After staking my monthly 200 LEO on LPUD, my focus shifts to adding LEO to liquidity pools.

Since I started early adding LEO to the SWAP.HIVE-LEO pool, I don't feel the need to increase this share for the time being. Therefore, I've been focusing on adding LEO to the Maya side, in the LEO-CACAO pool.

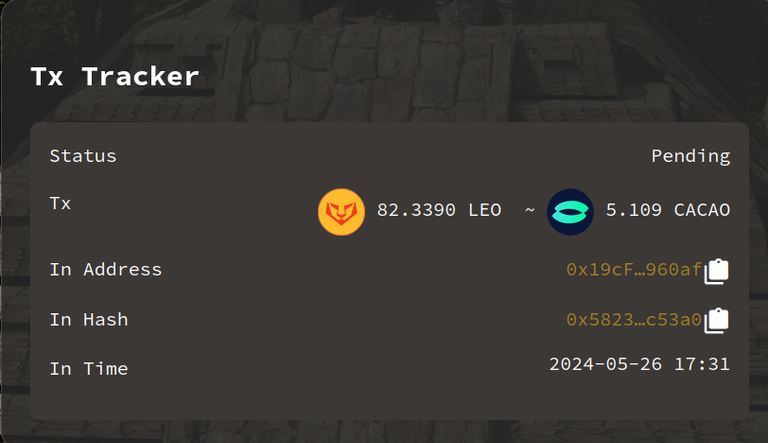

They are not big amounts (well, they are based on my LEO earnings), but this is the 3rd time I added small amounts to the pool.

Not everything went 100% smoothly, but in this post you can see how you can overcome some potential issues that may arise when working with DEXes...

As I mentioned in one of my previous posts, there is a great advantage to having transactions happen in your own wallet instead of custodial wallets. You can switch interfaces if something doesn't work properly in one of them and continue in another. You will see this exemplified in this post. The counter example would be to have HIVE in a CEX for example, and have the CEX disable HIVE transactions for no apparent reason or an expected time of resolution. And discretionary decisions by CEXes happened in the past and will happen again.

Preparations

If you never used LeoDex or DEXes in general, I advise you to not start without checking out the tutorials.

What was the process I went through?

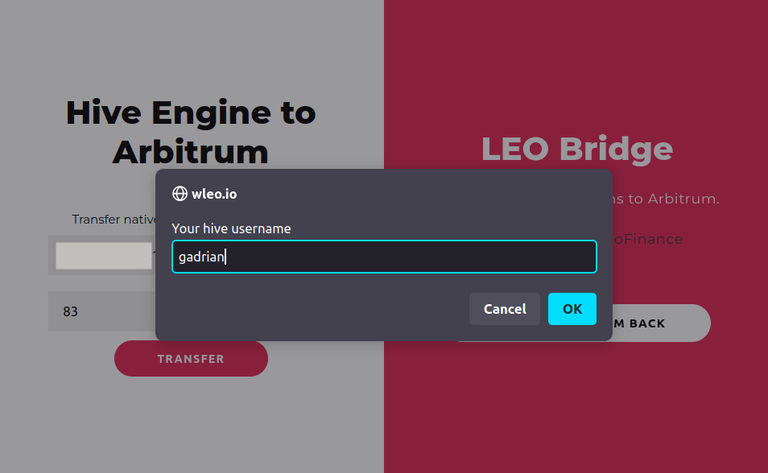

Transfer Hive-Engine LEO to Arbitrum LEO

That is done via the wleo.io tool, by choosing aLEO at the bottom of the list.

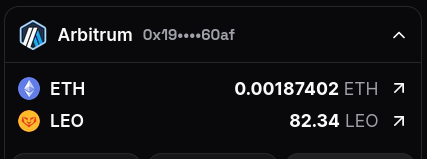

I already had a remainder of LEO on Arbitrum (I think it was 0.07), but otherwise my Arbitrum wallet on LeoDex reflects the 83 LEO transfer (minus a fee):

Add Liquidity

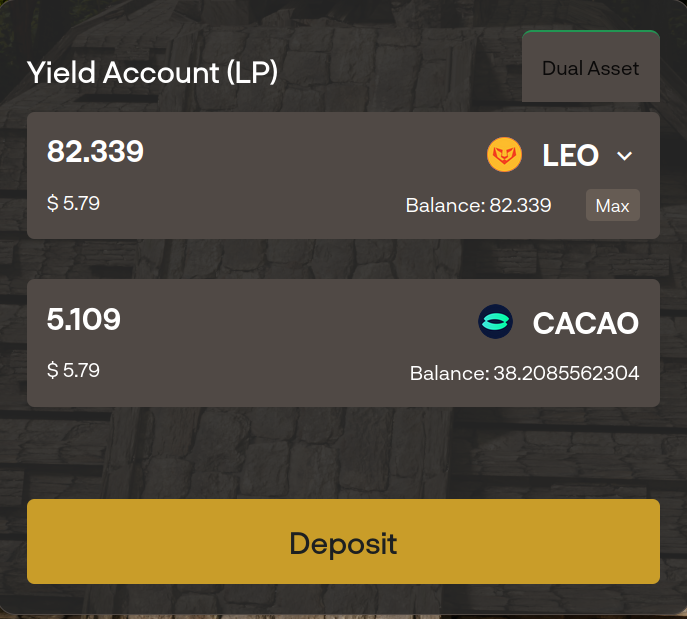

I already had CACAO in my account. If not you'll have to get some, for example by swapping half of LEO to CACAO.

To add LEO-CACAO liquidity from LeoDex, the theoretical process is simple:

- you select the Liquidity menu from the top

- you enter the desired amount of LEO and the other side will be automatically filled in with the appropriate amount

- you click Deposit Liquidity

and... it should work.

The problem is for me it worked once the first time I did it at the beginning of LeoDex, and then twice it didn't work, including today. The error received is UNPREDICTABLE_GAS_LIMIT. I already reported it last time.

But if it doesn't work, that's ok... We've got options. I have searched for them today.

Alternatives

My first alternative interface to check out to complete my process of adding liquidity to LEO-CACAO was ThorSwap because they recently added support for the Maya Protocol and I am familiar with it. But... unless I missed it, there is no way yet to add liquidity to Maya via Thorswap, only to swap tokens on Maya. Liquidity on Thorswap is still unilaterally linked to Thorchain and RUNE.

Ok... So what next? Well, I guess I'll take the Maya interfaces one by one and see where this works.

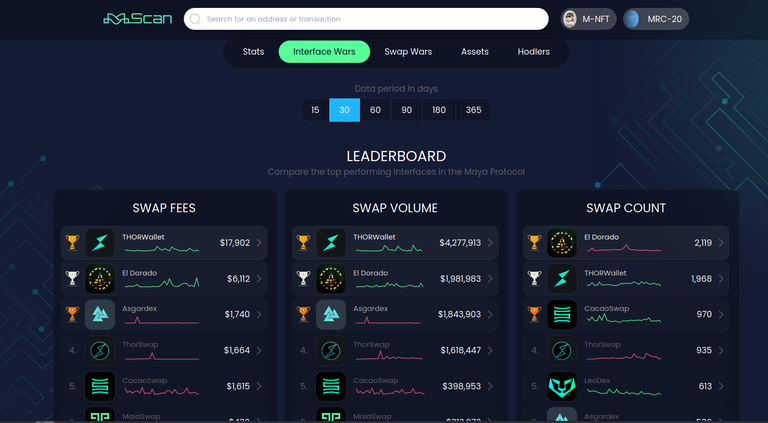

Where can you check top Maya interfaces? Well, there is a so-called "Interface Wars" on Maya, with various tops, and there you can check out other Maya interfaces.

This is the link to the Interface Wars on Maya.

So, I took them from top down. I didn't want to try Ascardex (3rd position), because that's a desktop wallet, and didn't want to download the appimage now (after I reinstalled my OS).

I started with ThorWallet, but at a first look, I didn't see how to add liquidity from it.

I then moved to El Dorado, the second in the list of swap fees. It is the oldest Maya interface if my speed reading didn't cause me to mix things up. And... it has support for adding liquidity. Which I did.

The result...

This interface doesn't show when a transaction is successful either (""success" instead of "pending"), but I confirmed that my liquidity was added from LeoDex, where I saw my LP increase broadcasting the transaction via El Dorado. LEO and the matching amount of CACAO for the LP was deducted from my wallet as well.

Conclusion

Using DEXes, even when things don't work, they work. Because you can find different alternatives to do the same thing. And at least one of the alternatives won't be a roadblock.

But with CEXes, things are different. If they hold your funds hostage, it's nothing you can do.

Want to check out my collection of posts?

It's a good way to pick what interests you.

Posted Using InLeo Alpha

Posted Using InLeo Alpha