''is that time of the week again?

Yeah, it seems is that time of the week again.''

Jesus, time flies. Have the feeling to be monitoring dozens of things at once and I'm not even noticing how fast the days come and go. As it's usual, let's try to make a recap for you, fellow readers & SEED holders. This week I'll be talking about the following:

- Equilibrium point reached. +30000 HBD in Savings + HBD/SEED Pool paying a 'constant' +12% APR

- DAO Analysis, Both Fundamental & Technical

- Brief analysis of SEED Supply.

- Comment on my recently deployed witness (@empo.witness).

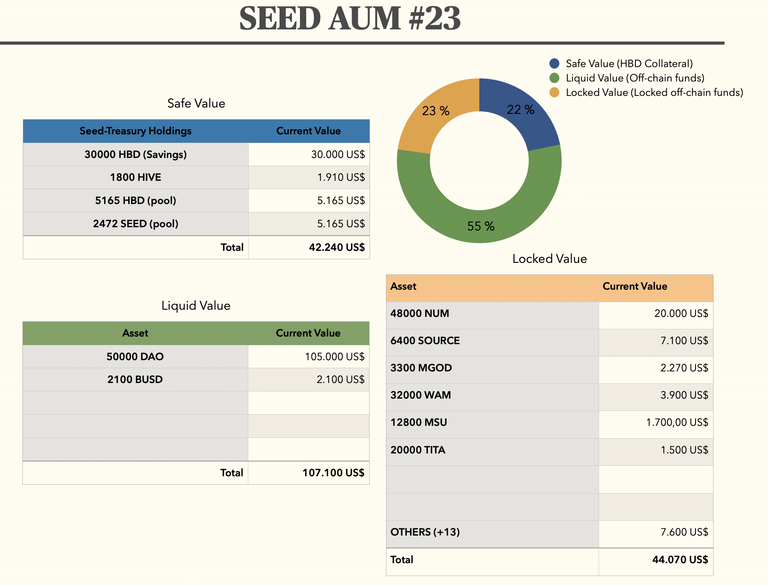

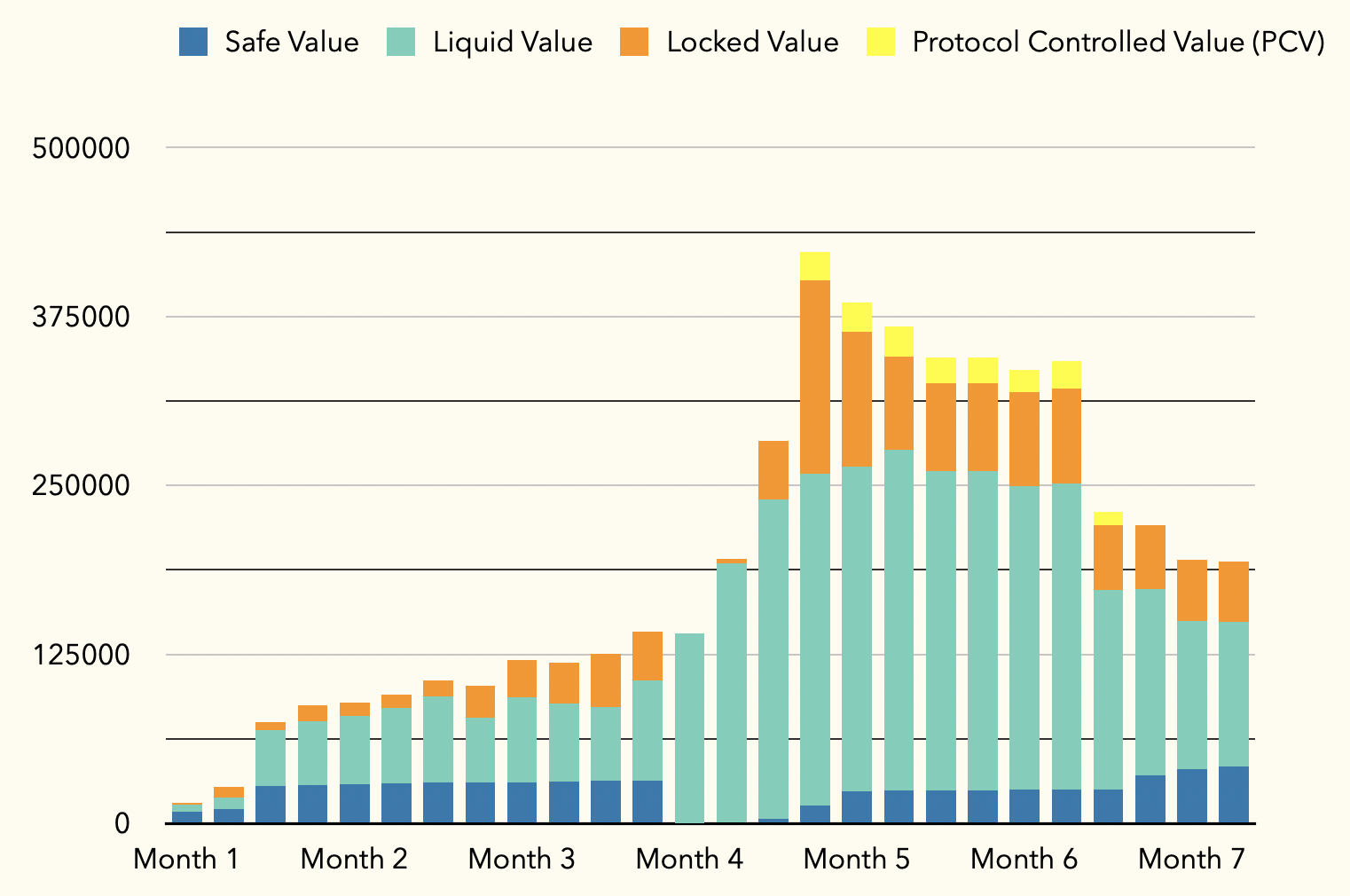

First is the typical colored chart and a few comments on that:

We reached for the second time the psychological milestone of 30K HBD in Savings. Moreover, @seed-treasury owns +5K HBD (plus the counterpart in SEED) allocated into the Diesel Pool from Hive-Engine.

In addition, the pool is paying +12% APR for pooling SEED+HBD. Rewards are paid in HBD and are non-inflationary for SEED.

The Pool rewards long-term holders by applying a 1% bonus daily for 50 days. That means that If you pool SEED+HBD today and wait for 50 days, on day 51 you'll be receiving a +50% bonus Vs someone who just entered the pool.We hold 2100 BUSD for new token presales, which have been a bit slow lately to come in lately (more on this later).

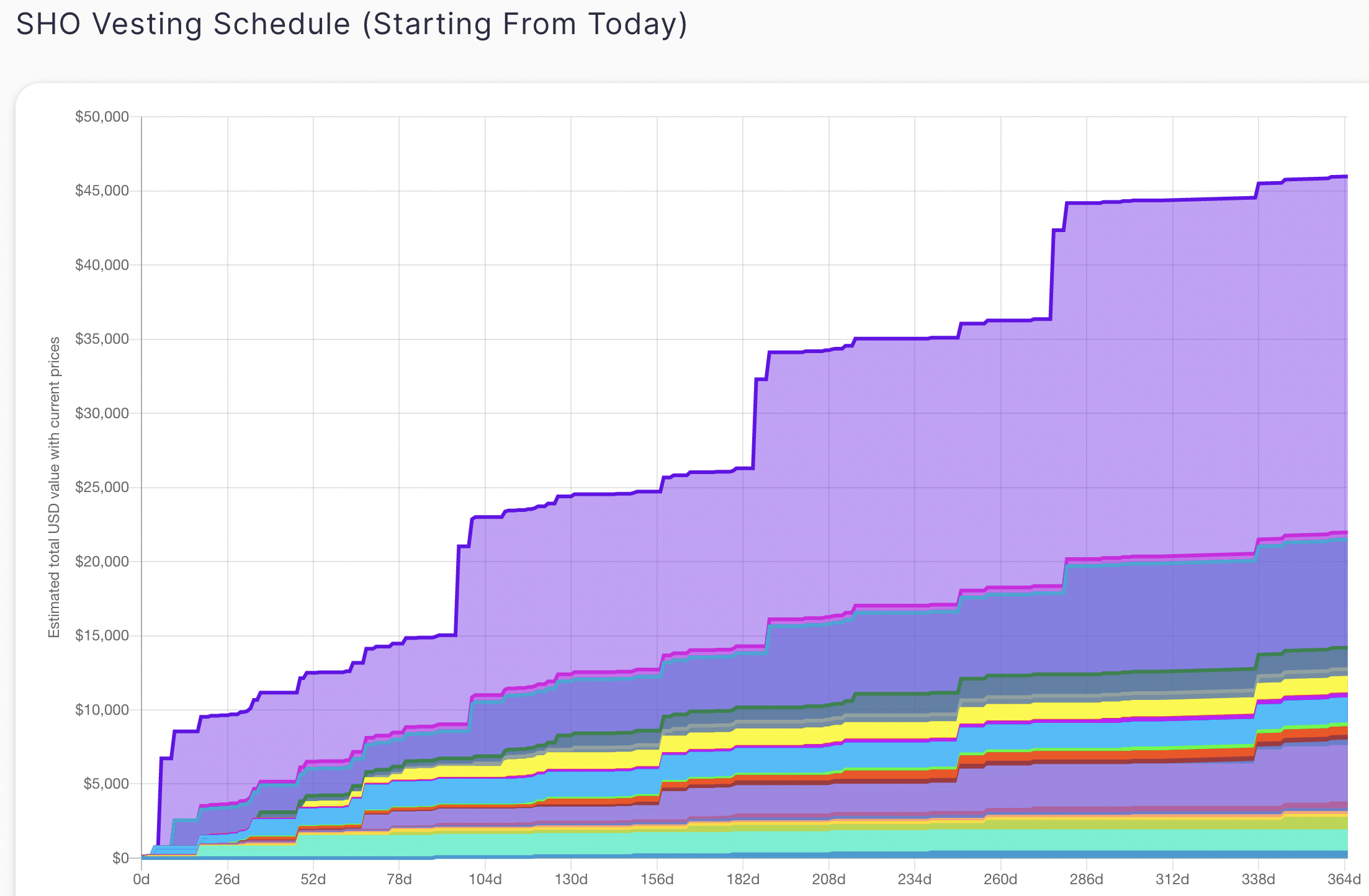

'Locked Value' Portfolio is being obliterated Since most projects there still have an unhealthy token distribution. I'm selling the new batches of tokens as soon as I'm allowed to. We're unlocking 6000$ worth of tokens in the next ~10 days from the NUM presale which is by far our biggest jackpot.

'Locked' Positions of less than 1500$ worth of tokens are being aggregated into the 'others' category to keep sections clean. Currently 13 projects & their respective shitcoins.

Let's make a brief $DAO analysis, Both Fundamental and Technical.

In the last weeks (10 weeks to be more precise) our main token in the portfolio, DAO, has been falling off a cliff. From the highs of 6 dollars in early December, down to 2$ at the time of writing. Since I'm just merely watching from the sidelines (as It's one of my favorite long-term holds and I don't want to lose pending vested tokens) I've been observing carefully what happened (apart from market conditions that affect every other token) and won't hide that I'm loving so much what I'm seeing with DAO Maker. More on that.

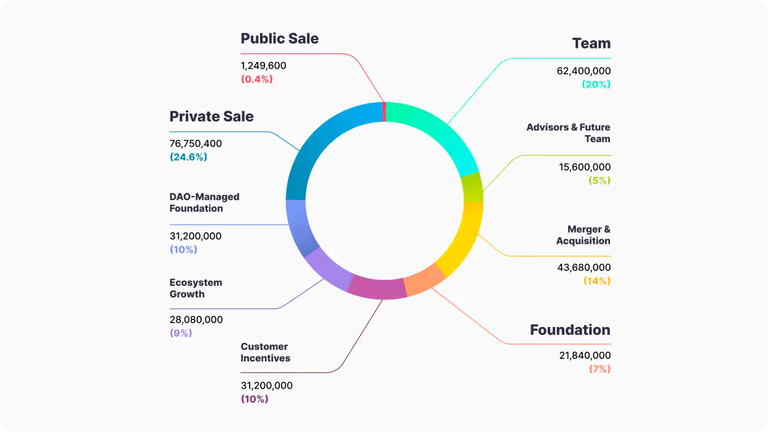

DAO (the token, not the company) is merely 1 year old. Had its token sale where Private & Public buyers had the opportunity to buy up the 25% of the token supply at 0,1$ the piece (x20 at current prices; x60 at ATH). The remaining was distributed as follows and has long time vesting periods:

- Public & private Investors (25%)

- Team & advisory (25%)

- DAO & Foundation (17%)

- Mergers, Customer Incentives & Ecosystem Growth (33%)

In the past year, DAO Maker had a few problems with hacks and they faced a profound restructuration from the roots to keep being competitive. One thing that they did and I liked a lot was assuming their part of the guilt.

They fired responsible people from their security departments and a few advisors. Therefore burned their proportional part of the pie.

From the max possible theoretical supply of 312.000 DAO tokens, DAO Maker burned ~34 million tokens from team members and advisors (this represents ~10% of the total supply). Loved the fact that as a company they're not allowing time for child's play.

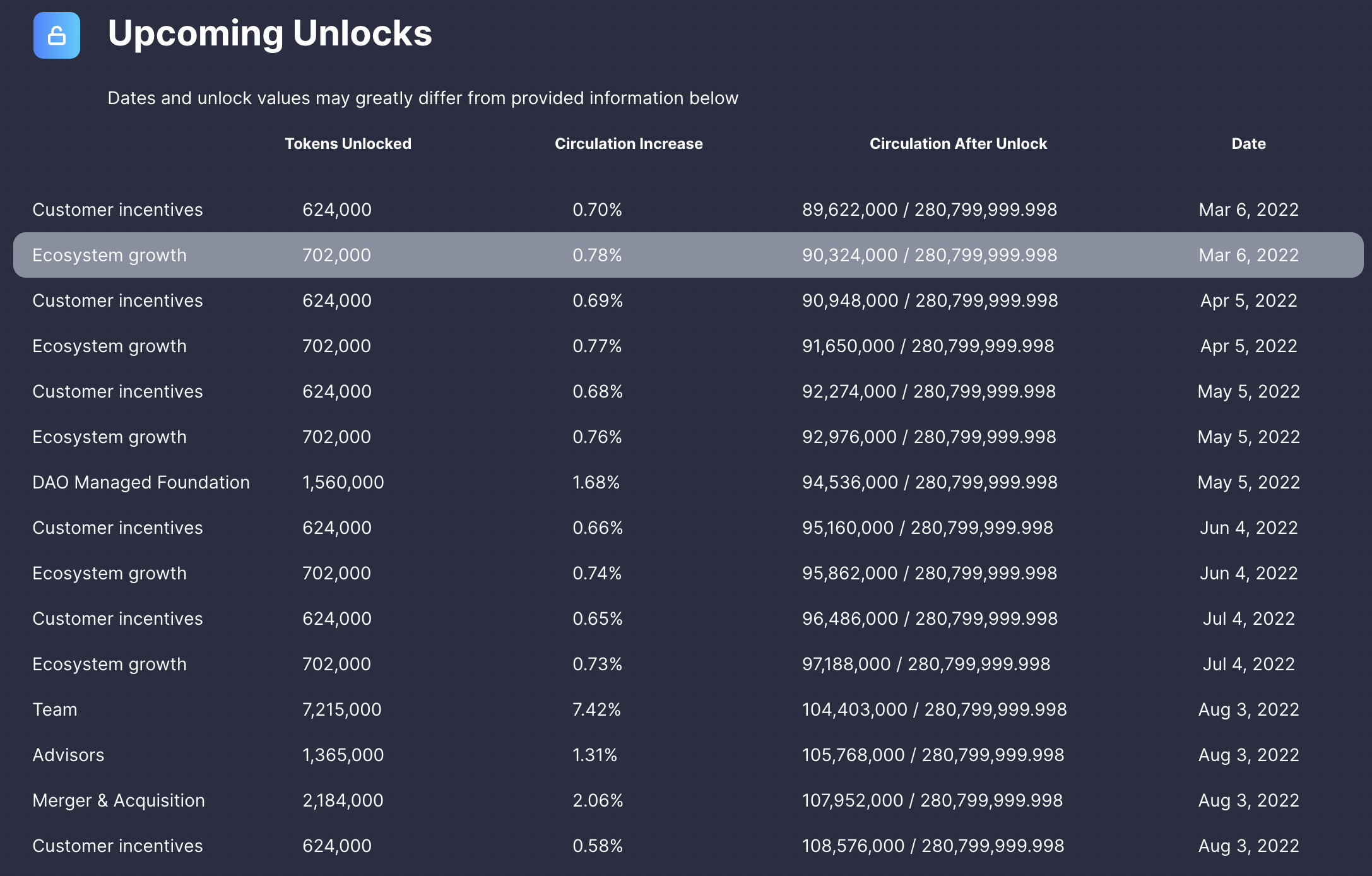

Private buyers always going to dump

This is an unavoidable truth. And especially after insane multiples like x10 or more in no time. The good news is that regarding DAO, these tokens are fully unlocked. And I'm suspecting that this fact alone is very responsible for the hard dump of DAO from the highs.

From now on its clear skies since the remaining supply will be gradually unlocked in 4 years representing a diminishing 1,5%/monthly increase in the supply which is perfectly manageable by the crypto market volatility. Also, note that except for the part of the 'team' the rest is used to favor 'everyone' (what I mean is that no one single entity is receiving a big bunch of tokens at once).

Ps. What do you think about these charts?! Pure Madness from an investor standpoint to get this kind of data.

Not only that, big amounts of DAO tokens are being burnt by the Venture Yield Program and another big chunk is being staked daily for long periods of time. Currently, ~50% of the circulating supply is staked for 550 days on average.

The unlocked funds from the above categories seem that be being used to expand DAO's reach. This last month alone DAO has been listed on Bithumb & Coinbase Custody (and you what this means next...)

On the technical side, all my alarms are screaming 'BULLISH!'. Sitting at Long-term support, plus MACD crossover + RSI oversold + Confluence.

Side notes on the DAO model and our current SEED supply distribution.

I always admired the way in which DAO Maker is transferring value from their incubated projects to its main token. I try to do the same for my own venture; SEED and I won't stop researching/learning new ways of doing this (which is work done on an ongoing basis).

We're still very pegged to DAO in that sense (since the lion's share of SEED is allocated into DAO), but this will change over time as we consolidate other revenue sources (atm the second-best is HBD Savings).

I'm very excited to see how the project evolves in that sense and how SEED will potentially evolve into a transparent money-making machine for its holders (remember, we're a profit venture). It's still very early to begin our transition to a more decentralized structure (if that ever happens, which is still to be seen). But I find it interesting to check how we're currently distributed.

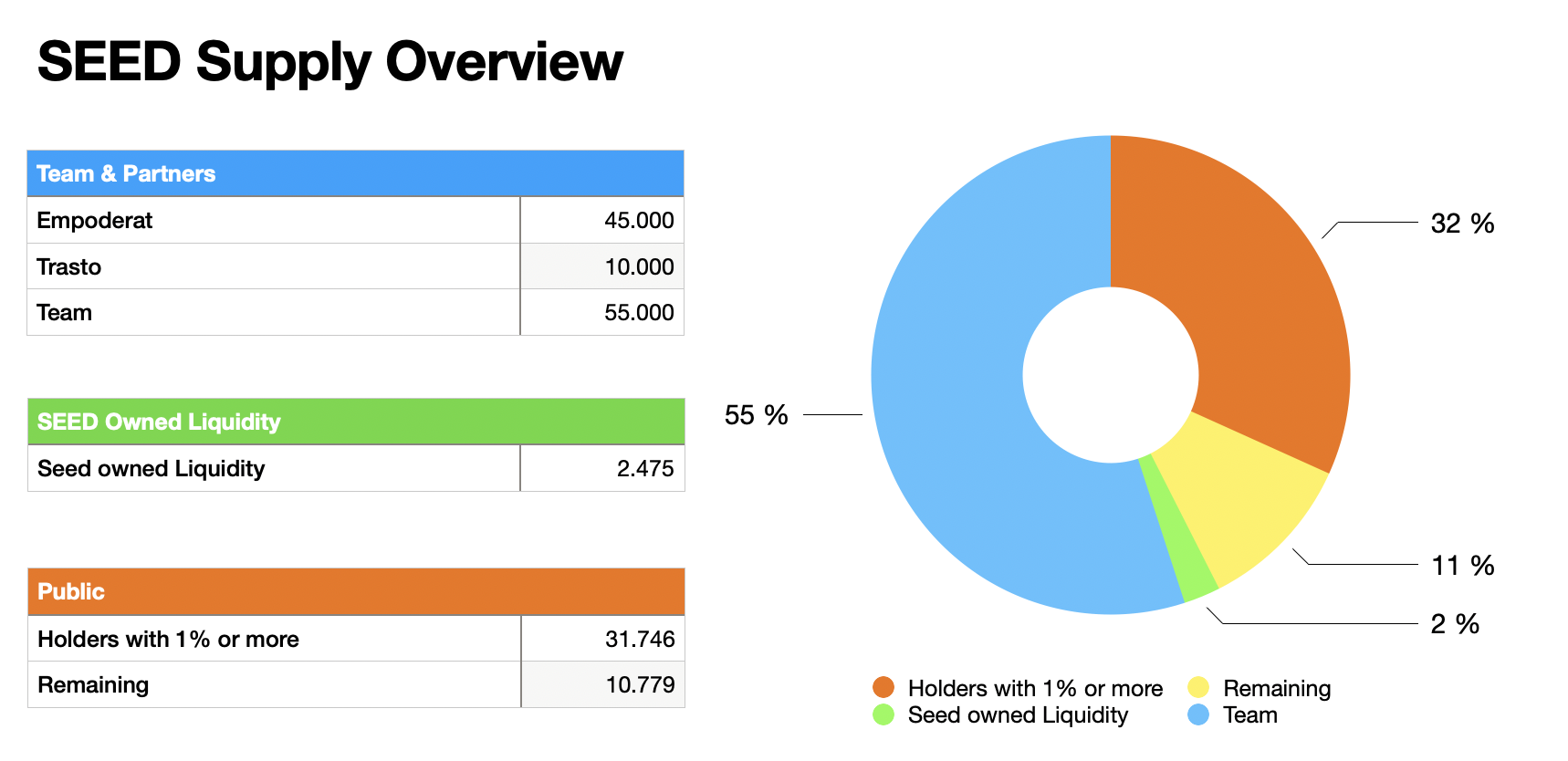

Currently, our whole supply stands as follows:

The current HBD in savings could satisfy almost 50% of the Public holdings (assuming everyone selling NOW at 1,9$ SEED). There is still a long way to go but we are doing well. If our DAO holdings pump hard we'll need to keep selling for stables (which isn't a bad problem to have IMHO).

I'm now a Witness!

Most of you already noticed, but I recently deployed a witness node on the mainchain & Hive-Engine.

My intention at the moment (if possible) it's to generate enough to cover the hosting expenses (currently 85$/month for both witnesses). But I don't want to sell any HIVE coming as block producer rewards.

Instead, I'm transferring & powering up to an alt account (@powercompound) for the time being. The long-term plan is to use this account as a curation trail & to support SEED, but I wonder if it ever will get enough size to matter.

Anyway! Big things started being small. Your vote would be very appreciated for the time being:

Witness account: @empo.witness

Hive (main chain) witness vote - https://vote.hive.uno/@empo.witness

Hive Engine vote - https://tribaldex.com/witnesses

Current SEED Stats:

Circulating Supply: 100.000 tokens (full released)

@seed-treasury owned: 2475 (2,47%).

AUM Value (All assets): 190.000$

SEED TOTAL Value: 190000/100000 = 1,9$ /SEED

190/7 = 27,1% MoM profit

We keep on building. Happy Sunday!

100% of blogging rewards paid to @seed-treasury.

Remember you can follow the portfolio in real-time here:

https://cointracking.info/portfolio/seedtreasury

You can join us on Telegram and follow me on Twitter.

Posted Using LeoFinance Beta