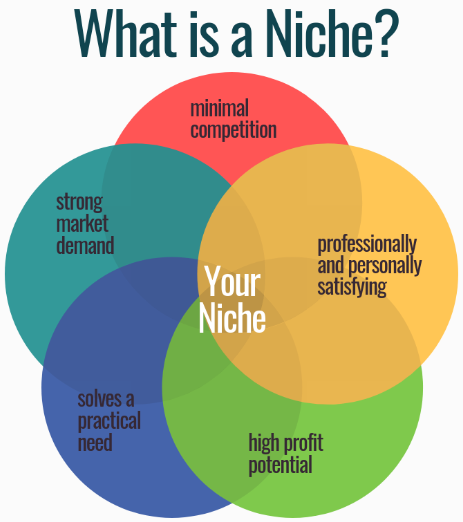

Within the context of decentralized infrastructure, the concept of a niche is very important. Every blockchain that claims to be a "general purpose blockchain that can do anything" is wrong. No one piece of the puzzle can do everything, that's the entire point. Thus, finding the niche becomes immensely important to not only distinguish our favorite chain from all the other options, but also to support those chains that many would wrongfully claim are "competition". A good niche helps everyone within the ecosystem.

Bitcoin as the anchor.

Like many blockchains that are first born, Bitcoin did not have a niche. That's because it was one of a kind. It was the only thing that did what it did. We can see that this status didn't last long as devs began to fork and refork the protocols and concepts surrounding cryptocurrency.

In the beginning, we might argue that Bitcoin's niche was an alternative to the corrupt banking sector. How funny is that? Bitcoin is itself an alt. However, as time went on and more and more chains started popping up it started to become clear that Bitcoin had the monopoly on one particular asset: security. And so security via the highest hashrate in the world coupled with 10 minute blocks (something no other chain dare compete with) became Bitcoin's niche after the fact. For example: we will never see a blockchain with a 20-minute block-time gain popularity. Never, ever, ever. That market has been cornered (and nobody cares and that's a good thing).

Unfortunately maximalists refuse to accept this fact and see fit to continually cockblock the ecosystem with their fanatical view that Bitcoin can, should, and will do everything going forward. This is a fantasy rooted in greed/tribalism/delusion/hypocrisy, and they're not going to snap out of it anytime soon. Perhaps they will be forced to when Bitcoin gets flipped, but that's not going to be pretty, as most of them will simply claim that "the market is wrong" rather than admit they were wrong. Classic humans doing human things.

![]()

Ethereum as an incubator.

ETH is one of those chains that also said they were going to do everything. "General purpose blockchain" that's going to be fast, decentralized, secure, and have low fees! Yeah, that's not how it works.

Ethereum's niche didn't become clear until the 2017 bull market narrative transitioned into the ICO craze. Now it has become quite obvious to me that Ethereum's niche is incubation. Ethereum is an incubator for other projects that are too small to make it on their own and require the infrastructure of ETH to flourish or expire depending on fate. But you'll have to take my word for it because as far as I know: I'm the only one actually making this claim.

However, I believe this concept of incubation as a niche has been even more reinforced during the last bull market that was fueled by DEFI and NFTs. When we look at the key function of DEFI it's easy to see how it was so easily able to flourish on an incubation platform. That's because DEFI was a massive upgrade for said incubation. All of a sudden DEX platforms like Uniswap were providing deep liquidity pools and atomic swaps between every different asset on the EVM chains. This utility was immensely powerful; potentially too powerful for its own good considering how many scams were being fueled at that time with all the new-money floating around looking for something to attach itself to.

If you doubt me I have but one argument to make: any project on EVM that gains massive success is guaranteed to move to their own chain and break away from the chain they were originally built on. I bet my life on it. We can already see how easy this is to do considering dozens of EVM chains are popping up on their own already regardless of success (mostly to subvert high fees elsewhere and capitalize on the deflationary gas token).

There's no reason to stay parked in a network of nodes that are doing a million other things when you're the biggest player in town. The only option is to fork to a new EVM chain and make the ERC-20 token the new gas token (just like Binance did). This is the perfect solution for sustainability while maintaining backwards compatibility to all other EVM nodes. Mark my words: this will happen many times.

Monero

XMR was one of those few tokens that built the niche into the protocol on square one: privacy. This was a good niche to pick, as clearly privacy was lacking, but at the same time it was also a terrible niche to pick, because the establishment hates it. But I suppose that was kind of the point, wasn't it?

I need to reiterate that once privacy coins like Monero get their liquidity back they are going to moon hard. They've been attacked and delisted from centralized exchanges left, right, and center. They're grossly oversold because of the fear that the regulators are going to somehow win this war of attrition. Spoiler alert: they are not.

When XMR gets listed on a DEX everything is going to change. Not only does XMR get its liquidity back, but also every other token on that DEX becomes private by proxy. All someone would need to do is move their coin into XMR, transfer the XMR one time, and then trade the XMR back into the token. This will completely break the ability to monitor where value is flowing, as XMR masks the sender, receiver, amount, public addresses, and even the node of origin.

The big problem with privacy coins is that if there is a bug or exploit it might go unnoticed for years while the hacker drains value from the ecosystem. Privacy is a two-way street. Transparency is the standard and zero-knowledge-proofs are mind-boggling. Also important to note that transparent blockchains become much more private when users gain access to spending the money on non-KYC platforms. If you never identify yourself, privacy is intrinsic to all cryptocurrencies. Be on the lookout for crypto city-states with no KYC. That's the ultimate end-game.

XRP

Ripple was also a token that build the niche into the cake: hooking up with the legacy banking sector. Considering this arguably dishonorable strategy of "sleeping with the enemy" combined with their disgusting premine, it's not worth talking about much.

What is worth talking about is the Ripple lawsuit with the Securities Exchange Commission. If they can actually win (and it looks like they have a good chance) people are going to start looking at XRP in an entirely new light. Their niche very well may become sticking the finger to the regulators and acting as a legal shield for smaller project that don't have the resources to defend themselves from regulators.

BNB

Binance coin is interesting because it shows how a cryptocurrency can act as a Stock 2.0. This is what I would call BNB's niche: Stock 2.0. It's not decentralized, and it doesn't need to be. On a legal level, it's not a security, even though common sense tells us it should be. However this token has way too much utility and reasons to hold it other than within the standard investment contract (proving my point). Hell there's an entire BSC EVM chain dedicated just to this extra utility that even people on Hive are building on. Crazy stuff.

BNB coin can do a lot of things. Used to be it would just cut down on your trading fees, but now it can be used in DEFI and on the beacon chain and CZ shows no signs of slowing down. I'm not saying it's a smart thing to hold, but it does have a niche, a very good trading history, and corporations aren't going anywhere anytime soon. Stock 2.0 may yet prove its worth in the field.

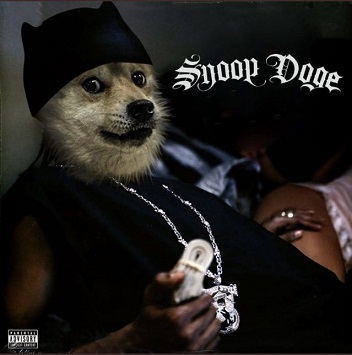

Dogecoin

What possible niche could Doge have? You might be asking this question, and it's a fair question to ask. Well, for one, it's a joke. It's a meme. It's a community. Doge proves to us that community is number one and that even a joke fork of Bitcoin can have real life-changing value associated to it. That's powerful, albeit enraging at times that irrational behavior gets rewarded by the mob.

Litecoin

Litecoin is the second cryptocurrency ever created, and that plays a big factor in the niche that it's found. In a way, Litecoin's niche contains a lot of redundancy. Many people think this redundancy is worthless because redundancy is a worthless attribute within the legacy economy. In fact in the UK layoffs are literally called "redundancies".

However I still use Litecoin all the time. It has great liquidity and is really good for transferring value from one exchange to another, especially if the amounts involved are less than a couple thousand dollars (the trading fee is less than the transfer fee of Bitcoin).

Litecoin is not an afterthought fork like Bitcoin Cash or BSV. The fact that it uses a completely different hashing algo is hugely significant, as networks like Bitcoin Cash will always be vulnerable to a hash attack coming from the Bitcoin network. This threat grows exponentially as governments, corporations, and banks migrate into the SHA-256 mining game.

Litecoin is more agile than Bitcoin, and we see that they're already implementing new tech like MimbleWimble (privacy) into the core code. The differences between the two will grow over time, and the Litecoin community isn't going anywhere. Redundancy is a key aspect of robust systems. Do not underestimate it.

Tron

lol

Cardano

lol (maybe one day it will do something)

ChainLink

The niche of ChainLink is oracles.

I'm not sure exactly how it works, but there are flaws.

And I'm biased because I'd trust a Hive oracle (witness) over link.

But what of Hive?

What is Hive's niche? We tried to program in one from the genesis block just like Monero did. Our niche was blogging and/or social media. However I've done enough research and been here long enough to know that this probably is not the case. We can embed JavaScript directly into the chain. Our transactions are "free" and blazing fast with near instant settlement. We have account recovery. We have time-locked yield farming, bandwidth farming, and coin voting within a pseudo-republic.

What is a comment even?

As someone who has actually dabbled in the code, comments on Hive are kind of weird. A top-level comment is a "post" while everything else is a short thread that hangs off of the posts. When I really try to put my finger on it a comment is less of a social media thing and more a declaration:

I may have added some value to Hive and you can reward me for that value with upvotes.

This is essentially what a comment is.

And that doesn't have to be a blog post or a response to one. It could be javascript. It could be an entire program. It could be a second-layer thing. It could be anything really, but the comment itself allows for the community to reward the value procured for the ecosystem (if any) with subjective architecture that revolves around stakeholders. Is this niche even definable?

I find it difficult.

Given this context I might try to make the claim that Hive's niche is distribution. We distribute tokens in a very unique way that incentivizes value to be built. I also might try to claim that this distribution is intrinsically linked to the governance and security of the chain, so perhaps our niche is governance? Unclear.

At the end of the day a cannonball of code can come out of nowhere and make Hive's niche very obvious. For example if some game on Hive were to go viral and it was filling up all the blocks and making RCs have a non-zero value, clearly our niche would pivot definitively to gaming. I think Hive's niche is still in a liquid position and may be determined at a later date depending on what gets built here.

Conclusion

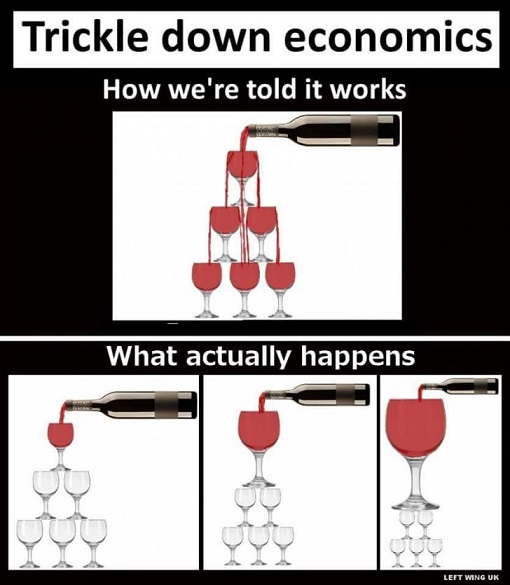

Well I once again thought this was going to be a short post and once again was able to ramble on incessantly and without mercy. Bottom line is that having a niche within the cryptosphere is crucially important, and any network that claims to do everything is provably full of it. Never trust someone trying to sell you the world. Trickledown theory actually makes sense given a non-centralized ecosystem. We must all find our niche within 'society'.