At the end of November and beginning of December, the price of Polygon (Matic) recorded good gains on the daily chart, however, some On-Chain metrics suggest that there are no conditions to maintain the growth in the short term, and the bearish could take control.

Source: Powerpoint image, Polygon logo taken from Coinmarketcap.

Matic is currently ranked number 10 in the market capitalization ranking, thanks to the fact that in early December the price of this asset recorded remarkable gains, which influenced the increase in traders' interest in this cryptocurrency, showing gains of approximately 8.5%. But some metrics do not reflect that it can maintain a sustained growth.

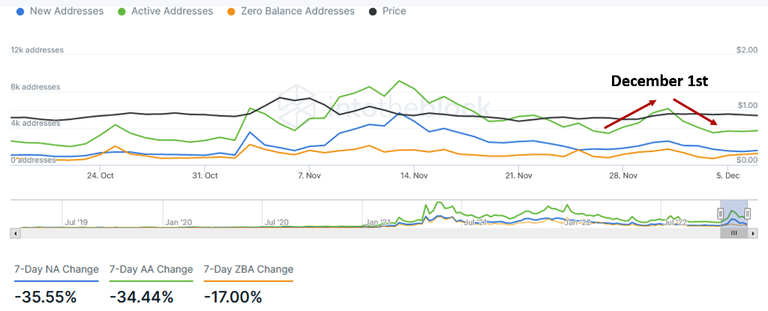

On the one hand we have that active addresses and new addresses are decreasing, in the last 7 days new addresses fell almost 35.5% while active addresses showed a decrease of approximately 34.4%.

Screenshot taken from intotheblock.com

As we can see in the graph above, between November 27 and December 01 we can see that the active addresses curve maintained a constant growth, going from 3.43k to 6.13k, which was related to the price increase, however, after December 01 the number of active addresses began to fall, reaching 3.73k at the time of this publication; an action that had a slight price correction. Recall that the number of active addresses shows the level of activity that a given network is having, so a decrease in active addresses is generally associated with less market activity due to a loss of interest in the short term.

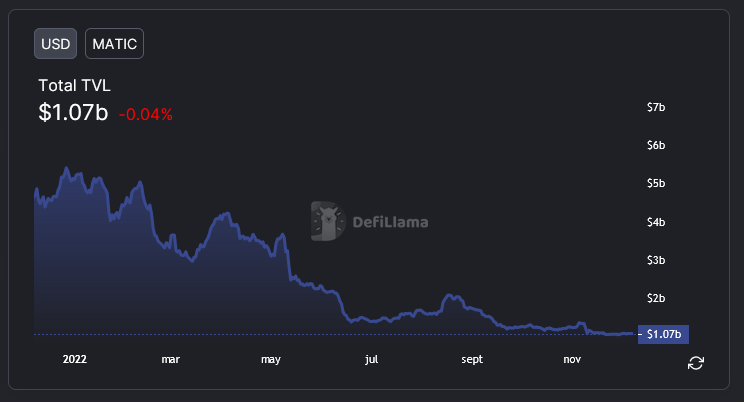

On the other hand, the total locked value (TVL) DeFi on Polygon is another metric that has also shown a decline. In the context of cryptocurrencies, TVL represents the aggregate sum of all funds deposited in decentralized finance protocols (DeFi). And in the following graph we can see that practically Polygon's TVL has been decreasing since the start of 2022, going from having approximately $5 billion on January 01, 2022 to almost $1 billion as of the day of this publication.

Screenshot taken from DeFiLlama.com

Although polygon has done well in terms of number of active users on the web3, ranking third, beaten only by BNB chain and Ethereum, in terms of active user count on the web, with approximately 311k daily active users according to metrics collected by Token Terminal on its website.

Screenshot taken from tokenterminal.com.

So, with the fall in the number of active addresses and the steady decline in LTV experienced so far this year, a significant increase in the Matic price will depend largely on investor euphoria and trader speculation in the short term.

Polygon (Matic) is today one of the most popular solutions in the crypto ecosystem for Ethereums scaling challenges, and although it seems to have problems in the short term, it still has a lot of potential and we may see a rebound in its price.

Well friends, I hope you liked the information, see you next time!

Posted Using LeoFinance Beta