Apparently, George Bernard Shaw said, in a play over a century ago, this line:

Those who can, do; those who can’t, teach

which later translated into a truncated version:

Those who can’t do, teach

As someone who has been in both camps to some degree, I know they both come with their challenges.

Someone who does is not necessarily well-equipped to pass his knowledge to other people, or they don't have the patience or time to do it. That's where teachers do their part...

From the student's perspective, the best teachers are the ones who also do, because they understand the practical aspect of their teachings better, and adapt the courses to match those aspects.

Ok... That was a pretty long preamble.

Hive - The Onion

A long time ago (maybe on the other chain), I compared Hive to an onion, with many layers one on top of another. To get to the core, one would need to peel the onion one layer at a time or cut it and extract the core.

What do I mean by this?

To understand Hive, you either understand it at a shallow level, then peel another layer to go deeper and understand that level, and so on, until you reach the core (very few people do that), or you go right to what interests you and focus only (mostly) on that.

It is a process, and it applies to Hive, the blockchain, and to its ecosystem.

I've been asked to explain how diesel pools work.

Hive has a base layer, where the core blockchain functions, where all the security lies, account management happens (including wallet transactions), posting and voting are handled, and HIVE Power/HBD rewards are distributed. It's also the level where governance and proposals are managed.

Then Hive has 2nd layers. Not only one of them. Functional, there's DLUX, where SPK/Ragnarok projects are being developed, among the popular ones.

And there's Hive-Engine, which is the first 2nd layer for Hive. That's what we'll focus on because here we have diesel pools.

Actually, the hive-engine.com website doesn't support diesel pools, but we'll get to that. I don't even recommend using this website anymore, because you are losing out on new features.

So, what is a diesel pool?

What Is a Diesel Pool?

A diesel pool is a place (thus, pool) where two tokens are paired together to provide liquidity to those who want to swap between the two tokens. Swapping means exchanging from one token to the other.

The two tokens are paired at a 50:50 ratio, initially calculated based on the market price of the tokens at the time of adding to the diesel pool. This balance is always kept through a mechanism called the Automated Market Maker (AMM).

When people swap tokens in a diesel pool, there is a 0.25% fee paid to liquidity providers, proportional to their share of the pool.

Liquidity providers are compensated in two ways:

- fees for swapping (always)

- potential rewards, if added for that diesel pool

There are two interfaces you can use for diesel pools:

- tribaldex.com - developed by the Hive-Engine team

- Beeswap - developed by @gerber from dCity

I use them both. The better place to check rewards and APRs is Beeswap.

Impermanent Loss

You see this everywhere as the biggest risk associated with defi: impermanent loss.

I can tell you. It's not. Other than rug pulls, the biggest risk in defi is both tokens going to zero. Actually, one token going to zero is enough to make a liquidity pool (diesel pool) worthless. The number of tokens needed from the other side to keep the 50:50 ratio with the token going to zero would keep getting lower and lower until they become irrelevant.

But let's talk about impermanent loss.

As the name says, it only becomes permanent, if you make it so. Meaning if you withdraw liquidity. Otherwise, it's still impermanent.

Without going into details, how does impermanent loss work?

Well, you enter your tokens A and B into the pool at certain dollar values.

To keep the 50:50 ratio between them, as the prices of A and B fluctuate, the number of A and B tokens in the pool fluctuates. If their dollar value is lower than the dollar value at the time of adding the liquidity, then that's called impermanent loss. And it can be a temporary thing, just like it can be temporary for a token (or a stock) to lose from its market value when you buy, and then, maybe, increase.

How to Deal with Impermanent Loss (IL)?

There are multiple ways to deal with impermanent loss:

- you remove it from the equation: when you enter stable pools (where both tokens are stablecoins), the impermanent loss should not exist (counter-example: UST, which lost its peg forever)

- you make it a non-issue: when you want both tokens equally and don't care which one of them you have more of when you withdraw liquidity, then IL doesn't matter

- risky and often non-productive: wait until tokens go back up.

How to Select the Diesel Pools to Provide Liquidity For?

There are multiple ways to do that.

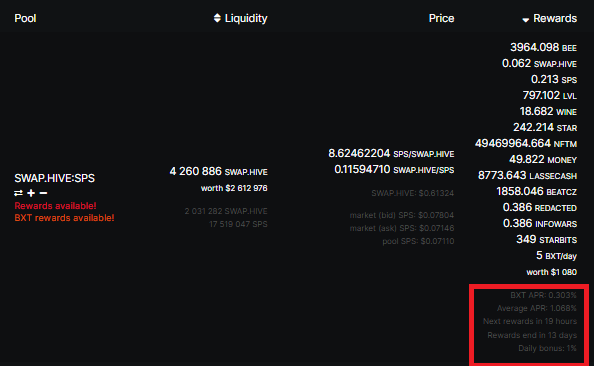

First things first, you should check out their rewards and APRs. As I mentioned earlier, it's best to do that from Beeswap. Here's an example for SWAP.HIVE:SPS:

In the red rectangle, you can find information like the average APR, the APR for BXT (that's the token of Beeswap), when will the next rewards be paid, and for how many days are there still rewards in the distribution contract (unless more are added), and anything else that may be important to know.

Above that, you see the list of tokens that are rewarded for this pool.

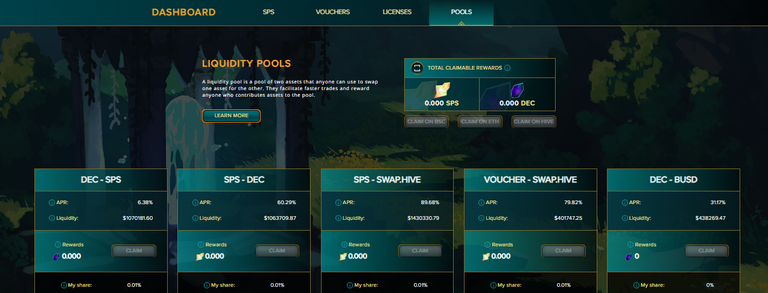

This diesel pool is an exception, and I've chosen it on purpose. Most diesel pools related to Splinterlands also have rewards paid out by Splinterlands directly, but those are not shown on these interfaces. To see them, you need to go to the Splinterlands website, and look at the management page for pools:

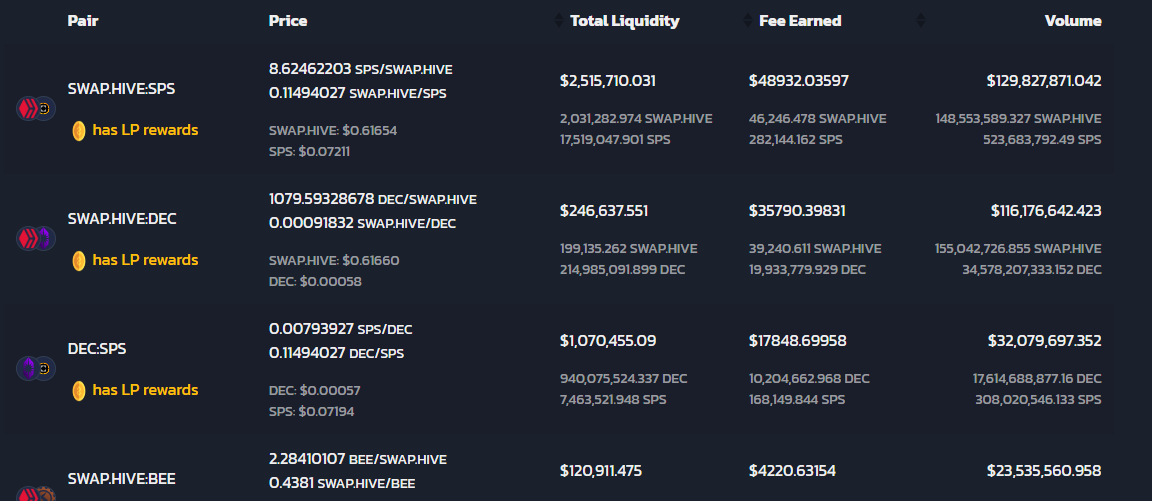

On TribalDex, on the other hand, you can see the volumes for each diesel pool and the generated fees:

Now, let's get to the point. How to select the diesel pool to select liquidity for.

Here are some potential strategies:

- select the diesel pool where you need both tokens (you won't care about IL much)

- select the diesel pool that protects against a bear market or IL (two stablecoins - note: doesn't protect against potential issues with Hive-Engine)

- select a diesel pool with only one stablecoin

- select by the highest APR (not recommended without further conditions)

- select by the highest APR, where you have some level of confidence in the tokens in the pool

- select by the tokens you receive as rewards

How to Add Liquidity to a Diesel Pool?

I use TribalDex to add liquidity. But I think it's just a matter of habit. The process is the same on Beeswap.

On TribalDex, on the top menu, there's Pools. Click on it. You'll reach the Diesel Pools page.

There are two ways to add liquidity to a diesel pool:

- asymmetrically

- symmetrically

Don't worry, these are just fancy words to describe simple situations. When adding asymmetrically, you only have one of the tokens from the diesel pool.

Suppose you want to add SIM asymmetrically to SWAP.HIVE:SIM. What you have to do is sell half your SIM for SWAP.HIVE first. That's it! Then follow the process below for adding liquidity symmetrically (I won't mention 'symmetric' anymore, since it makes reading harder).

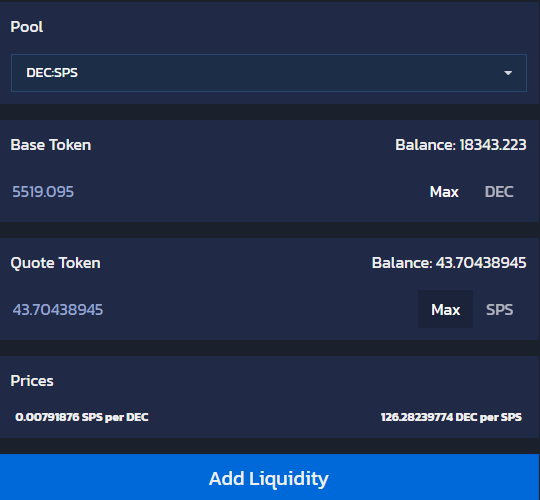

To add liquidity, you go to the 'Add Liquidity' menu on the Diesel Pools page, and from there you choose the pool to add to, and the amounts for the two tokens (it's enough to add the amount for one token, the other is calculated by default).

How to Remove Liquidity from a Diesel Pool?

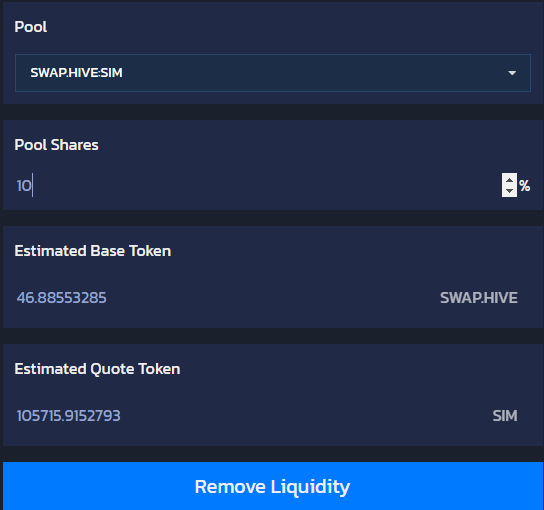

To remove liquidity, from the same Diesel Pools page as above you click Remove Liquidity.

There you select a percent of your liquidity you want to withdraw. You'll be presented with what that means for each of the two tokens. And you click Remove Liquidity. That's it!

Conclusion

That's what I could think of to include in a basic guide for diesel pool. Maybe there's more. Or maybe some information still needs more explaining. But it's a starting point. Questions in the comments, please.

Posted Using LeoFinance Beta