienced. UST was only shorted in the first place because the debt ratio was already 80%, and within days it skyrocketed to over 4000% (meaning the market cap of LUNA was x40 lower than the market cap of UST). HBD can't even go above 10%, which is something I've talked trash about multiple times but, in the wake of this disaster I have more respect for it.

Do Kwon backing UST with Bitcoin.

Many point to this as evidence that LUNA was centralized. Again, saying LUNA failed because of centralization is foolish and ignorant. It's a free market. If the founder wants to collateralize an unstable debt ratio with BTC, no one can stop them. If a billionaire said they were going to stabilize HBD, would that make HBD less decentralized? Seriously think about the logic. It's nonsense.

The fact that Do Kwon attempted this simply proves that anyone who actually looked at the debt ratio already knew it was fully unstable and extremely dangerous. Again, it's a free market. There are no regulations. Anyone can do whatever they want. A billionaire being a billionaire does not somehow magically make a decentralized protocol centralized after it fails. Seriously though this is a big thing that people need to look it. It's full on delusional thinking to believe that decentralized code can't fail, and if it does fail it must be because it was centralized. I just can't seem to get over this one. DECENTRALIZATION FAILED. End of story.

BUT BUT BUT BUT 20% APR WAS UNSUSTAINABLE!

OMFG... shut up. 20% APR was perfectly sustainable. Crypto can go +100% every year and be sustainable for over 10 years. Bitcoin has already proved that. Again, people are trying to say that the interest rate of UST is what caused it to be unstable. Like... no. Seriously. Stop. It wasn't a 20% APR that increased the debt ratio to over 100%. It was the ability to convert LUNA into UST instantly at the current market price that caused it to be overleveraged. This is so obvious. People need to stop blaming the failure on other things. Too many "20% is unsustainable" arguments. Too many "centralization" arguments. It was the conversions combined with the debt ratio. That is all. 20% interest rates played only a very small part in increasing the debt ratio.

Conclusion

People bought into UST because it was the most stable decentralized option for a stable coin. Users wrongfully assumed that because UST was decentralized it had the lowest chance of failure. In reality, anyone that looked at the debt ratio and the collateral that this debt was based off of (the LUNA market cap) would be able to see the truth. I personally never bought any UST because I never did the research. Unfortunately others blindly bought in thinking they were safe.

And then the icing on the cake of this scenario is that in retrospect after the decentralized code failed everyone refused to admit that decentralization failed, and instead wrongfully blamed the entire debacle on 'centralization'. That's not how it works. We need to stop burying our heads in the sand and admit failure when it occurs. Outsourcing our failure as "centralization" isn't going to lead to anything getting better around here in the cryptoverse.

Posted Using LeoFinance Beta