LeoFinance Keeps Giving

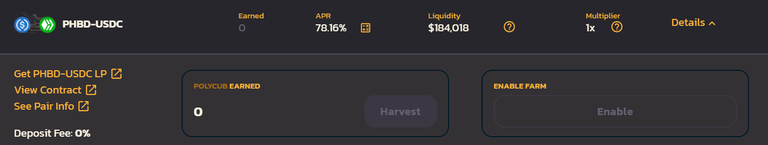

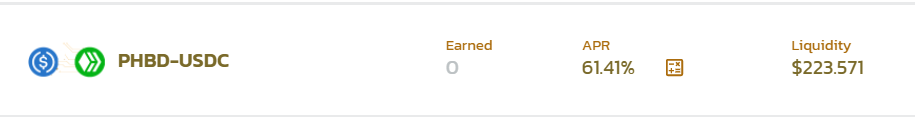

Welcome to one of the biggest updates in Hive's history. Our dearest $HBD aka stablecoin of the stablecoins, has entered the world of DeFi on Polygon Network. Thanks to Leo Finance team, we now have a running liquidity pool of pHBD & USDC on PolyCUB. You can club pHBD & USDC and stake them into the pool to earn PolyCUB Tokens at APR 58.55%. $232,491

For anyone who doesn't know it already, PolyCUB is a DeFi yield optimizer on Polygon with improved & sustainable tokenomics. Check out the ultimate PolyCUB guide by @mikedcrypto to understand how you can stake your crypto and earn rewards for doing so. Recently, @taskmaster4450 did a comparison between HBD (on Hive) & pHBD (on Polygon) and listed down PROs & CONs of investing in each of them. @edicted gave enough good reasons to invest in pHBD-USDC pool on PolyCUB over HBD in savings. Now it's time for everyone to read my thoughts about this topic if anyone cares enough! 😂🙈

Should You Should Invest In pHBD-USDC Pool?

I have been a huge fan of Stablecoin pools since you get to avoid volatility in the markets and get decent returns on your investment. Definitely better than keeping your money in a savings bank account. Also better than holding stables in your wallet doing nothing. With DeFi, you can simply put your money to use. As we all know, you now have two great options to use your $HBD - either put them in Hive Savings for 20% APR or put them into pHBD & USDC pool for the following reasons:

- Exposure To Polygon DeFi: pHBD-USDC is your safest bet to get some exposure to Polygon DeFi. Last year, I started my DeFi journey with Cub Finance. It was my first time and since then, I have learned a lot. It is the future of Finance. If you are a regular Hive user, chances are that you make a decent amount of $HBDs. You can use them to try DeFi opportunities outside of Hive. Since $HBD & USDC, both are stablecoins, you don't have to worry about the market crashes. Another plus point is that Polygon is cheaper than BSC in terms of transaction fees.

- HBD Supply Issue Solved: HBD has a supply issue. Now that the HBD Savings APR is increased to 20%, it is vital to fix the supply in order to see any kind of mass adoption of HBD. A deep liquidity pool on PolyCUB would greatly help everyone. If you are a whale on Hive who already owns a decent chunk of HBD, just bridge it to Polygon to get pHBD and provide LP. You'd be helping in fixing this issue.

- No Impermanent Loss: Impermanent loss is a massive turn-off and a risk factor for liquidity providers. In case of Stablecoin or single staking pools, there is zero impermanent loss. Both pHBD and USDC will not change in price that much, so there is no risk of losing one asset due to market volatility.

- Get In Early For The Highest Returns: Right now the APR is around 50% which is better than 20% you get in HBD Savings. If you get in today, you can enjoy these APRs while they last. As more people join in, it will get reduced. The plan of Leo Finance team is to keep it steady at 30% and above. In the future when PolyCUB governance is out, then users will be able to vote to change various aspects of the platform including the APR% you can get from this pool. As we all know, timing is very important in crypto. Get in early to make the most out of this opportunity.

- xPolyCUB: The yields you are going to get from pHBD-USDC pool are going to be in the form of PolyCUB, the native token of the platform. This can can be further staked in xPolyCUB vault which is one of the most interesting investment opportunities on the platform. Since it's a single staking vault, there is no impermanent loss. xPolyCUB to PolyCUB ratio keeps increasing because it auto compounds your rewards. It is designed in such a way that it keeps increasing.

What do you guys think? What are you going to do with your HBDs now? ;) Please comment below!

Posted Using LeoFinance Beta